Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 21.

There are no changes recommended for any of our Portfolios.

After what appears to have been a pause in its rate-hiking program last week, Fed Chair Jerome Powell told Congress today that he expects the Federal Reserve (Fed) to raise interest rates further by the end of the year. Stocks are down a bit. But I’m not sure the Fed’s actions matter as much going forward.

Powell and his colleagues estimate the benchmark fed funds rate will reach 5.6% by the end of the year from the current range of 5.00%-5.25%. Not only do the Fed governors have a poor track record when it comes to forecasting where the fed funds rate will be (even though it is the one rate they have direct control over), but that’s only around 0.35% to 0.60% higher than where things currently stand.

The big move in interest rates is behind us—don’t get caught up in the minutiae as policymakers fine-tune their instruments.

Securities Lending for The Rest of US

Large, so-called institutional investors (think mutual funds, ETFs, pension funds and endowments), have long been able to generate a little extra income on their holdings by temporarily letting other investors borrow them.

The practice, called securities lending, involves loaning shares of a stock you own to a counterparty (typically someone who wants to short the stock, like a hedge fund) in exchange for some income. It’s standard operating procedure for Vanguard’s index funds. For example, according to Kim Clark at Kiplingers, Vanguard added 0.02% to Total Stock Market Index’s (VTSAX) return by lending out securities last year.

Last week, Vanguard rolled out securities lending for the rest of us. Vanguard’s calling it the Fully Paid Lending (FPL) program. If you got an invite to the program (I didn’t, but I also don’t own any individual stocks at Vanguard), it probably looked something like this:

Here’s how the FPL program works: If you own individual stocks and enroll in the program, Vanguard will from time-to-time loan out some of your stocks. You’ll earn a bit of income—which you’ll split 50/50 with Vanguard—and at the end of the loan you’ll get your shares back. While your stock is out on loan, you’ll maintain economic ownership of the shares—you can sell them at any time.

What’s not to like? First, you give up voting rights while the shares are on loan. Additionally, the shares are not protected by SIPC when loaned out. If the stock pays a dividend, you’ll get that money, but it might be taxed differently. Finally, there’s no guarantee of how much you’ll earn here—extra income is generally good, but you won’t really be able to plan around it.

You should be aware of those factors even though, in my view, they are relatively minor considerations. The big question we should be asking is, what are the risks of securities lending?

Securities lending is a bit more complicated than I’ve described here. It involves multiple parties—the lender, a borrower and the lending agent who sits between the two—posting collateral, reinvestment of that collateral., etc. The primary risk is that the borrower defaults and the lending agent doesn’t have enough collateral to make the lender (you) whole.

That risk is small—Vanguard has a lot of experience lending out securities and the infrastructure and regulation of securities lending has improved over the years—but the risk still exists. This is no free lunch.

Should you enroll in the program?

On the surface, it does seem like a low-risk way to earn a bit of extra income from your portfolio. But, well, Vanguard added just 0.02% to Total Stock Market Index’s return lending out literally thousands of shares … is the small amount you might earn on your personal portfolio worth the additional risk?

Of course, the additional return (income) will vary through time and depend on which stocks you own—it’s possible you’ll earn more than just 0.02% through the program. Maybe. Either way, you’ll need to keep your expectations in check. Enrolling in this program isn’t going to suddenly turbo-charge your returns. It’s also not going to protect you if the stock drops in price.

Why is Vanguard rolling this out now? Well, as Vanguard tells it:

We are offering this new product to our clients to provide another investment option.

I applaud Vanguard for bringing this institutional strategy to its clients, but I can’t help but note that not only is this another revenue source for Vanguard (they are keeping 50% of the income) but it’s also another case of Vanguard playing catch-up—Fidelity and Schwab already offer this to their clients.

Me, well, I’m not a stock guy so I’m not even eligible. But if I was, I’d probably let it pass me by. I don’t need another complication for an extra basis point or two of income (and that’s before taxes).

Our Portfolios

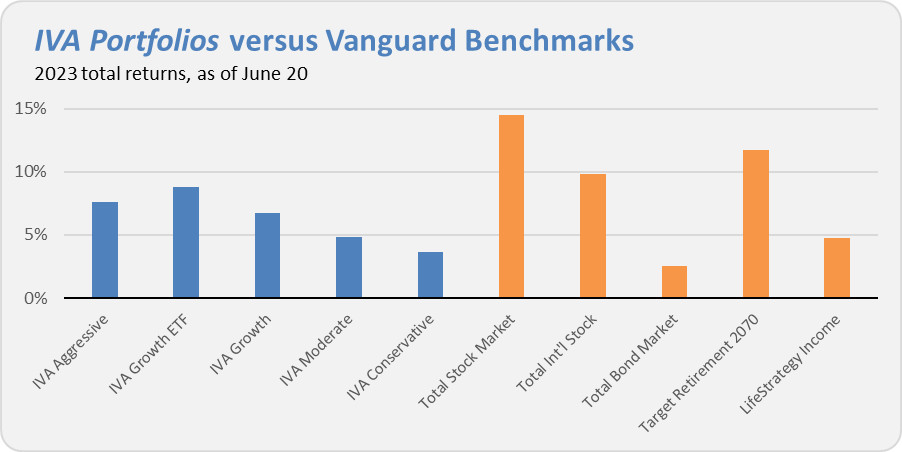

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 7.6%, the Growth ETF Portfolio is up 8.8%, the Growth Portfolio is up 6.8%, the Moderate Portfolio is up 4.9% and finally the Conservative Portfolio has gained 3.7%.

This compares to a 14.5% return for Total Stock Market Index (VTSAX), a 9.8% gain for Total International Stock Index (VTIAX), and a 2.6% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.8% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.