Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 23rd.

There are no changes recommended for any of our Portfolios.

As it is time for giving thanks, allow me to thank all of you for subscribing. I hope you’ll find the data and analysis here both bountiful and satisfying.

As it’s the holiday season, it must be time to discuss cryptocurrencies. Five years ago, when bitcoin first caught popular attention, its price peaked over $18,000 in December 2017 and talk of this newfangled cryptocurrency dominated my holiday dinner conversations. Since then, bitcoin has been through a few boom-and-bust cycles ... currently it’s in a bust.

Today cryptocurrencies are making headlines, not for soaring prices, but because the second-largest cryptocurrency exchange, FTX, recently failed and filed for bankruptcy ... and the fallout is still spreading across the cryptosphere. This isn’t a “crypto newsletter,” and I touched on the topic last week, so I’m not going to go deep into cryptocurrencies and how they work, but as there’s a good chance FTX, bitcoin and cryptocurrencies will end up being discussed at your holiday table (once again) this year, I figured I’d offer a few thoughts.

First, no thinking investor should be surprised to see exchanges and other crypto-related companies go belly up. Why? Because the crypto crowd is, in one sense, trying to build a new financial system. For all the flaws of the modern financial system though, I think it’s safe to say that we’ve learned a lot of lessons over the years when it comes to regulation and keeping customer assets safe. Crypto companies haven’t learned those lessons yet, though I’m betting the survivors are dusting off the history books.

Second—speaking of learning lessons—there’s a lesson here that goes beyond cryptocurrencies. FTX was backed by some of the “smartest people in the room”—think, some of the biggest venture capital firms, for instance. How did those savvy investors miss, well, everything when it came to FTX?

They missed it because a rising tide lifts all boats. When prices are rising and everyone is making money, it’s easy to get caught up in the hype. It’s easy to hear and see what you want to when everyone around you is profiting, and you want to get your piece of the pie. We saw it during the meme-stock rally when usually unremarkable companies soared in value only to crash when traders tired of one stock and moved on to another. If it can happen to the so-called smartest investors, it can happen to anyone. Tread carefully in the crypto space.

I don’t think FTX’s demise leads to contagion across the more traditional stock and bond markets. If anything, it strengthens their appeal, in my view. The cryptosphere is, by design, mostly outside of the traditional, global financial system. This isn’t like the global financial crisis when sub-prime debt was leveraged throughout the network of megabanks and the mortgage industry. Crypto makes a lot of noise despite its relatively small size and influence.

Finally, what I find fascinating about cryptocurrencies is that we are watching collective story telling happen in real-time. Does bitcoin (or any other cryptocurrency) have value or not? Depending on which narrative is dominating, prices rise or fall dramatically. For the record, most cryptocurrencies are worthless in my view.

As I said last week, I don’t own and haven’t owned any cryptocurrencies, and I view them as a speculation—not an investment.

Turning to the mainstream markets, we can all be thankful that performance has improved over the past two months. September was a tough month for both stock and bond investors—500 Index (VFIAX) fell 9.2% and Total Bond Market Index (VBTLX) slid 4.2%. But since the end of September, 500 Index is up 11.9% and Total Bond Market Index is up 1.1%. (Okay. Maybe that’s not a big gain from the bond index fund, but a gain is a gain.) In fact, only four Vanguard funds are down since September—three long-maturity Treasury funds and Short-Term Inflation ETF (VTIP)—and we are talking declines of just 1% to 2%.

Interestingly, Europe ETF (VGK) is near the top of the performance table over the last (nearly) two months with a gain of 20.2%. None of Europe’s “challenges” have been solved—war continues in Ukraine, inflation is running high on the continent and energy supplies are constrained—but when expectations are rock bottom, it doesn’t take much for things to be not as bad as everyone feared. Sometimes that’s all it takes for markets to rebound. A weakening dollar has helped too.

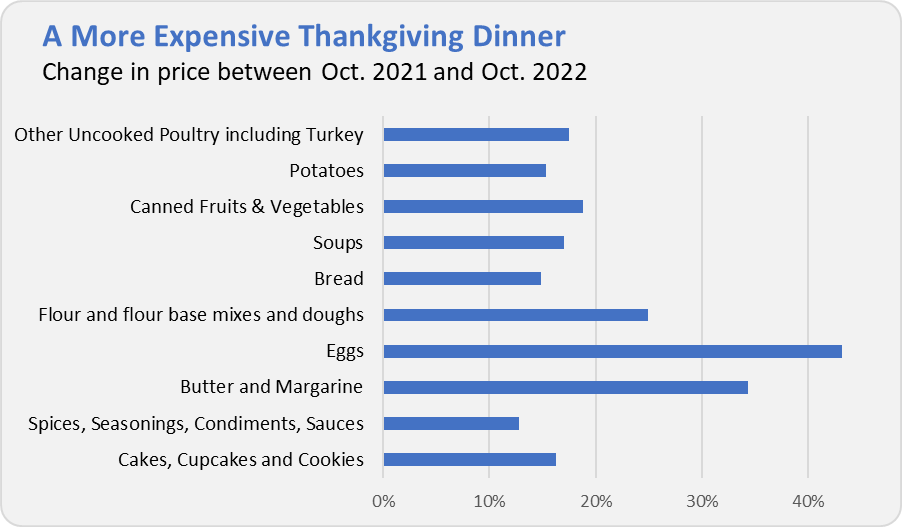

On a lighter note, as we head into the holiday, I wanted to look at how much more expensive this year’s Thanksgiving dinner is compared to last year.

The Bureau of Labor Statistics gets granular in their inflation tracking—though some of their category names are a little clunky. For example, Tukey is found under the “Other Uncooked Poultry including Turkey” category. And, as you can see in the chart below, turkey prices in October were up about 17% compared to October 2021.

But it’s the bakers among us who face the biggest price increases. If you were looking to wow your guests with a homemade pie, be aware that eggs, butter and flour prices are up 25% to 45% over the past year.

The fact that headline inflation ticked lower the past month is of little solace to those of us shopping for holiday meals.

All this talk of fattening up over the Thanksgiving meal leads me to the improved returns for some of our chosen managers and, ultimately, our Portfolios. For the year through Tuesday, the Aggressive Portfolio is down 13.6%, the Growth ETF Portfolio is off 16.0%, the Growth Portfolio has declined 12.5% and finally the Moderate Portfolio is down 10.0%. This compares to a 16.2% decline for Total Stock Market Index (VTSAX), a 16.9% loss for Total International Stock Index (VTIAX), and a 13.3% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), is down 15.8% for the year and its most conservative, LifeStrategy Income (VASIX), is off 13.1% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 8.4%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future, and a very happy Thanksgiving.