Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, February 8th.

There are no changes recommended for any of our Portfolios.

If you’re in the “soft landing” or no recession camp, then two economic data points released this week favor your scenario.

First, the economy added over half a million jobs in January and the unemployment rate fell to 3.4%—the lowest level since the 1950s. Even if you look at a broader definition of unemployment (the U-6 unemployment rate), which is hovering around 6.5%, it’s the lowest level since 1994 (when my data starts). My point is: Consumers are employed. And if they are employed, they are being paid. And if they are being paid, they are probably spending some of that money which means continued economic activity and yes, growth, not recession.

Second, a month ago I showed you that both the manufacturing and service sides of the economy were contracting, according to Institute for Supply Management (ISM) surveys. While the manufacturing sector continued to contract in January, the service sector bounced back from 49.2 to 55.2. (Remember, anything above 50 signals expansion.) I’ll be keeping an eye on this survey in the months ahead, but it is likely that the December decline was just a blip in the data, not the beginning of a trend.

That’s economics. The other development that I have an eye on is the advances in artificial intelligence (AI). The chatbot ChatGPT developed by OpenAI and released around Thanksgiving last year was a BIG step forward in our computers’ abilities to “think” and “communicate.” Now, Microsoft (which is a partner/investor in OpenAI) is incorporating the same technology into their Bing search engine. Google hasn’t been standing still though and has punched back by testing out its own chatbot (called Bard) and incorporating AI into certain aspects of its search and map apps.

I’m not a futurist and trying to predict how (and when) artificial intelligence will impact the economy and our lives is, well, that’s a big question. But it is fair to say that AI is poised to have greater consequence for investors over the long haul than where the next ISM or unemployment report comes in. But AI isn’t quite ready to replace everything we humans do.

For a bit of fun, I asked ChatGPT “Do index funds always outperform active management?” Here was the bot’s response:

Index funds have historically outperformed actively managed funds, but there is no guarantee that this trend will continue in the future. It largely depends on market conditions, the efficiency of the markets, and the skill of individual fund managers. Additionally, past performance is not a guarantee of future results, so it's important to consider multiple factors when making investment decisions. Ultimately, both index and actively managed funds have their own advantages and disadvantages, and the best choice will depend on the individual's investment goals, risk tolerance, and personal circumstances.

It's not bad … but it is a boilerplate response—even managing to work in “past performance is not a guarantee of future results.” When I asked the bot more fund-specific questions—like, is Vanguard PRIMECAP a good buy?—we ran into a dead end. In short, ChatGPT isn’t going to tell you want to buy and sell or replace your financial advisor—at least not yet.

Or as OpenAI's CEO Sam Altman said:

ChatGPT is incredibly limited, but good enough at some things to create a misleading impression of greatness.

My response on the index versus active fund question would be a little different from the bot's. I expect index funds to outperform the average active manager over time. So, if you don't have an edge when it comes to selecting active managers, you should just buy an index fund (or ETF) and keep it simple—and there’s nothing wrong with that.

Anyways, I’ll have more to say about ChatGPT, AI and investing in the months ahead.

Turning to Malvern …

Manager Mix Up

Recently I was digging through various Statements of Additional Information (SAI)—which are the detailed add-ons to each fund’s primary prospectus—to hunt down how much the portfolio managers invest in their funds. (That’s my idea of a fun Tuesday afternoon!) I want to know if the managers running the funds day-to-day are investing alongside shareholders—eating their own cooking—or not.

I would love to see Vanguard step up and lead the industry by providing more transparency and ease of access to this information. But so far Vanguard only discloses what’s required of them, leaving it buried in the legal docs. Why make it so hard and time consuming for shareholders to find this information?

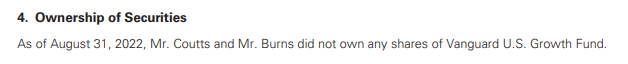

Of course, no one is perfect, but you probably won’t be surprised to hear that Vanguard makes mistakes in their reporting on manager ownership from time to time. The latest slipup was in the reporting of the Baillie Gifford managers overseeing a sleeve of U.S. Growth’s (VWUSX) portfolio. The Baillie Gifford duo on Baillie Gifford is Tom Slater and Gary Robinson, but in U.S. Growth’s latest SAI, Vanguard lists Tom Coutts and Lawrence Burns—the managers of International Growth (VWIGX).

I suppose it’s good to know that Coutts and Burns don’t own U.S. Growth, but then, they aren’t the portfolio managers. That said, I don’t expect Slater or Robinson own shares of the fund either … as they live and work in Scotland, they can’t own shares of U.S. mutual funds.

The point is that, like all of us, Vanguard makes mistakes. They make them in their service operations, as I’ve been reporting, and they make them in their documentation. With the SEC completely overrun and underbudgeted, it’s left to companies like Vanguard to self-regulate, which is fine until it’s not.

Adani

Adani Group, a giant Indian conglomerate made up of several public companies, has been under pressure since Hindenberg Research (an investment research firm) released a report on January 24 alleging fraud and market manipulation. After falling off a cliff, Adani’s stock(s) have been on the rise the past couple of days. However, I’m not here to speculate on the report or Adani’s future. I want to look at this through the lens of a Vanguard investor. Fortunately, it’s not particularly impactful.

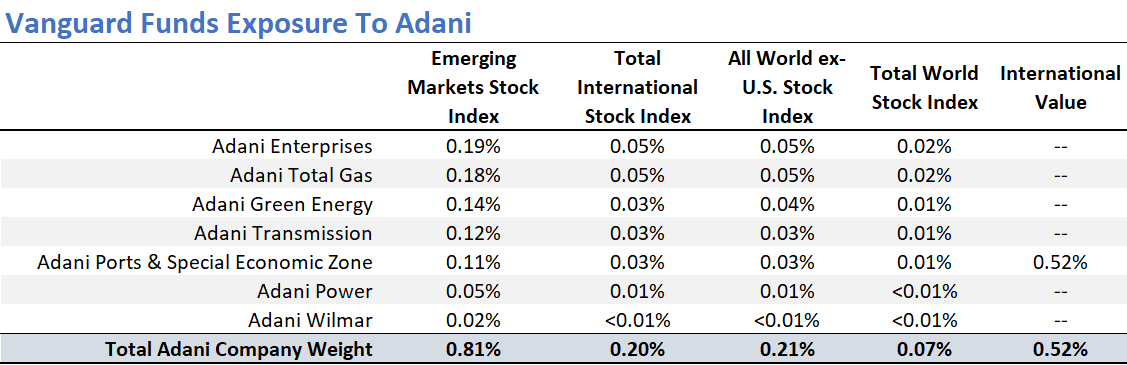

In the table below, I pulled out the Vanguard funds that held Adani stocks at the start of the year—either the flagship Adani Enterprises or one of the subsidiaries. I also show how much of each fund was allocated to them.

Along with International Value (VTRIX), which had a 0.5% position in Adani Ports & Especial Economic Zone, only four index funds held Adani stock. Emerging Markets Stock Index (VEMAX and the ETF shares VWO) had about 0.8% of its assets invested across the Adani companies. So, if they all went to zero, investors in the index fund would lose 0.8%, all other things equal—the equivalent of a not-so-bad day in the market for that fund. The other index funds had about 0.2% or less invested in Adani stocks.

Again, the headlines are dramatic—which is the case anytime a company loses $100 billion in value in short order—but, as Vanguard investors, the impact to our bottom lines barely registers.

Our Portfolios

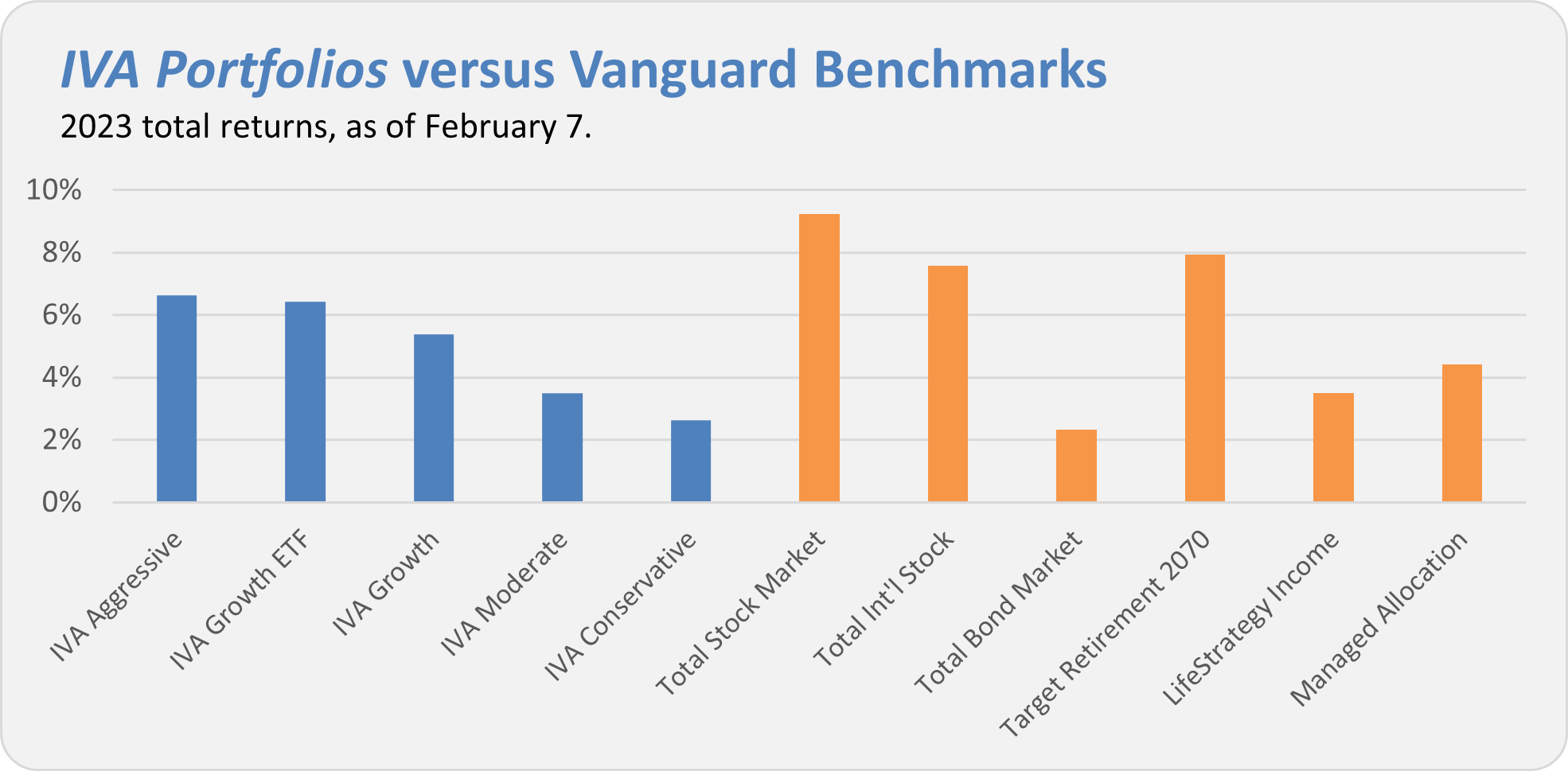

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 6.6%, the Growth ETF Portfolio is up 6.4%, the Growth Portfolio is up 5.4%, the Moderate Portfolio is up 3.5% and finally the Conservative Portfolio is up 2.6%. This compares to a 9.2% gain for Total Stock Market Index (VTSAX), a 7.6% return for Total International Stock Index (VTIAX), and a 2.3% gain for Total Bond Market Index (VBTLX).

Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 7.9% for the year and its most conservative, LifeStrategy Income (VASIX), is up 3.5% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) has returned 4.4%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.