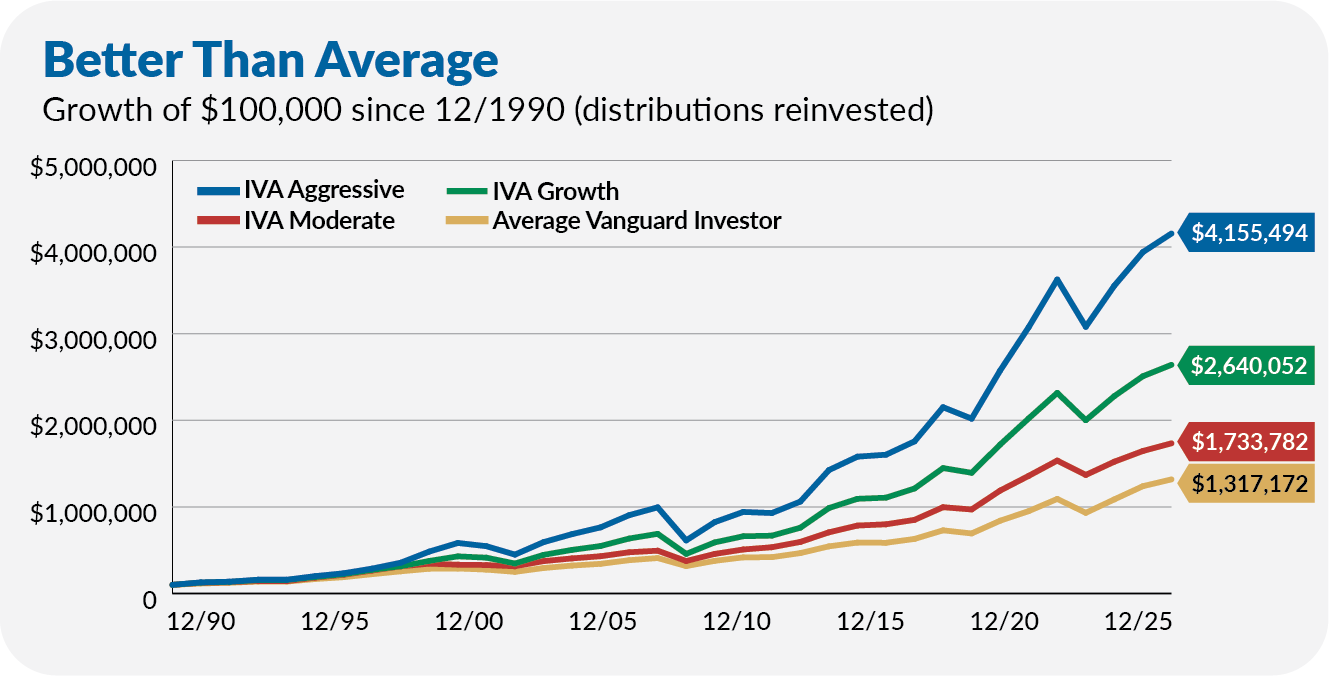

How Our Vanguard Portfolios Delivered 4,055% Returns While Others Earned Just 1,217%

Finally! Your common-sense answer to the question:

"Where is a real-world Vanguard newsletter with a long-term track record of beating the average investor?"

Unlock your Vanguard portfolio's full profit potential with the only independent resource that's delivered market-beating results to thousands of people for over 30 years – backed by performance data going back to 1991

You've likely heard the disclaimer countless times:

Past performance is not a guarantee of future results. That's true.

However, you won't trust your hard-earned dollars to just anyone. You want someone with a proven track record of navigating bull and bear markets.

We've done just that, while keeping our eyes firmly on Vanguard for over 30 years.

Here's exactly what our proven track record looks like in real dollars:

An aggressive investor who followed our recommendations ended up with $2.8 million more than the average Vanguard investor over 30 years.

But you didn't have to be gung-ho about risk; even moderate investors following our approach did significantly better than average.

This time-tested approach has been proven effective across every market crisis since 1991, including the dot-com crash, the 2008 meltdown, the 2020 pandemic, the 2022 bear market, and the volatility of 2025.

Now you can use the same strategy in your own Vanguard account starting today.

"Following this advice on Vanguard mutual fund picks made me a lot of money over many years... I was able to retire early in spite of my pension fund and pay slashed severely due to the airline bankruptcies after September 11."

– Commercial pilot, early retiree

"Over the past 20 years you have helped me to not react to the news - and in fact mostly ignore the news."

– Lawrence B., 20-year subscriber

"You are my life support when it comes to Vanguard."

– Premium member

"I've been with you for 19 years... I like that you trade infrequently, that you explain your trades when you do it, and that you maintain calm when the news is going hyper."

– Senior citizen, 19-year subscriber

"Following our returns have been consistently better, after fees, than several friends that pay advisors to manage their portfolios."

– Long-term subscriber

"Thank you for keeping up the quality of investment advice... I look forward to your continued financial guidance."

– 15-year subscriber

Here's what most Vanguard investors don't realize:

You could be leaving millions on the table even if you're invested in "good" Vanguard funds.

The average investor earned 7.8% annually since 1991.

But you could have earned 11.4% with our Aggressive Portfolio over the same period.

That 3.6% difference? It compounds into millions over decades.

Vanguard offers over 200 funds. Low fees don't turn bad funds into winners. Short-term success doesn't guarantee long-term profits. And diversification without strategy is expensive mediocrity.

Simply put: We help serious Vanguard investors outperform other Vanguard investors.

Take Advantage Of Our 34-Year Winning Track Record For Your Own Portfolio

Since we started analyzing Vanguard funds in 1991, our model portfolios have outperformed both the market and the average Vanguard investor. Now you can use the same fund selection strategy that delivered these results.

If you'd followed our Aggressive Portfolio: Your 4,055% total return vs. 3,485% for the S&P 500

If you'd followed our Growth Portfolio: You'd have nearly matched the market while taking on significantly less risk—meaning better sleep during crashes

If you'd followed our Moderate Portfolio: You'd have outpaced Vanguard's own LifeStrategy Moderate Growth fund

But here's the number that really matters to your financial future:

Your Portfolio Could Grow 3X Larger Than the Average Vanguard Investor's

For every $100,000 the average Vanguard investor grew to $1.3 million, our readers' portfolios grew to $4.1 million.

Think about what that means in real dollars:

On a $100,000 starting portfolio over 34 years:

- ● Following our approach: $4.1 million

- ● Following the average investor: $1.3 million

- ➤ The difference: $2.8 million more

On a $500,000 starting portfolio over 34 years:

- ● Following our approach: $20.7 million

- ● Following the average investor: $6.5 million

- ➤ The difference: $14 million more

Over decades of compounding: The difference between a comfortable retirement and true financial freedom.

These aren't cherry-picked results. This performance includes every major market crisis since 1991 – no hiding behind selective time periods or favorable market conditions.

How We Help You Capture Better Returns And Keep Delivering Year After Year

We Focus on What Actually Drives Your Long-Term Returns

While others obsess over daily market movements and quarterly earnings, we ask the questions that determine your decade-long performance:

Which funds consistently beat their benchmarks across multiple market cycles?

We analyze performance and risk across various market environments to identify funds that deliver solid returns over the long run, not just during favorable periods.

Where's the sweet spot between low fees and high performance?

Low fees matter, but the cheapest fund isn't always the best fund. We find the optimal balance between cost and potential returns.

Is the management team aligned with shareholders?

We examine whether fund managers have personal stakes in their funds, ensuring their interests match yours as an investor.

How do they perform during market stress?

Anyone can look good during bull markets. We focus on funds that protect and grow capital when markets turn turbulent.

Plus, We Don't Just Analyze – We Have Skin In The Game

When we recommend a fund for your portfolio, we buy it for ours. When we suggest you make a portfolio change, we make that same change in our personal accounts.

Nearly every dollar of our retirement savings follows the exact same strategies we send to subscribers.

When you win, we win.

When the market crashes, we feel it too.

In fact, that's when this alignment matters most - because we’re not just analyzing your situation from the sidelines, we’re living it alongside you.

You get our absolute best thinking, complete focus, and every ounce of experience we’ve built over decades navigating Vanguard's fund lineup.

We succeed only when our subscribers succeed.

Why We Focus Exclusively on Vanguard

Jack Bogle revolutionized investing when he founded Vanguard with a simple premise: lower costs mean higher returns for investors. He was right.

But there was one problem he couldn't solve: Which funds should you actually choose?

Vanguard now offers something for everyone – from extremely conservative bond funds to aggressive growth portfolios. It's one of the "Big Three" asset managers alongside BlackRock and State Street, managing trillions in investor assets.

This creates an incredible opportunity for investors who know how to navigate their fund lineup. It also creates paralysis for those who don't.

We focus exclusively on Vanguard because it allows us to go deeper than any generalist newsletter ever could. We know these funds inside and out. We have relationships with the managers. We understand the nuances that determine which funds thrive and which ones fade.

Most importantly: We invest our own money using the exact same approach we recommend to subscribers.

Which Type of Vanguard Investor Are You?

No Matter Your Style, We've Got You Covered

For Busy Professionals: Get Your Weekends Back

"No work for me... It does the homework for me."

– Time-conscious subscriber

How much time did you spend researching investments last month? If you're like most professionals, it was either way too much or not nearly enough.

Every week, we spend hours analyzing Vanguard's fund lineup – tracking manager changes, reviewing performance data, monitoring expense ratios, and watching for strategy shifts that could impact your returns.

You get the results in minutes, not hours. Your weekends are yours again.

Our Model Portfolios work like an investment autopilot. Instead of spending weekends comparing expense ratios and manager track records, you get five professionally-managed portfolios with exact allocations, updated

Here's What You Get Back When You Stop Doing It Alone:

- ✓ Your decision-making energy (no more paralysis about when to rebalance)

- ✓ Your research hours (no more weekend deep-dives comparing fund managers)

- ✓ Your peace of mind (no more nagging worry you missed something critical)

- ✓ Your free time (no more tracking performance across multiple holdings)

Our approach: Open your email. See which portfolio fits your risk level. Invest. Done.

For Performance-Focused Investors: See Exactly How We Beat the Market

"I've learned more about investing from those explanations than from any other source."

– Premium subscriber

You want to understand the "why" behind every recommendation. You want to see the complete methodology that delivered our 30+ year track record.

As a Premium member, you get something no other service provides: You see inside our professional-level decision-making process. Nothing is hidden from you.

Here's exactly what you gain immediate access to:

- ✓ Side-by-side fund comparison methodology – learn to evaluate any Vanguard fund like a professional analyst

- ✓ Risk assessment frameworks – understand which metrics actually predict long-term success

- ✓ Trading decisions explained – see exactly how we decide when to make moves vs. when to stay put

- ✓ Manager evaluation techniques – spot warning signs before fund performance deteriorates

Plus exclusive access to information others never see: When we have conversations with Vanguard managers about strategy changes, Premium members get insights that don't make it into public communications.

When we spot early trends in fund flows or manager departures, you're among the first to know exactly what it means for your money and what actions you can take.

When market conditions create opportunities in specific Vanguard funds, you get immediate analysis while the opportunity still exists.

For Value-Conscious Investors: Every Dollar Justified

"Thanks for solid content at a time when snake oil is readily available everywhere I look."

– Tony, long-term subscriber

You're tired of hyped-up investment newsletters that promise impossible returns. You want honest analysis based on verifiable data, not marketing gimmicks.

That's exactly what separates us from typical financial publishers:

Many investment services cost $500to $1,500 annually and focus on making hot stock picks or timing the market. We cost $175 annually and focus on a disciplined long-term strategy with achievable results.

Most financial advisors charge 1% of your portfolio annually (that's $1,000 per year on a $100,000 portfolio) and often recommend funds they get paid to sell. We charge a flat fee regardless of your portfolio size and recommend only what we own ourselves.

Most "Vanguard experts" are really generalists who cover Vanguard alongside dozens of other fund companies. We've focused exclusively on Vanguard for decades, developing relationships and insights no generalist can match.

Our value proposition is straightforward: For less than $15 per month, you get access to decades of specialized expertise that has consistently beaten the average Vanguard investor.

The math works strongly in your favor: On your $100,000 portfolio, the $175 annual cost represents just 0.18% of your investment value. If our approach adds even that small amount to your returns, the service pays for itself. Our historical edge over the average investor is 3.6% annually – that's 20 times what you need to break even.

For Risk-Aware Investors: Better Sleep and Fewer Emotional Mistakes

"Investment advice written to be understandable to the layman... A 'time in the market' approach with little trading. Calming nerves in turbulent times."

– Premium subscriber

You understand that risk and return are connected, but you want to take only the risks worth taking. You don't want unnecessary volatility in pursuit of marginal gains.

Our approach to risk management helps protect your portfolio in ways simple diversification can't.

Risk-Adjusted Returns: Our Growth Portfolio has nearly matched the returns of the S&P 500 while taking significantly less risk. This isn't about avoiding all risk – it's about being compensated fairly for the risks you take.

Downside Protection: During the 2008 financial crisis, our Moderate Portfolio protected capital more effectively than generic balanced funds. During the 2020 crash, our risk management helped subscribers avoid panic selling at market lows.

Volatility Management: We don't just look at average returns – we examine how much volatility you endure to achieve those returns. Lower volatility with similar returns means better sleep and fewer emotional investment mistakes.

Correlation Analysis: We understand how different Vanguard funds interact with one another under various market conditions. This allows us to build portfolios that are truly diversified, not just spread across different funds that all move together during crises.

You get sophisticated institutional-quality risk management in language you can understand and implement.

Here’s Exactly What You Get as a Member

✔ 5 Battle-Tested Model Portfolios – Exact Allocations Included

- The Aggressive Portfolio: For investors who want maximum growth and can sleep soundly during market crashes. Delivered 11.4% annualized returns since 1991.

- The Growth Portfolio: For investors whose priority is capital appreciation but who don't want to ride every market swing. Nearly matched market returns with significantly less risk.

- The Moderate Portfolio: For investors seeking balance between growth and income with our refined take on the classic 60/40 approach. Outpaced Vanguard's own LifeStrategy Moderate Growth fund.

- The Conservative Portfolio: For investors whose priority is income while maintaining opportunities for capital growth. Launched in 2022 for income-focused investors.

- The Aggressive ETF Portfolio: For investors with long time horizons who want to use ETFs exclusively for maximum tax efficiency. Delivered 10.0% annualized since 1995.

You get complete performance history for each portfolio, exact fund allocations you can implement today, and clear explanations so you know exactly when and why to use each approach.

✔ Buy, Hold, and Sell Ratings on 100+ Vanguard Funds

Every month, we update our comprehensive ratings on Vanguard's most important funds and ETFs. No guesswork about which funds deserve your money and which ones to avoid.

We identify the funds that consistently beat their benchmarks while others fade. Our analysis goes beyond surface-level metrics to examine manager tenure, strategy consistency, and competitive positioning within each fund category.

✔ Exclusive Fund Manager Interviews

Direct access to the thinking behind Vanguard's funds. We regularly speak with Vanguard fund managers to discuss their strategies, market outlooks, and portfolio positioning—then translate what we learn into potential actions for your portfolio. You get insights other investors never see.

You get information that other investors never see.

✔ Inside Analysis of Vanguard's Corporate Moves

When Vanguard changes website features, adjusts fund policies, launches new products, or makes organizational shifts, we explain exactly what it means for your investments.

No PR spin. Just honest analysis of how Vanguard's decisions impact your portfolio.

✔ Weekly IVA Research Deep Dives

This is where Premium members see the complete research process that drives our recommendations.

While our free Weekly Briefs give you solid insights in just a few minutes of reading, Premium members get the detailed analysis that informs every decision:

- ✓ Complete fund performance analysis

- ✓ In-depth manager interviews and strategy explanations

- ✓ Market condition assessments and portfolio positioning insights

Recent examples include our three-part series on Vanguard's sector funds, our comprehensive analysis of Treasury Inflation-Protected Securities (TIPS), and our detailed breakdown of international fund opportunities.

✔ Immediate Trade Alerts With Complete Reasoning

You'll get precise trade alerts only when they matter – no noise, no overtrading, just the moves that can actually improve your returns.

Most months, you won’t get any alerts because the best move is to do nothing. When we do recommend changes, you get immediate notification with complete explanations of our reasoning.

No waiting for the next monthly issue.

No wondering why we made a move.

No guessing about timing.

✔ Complete Archive and Priority Support

Access years of market analysis and fund research, plus direct access to Jeff for your Vanguard questions. While we can't provide personalized investment advice, we work to clear up any confusion about our service and Vanguard strategies.

Real Stories from Real Subscribers

Vanguard Flagship Status Achieved

"I first subscribed to your service in April, 2000. Over the next two years, I moved all of our mutual funds to Vanguard and invested in your recommended portfolios. Our regular funds were invested in the Aggressive Growth Portfolio and our IRA funds were invested in the Income Portfolio. We have diligently followed your weekly portfolio changes over the years. Your outstanding and accurate advice has enabled us to become Vanguard Flagship members for quite a few years now."

– Earl & Donna C.

Early Retirement Despite Crisis

"Following [this] advice on Vanguard mutual fund picks made me a lot of money over many years... I was able to retire early in spite of my pension fund and pay slashed severely due to the airline bankruptcies after September 11."

– Long-term subscriber

20+ Year Success

"Keep up the good job you all have done for me for 20+ years!"

– Bob P.

Reversing Financial Mistakes

"My great uncle is one of the smartest investors I know and he recommended your publication years ago, he has been a loyal subscriber for a long time. I on the other hand have made some unwise money choices. My great uncle gave me a publication to read, I enjoyed it very much and have been a subscriber myself for several years."

– Craig S.

Managing Family Finances

"Long term sub, looking after his mom's finances. Can't thank you enough for the advice you've provided over the years. I like that you ate the same meals that you're preparing for your subscribers."

– David H.

Continuity and Guidance

"I'm very glad you've taken over from Dan. All of us long-term Vanguard investors need continued guidance going forward so we can stay invested in the Vanguard funds that will do reasonably well for us."

– Walter W.

What Separates Us From Every Other Service

Access to Information Others Can't Get

Exclusive Manager Interviews

We regularly speak with Vanguard fund managers to discuss their strategies, market outlooks, and portfolio positioning. Premium members gain valuable insights from these conversations that are not shared in public communications.

Behind-the-Scenes Vanguard Analysis

When Vanguard makes organizational changes, launches new funds, or shifts strategies, we provide context about what it really means for your investments.

You Also Get a Masterclass In Reading Vanguard Funds

While other services give you buy/sell recommendations without context, we teach you to think like a professional fund analyst. You'll understand:

Fund Manager Psychology

How portfolio managers think during different market conditions and what drives their decision-making processes.

Regulatory Impact Assessment

How SEC regulations, tax law changes, and Vanguard policy shifts affect your investment options.

Economic Cycle Positioning: How to adjust your Vanguard allocation based on where we are in the economic cycle.

This isn't just about following recommendations – it's about developing the knowledge to make confident independent decisions.

Why Our Track Record Matters Now More Than Ever

Market volatility hits. Fed policy shifts. Economic data surprises Wall Street.

In these moments, when uncertainty meets opportunity, you need steady guidance based on decades of experience. That's when our track record matters most to your financial future.

Here's what we've learned after 30+ years navigating market volatility: The same headlines can trigger completely different market responses.

In April, talk of trade policy changes had markets down nearly 20%. By July, similar headlines were hitting while markets climbed to new highs.

What changed? The underlying fundamentals provided context.

The market doesn't move strictly on good or bad news – it moves on whether things are getting better or worse relative to expectations.

How Our Disciplined Approach Works During Uncertain Times:

We build resilient portfolios designed to perform across different market environments – not just when everything goes right.

We focus on getting paid for taking risk – avoiding areas where the potential reward doesn't justify the volatility.

When we don't see a reason to change, we say so – with clear reasoning you can trust.

When adjustments make sense, you get immediate alerts with complete explanations

The Market's Most Challenging Periods Prove Our Approach Works

When markets crash, true investment strategies are tested. Here's exactly how our disciplined approach performed during the most challenging periods since 1991:

The Dot-Com Bubble (2000-2002)

While the NASDAQ fell 78% and many growth investors lost everything, our diversified approach protected capital. We didn't chase the Internet bubble and avoided the worst losses when it burst.

The 2008 Financial Crisis

If you'd followed our Aggressive Portfolio, you would have fallen 38.4% in 2008 – painful, and even a touch worse than the S&P 500's 37.0% decline. But, crucially, you would have recovered faster. In 2009, we gained 34.4% vs. the market's 26.5%.

This is where disciplined fund selection and patience matters most.

The 2020 Pandemic Crash

When markets fell over 30% in just weeks, many investors panicked and sold at the bottom. Our subscribers received clear guidance: stay the course. The Aggressive Portfolio finished 2020 up 19.4%. Those who sold in March missed the entire recovery.

The 2022 Bear Market

While growth stocks collapsed and many portfolios lost 20-30%, our Moderate Portfolio held up remarkably well, demonstrating the value of proper risk management across different market environments.

The pattern is clear: Steady, disciplined investing beats emotional decision-making, especially during the most challenging market conditions.

Meet Jeff DeMaso: The Expert Behind the Track Record

Jeff DeMaso is the former director of research at a multi-billion-dollar investment firm and co-authored the world's leading independent Vanguard newsletter alongside his mentor, Dan Wiener.

His expertise built a reputation for honest, practical investment advice that real investors could rely on – without false promises or get-rich-quick schemes.

Jeff doesn't just analyze Vanguard funds – he lives and breathes them.

Since entering the investment world in 2005, he's dedicated his career to mastering Vanguard's fund lineup.

He's analyzed their bond fund innovations across different market cycles.

He's tracked manager changes and strategy shifts.

He's studied how fee structures impact long-term returns across their entire fund family.

This deep, focused expertise over nearly two decades means you get the same authoritative Vanguard analysis that major financial media outlets rely on Jeff to provide.

When The New York Times needed expert commentary on election-year investing strategies, they called Jeff.

When Barron's profiled leading independent newsletter publishers, they featured our service.

When Kiplinger needed insights into Vanguard's latest developments, Jeff provided the analysis.

The media turns to Jeff when they need authoritative analysis on Vanguard strategies because he combines deep institutional knowledge with complete independence from Vanguard itself.

However, what matters most is that Jeff invests most of his retirement savings using the exact same strategies he recommends to his subscribers.

Nine out of ten dollars of his retirement portfolio is invested in the same funds recommended in the IVA Portfolios. For the one dollar that's allocated differently, he tells subscribers exactly what he's doing and why in his annual "Eating My Own Cooking" series.

No double standards. No hidden strategies. Complete transparency.

Why This Matters for Your Investment Success

Most newsletter publishers don't invest in what they recommend. Many financial advisors recommend different strategies for different clients based on fees or commissions. Most fund analysts work for firms with conflicts of interest.

Jeff's approach is different: Every recommendation comes with skin in the game.

When he suggests adding a new fund to the Portfolios, he buys it for his own account. When he removes an underperforming fund, he sells it from his personal holdings. When market conditions call for defensive positioning, he reduces risk in his own portfolio. And when he preaches patience during market turbulence, he’s staying invested.

This alignment creates powerful incentives for long-term thinking over short-term marketing.

A Personal Message From Jeff to You

Hi, I'm Jeff DeMaso.

Welcome to The Independent Vanguard Adviser.

After spending decades in the investment industry, I've seen how most financial advice serves the advisor's interests rather than yours.

I've watched supposedly sophisticated investors get mediocre results because they followed conventional wisdom instead of proven strategies.

I've seen brilliant people make emotional investment mistakes during market crises because they lacked access to experienced perspective.

That's why The Independent Vanguard Adviser exists.

We prove that you can beat professional averages when you have the right guidance, stick to disciplined strategies, and avoid emotional decision-making.

Our subscribers aren't superhuman. They're normal people who recognized the value of specialized expertise and committed to following a proven long-term approach.

The results speak for themselves: 4,055% returns since 1991 versus 1,217% for the average Vanguard investor.

But beyond the numbers, what matters most is the confidence our subscribers gain. They sleep well during market volatility. They make investment decisions based on data rather than fear. They stay focused on long-term wealth building instead of getting distracted by short-term market noise.

That's the real value of what we provide: peace of mind backed by proven performance.

If you're ready to stop settling for average results and start positioning yourself among the most successful Vanguard investors, I invite you to join us.

Your financial future deserves better than guesswork.

-Jeff

Is This Right for You?

The Independent Vanguard Adviser is FOR you if:

You're tired of sales pitches from traditional financial advisors who charge 1% annually while delivering average returns.

You're a busy professional who wants to maximize their Vanguard returns without spending weekends researching fund managers and expense ratios.

You're an experienced DIY investor who recognizes the value of specialized expertise and wants access to professional-level Vanguard analysis.

You're building long-term wealth and understand that 3-4% annual advantages compound into life-changing differences over decades.

You want to sleep soundly during market volatility knowing your strategy is backed by 30+ years of proven results across every major crisis.

This is NOT for you if:

You prefer set-it-and-forget-it target date funds and don't want to optimize your Vanguard allocation.

You change strategies every time the market dips instead of maintaining long-term discipline.

You're looking for get-rich-quick opportunities rather than steady wealth building.

You believe superior investment results are impossible and that everyone gets the same returns by default.

During Your Trial, You’ll Get Complete Access to Everything You Need to Outperform the Average Vanguard Investor

We're so confident you'll see immediate value that we're giving you 30 days to try everything completely free.

Our Model Portfolios with three decades of performance history, our comprehensive fund ratings system, our weekly research that goes far deeper than anything available for free, our complete archives, and direct access to Jeff when you have questions.

You'll experience firsthand how our disciplined approach works, see the quality of analysis that drives our recommendations, and understand why thousands of investors have trusted our guidance through multiple market cycles.

Most importantly, you'll have 30 days to evaluate whether our approach can help improve your investment results without any financial commitment.

On day 23, we'll send a friendly reminder with simple cancellation instructions if you decide our service isn't the right fit. If you cancel anytime during your trial, you pay nothing. If you continue past day 30, you'll be charged $175 for a full year of access.

Most financial advisors charge 1% of your portfolio annually. On a $100,000 portfolio, that's $1,000 every single year... $10,000 over a decade... $30,000 over 30 years.

Our entire service costs $175 per year after your free trial ends.

That's less than what most advisors charge in two months. It's about 48¢ per day for independent, disciplined guidance that has outperformed the average Vanguard investor by 3.6% annually over more than three decades.

Put this in perspective: If our approach helps you capture even a fraction of our historical edge, this $175 investment could easily return hundreds of times its cost.

Consider the math on a $100,000 portfolio:

- ✓ A 1% annual improvement = $1,000 additional return in year one

- ✓ A 2% annual improvement = $2,000 additional return in year one

- ✓ A 3% annual improvement = $3,000 additional return in year one

The service pays for itself if it adds just 0.18% to your annual returns.

Our historical edge is 3.6% annually. Even capturing a tenth of that advantage makes this investment incredibly profitable.

What makes this trial genuinely risk-free:

Cancel through your online account anytime during the trial period with no phone calls required, no hassle, and no questions asked. You either pay nothing if you cancel, or get the full year if you continue. Complete access to everything during your trial with nothing held back.

If our track record, methodology, and results don't convince you within 30 days, simply cancel and walk away owing nothing.

Every Month You Wait Is Another Month of Potential Gains You’re Not Capturing

You already know Vanguard funds are excellent wealth-building vehicles. The question is: Are you going to settle for average results, or are you going to position yourself to beat other Vanguard investors?

Our 34-year track record isn't marketing hype. It's performance data across every major market cycle since 1991.

The difference between "good enough" and "exceptional" isn't obvious in a single year. Over decades, it's the difference between a comfortable retirement and true financial freedom.

The choice is yours:

Option 1: Keep doing what you're doing and hope for the best. Accept average returns and wonder what might have been.

Option 2: Follow the same disciplined approach that helped thousands of investors beat the average Vanguard investor by 3.6% annually for over three decades.

If you want access to the same process Jeff uses for his own investments, the same approach that's guided subscribers through every major market storm since 1991, join us today.

Frequently Asked Questions

Q: How is this different from just buying index funds and holding them

A: Index fund investing is great, but it's just the starting point. Our Aggressive Portfolio beat the S&P 500 index by 0.5% annually since 1991 with the same level of risk. More importantly, we beat the average Vanguard investor by 3.6% annually. Even within Vanguard's excellent fund lineup, fund selection and allocation matter enormously. We help you make the optimal choices instead of settling for "good enough."

Q: I'm already working with a financial advisor. Do I still need this?

A: Most financial advisors charge 1% of your portfolio annually and often recommend funds across multiple companies without deep expertise in any single provider. We focus exclusively on Vanguard with 30+ years of specialized knowledge. Our entire annual cost ($175) is less than what most advisors charge quarterly on a $100,000 portfolio. You can use our guidance to evaluate your advisor's recommendations or potentially replace expensive advisory services altogether.

Q: How much time does this require each week?

A: Most subscribers spend 10-15 minutes per week reading our analysis. When we issue trade alerts (typically 0-2 per year), implementation takes another 10-15 minutes. That's it. We do the heavy research so you can make informed decisions quickly. As one subscriber put it: "No work for me... It does the homework for me."

Q: What if I have a small portfolio? Is this still worth it?

A: Our guidance becomes valuable at any portfolio size because the principles compound over time. Even on a $25,000 portfolio, a 1% annual improvement adds $250 in the first year and much more as your investments grow. The service pays for itself if it adds just 0.7% annually to a $25,000 portfolio – well below our historical edge of 3.6%.

Q: Are there any hidden costs beyond the $175 annual fee?

A: No hidden costs whatsoever. The $175 annual fee gives you access to everything: all Model Portfolios, fund ratings, weekly research, trade alerts, archives, and priority support. The only additional costs are the normal expenses within Vanguard funds themselves (typically 0.03% to 0.50% annually)--there’s no avoiding those fees.

Q: How often do you make changes to the portfolios?

A: We make changes only when they're likely to improve long-term results. Some months have no changes at all because the best move is to do nothing. When we do adjust portfolios, it's typically 1-2 changes per year with complete explanations of our reasoning. This isn't day trading – it's disciplined, long-term portfolio management.

Q: What happens if I'm not satisfied during my free trial?

A: Simply cancel anytime during your 30-day trial period and you won't be charged anything. You can cancel easily through your account on our website or by contacting our support team. We'll send you a friendly reminder on day 23 with simple cancellation instructions if you decide the service isn't right for you.

Q: How do I know your performance numbers are accurate?

A: Our performance is calculated using standard industry methodology with all distributions reinvested. We provide complete transparency about our track record, including our worst years alongside our best. The same calculation methods show the S&P 500 gained 3,485% since 1991 while our Aggressive Portfolio gained 4,055%. You can verify market returns independently and see exactly how we compare.

Ready to join thousands of successful Vanguard investors who've beaten the average by following our proven approach?

I look forward to welcoming you as our newest member.

Sincerely,

Jeff DeMaso

The Independent Vanguard Adviser

30-Day Free Trial Guarantee

Try The Independent Vanguard Adviser free for 30 days.

You'll get immediate access to everything: all Model Portfolios, fund ratings, weekly research, trade alerts, and our complete archives.

After your 30-day trial, you'll be charged $175 for a full year unless you cancel. We'll send you a reminder on day 23 with simple cancellation instructions.

Cancel anytime during your trial period and pay nothing.

We're confident you'll see the value. Welcome to the family!

All return stats are as of June 30, 2025.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.