Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 3.

There are no changes recommended for any of our Portfolios.

Welcome to 2024! I hope you made some wonderful holiday memories over the past week.

Premium Members have heard from me a lot recently:

- Thursday, December 28: I shared my 2024 Outlook, The First Shall Be Last.

- Sunday, December 31: I sent out a Trade Alert for those following the Hot Hands strategy.

- Sunday, December 31: I published a review of the events that caught our attention every month—here.

- Monday, January 1: I shared my 2023 Market Review, Super Stocks Put an End to Bear Market.

- Tuesday, January 2: I finished up with the January 2024 Monthly Recap—here.

So, this week, I’ll review the Vanguard news you may have missed these past two weeks and report on the final 2023 numbers for my Portfolios.

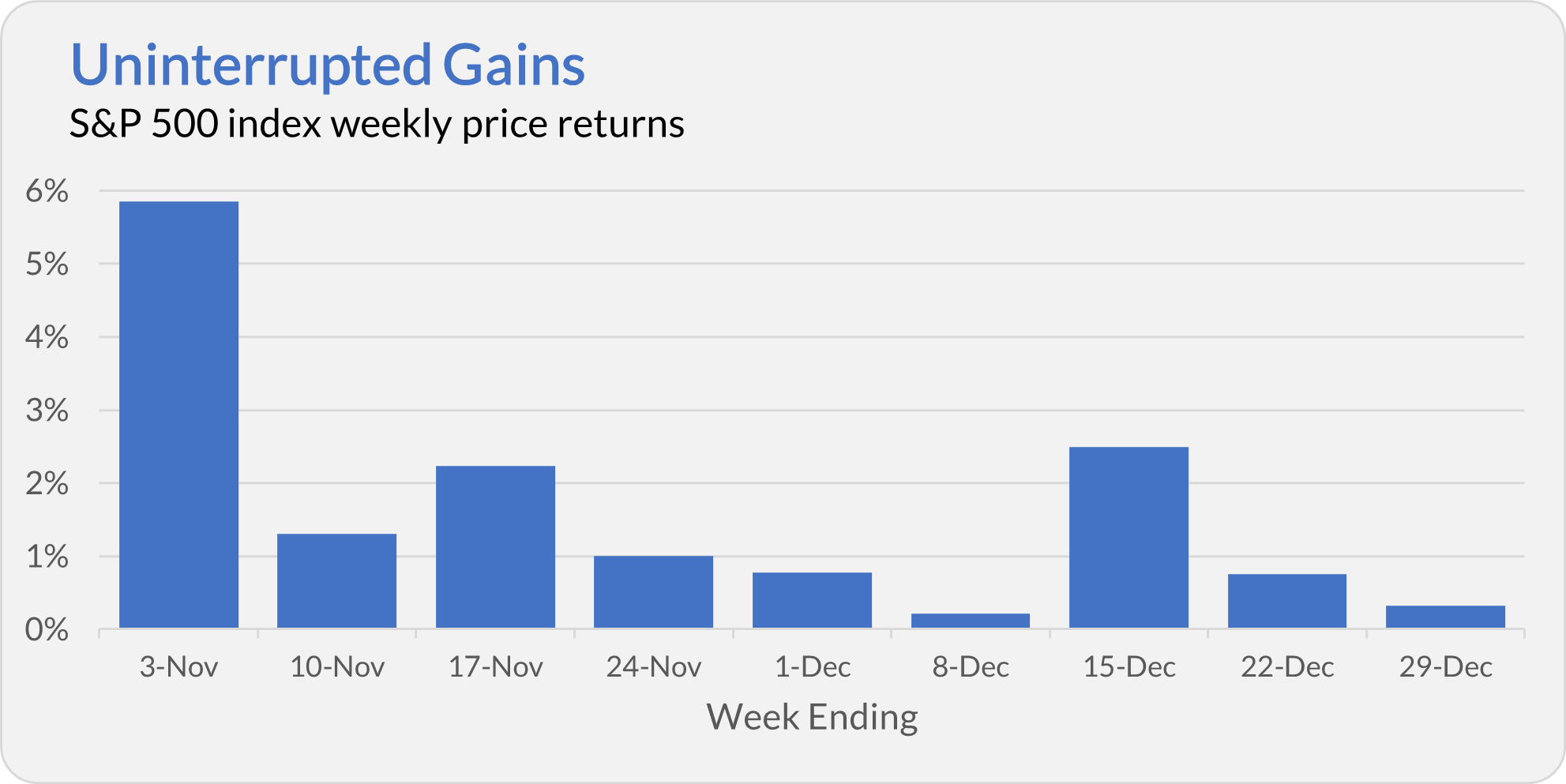

But very quickly, I want to note that the S&P 500 index ended 2023 on quite the streak—gaining ground for nine consecutive weeks to close the year on a high note.

It should go without saying, but this streak will eventually end. It’s equally important to remember that when the index finally stumbles, that doesn’t mean it’ll come crashing down.

With that said, here’s what you may have missed during the holiday “break.”

News From Malvern

Lubos Pastor, a finance professor at the University of Chicago Booth School of Business, joined Vanguard’s board of directors on Monday, January 1.

I’m sure this is just a coincidence, but Pastor’s most-cited research relates to the “liquidity factor”—the idea that stocks sensitive to market liquidity generate higher returns over time. Vanguard gave up on its U.S. Liquidity Factor ETF in late 2022.

It will be fascinating to see which Vanguard funds Pastor owns as the data becomes available. Unfortunately, based on the delays I expect from Vanguard, we may not see any data on Pastor until 2025.

On the fund front, there were manager changes on two of Vanguard’s multi-manager funds—Explorer (VEXPX) and Selected Value (VASVX).

ClearBridge, which manages 15% of Explorer’s portfolio, added Jeffrey Bailin as co-manager. He replaced his colleague, Jeffrey Russell. As of September 30, 2023, Bailin did not own any shares in Explorer.

Pzena Investment, responsible for nearly 40% of Selected Value’s assets, replaced Richard Pzena with Evan Fox. As of September 30, 2023, Fox did not own any shares in Selected Value.

Neither Russell nor Pzena owned shares of the funds either. So, their colleagues are carrying on the questionable tradition.

If I owned either of these funds—I don’t—I wouldn’t be too bothered. That said, I don’t recommend them.

Another Law Suit

Two California shareholders have sued Vanguard, claiming that Vanguard’s website, investor.vanguard.com, prohibits users from commenting negatively about the firm.

The complainants take issue with the terms of use for Vanguard’s website, which says that users cannot “submit, upload, post, e-mail, transmit or otherwise make available any [statement or content] that personally attacks or is derogatory toward Vanguard as an entity, Vanguard employees, any Vanguard products or services or any Vanguard materials.” Additionally, Vanguard’s terms forbid users from using language that “disparages or discredits” the company and brand.

When it comes to Vanguard’s finer points and quirks, I have always tried to call it like I see it. I’m as much a fan of the firm as anyone, but I’m also a critic and far from a naïve cheerleader. I don’t want Vanguard (or anyone else) infringing my (or anyone else’s) right to free speech.

That said, I struggle to see where the harm is here. Vanguard’s investor website isn’t an online forum—you can’t even comment on their blog posts.

Even though there is no place to comment, this feels like a situation where the terms and conditions have “crept” too far. Not many of us read the T&Cs of the websites we use, so lawyers can keep adding language advantageous to their clients.

Singleton Schreiber, the firm representing the plaintiffs, has filed similar suits against companies like Amazon, Bank of America, and TikTok, so Vanguard isn’t the sole target.

I just don’t see where this gets us or the plaintiffs.

False Start

In my month-by-month review of 2023, I said:

I sincerely hope 2024 is the year I get to write about how Vanguard’s service has dramatically improved—I’m not holding my breath, though.

“Cough!” It’s a good thing I’m not holding my breath. As the year opens, Vanguard’s tech has not gotten off on the right foot.

I’ve heard from several of you that Vanguard has been reporting inconsistent returns and year-end values for your accounts. When I logged into my account today, I was greeted by warning messages that Vanguard was “making updates” to my accounts and performance.

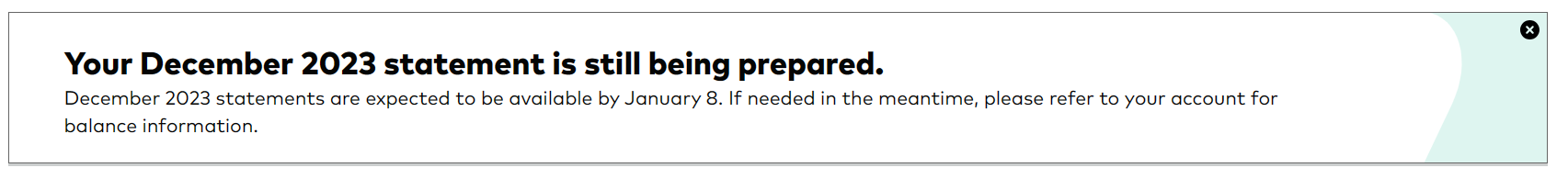

Given those messages, it's no surprise that Vanguard’s December 2023 statements are still being processed. Apparently, Vanguard initially made some statements available but then pulled them.

When I go to my account, it says I can expect my statements by January 8. The 8th!

Meanwhile, Fidelity’s year-end statements were available online on January 1.

We all make mistakes (myself included!)—and I certainly want Vanguard to give us accurate information and data—but this is not confidence-inspiring, in the least.

For those of you taking RMDs, I would wait until you get that final year-end statement before determining how much you need to withdraw in 2024. That way, you’ll at least have a paper trail should there be any issues.

Our Portfolios

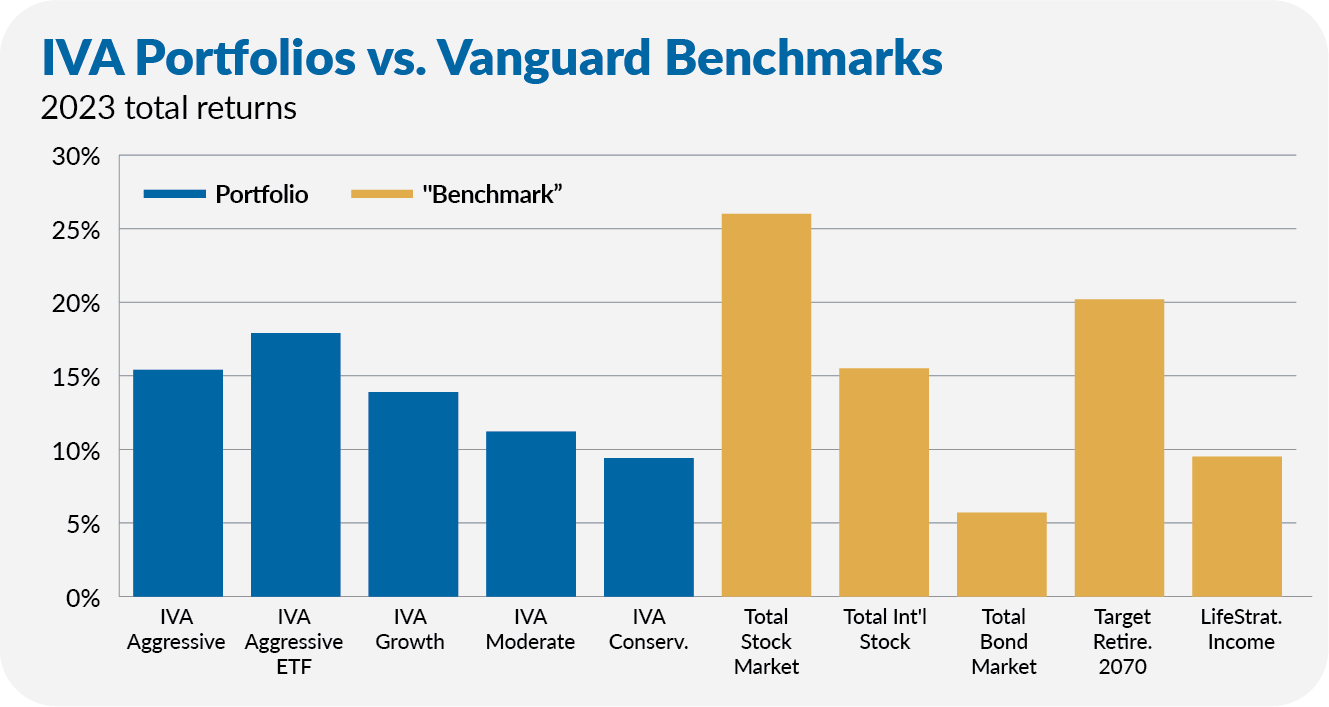

We’re only one trading day into 2024, so, let me provide a final review of how our Portfolios fared in 2023. My Portfolios delivered solid absolute but lagging relative returns in 2023. The Aggressive Portfolio gained 15.4%, the Aggressive ETF Portfolio returned 17.9%, the Growth Portfolio advanced 13.9%, the Moderate Portfolio gained 11.2% and the Conservative Portfolio returned 9.4%.

This compares to a 26.0% gain for Total Stock Market Index (VTSAX), a 15.5% return for Total International Stock Index (VTIAX), and a 5.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), returned 20.2% for the year, and its most conservative, LifeStrategy Income (VASIX), gained 9.5%.

For Premium Members, I dug deep into the performance of my Portfolios here and explained why I believe that patience will be rewarded.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.