The Seven Best Vanguard Funds for 2025 & Beyond

Here’s a secret you won’t hear from most of Wall Street: Keeping it simple can be highly effective. Or, said the “other” way around, adding complexity to your portfolio doesn't guarantee better outcomes.

While I like to keep investing simple, you'll never hear me say that investing is easy—it isn't. But if you ask many investors today, they’ll tell you that investing is easy! Just buy the S&P 500 index or, better yet, the biggest tech companies, and you can’t go wrong. Or so the current thinking goes.

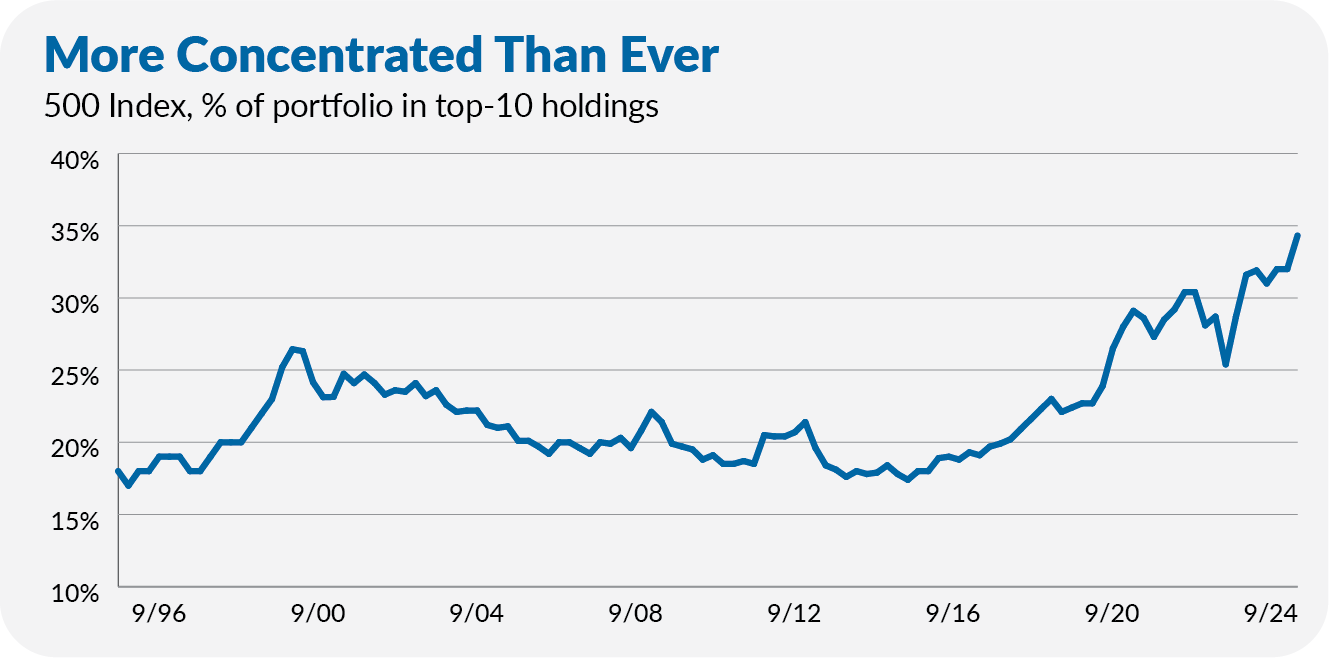

Look, buying a fund tracking the S&P 500 index—like Vanguard’s 500 Index (VFIAX) fund or its ETF sibling (VOO)—is a solid long-term approach. But it’s also one that might carry more risk today than you realize.

Why? The index has never been more reliant on just a handful of companies. At the end of September 2024, nearly 35% of 500 Index’s portfolio was invested in just the ten largest stocks. That’s a record over the past (nearly) three decades my data covers.

Chief among the market darlings are the so-called Super (or Magnificent) Seven—Apple, Amazon, Alphabet (Google), Meta (Facebook), Microsoft, NVIDIA and Tesla. If you think those giants will continue to rule the roost forever, this report isn’t for you—just stick with 500 Index or a tech sector ETF like Information Technology ETF (VGT). But if you’re like me, you believe markets are cyclical and trees don’t grow to the sky.

I’ve identified seven funds that can deliver solid absolute returns if the Magnificent Seven continue to run riot. (I’ve also included three substitute ideas for ETF investors.) However, these overlooked, hidden gems could deliver serious market-beating results when the cycle turns.

PRIMECAP (VPMCX)

The PRIMECAP Management team brings everything I look for in an active manager. They are long-term-oriented stock pickers who value independent thinking and build distinct portfolios. They are thoughtful in how they invest and how they run their firm.

PRIMECAP Management was initially hired by none other than Vanguard founder Jack Bogle, Mr. Index himself. He pursued the company after his initial requests to have them join the Vanguard fold were rebuffed. They eventually acquiesced—and, well, the record is strong.

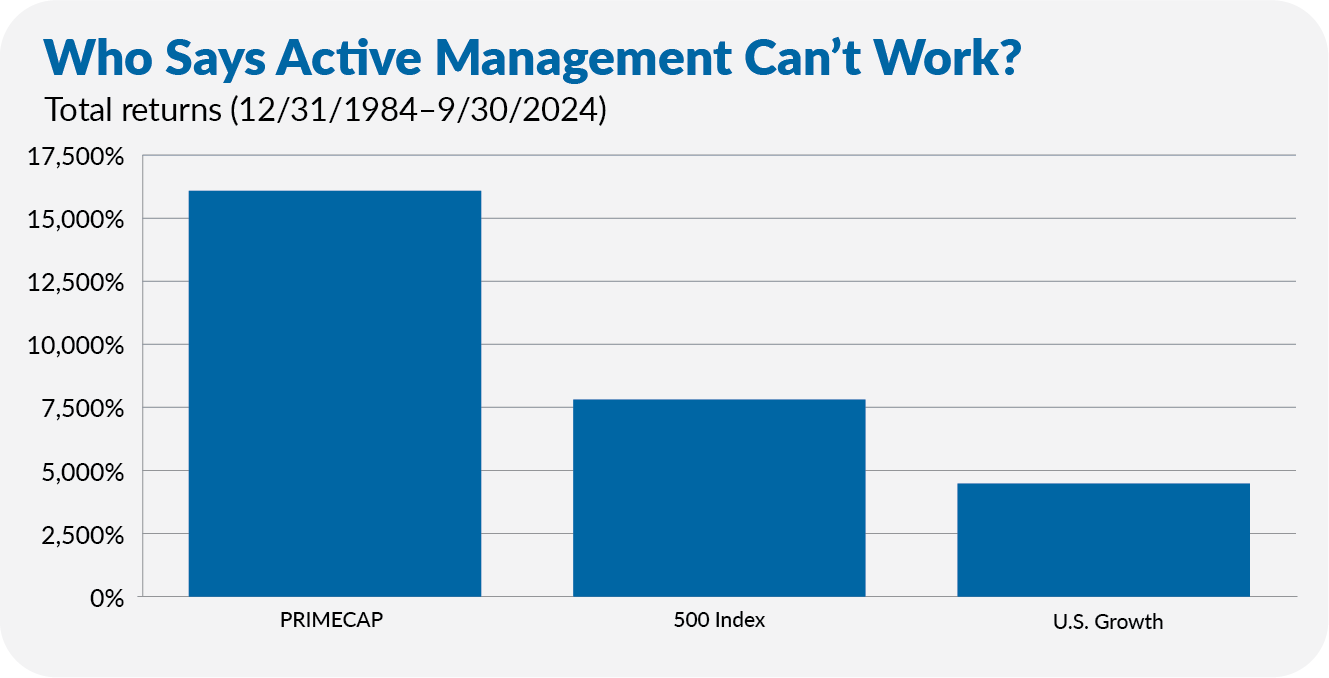

Their longest-run fund, PRIMECAP (VPMCX), has one of the best track records in the entire mutual fund business over the last four decades.

A dollar invested in 500 Index at the end of 1984, when PRIMECAP was launched, was worth $79 at the end of September 2024. A dollar invested in U.S. Growth (VWUSX) over that period would be worth $46. A dollar in PRIMECAP? $162!

How do they do it?

Independent thinking, patience and a distinct approach to picking growth stocks at value prices.

If I had to label the PRIMECAP Management team’s approach, I’d call it growth-at-a-reasonable-price, or GARP. The managers look for companies with the potential for strong earnings growth but which are currently selling for less than comparable growth companies. This is often because some negative factors are influencing most investors’ perceptions of the company’s potential.

In contrast to many other growth managers, the PRIMECAP team is willing to wait for the market to recognize the value they perceive. On average, they hold onto a stock for a decade.

Also, unlike other growth managers, there is no star manager here. The PRIMECAP team eschews the limelight. Each of its five managers is responsible for buying and selling within a predetermined slice of the fund. If two managers own the same stock, it will result in a larger position in the portfolio, but each manager is accountable for their own decisions.

The result is a high-conviction portfolio with roughly 170 stocks and around 35% of the assets in its 10 largest holdings.

The other result of the approach is a portfolio that doesn’t look like the market. To outperform the market, you can’t look like the market … but looking different doesn’t guarantee better results—it just guarantees different results.

Since the fund’s inception, PRIMECAP has only outperformed 500 Index 56% of the time on a month-to-month basis—roughly 7 out of 12 months. However, those periods of outperformance have created a long-term market-beating track record.

This means that, similar to how the PRIMECAP portfolio managers are patient with their stock picks, if you’re going to invest here, you must also be disciplined.

PRIMECAP hasn’t exactly lit the investment world on fire lately, but that makes this long-term winner a hidden gem. Allocating dollars to talented managers when they are out of favor can be a recipe for success.

So, let me give you two bonus picks—both run by the same team calling the shots at PRIMECAP: Capital Opportunity (VHCOX) is a slightly more aggressive fund run by the same team, though it’s closed to new investors. PRIMECAP Core (VPCCX) is a lower-risk fund.

Pick the fund that works for you. What matters is the manager.

Additional reading: You can read a deep dive into the PRIMECAP Management-run funds here.

BONUS ETF PICK: If you’re looking for an ETF solution, S&P 500 Growth ETF (VOOG) is my pick due to its tilt toward quality companies.

Dividend Growth (VDIGX)

Are you looking to compound your wealth in a risk-aware manner? Look no further than Dividend Growth (VDIGX).

The portfolio manager, Peter Fisher, is carrying on where his mentor (Don Kilbride) left off. He aims to build a portfolio producing a steady, growing stream of dividends. He does this by owning companies that have the ability and willingness to pay dividends and increase those payouts over time.

It’s not about buying the highest-yielding stocks but finding companies that will grow their dividends. Fisher typically owns around 50 stocks and keeps turnover very low.

Think about this for a minute. Quality companies don’t typically pay dividends if their businesses can’t afford to do so (or they go broke). Companies that can continually raise their dividends are those that, presumably, are growing their businesses and doing so profitably. That’s what Fisher is looking for.

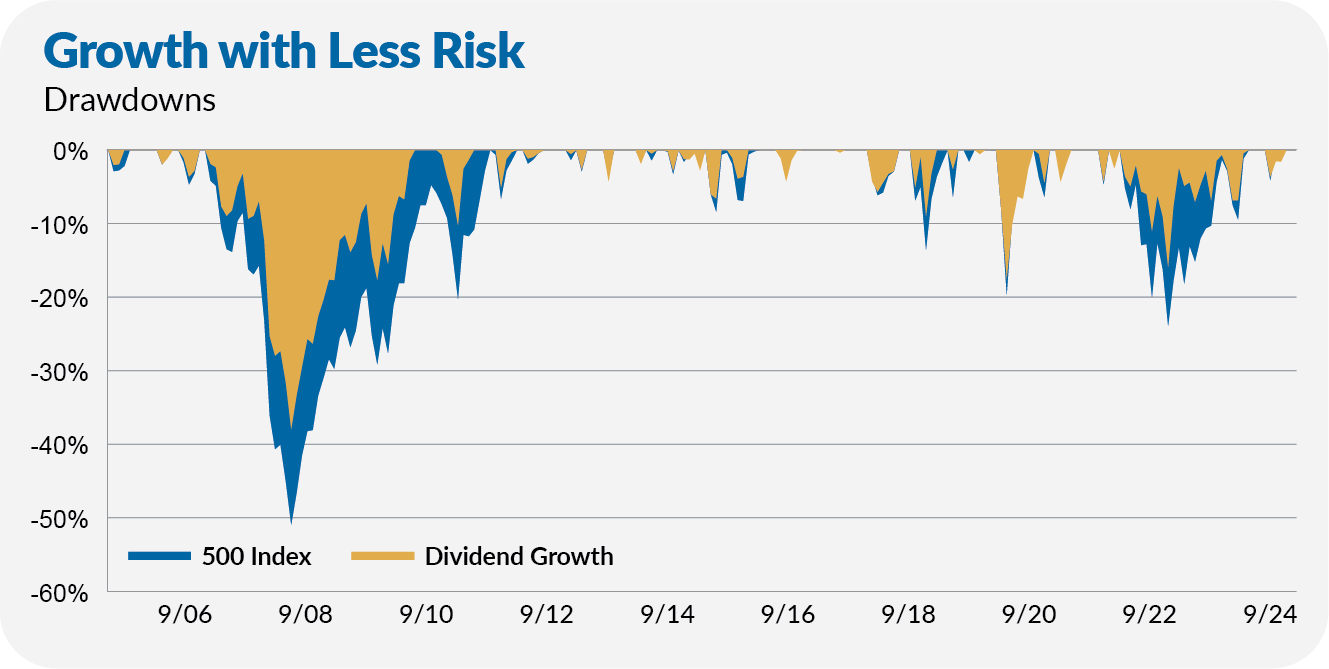

The short story is that Dividend Growth has delivered on its goal of providing solid returns with less risk over time.

To put some numbers on it, from the end of April 2006 through September 2024, Dividend Growth returned 514% (or 10.4% per year) and 500 Index returned 530% (10.5% a year).

You may wonder what’s so great about market-like (or slightly below-market) returns. We also have to consider the risk side of the equation, where Dividend Growth shines.

To help illustrate Dividend Growth’s ability to protect on the downside, consider the chart below comparing the dividend fund’s drawdowns (a decline from a prior high) over time to 500 Index’s drawdowns.

Dividend Growth held up better during the most challenging markets of the past two decades: 2007–2008 (the Global Financial Crisis), 2011 (the European debt crisis), 2018 (a near-bear market) and 2022 (the reflation bear market).

The exception is March 2020, when COVID-19 lockdowns began. The market’s decline was too short-lived (lasting about three weeks) for Dividend Growth’s defensive features to come through.

In sum, Dividend Growth has delivered market-like returns with less risk over the full cycle. That’s a good combination for a fund that I recommend as the core of a portfolio.

With a dedicated manager whose own money is invested alongside shareholders and a disciplined investment approach, there is a lot to like about Dividend Growth.

While the fund isn’t going to lead the pack when animal spirits are up and the market is racing ahead, when the cycle turns, Dividend Growth has market-beating potential.

Additional reading: Enjoy my exclusive (lightly edited) conversation with Wellington’s Don Kilbride and Peter Fisher here.

BONUS ETF PICK: If you’re looking for an ETF solution, Dividend Appreciation ETF (VIG) is the answer. The ETF aims to track the S&P U.S. Dividend Growers index, which includes companies with a history of raising dividends. Think of it as S&P’s attempt to distill the Kilbride/Fisher approach into a rules-based, mechanical investment strategy.

International Growth (VWIGX)

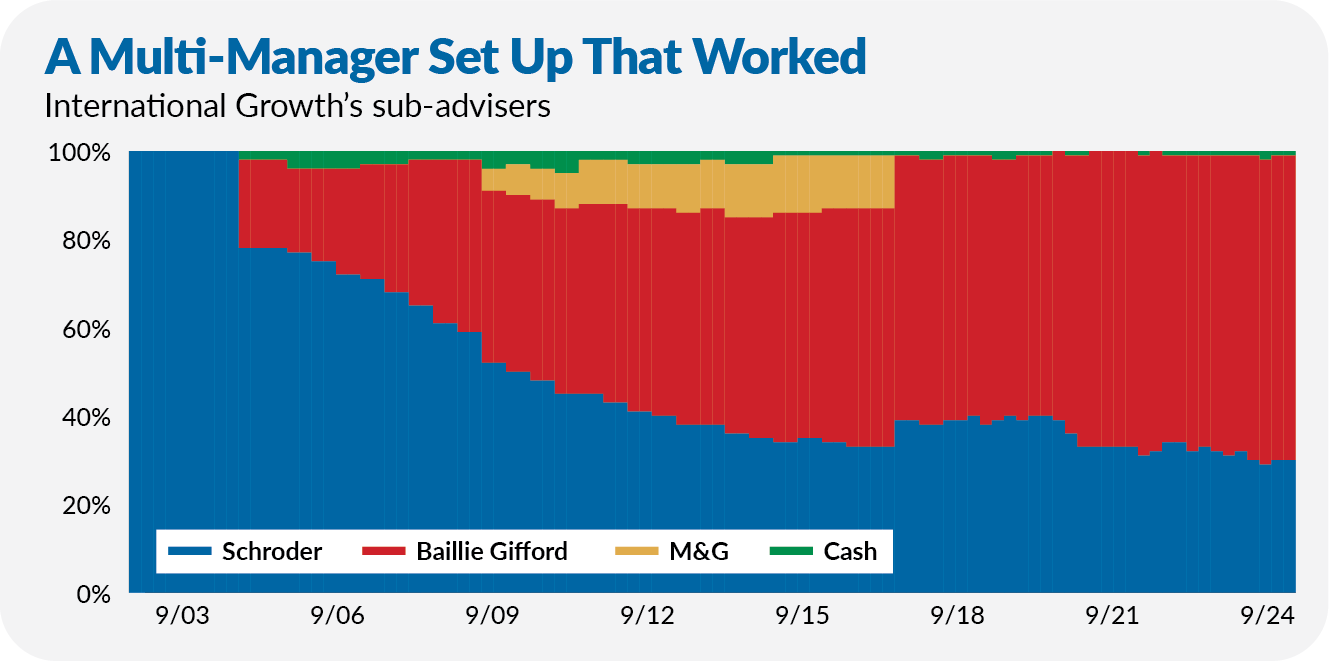

International Growth (VWIGX) is one of the multi-managed funds that actually works—though, as with any active strategy, there can be periods when performance lags.

Schroders Investment Management was International Growth’s original manager. In 2003, Vanguard added Baillie Gifford to the mix, handing the Edinburgh-based managers 20% of the fund’s assets. Over the years, Vanguard gradually transitioned more assets from Schroders toward Baillie Gifford. In 2013, Baillie Gifford was responsible for half of the fund’s assets.

As you can see in the chart below, M&G Investments had a brief stint on the fund from 2008 to 2016. But this has primarily been the Schroder and Baillie Gifford show. Today, Baillie Gifford directs about 70% of assets, while Schroder invests the other 30%.

With around 125 holdings and the top-10 stocks soaking up about 30% of assets, this isn’t a bloated portfolio. Both sub-advisers run relatively concentrated portfolios, but Baillie Gifford is the engine that powers International Growth.

The Baillie Gifford team typically owns 50–70 exceptional growth companies with a long-term view. They do not focus on geographic or sector allocation but look to build a diversified portfolio of independent bets.

This approach to investing is all about embracing the asymmetry of stock returns. In English, this refers to the fact that when you buy a stock, the most you can lose is how much you put in, but it’s possible to make multiples of your initial investment if it works out. This means that a few big winners can more than make up for your losers—as any venture capital investor would tell you.

That’s easier said than done, and this approach may not be for everyone. To beat “the market,” you need to be different from the market. Of course, as I said about PRIMECAP, different doesn’t always mean better.

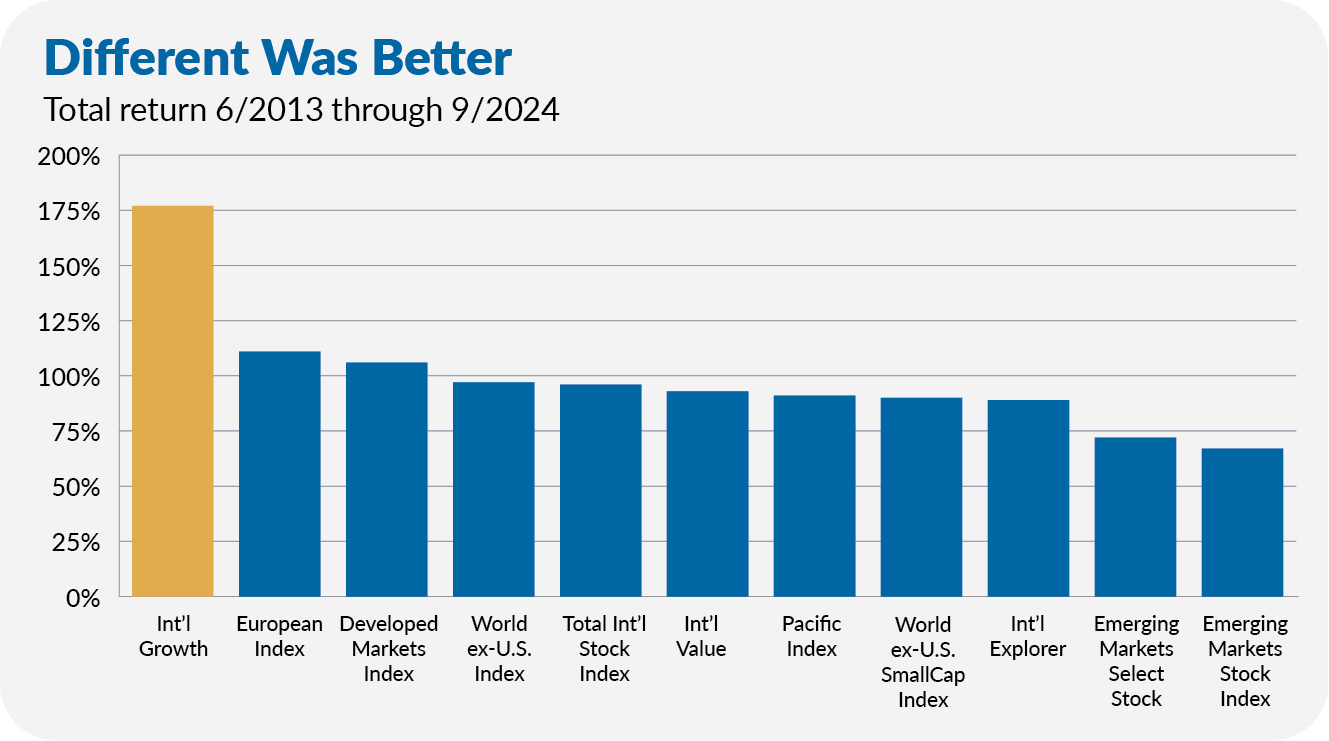

However, International Growth has been Vanguard’s best-performing foreign stock fund since I first purchased it in the Aggressive Portfolio in 2013 (through September 2024)—and it’s not even close. International Growth’s 171% gain is way ahead of the next closest fund, European Index (VEUSX), which returned 111%.

Sometimes, being different is better!

Additional reading: Enjoy my exclusive (lightly edited) conversation with Baillie Gifford’s Thomas Coutts here.

BONUS ETF PICK: If you’re looking for an ETF solution, keep it simple with Total International Stock ETF (VXUS).

International Core Stock (VWICX)

International Core Stock (VWICX) is my preferred foreign stock fund for conservative investors.

The fund launched in October 2019, with Wellington Management’s Ken Abrams and Halsey Morris—two Ivy League grads—calling the shots. Anna Lundén was named a manager before Abrams’ June 2024 retirement.

Why do I have confidence in a fund when the founding partner has recently departed?

First, to hear Abrams tell it, he had a knack for finding (and partnering with) Wellington’s most talented investors. From the fund’s get-go, Abrams knew he would only be around for five years, so he built a team and process to outlast him.

I’m trusting that he’s done that. Abrams certainly thinks he’s succeeded—not only is he keeping every dollar he’s invested in the fund there, but he’s planning to add to his position!

Second, this strategy isn’t driven by one person’s stock-picking genius.

The process is designed to take advantage of Wellington’s various disciplines and insights. International Core Stock holds between 60 and 100 stocks of the 400 companies screened and selected by Wellington’s research analysts in both emerging and developed foreign markets.

If Wellington’s analysts do their jobs well, Morris and Lundén will pick from an attractive stock basket. Managing a fund involves more than buying good stocks, but that’s certainly a good starting place.

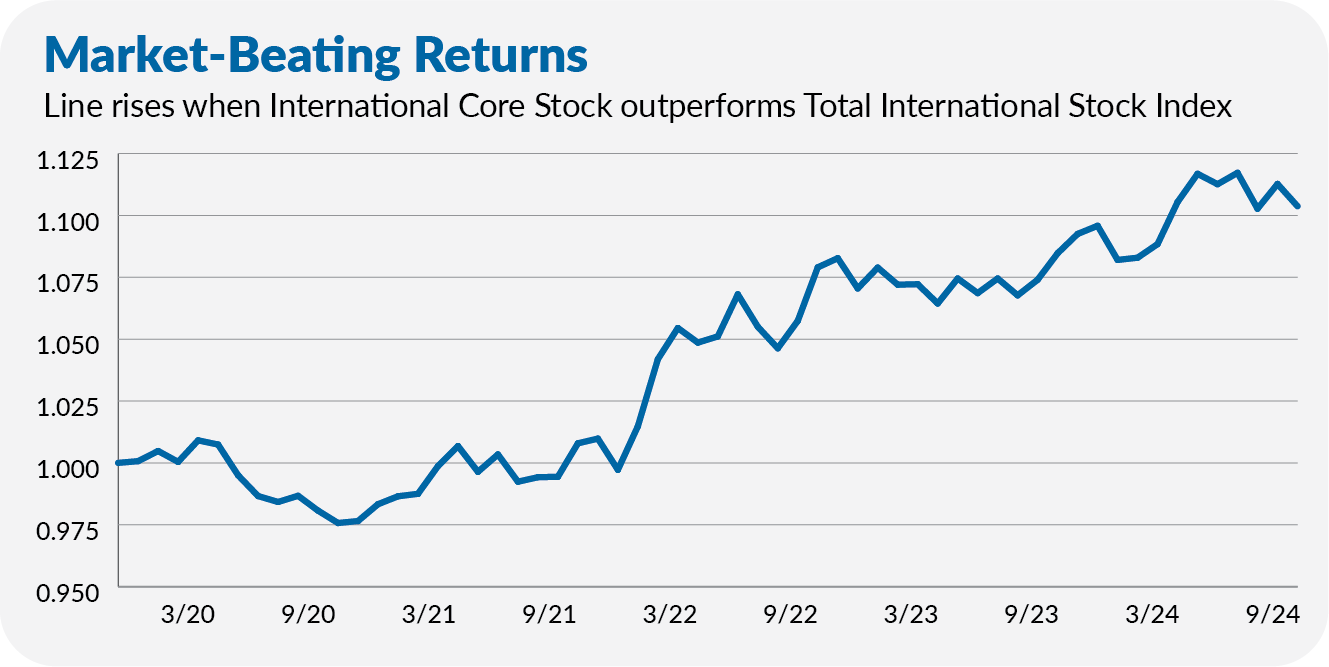

Third, the results have been solid—and exactly as advertised. The managers aim to win over time by participating in bull markets while holding up better in bear markets.

Well, since its launch through September 2024, International Core Stock has outperformed Total International Stock Index (VTIAX) by 2.2% per year. It’s mainly won by controlling risk.

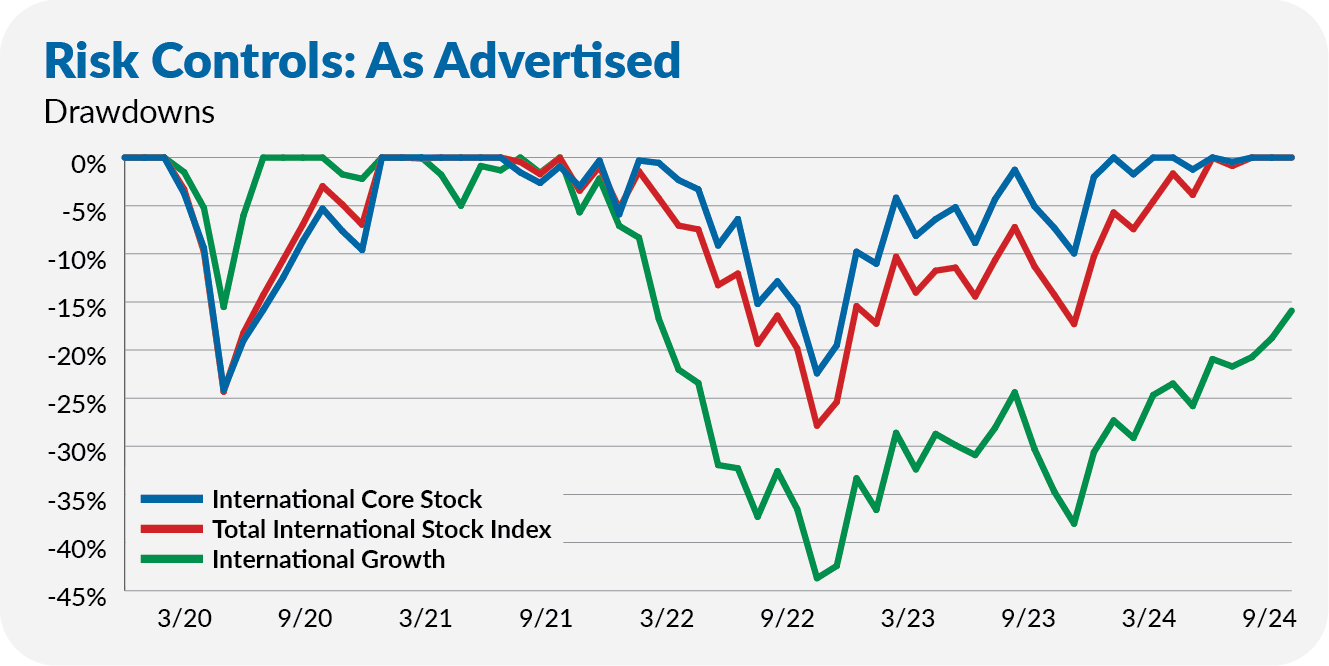

International Core Stock has been the second-best performing of Vanguard’s large-cap foreign stock funds. Only International Growth has done better, though with much more risk—as shown in the drawdown chart below.

Abrams may be gone, but the bottom line is that this remains a solid choice for any investor (particularly conservative ones) looking to add foreign stocks to their portfolios.

Additional reading: Enjoy my exclusive (lightly edited) conversation with the Wellington co-managers—Kenny Abrams, Halsey Morris and Anna Lundén—here.

BONUS ETF PICK: If you’re looking for an ETF solution, keep it simple with Total International Stock ETF (VXUS).

U.S. Value Factor ETF (VFVA)

Vanguard has been in the factor game for decades—even if they didn’t call it that—but it launched its family of “labeled” factor ETFs in 2018. I’ve been skeptical of these funds from Day 1. And my hesitancy was justified—none of the factor ETFs have outperformed Total Stock Market ETF (VTI) since their launch.

So, why am I shaking off my doubts and flagging U.S. Value Factor ETF (VFVA) as a top pick for the year ahead? That’s a great question.

I believe U.S. Value Factor ETF provides Vanguard’s “best” exposure to value stocks—giving investors the most bang for their buck.

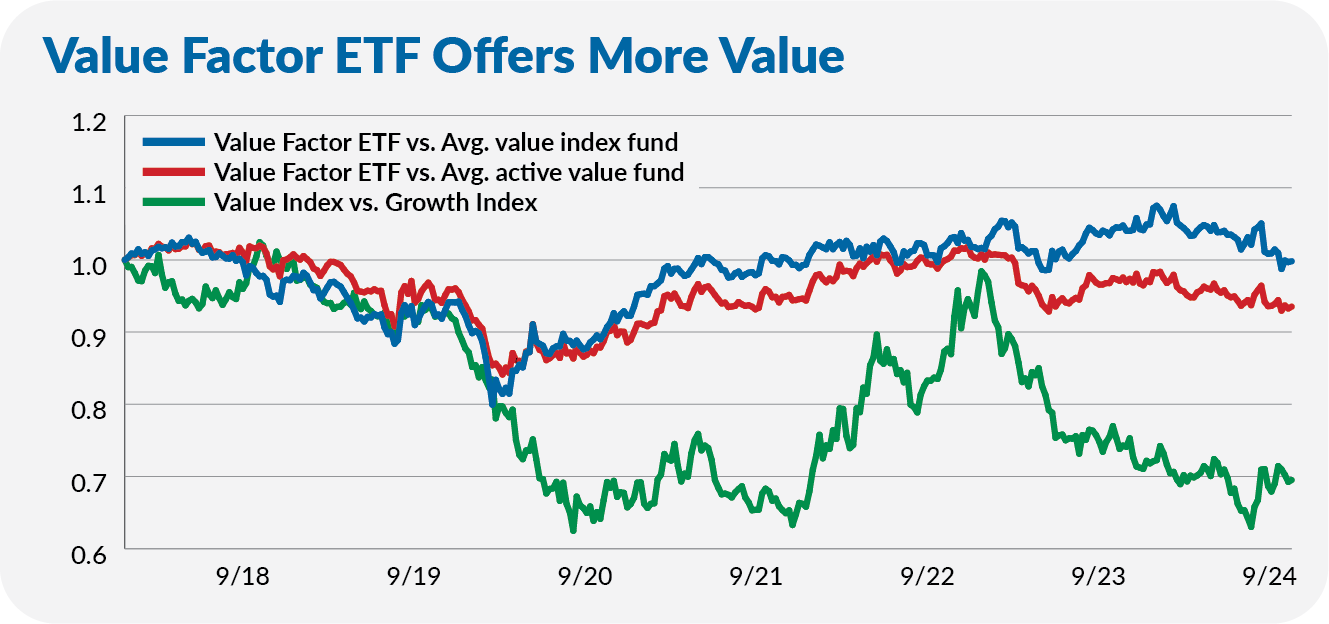

I’ve demonstrated this in the relative performance chart below comparing U.S. Value Factor ETF to its in-house value brethren.

Since the ETF allocates evenly to large, mid and small stocks, I combined Value Index (VVIAX), MidCap Value Index (VMVAX) and SmallCap Value Index (VSIAX) into one all-cap value “index.” The blue line compares U.S. Value Factor ETF to this average index.

U.S. Value Factor ETF is active, as manager John Ameriks (aided by computer models) constantly picks stocks with relatively low valuations—think price-to-earnings and price-to-book ratios.

Vanguard also offers other active value funds. The red line in the chart below compares the ETF to the average performance of Strategic Equity (VSEQX), Strategic SmallCap Equity (VSTCX), Selected Value (VASVX), Windsor (VWNDX) and Windsor II (VWNFX).

The final line in the chart, comparing Value Index and Growth Index (VIGAX), acts as a barometer of the market environment—signaling when value or growth stocks are in favor. The green line rises when Value Index outperforms and falls when Growth Index leads.

The takeaway is that U.S. Value Factor ETF tended to beat its siblings when value stocks were in favor but trailed when growth stocks were outperforming.

It’s not perfect—for example, the ETF navigated the aftermath of the COVID-19 market shock better than its peers even though growth stocks outperformed value stocks. It’s also encouraging to see that the factor ETF has kept pace with its value siblings the past year (or so) when growth stocks were in favor.

Still, the trend is clear. When the pendulum swings and value stocks are in favor, I expect U.S. Value Factor ETF to be among Vanguard’s best performers.

Additional reading: You can find a deep dive into Vanguard’s factor ETFs here.

SmallCap ETF (VB)

As you’ve probably figured out by now, I’m a fan of partnering with the “right” active managers. However, you have to be very selective in choosing managers. Most active managers don't outperform their benchmark indexes or index funds over time.

So, I won’t buy an active manager out of stubbornness or a need to be consistent. I'm delighted to own an ETF (or index mutual fund) where I lack confidence or conviction that a fund manager can give us the outperformance we want.

And that’s the situation when it comes to Vanguard’s aggressive small-stock fund options. With less-than-inspiring active funds to choose from, don’t overcomplicate things.

For just 0.05% (five basis points), SmallCap ETF (VB) gives you broad exposure to small-sized stocks in the U.S. in a very tax-friendly manner. Let’s not look a gift horse in the mouth.

So, why SmallCap ETF for the year ahead?

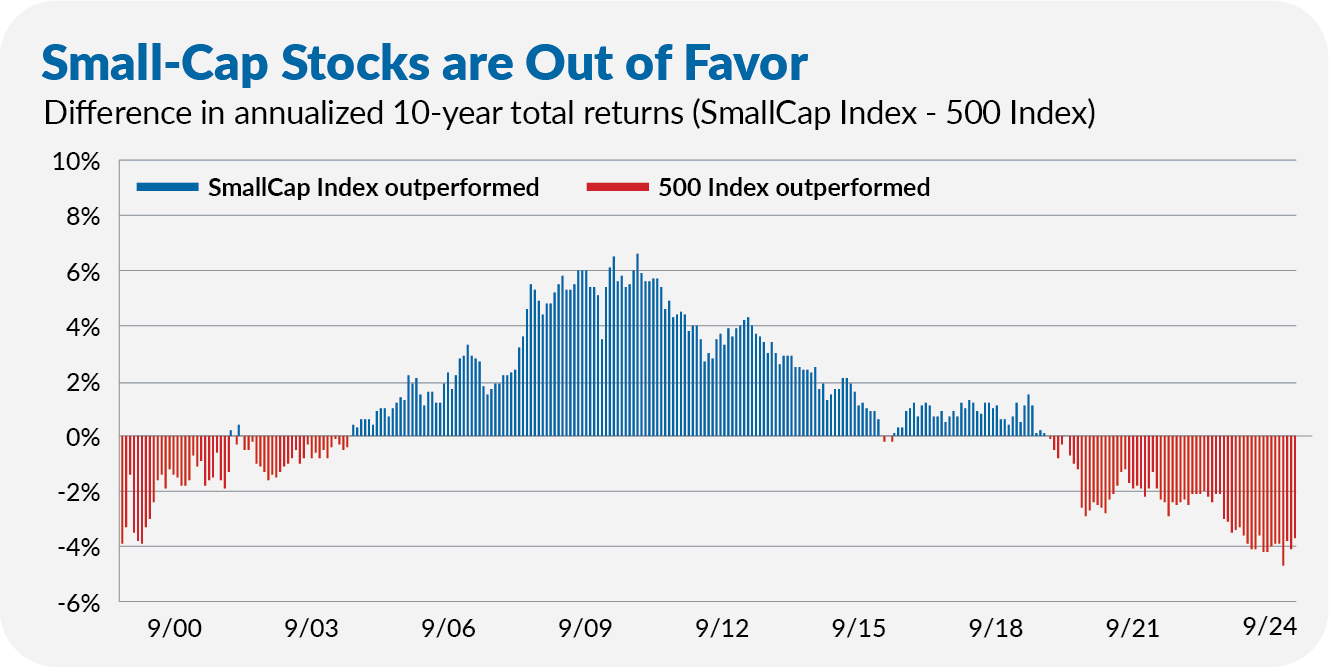

The small-cap index fund has trailed 500 Index over the past decade by the largest margin in three decades. That’s an outlier and an opportunity—if you ask me.

Note: If you prefer mutual funds, go ahead and buy the fund’s mutual fund shares (VSMAX). I’m agnostic about buying a Vanguard index mutual fund or its ETF sibling. I use the mutual fund in the chart because it has a longer history.

Additional reading: You can find a deep dive into Vanguard’s aggressive small stock funds here.

Real Estate ETF (VNQ)

Real estate (or land) is one of the oldest assets. For many of us, our homes are the largest assets on our balance sheets. And though it is a significant investment for many consumers, real estate doesn’t always get the same attention from investors.

Real estate accounts for just 3% of Total Stock Market ETF’s portfolio, so one could say it’s an afterthought for investors but front of mind for consumers.

Right now, I’m also seeing many dire headlines about real estate from an investment perspective. For example, The New York Fed Is Sounding The Alarm About Commercial Real Estate or Will the Commercial Real Estate Market Crash in 2024? And, of course, higher mortgage rates have impacted the housing market. The fearmongering machine is up and running full steam.

And that’s precisely why investors should pay attention to Real Estate ETF (VNQ) now.

But, taking a quick step back, let’s ensure we all understand what we are buying.

Think of REITs—real estate investment trusts—as a mutual fund. The managers of a REIT pool capital from multiple investors and then purchase (and manage) multiple properties. REITs give small investors instant diversification and access to professional management. And like mutual funds, REITs come in different flavors—some are very diversified, while others focus on specific types of properties (think offices, warehouses, apartment buildings or shopping centers).

The mutual fund analogy isn’t perfect, but the core idea of pooling capital to achieve immediate diversification and professional management is the same.

Put a bunch of REITs together into a fund—say, Real Estate ETF—and you can achieve a level of diversification that we mere mortals could never achieve on our own. By holding over 150 REITs, Real Estate ETF owns thousands of properties of all shapes and sizes nationwide.

Real estate (and, by extension, REITs) is, in many ways, a hybrid asset. Most of the returns they generate come from income, like bonds. However, like stocks, the price of the properties is driven by the market—there is no guarantee of what price you will receive when it comes time to sell. Real estate is also a real asset (it’s in the name), so we should expect prices to rise with inflation.

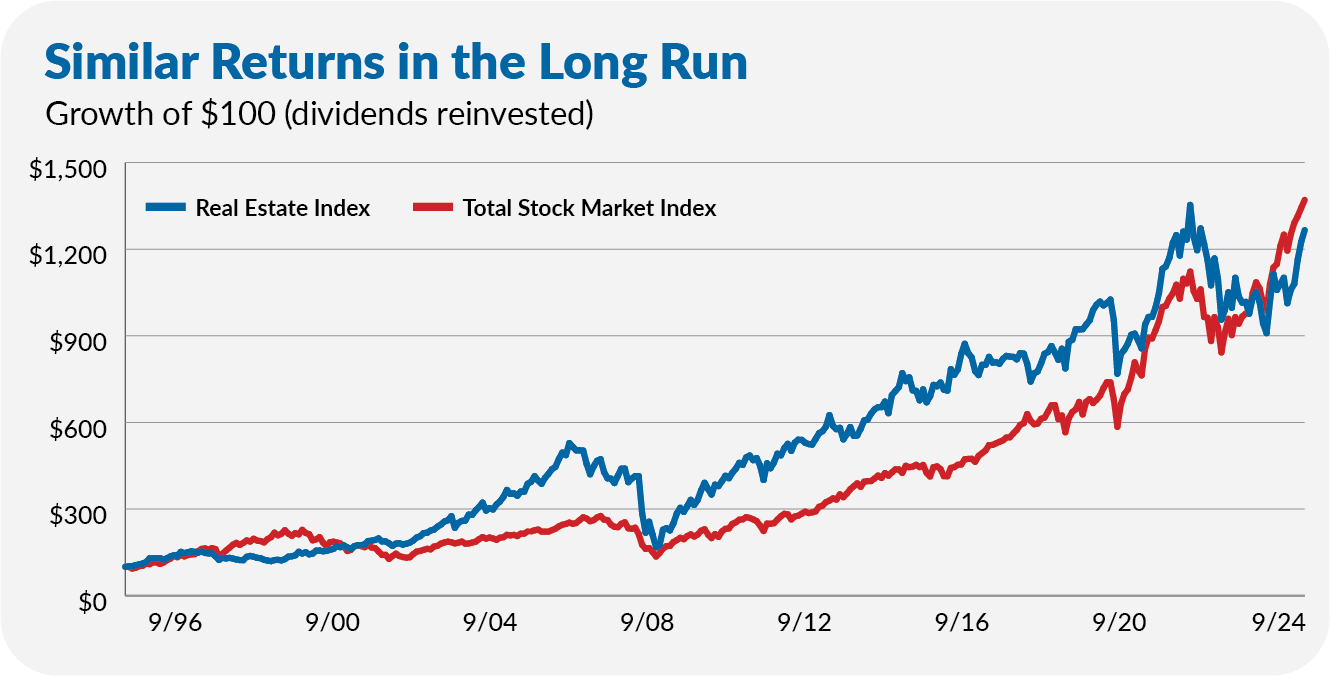

Since Real Estate ETF was launched—or rather, since its mutual fund share class was launched in 1996—it has delivered similar returns to Total Stock Market Index (VTSAX). The real estate fund has gained 1,166% (or 9.4% per year), while the stock fund is up 1,270% (or 9.7% annually).

However, the two funds have not moved in lock-step, making them complementary holdings in a diversified portfolio.

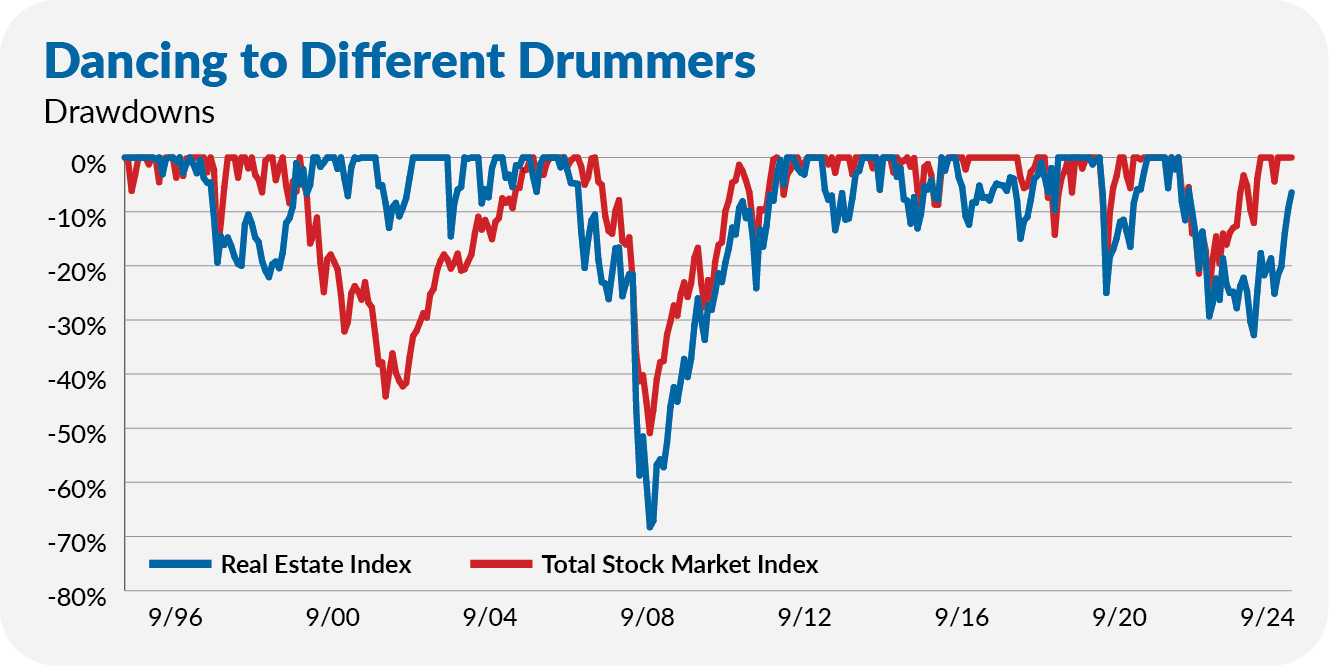

The chart below compares the drawdowns of the two funds over the past three decades.

At times—like during the Global Financial Crisis and COVID-19—real estate and stocks have fallen together. But that hasn’t always been the case. For example, in the late 1990s, real estate was in a bear market (down 20% or so) while stocks made record highs. The two assets reversed positions when the tech bubble burst in 2000–2002.

For the past two years, stocks have rebounded and set record highs, while real estate has languished in bear market territory. However, we’ve seen some signs of life out of Real Estate ETF recently. In the third quarter of 2024, the real estate fund gained 17.2%, while stocks only advanced 6.2%.

So, if you’re looking for an asset that has been out of favor but is showing some positive momentum as we enter 2024, look no further than Real Estate ETF.

Note: Again, I’m agnostic between the ETF shares (VNQ) and the mutual fund shares (VGSLX). I used the mutual fund shares in my charts because it has a longer history.

Additional reading: You can find a deep dive into the dynamics of the real estate sector here.

Eating My Cooking

There you have it: my seven funds for 2025 and beyond.

For the record, I own six of these seven funds. I do not own PRIMECAP. However, PRIMECAP Odyssey Aggressive Growth (POAGX)—a more aggressive fund run by the same management team—is my single largest investment. (I write often about the PRIMECAP Odyssey funds, which are a great way to access the team's talents directly.) So, for better or worse, I have my money where my mouth is.

Here's to a prosperous and profitable investment future.

While the information provided is obtained from sources believed to be reliable, its accuracy or completeness cannot be guaranteed; nor can the publication be considered liable for the future investment perfor mance of any securities or strategies discussed. The information provided is of general interest and is not intended as individualized investment advice for any subscriber or specific portfolio.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.