Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 12.

There are no changes recommended for any of our Portfolios.

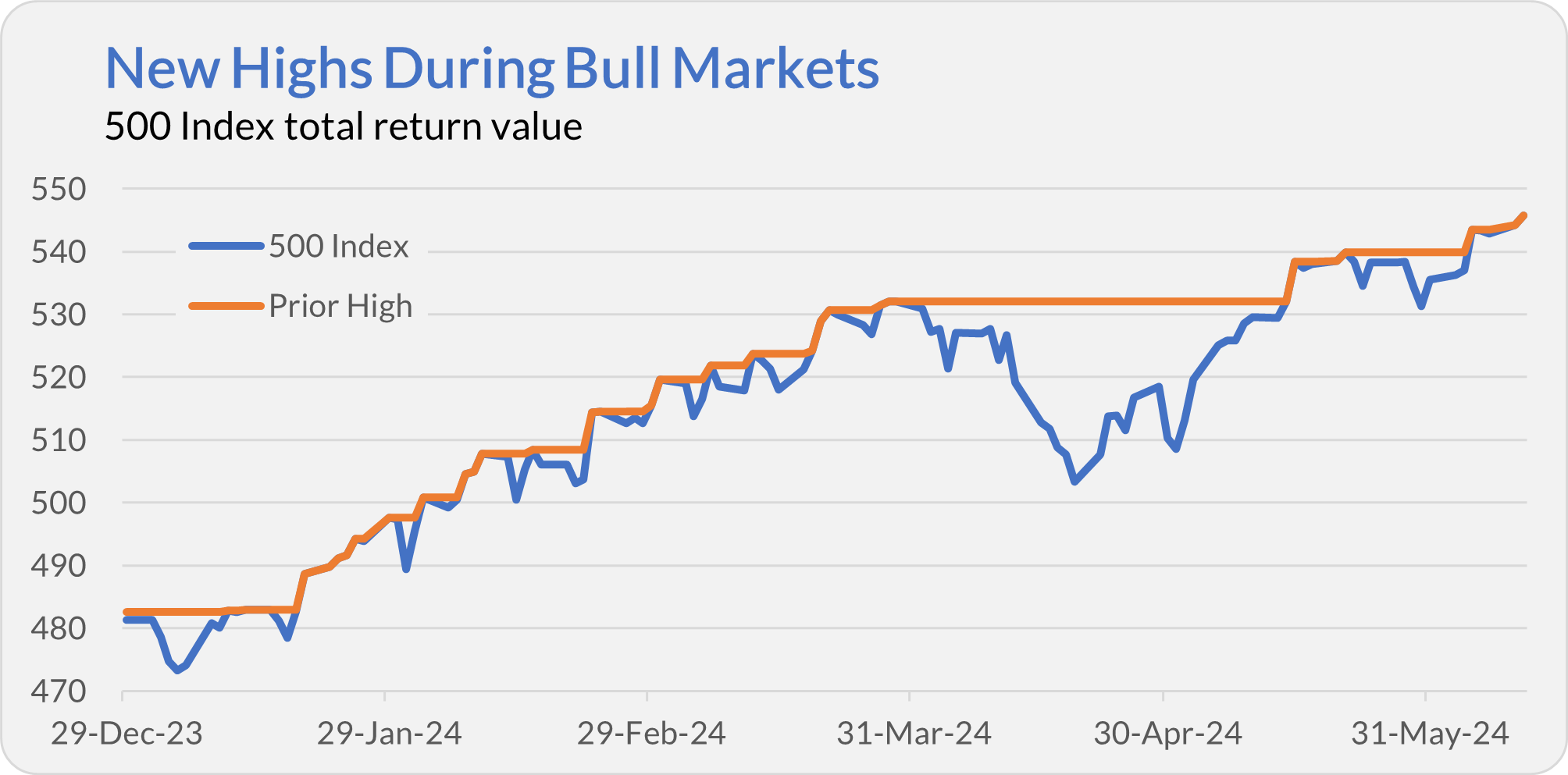

It may sound obvious but as I’ve said countless times, stock markets make new highs during bull markets. The S&P 500 index notched its 26th new high of the year on Monday, its 27th on Tuesday and is on track to make it 28 today (Wednesday). Add in dividends, and the index will have hit 32 new highs this year (assuming it finishes the day in the green).

However, while the headline indexes, dominated by the big technology companies, have been making new highs, smaller stocks have been left lacking. The S&P 600 index of quality, smaller companies is still 12% below its November 2021 peak. Or, if you prefer, the Russell 2000 index is 17% below its own high.

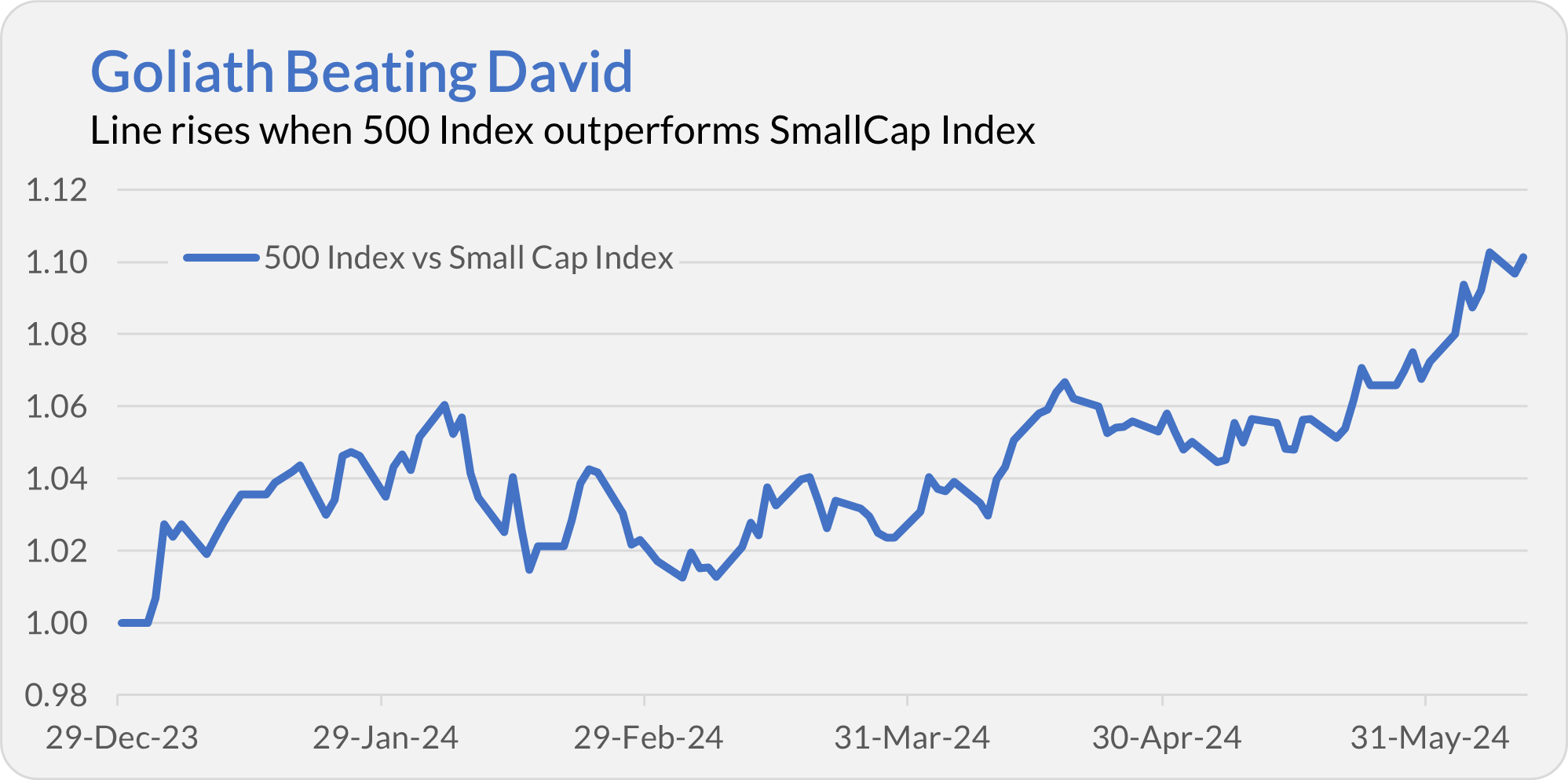

Looking at Vanguard’s funds, 500 Index (VFIAX) is outpacing SmallCap Index (VSMAX) by 11 percentage points this year—13.4% to 2.4% (as of Tuesday’s close). As you can see in the relative performance chart below where the line rises when 500 Index outperforms, large stocks have sprinted dramatically ahead over the past month.

But the big guys can’t outrun their smaller siblings forever. When the tide turns, it could happen quickly. For example, the Russell 2000 index is up more than 2% today, while the S&P 500 index is up only 1.2%. Today’s inflation report is driving those gains.

Speaking of inflation …

On Target

Can artificial intelligence see into the future?

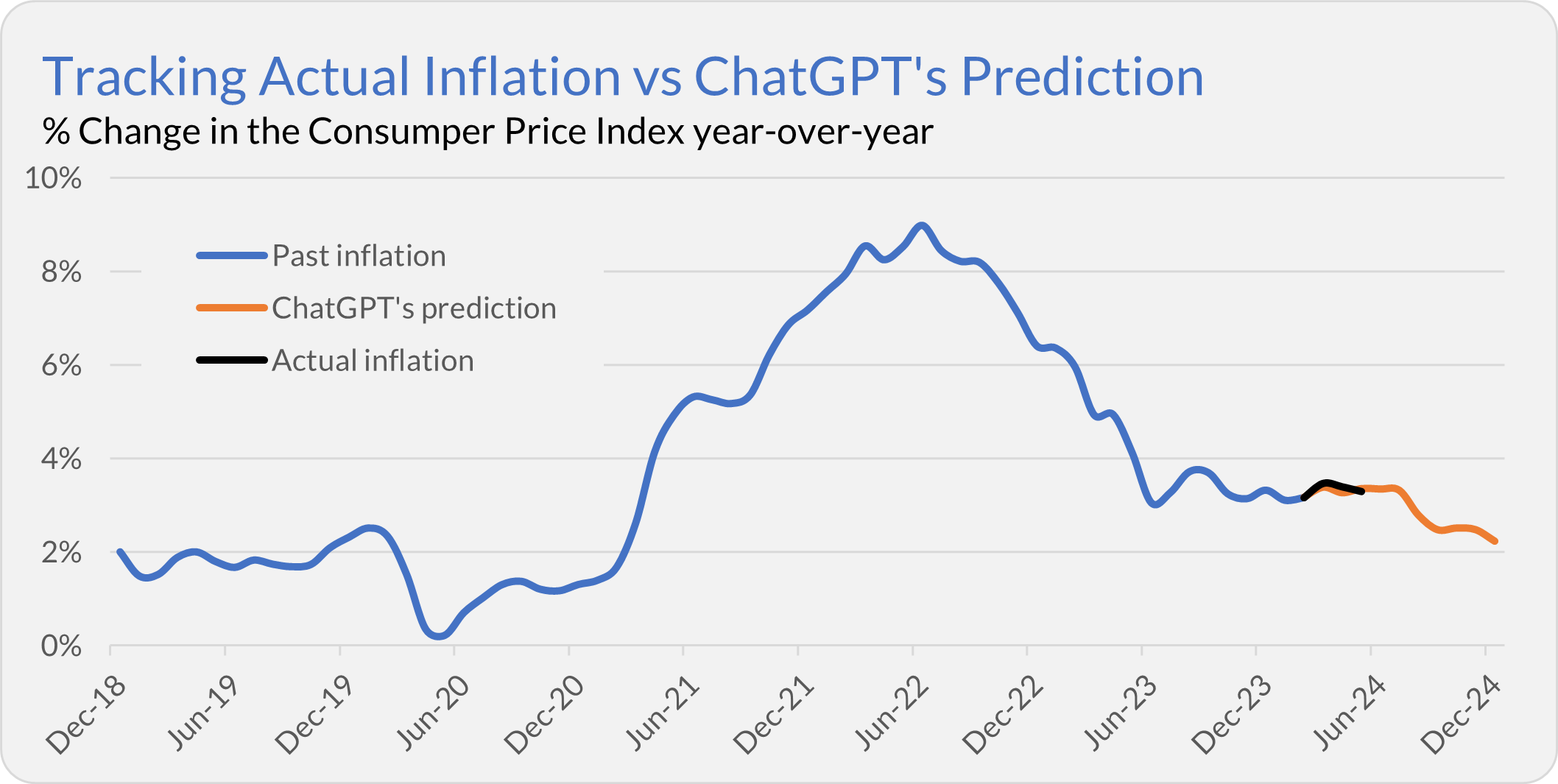

Two months ago, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Today, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was flat in May and is up 3.3% over the past 12 months.

ChatGPT expected inflation to clock in at, you guessed it, 3.3%!

No, I don’t really believe that artificial intelligence can predict the future. As I said two months ago, I’d chalk an accurate forecast up to luck more than anything else. ChatGPT’s projection assumed that inflation would return to its average level.

So, what does the latest inflation report mean for investors? Don’t ask the computer for that answer. The fact is that most traders (and commentators) are taking the subdued inflation report as a sign that Federal Reserve policymakers are more likely to cut interest rates this year.

You may recall that one month ago, the inflation report had those same prognosticators predicting there would be no cuts in 2024. Take all these short-term predictions with a large grain of salt.

My view remains consistent. I think policymakers will continue to sit on their hands as long as inflation runs around 3% and unemployment stays near 4%—which is where we are today. That means we’ll have to see a greater move lower for inflation or higher for unemployment before a meaningful change in Federal Reserve policy is warranted.

My Watch List

At the beginning of June, Vanguard redesigned vanguard.com’s “My Watch List” tool. Not everyone is thrilled with the new look.

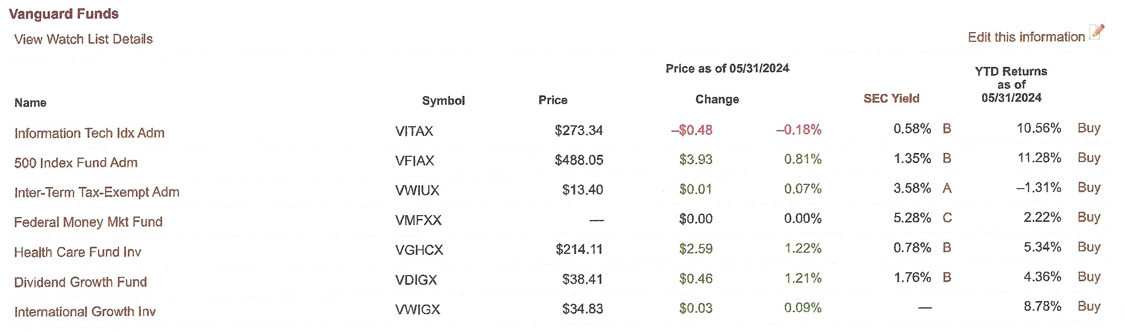

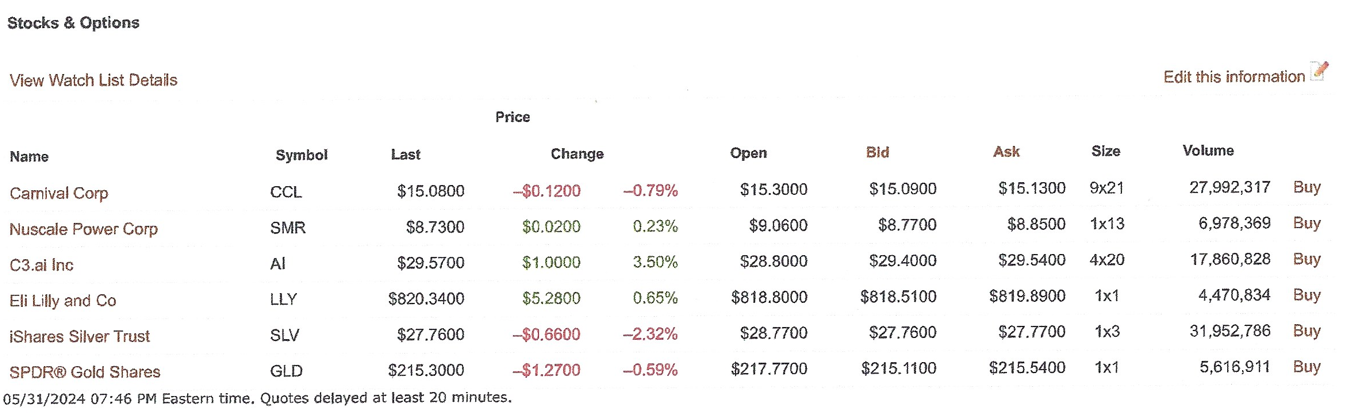

In the old version, Vanguard included each fund’s name, ticker, price, one-day change in price (both in dollars and percentage terms), SEC yield and year-to-date returns. One of your fellow IVA readers was kind enough to share a screenshot of his Watch List from the end of May with me.

For stocks and ETFs, Vanguard provided information on the bid and ask and trading volume.

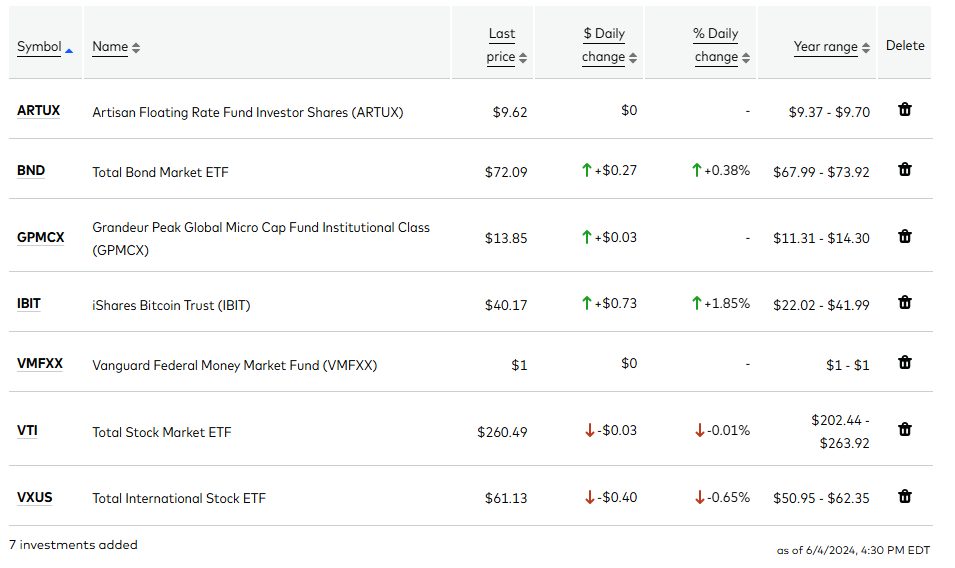

The new look is undoubtedly “cleaner,” but as you can see in the screenshot below, it includes a lot less information.

No SEC yields or year-to-date returns. No bid-ask spreads or trading volume. Sure, you now get each security’s trading range from the last 12 months, but in my book that isn’t much help. For example, Federal Money Market’s (VMFXX) trading range is useless. Also, I’m unsure why a few funds are not reporting a figure for the % Daily change, given that they show the $ Daily change.

Was the old My Watch List perfect? No. Ideally, you’d be able to select the data points you want to see from a list of options. But, in my view, the new version is a step backward—less is not more in this situation!

Is this really how Vanguard is spending its billion-dollar budget on improving technology? Give me a break.

Our Portfolios

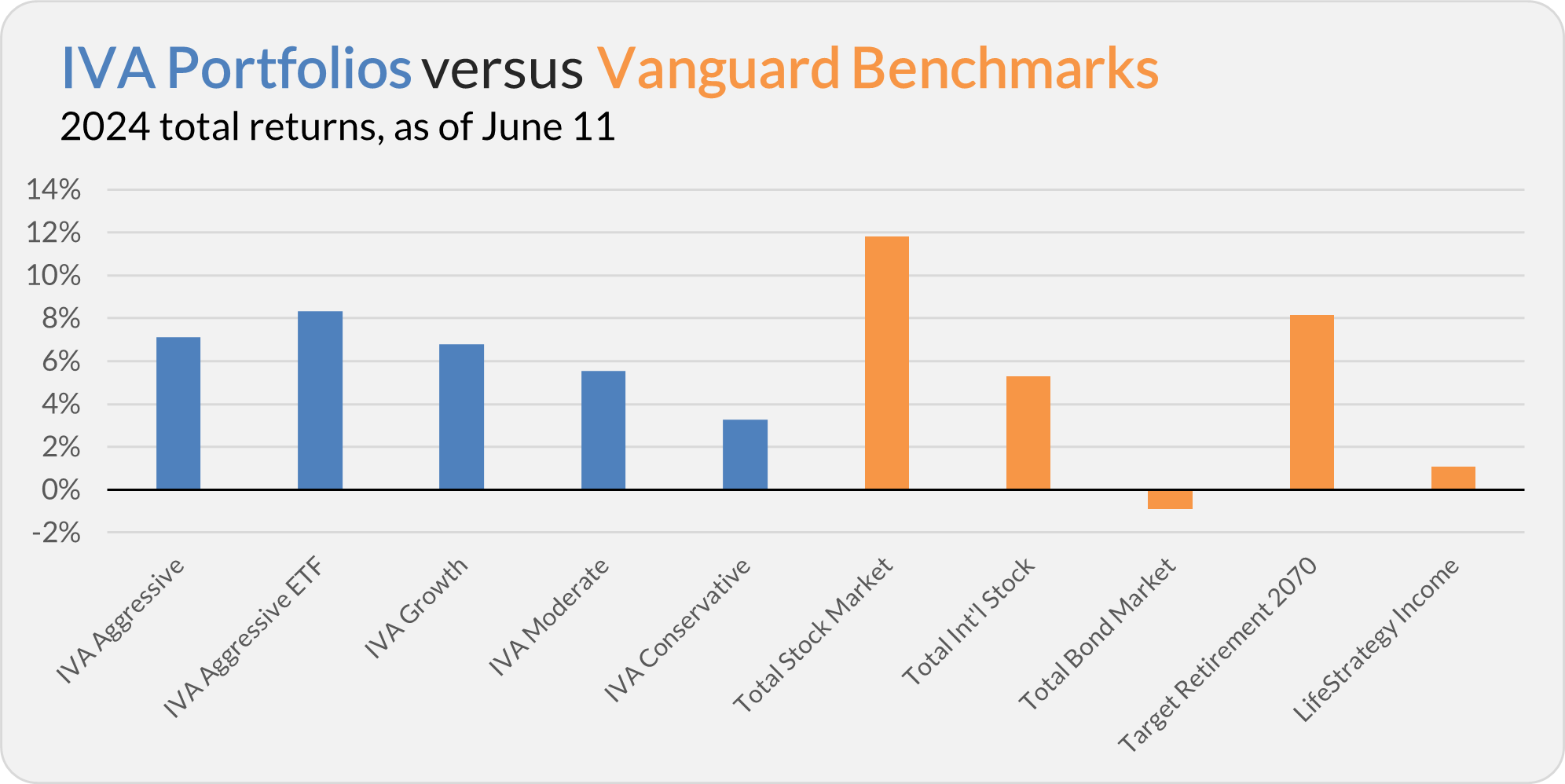

Our Portfolios are showing positive absolute but mixed relative returns for the year through Tuesday. The Aggressive Portfolio is up 7.1%, the Aggressive ETF Portfolio is up 8.3%, the Growth Portfolio is up 6.8%, the Moderate Portfolio is up 5.5% and the Conservative Portfolio is up 3.3%.

This compares to an 11.8% gain for Total Stock Market Index (VTSAX), a 5.3% return for Total International Stock Index (VTIAX), and a 0.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 8.1% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.1%.

IVA Research

Yesterday, in Vanguard: “Don’t call us, we’ll …”, I explored Vanguard’s electronic lines of communication with Premium Members. In short, Vanguard needs to do better.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.