Executive Summary: After-tax returns are what matter most for taxable investors. While index funds set a high bar for tax efficiency, select actively managed funds compete well. Here’s how IVA Portfolio holdings stack up after taxes and the tweaks tax-savvy investors might consider.

Last week, I made the case that, from a tax perspective, most investors are best off using index funds (or ETFs) in their taxable brokerage accounts.

However, remember that taxes are just one factor to consider when building your portfolio. Importantly, the goal is to maximize after-tax returns, not to minimize your tax bill. In other words, while index funds win on average, some actively managed funds may be worth owning by delivering market-beating returns, even if they saddle shareholders with a larger tax bill.

Factoring in taxes raises the bar when evaluating funds, so today I want to turn our attention to the actively managed funds I recommend (and own myself) in the Portfolios.

Key Points

- Taxes are a cost to all investors, even index fund owners.

- Some actively managed funds, especially in foreign markets, have matched or even beaten index funds after tax.

- To earn a place in taxable accounts, active fund performance must clear a meaningful “tax hurdle”—often about 0.5%–0.8% per year.

- Tax-sensitive investors using the Portfolios can consider favoring municipal bonds and index funds.

Index Funds: Not Immune to Taxes

Before I dig into the IVA holdings, let me emphasize a point that may have escaped notice in this tax-efficiency series: Taxes are a cost for all investors, whether you own an actively managed fund, an index mutual fund or an ETF.

No, index funds aren’t always 100% tax-efficient.

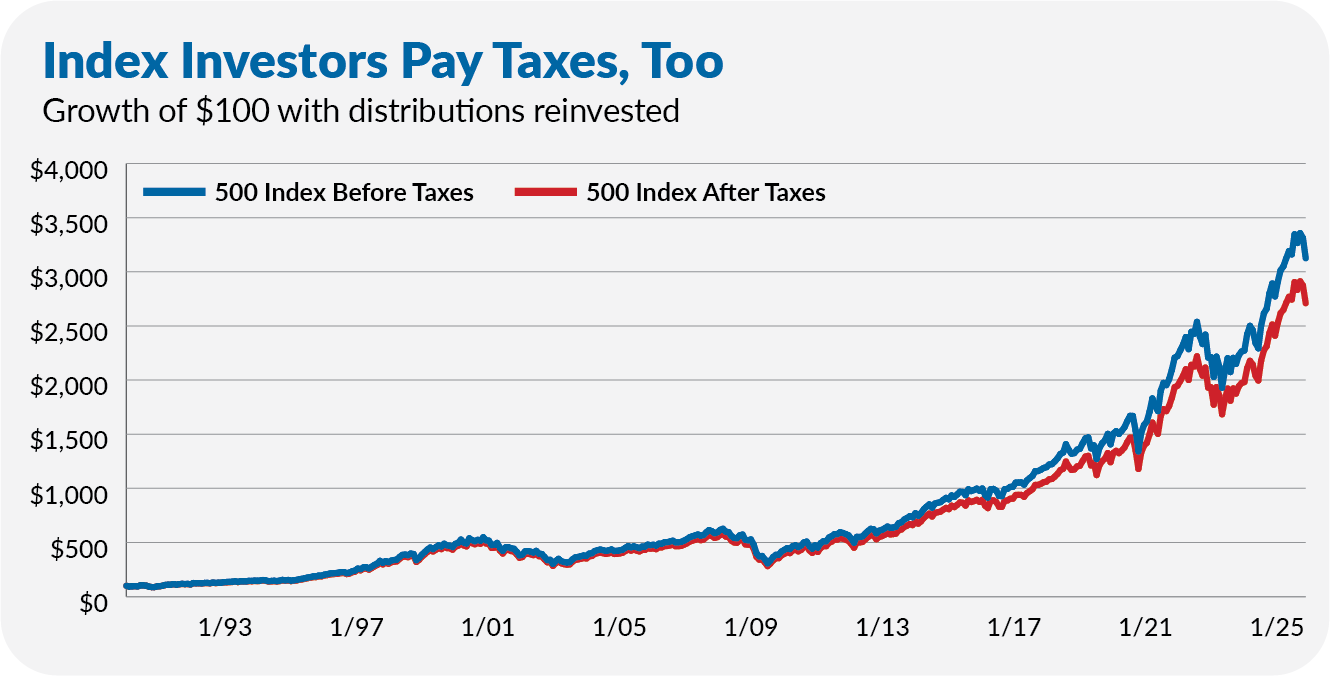

The chart below plots the growth of an investment in 500 Index (VFINX) before and after taxes since the end of 1989. As a reminder, I applied a 20% tax rate to qualified income (such as dividends) and long-term capital gains. I used a 40.8% tax rate for short-term capital gains and regular income, such as interest.

The flagship index fund compounded at a 10.3% annual rate over the period before taxes, but drops to a 9.8% pace after taxes. So, the tax hit was around 0.5% per year.

Despite the fact that I’ve been able to run the data back to 1990 for 500 Index, for most of this article, I’ll focus my analysis on the period for which I have the most data, between 2007 and March 2025. (I’ve only extended it to the 1990s for a few funds.) Even over this shorter 17-year period, 500 Index still gave up just 0.4%–0.5% per year in returns to the tax man.

So, let’s consider 0.4%–0.5% as the baseline tax-cost of spending time in the U.S. stock market. For foreign stocks, which tend to pay higher dividends, that baseline climbs to about 0.8%.

So, as we size up actively managed funds, don’t just ask how much they lost to taxes—ask how much more they lost compared to the baseline. That’s the hurdle that the portfolio managers need to clear.