Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 24.

There are no changes recommended for any of our Portfolios.

The Bear Market is Officially Over

I told you last year that the bear market was over, but then, I like to count dividends. But now, even if you only look at the S&P 500 index’s price, the bear market is officially over. The S&P 500 index closed at 4839.81 on January 19, surpassing its prior (Jan. 3, 2022) high of 4796.56.

The recent bear market lasted two years, from peak to trough to recovery. The S&P 500 index fell 25% in the first nine-and-a-half months and took another 15 months to recover.

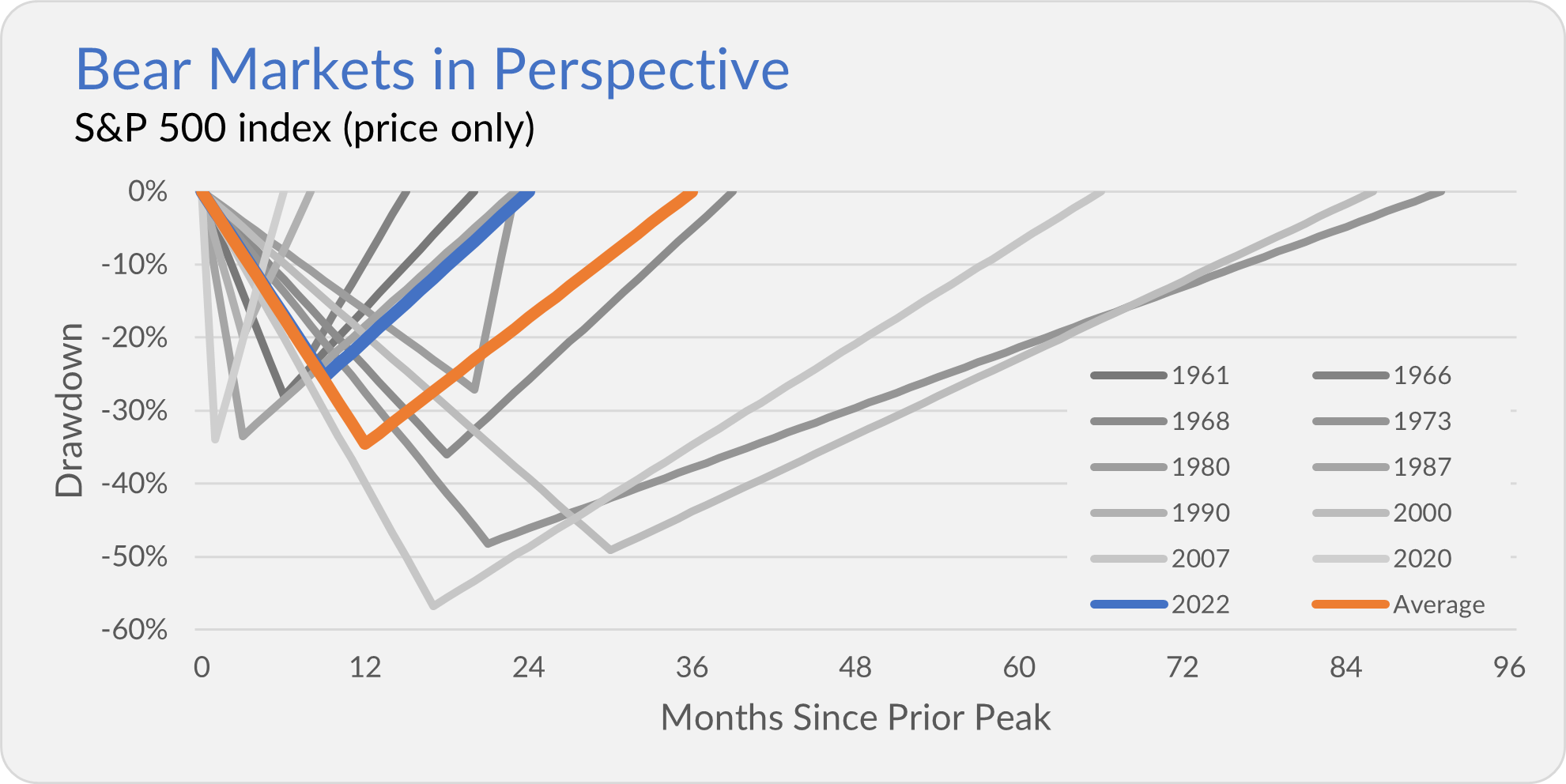

Allow me to quickly put this bear market into context. The chart below plots 11 bear markets (including the most recent one) since the S&P 500 index’s 1957 inception. I’ve highlighted the recent bear market and the “average” bear market.

As you can see, no two bear markets are alike. Some were over in the blink of an eye; others dragged on for years and years.

Nonetheless, the recent bear market was relatively mild as far as bear markets go. The average bear market saw the index decline 35% over the course of a year. And, on average, it took two years for the index to make up those losses.

What’s missing from this chart is all the bull markets and gains investors have earned over the past six decades. On the eve of the first bear market in my chart (Dec. 12, 1961), the S&P 500 index closed at 72.64. As I said, as of Friday, it had reached 4839.81. That’s a gain of over 6,500% (or 7.0% per year)—and that’s before counting dividends!

Bear markets happen, but they are the price long-term investors pay to reap the rewards of spending time in the market.

Yield Rollercoaster

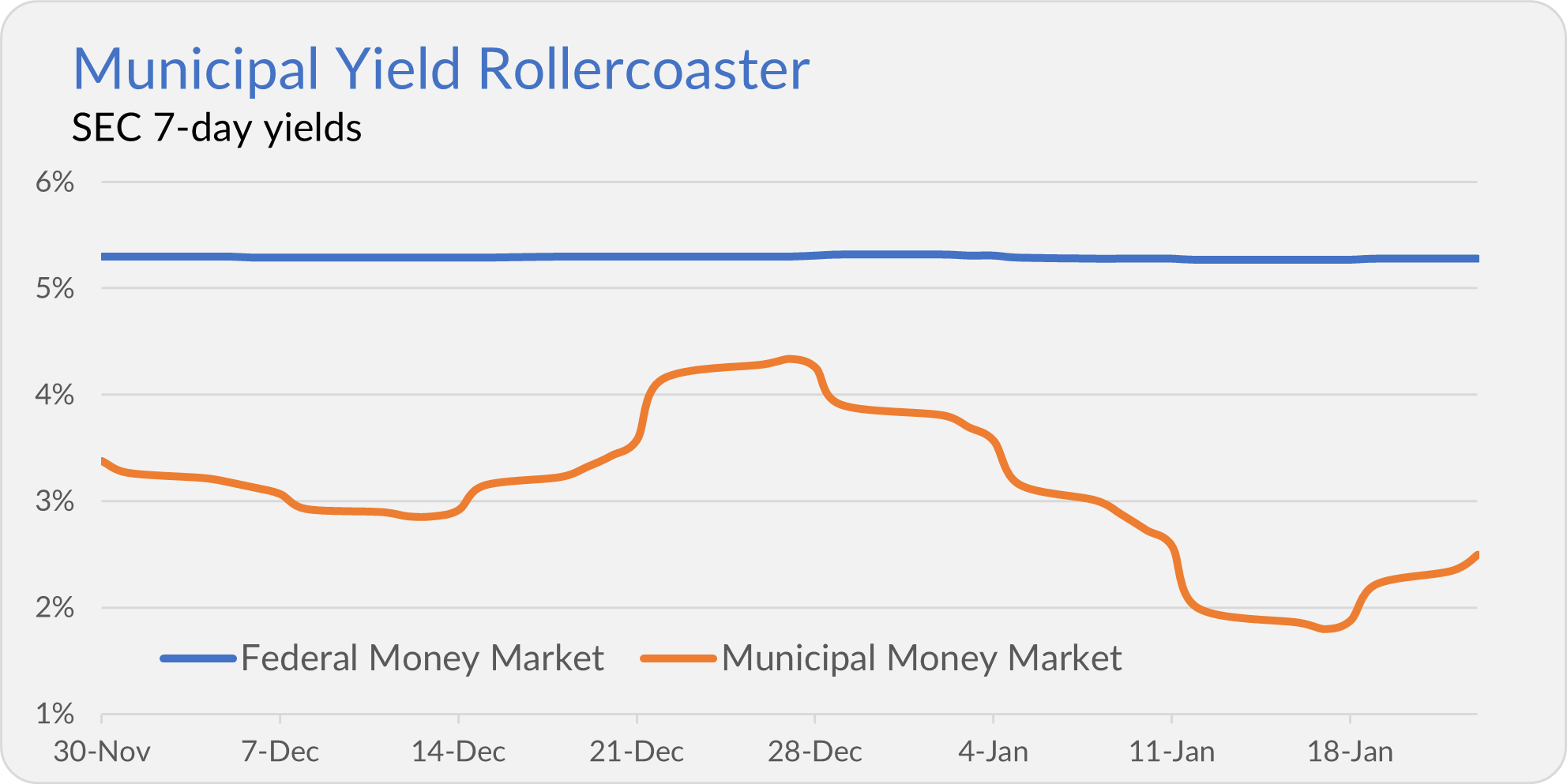

Municipal money market yields have been on a rollercoaster ride for the past five weeks.

In the final two weeks of December, Municipal Money Market’s (VMSXX) yield went from 2.86% to 4.34%. The money market fund’s yield then fell by nearly 60% over the next three weeks, landing at 1.80%. Fortunately for investors, the fund’s yield is recovering—it’s risen to 2.50% as of Tuesday’s close.

By way of comparison, Federal Money Market’s (VFMXX) yield has traded between 5.27% and 5.32% over the past two months.

I’ve written to you before about this seasonal pattern of municipal money markets—yields rise in December and fall in January. Yes, if you own Municipal Money Market today, you could switch to Federal Money Market and pick up some additional income—even after taxes are taken into account.

But I expect this will be short-lived—as you can see, Municipal Money Market’s yield is already on the rise. All things equal, given Federal Money Market’s 5.3% yield, I’d expect Municipal Money Market to yield around 3.4%.

If you want to chase money market yields, go for it. But it’s not going to make or break your investment success.

Better Than Plain Vanilla

Last week, Vanguard announced a partnership with estate planning software Vanilla.

The tool will only be available to Vanguard’s Personal Advisor Wealth Management clients—those with over $5 million who are paying Vanguard for advice. Vanguard has piloted the program with a handful of clients since 2022 and will roll it out over the year. Vanguard also left the door open to expand the software to other clients.

While I’ve never seen the tool in person, based on Vanilla’s website, it looks like a powerful tool for investors with complex estate plans—it can parse trust documents to help people visualize and keep track of where everything is and where it is going.

For the average investor, it’s probably overkill, but if you have a lot of moving pieces, Vanilla looks like a nice addition to Vanguard’s toolkit.

It’s worth noting that Vanguard’s former CEO, Bill McNabb, was an early investor in Vanilla and sits on the board of directors. Vanguard is also an investor in the company, having participated in a $30 million Series B funding round.

Our Portfolios

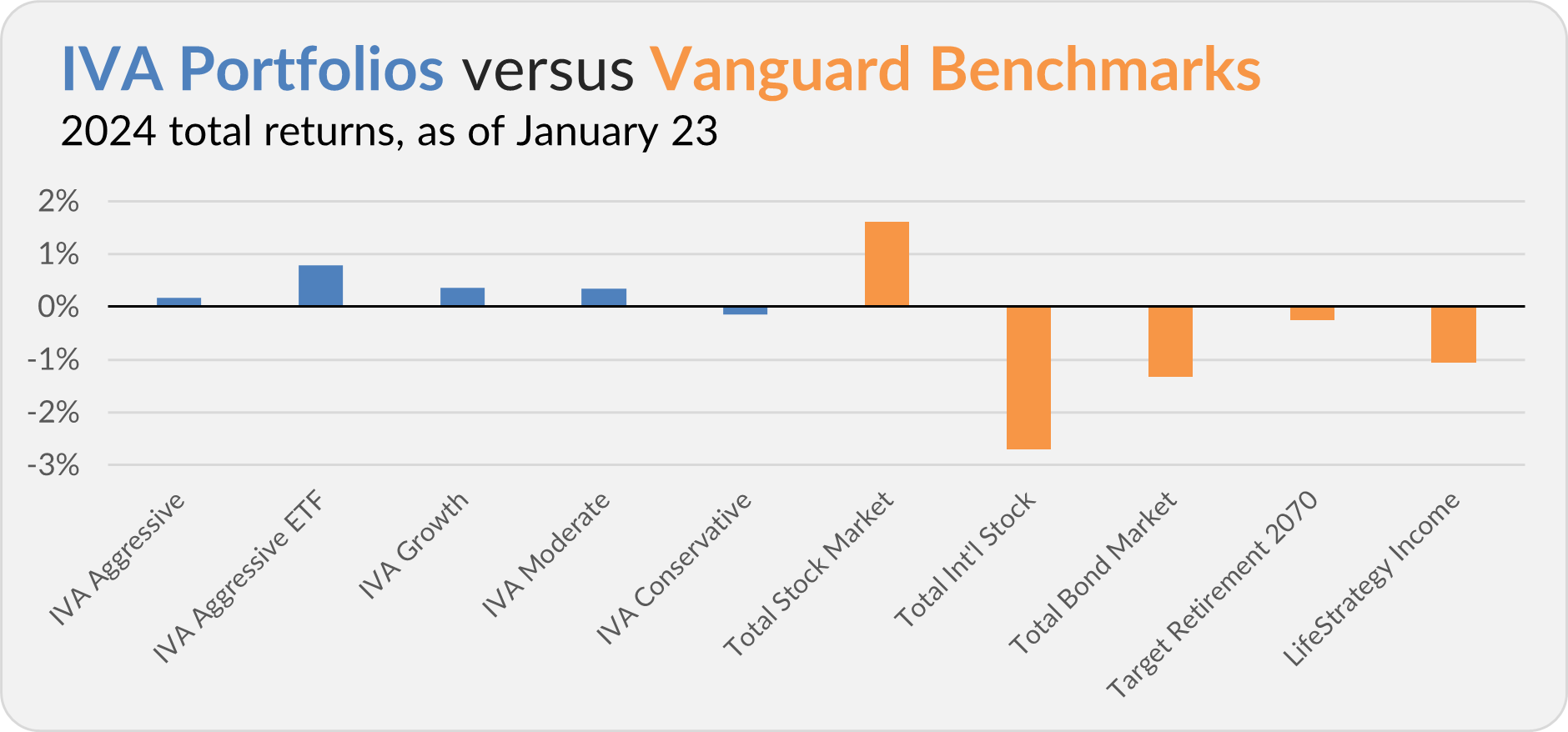

Our Portfolios are off to a slow but generally positive start to the year. The Aggressive Portfolio is up 0.2%, the Aggressive ETF Portfolio is up 0.8%, the Growth Portfolio is up 0.4%, the Moderate Portfolio is up 0.3% and the Conservative Portfolio is down 0.1%.

This compares to a 1.6% return for Total Stock Market Index (VTSAX), a 2.7% decline for Total International Stock Index (VTIAX), and a 1.3% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 0.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.1%.

IVA Research

Yesterday, in Vanguard’s Bitcoin Gamble, I shared my take on the long-term implications of Vanguard’s stance against bitcoin with Premium Members.

I’ve spilled a lot of ink on bitcoin the past few weeks ... I am looking forward to returning to more regularly scheduled programming. In February, I plan to analyze Vanguard’s growth and income funds and review the firm’s cash options. Stay tuned!

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.