Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, December 21st.

There are no changes recommended for any of our Portfolios.

It’s been a rough three weeks in the stock market. 500 Index (VFIAX) has fallen 6.3% in December (through Tuesday). Fortunately, when it comes to our Portfolios, funds like Dividend Growth (VDIGX) and Health Care ETF (VHT) are holding up relatively well this month. A newer holding in our Conservative Portfolio, International Core Stock (VWICX), is also down less than the broad market.

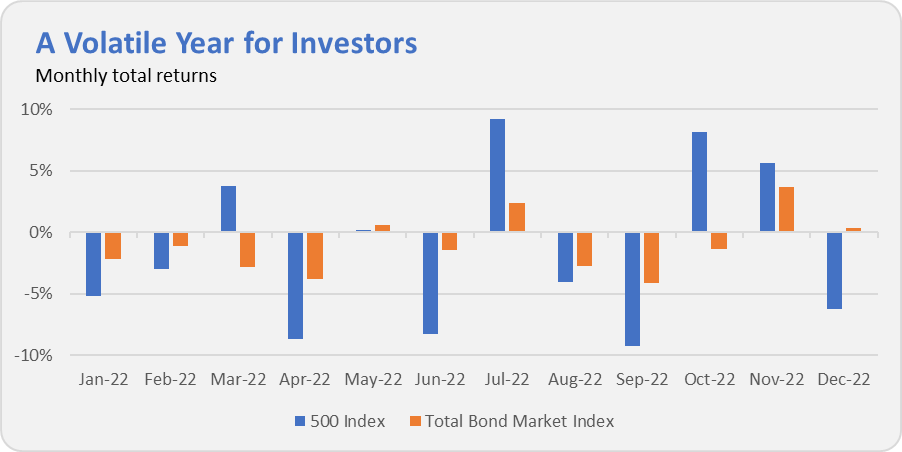

But it’s not just the past few weeks, it’s been a challenging year for investors. If December’s 6.3% drop stands, 500 Index will have fallen 5% or more in four month this year (April, June, September and December). The index fund has also risen more than 5% in three months (July, October and November). That kind of down then up then down behavior is tiring for investors and traders.

To make it even more challenging this year, bonds failed to live up to their billing as a portfolio shock absorber. As you can see in the chart below, every month 500 Index was in the red this year, so was Total Bond Market Index (VBTLX). Or at least that was true up until December—Total Bond Market Index is up 0.4% this month. It’s nice to see bonds coming through and providing some portfolio protection against falling stock prices in the final month of the year.

Shot in the dark

One of the main stumbling blocks for the market this month was the Federal Reserve (Fed) suggesting that they expect to keep the fed funds rate (their primary policy tool) higher for longer than the market expected. That very well may come to pass, but we can’t take the Fed’s word as gospel—even when it comes to the fed funds rate.

Consider that at their December 2021 meeting, Fed officials projected that the fed funds rate would be between 0.4% (the lowest estimate) and 1.1% (the highest) at the end of 2022. They were way off! Last week they raised fed funds rate to 4.25%-4.50%. In other words, even the best-informed people who control the fed funds rate don’t have a clue what it will be in a year’s time.

Three’s a crowd

And then there were two. On Monday, Vanguard fired RS Investments (part of Victory Capital) from MidCap Growth (VMGRX), leaving Frontier Capital and Wellington Management as the perennially bad fund’s two remaining sub-advisers. I covered this manager change in greater detail for Premium Members on Monday when it was first announced, but the bottom line is that MidCap Growth has failed to deliver for years and years despite Vanguard constantly hiring and firing the sub-advisers in search of a winning combination. Given that Frontier and Wellington haven’t exactly made up for RS Investments’ failings over the past several years, I’m not convinced Vanguard has found the right mix yet.

Going Hollywood

Speaking of Vanguard’s sub-advisers, the team at Malvern is having a casting call in an apparent search for some new partners. They’ve posted to LinkedIn “calling all investment managers” to apply. And here is the landing page that post takes you to.

What’s Vanguard doing? Here are my initial reactions:

First off, is this really how they recruit top-tier portfolio managers now? Is a broad call on social media really the best way to find new partners? I’d have thought that Vanguard had the resources and reach to find managers they want to partner with and approach them directly rather than having a casting call.

I suppose this new tactic may turn up some “undiscovered” managers or funds that Vanguard wouldn’t typically look at. But if the manager is flying that far under the radar, they are probably darned small, and you’ve got wonder if they’ll even have the systems and infrastructure in place for Vanguard to want to partner with them.

Second, according to their requirements, if you are going to apply, managers need to have a “differentiated investment philosoph[y] and a clear, compelling investment edge.” I certainly want those things out of my active manager as well. However good this might sound it may just be words since it’s not clear to me that Vanguard has always partnered with managers meeting those criteria in the past.

Third, $1.5 trillion in active management!? Everyone thinks of Vanguard as an index shop, but that sure sounds like a lot of money in active strategies. It is, and it isn’t. Keep in mind that about half of that is run by Vanguard’s in-house fixed-income team. At the end of November, shareholders had about $350 billion invested in active Vanguard-managed bond funds. Vanguard’s money market team overseas another $365 billion or so.

Strip that out—and take another $30 billion or so out for Vanguard’s quantitative stock team—and you’re talking about maybe less than $900 billion, a lot of money, yes, but a lot less money invested with outside active managers than the advertisement might suggest.

My bottom line: We’ll see if shaking the trees brings out any unknown managers. If any unheard-of managers do emerge, I’d suggest watching from the sidelines. Vanguard may uncover the next big star in this search but there might also be a good reason why that manager was previously undiscovered. There’s no need to rush into every fund Vanguard launches.

Put one in the win column?

Dan and I report on Vanguard’s technology and customer service missteps far more often than I would like. (Honestly, I wish there weren’t any missteps to report.) So, it’s also only fair to report on a (relative) win for Vanguard’s platform.

Last week when PRIMECAP Odyssey Aggressive Growth (POAGX) reopened to new investors, it took Vanguard’s system about half a day to catch-up to the change in the fund’s status. I’ve heard from some of you that you are still running into issues buying the fund at Vanguard here or there, but those have generally been resolved with a phone call. Compared to Schwab, where the fund is apparently still closed to new investors, well, Vanguard is operating at warp speed.

Down but still ahead

Our Portfolios are in the red this year but are showing some decent relative returns for the year through Tuesday. The Aggressive Portfolio is down 15.7%, the Growth ETF Portfolio is down 18.6%, the Growth Portfolio is off 14.2% and finally the Moderate Portfolio is down 11.2%. This compares to a 20.0% drop for Total Stock Market Index (VTSAX), a 16.4% decline for Total International Stock Index (VTIAX), and a 12.3% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), is down 17.7% for the year and its most conservative, LifeStrategy Income (VASIX), is off 13.3% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 9.4%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.