Updated on Dec. 9, 2025 to clarify that you can only write checks from Federal Money Market in a taxable account. It is not available in retirement accounts.

Executive Summary: Cash Plus offers FDIC insurance and spending features, but its yield lags Federal Money Market by about 0.60%. This analysis breaks down what savers are paying for and what they’re giving up with Cash Plus, and why the higher-yielding money market fund remains the stronger choice for most.

Vanguard has been pushing its souped-up savings account—Cash Plus Account—hard. The pitch’s come-on: “Earn up to 8x more.”

But, 8x more than what?

Sure, earning 3.25% (currently) with Cash Plus is undoubtedly better than the next-to-nothing yields on most banks’ checking and savings accounts. But if you’re going to move your cash to Vanguard to earn more income, Cash Plus is not the only “higher-yield” option on the menu—and it’s certainly not the highest yielder.

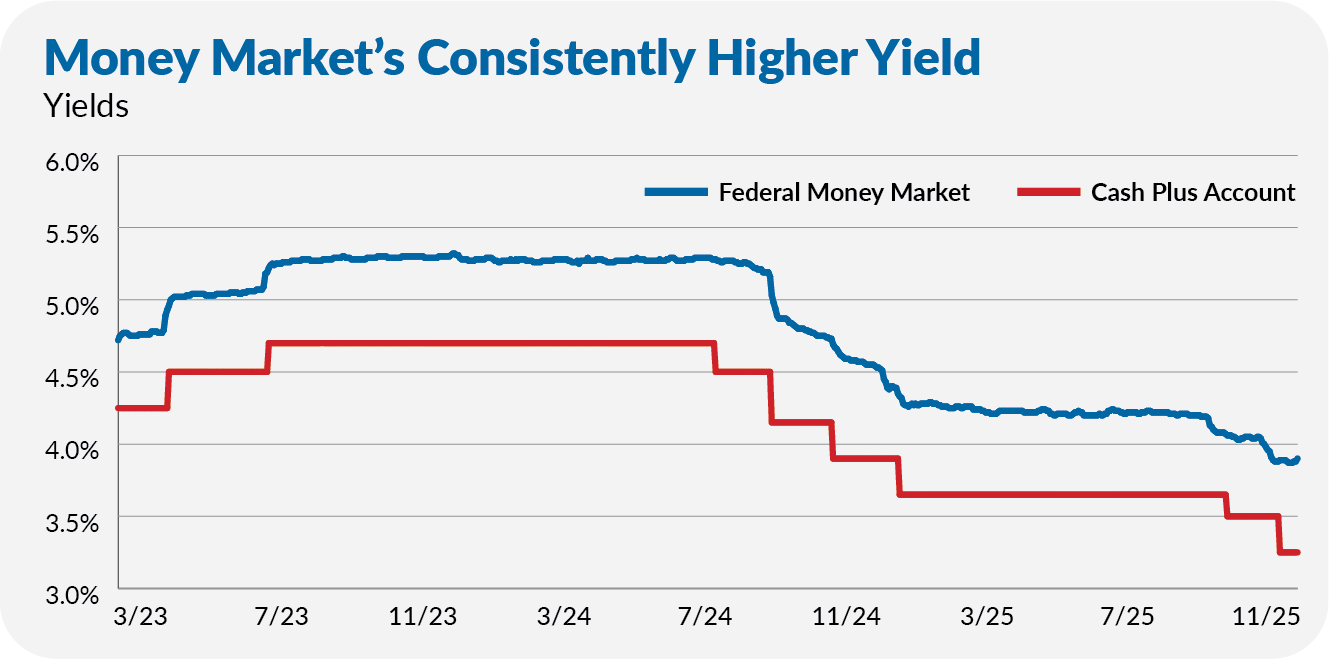

Federal Money Market (VMFXX) has consistently yielded about 0.60% more than Cash Plus since mid-2023 (when I began tracking Cash Plus’s yield daily).

So, if an investor (or saver) in Cash Plus is giving up 0.60% in yield, what exactly are they getting in return?