Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 13.

There are no changes recommended for any of our Portfolios.

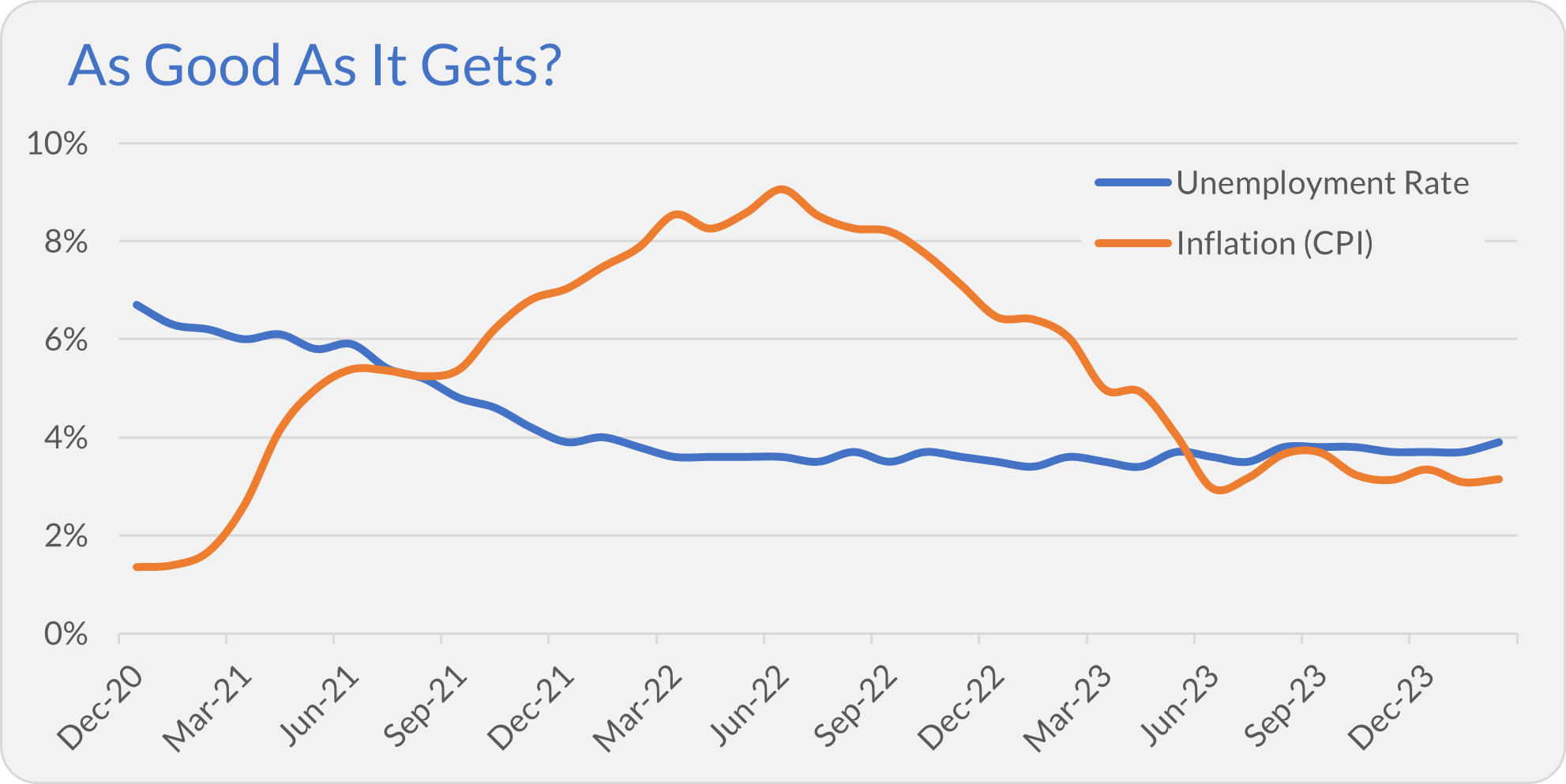

Two “big” economic numbers were reported in the past week. The unemployment rate increased from 3.7% to 3.9% in February, and the consumer price index (CPI, so-called headline inflation) also ticked higher, from 3.1% to 3.2%.

As you can see in the chart below, for the past six months or so, the unemployment rate has clocked in just under 4% while inflation has fluctuated around 3%. Is this as good as it gets for the economy?

Possibly. Federal Reserve policymakers would like to see inflation fluctuate around 2% instead of 3%. But, as I’ve said before, barring a recession, I think the days of sub-2% inflation are behind us.

Also, keep in mind that there are many ways to measure inflation, and the Fed’s preferred measure (core PCE) tends to run a little colder than CPI. So, policymakers might feel they are closer to achieving their inflation goal than the headline number (3.2%) suggests.

As I’ve been saying for several months, low unemployment and inflation mean that policymakers can sit on their hands and see how the data comes in. I expect that the Fed would accept a slightly higher unemployment rate (say, 4.5%) if it means that inflation falls the final percent to their 2% target. But there’s a fine line between unemployment ticking higher and the economy falling into a recession.

Scam Alert

This morning, a subscriber forwarded me a very real-looking but suspicious email that appeared to come from Vanguard’s PR department. The email touted the launch of the “Many Happy ReturnsTM toolkit for climate-conscious investors.” Just before lunchtime today, Vanguard confirmed to me that the email is not legitimately affiliated with Vanguard.

I have attached a PDF of the email. As you can see, it looks legit at first glance. The links in the article also take you to websites that look a lot like Vanguard websites. But I’m not including links or a “live” version of the email on purpose.

I can’t tell if this email and website are just an elaborate joke or a scam to get you to enter your account login information. (I’m not about to “log in” to the fake website to find out!)

While the appearance of the email and “happy returns” website is a decent approximation of official Vanguard materials, the text doesn’t pass the smell test. It’s too tongue-in-cheek and unbelievable. A pill that “inhibit[s] cognitive dissonance?” A helmet that “simulates immersion” in a forest? Please.

Also, the websites and email addresses are close but off just enough from legitimate Vanguard sites that they raised my alarm bells. Before I got confirmation from Vanguard, I visited what I know to be legitimate Vanguard sources and verified that I couldn't find any mention of this “toolkit.”

All in all, I wasn't surprised to see Vanguard's confirmation that it's all fake.

So, you’ve been warned!

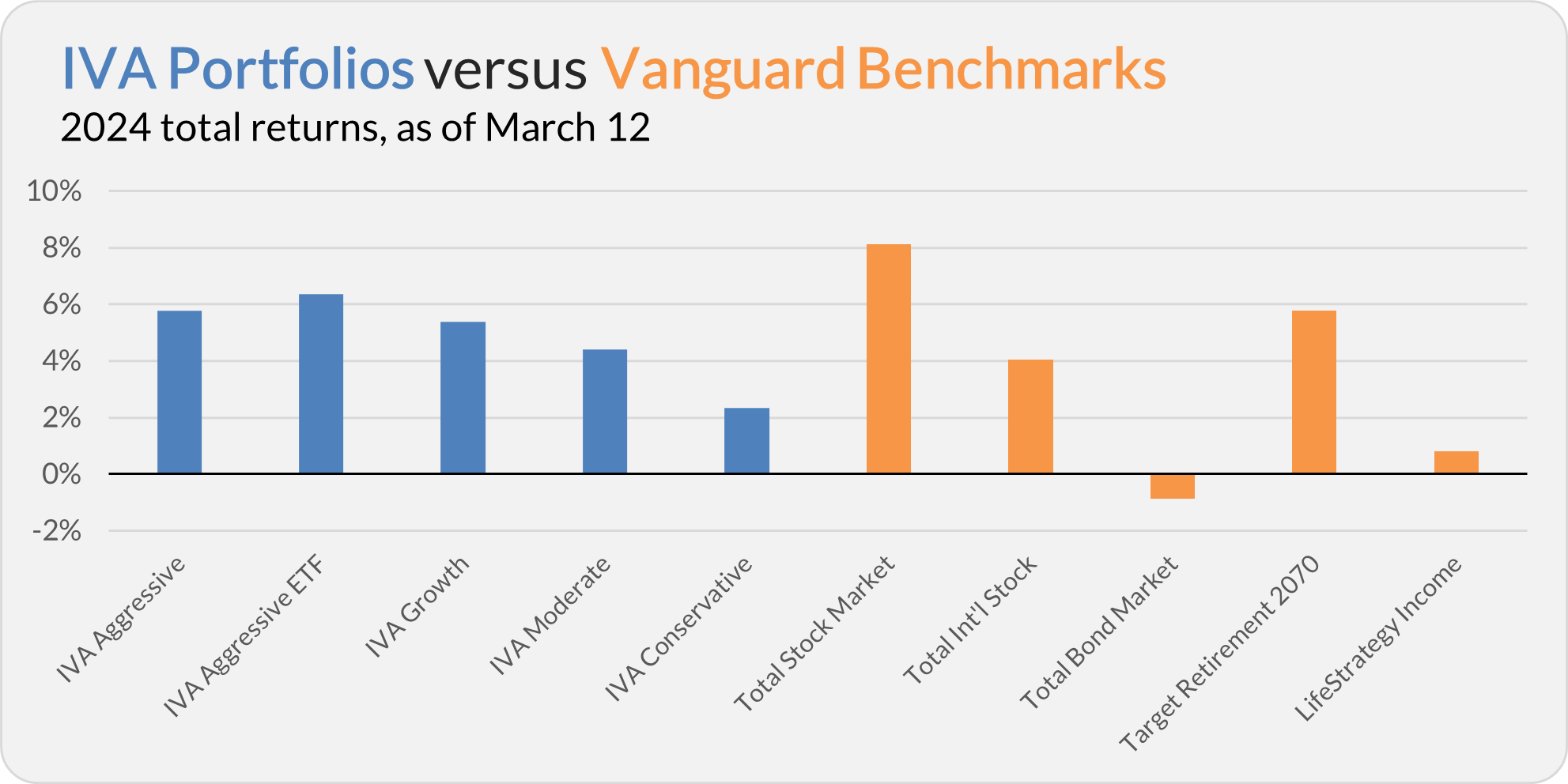

Our Portfolios

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 5.8%, the Aggressive ETF Portfolio is up 6.4%, the Growth Portfolio is up 5.4%, the Moderate Portfolio is up 4.4% and the Conservative Portfolio is up 2.3%.

This compares to an 8.1% gain for Total Stock Market Index (VTSAX), a 4.0% return for Total International Stock Index (VTIAX), and a 0.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.8%.

IVA Research

Yesterday, in Eating My Own Cooking, I shared my personal long-term investment portfolio with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.