If you’re paying taxes, then you’ve made money. That’s a good thing.

But nobody enjoys paying taxes—no matter how much money they’ve made. As I've said before, from an investment standpoint, taxes are a cost—it’s money that goes to Uncle Sam instead of compounding in your portfolio. You can go too far in the pursuit of minimizing your tax bill, but completely ignoring taxes can also be expensive. I believe there’s a balance to be struck between being tax smart and letting the tax tail wag the portfolio dog.

Last week, in Taxing Returns, I kicked off the after-tax return conversation by defining some terms and taking a snapshot of Vanguard’s funds from that perspective. This week I’m going to answer one question that often comes up when choosing funds based on tax considerations: “Are low-turnover funds more tax efficient?” (Spoiler alert: The answer is no!)

Additionally, I’ll provide a formula to help you identify funds that may be poised to pay out large capital gains distributions. I will also lay the groundwork that builds toward a deeper exploration of the tax implications of investing in active funds versus index funds.

Key Points

- Turnover tells you nothing about a fund’s tax efficiency.

- Index funds are more tax efficient over time, but not all the time.

- Funds with large unrealized gains facing withdrawals are at risk of paying out large distributions.

- Large distributions are another risk whenever Vanguard hires or fires a sub-adviser or dramatically reshuffles allocations among advisers.

Turning Over Misconceptions

Given that capital gains are only realized when fund managers trade, it’s logical to assume that more trading leads to more capital gains. I can’t tell you the number of times I’ve heard that the only way to identify funds with high tax efficiency is to find those whose managers kept their turnover low.

The problem is it’s wrong: Low turnover doesn’t automatically lead to high tax efficiency. I’ll show you.

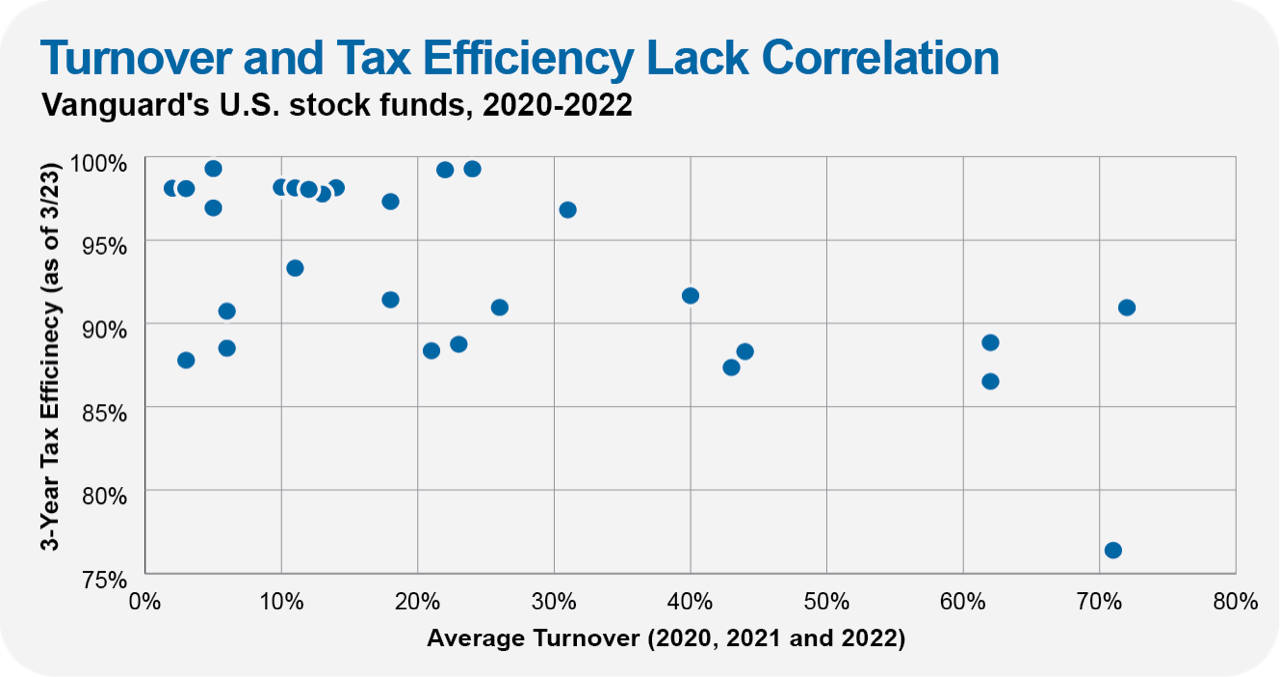

In the chart below, I’ve plotted Vanguard’s U.S. stock funds1 according to their average turnover over the past three calendar years and their tax-efficiency score over the three years ending in March 2023.

On the surface, it looks like the logic that higher turnover leads to lower tax efficiency holds up. It’s not a perfect relationship, as you have funds with sub-10% turnover ratios with tax efficiency scores in the 80s—but, taken as a whole, there is some correlation. At the very least, this chart suggests that it’s hard to be highly tax efficient when your turnover is high.

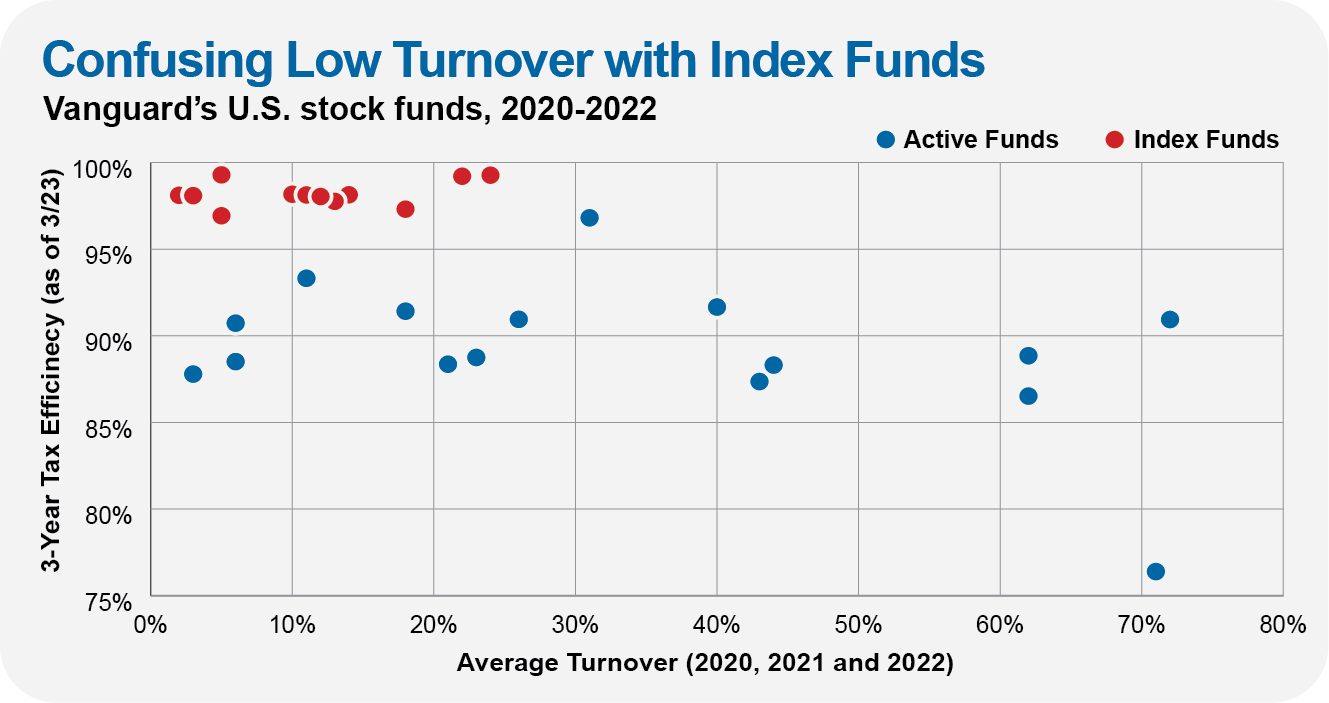

However, on the following chart, I’ve separated those same funds into two groups—active and index. The story now looks a little different. If you look within groups, there is no relationship between turnover and tax efficiency.

It didn’t matter if an index fund had turnover below 10% on average, or over 20%, they all were more than 95% tax efficient. And pretty much all of the active funds clocked in between 85% and 95% tax efficiency regardless of their turnover.

That outlier at the bottom of the chart is MidCap Growth (VMGRX), which saddled investors with a massive capital gains distribution in 2021. I’ll come back to MidCap Growth in a minute, but the fact that another fund, Strategic SmallCap Equity (VSTCX), had a similar level of turnover (70% or so) but was more than 90% tax efficient only highlights that turnover doesn’t tell you much about tax efficiency.

When investors say they identify tax efficiency by seeking out funds with low turnover, they are conflating low turnover funds with index funds.

As I said last week, all after-tax returns and tax efficiency numbers are point-in-time calculations and need to be taken with a grain of salt. The story—or at least part of it—changes when I look at a different time period. The next chart is the same as the one above but for the three years ending in 2012.