Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 9th.

There are no changes recommended for any of our Portfolios.

For citizens and members of the community, elections are “big events.” In the lead-up we debate policies and candidates. On election day we take time out of our usual routines to vote. And of course, the results often aren’t known right away so the noise carries on for a few more weeks.

The rub, however, is that from an investment standpoint, elections (at least here in the U.S.) simply aren’t critical. Of course, politics and policy matter … but they make for poor inputs into your investment decision-making process.

Here’s one way I try to keep political concerns out of my portfolio.

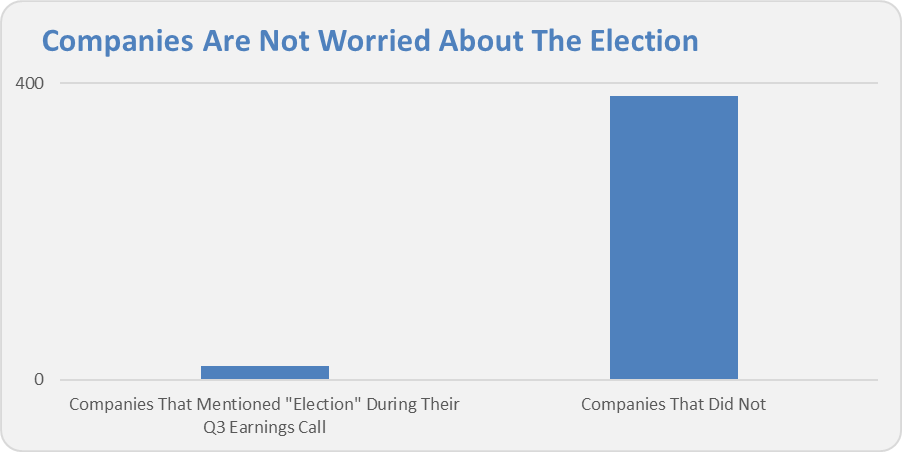

I remind myself that companies, or their managers, simply aren’t that worried about election results—or at least they aren’t talking about them. According to financial data provider FactSet, executives at just 18 (4%) of the 401 companies in the S&P 500 which reported third quarter earnings between September 15 and November 3 mentioned the word “election.” As divisive and noisy as this election season has been, the data is on par with past mid-term election cycles.

So, if the executives at the companies I’m invested in don’t believe the election is a material event worth mentioning in their earnings calls, I think I can safely ignore them myself—at least from the standpoint of how I view my portfolio.

Which brings me to a recent conversation I had with an investor who wanted to measure their losses over the past two years—since the Presidential election. Despite being in a bear market, the results came as a surprise.

From December 2019 through October 2022, 500 Index (VFIAX) gained about 6%. Not too bad.

Unfortunately, balanced investors were down a lot more, and you can blame it on bonds. Total Bond Market Index (VBTLX) lost 17% over the period. For what it’s worth, when I link up our old Conservative Growth Model with our new Growth Portfolio, the decline was about 4%. (Foreign stocks were down as much as bonds, about 18% over that period, and explains the underperformance compared to the U.S.-only 500 Index.)

Of course, these are only point-in-time returns, and I often say that you can change the investment narrative by changing the timeframe. But still, a 4% loss over a period that includes a bear market is hardly a devastating blow.

Now, not to get too caught up in short-term performance, our Portfolios are having a good start to November as Capital Opportunity (VHCOX), Dividend Growth (VDIGX) and Health Care ETF (VHT) are all ahead of the broad market. Foreign stocks are also beating U.S. stocks—International Growth (VWIGX), for example, is up 4.4% so far this month as China has rebounded.

Looking beyond November, our Portfolios are showing poor absolute but decent relative returns for the year through Tuesday. The Aggressive Portfolio is down 17.1%, the Growth ETF Portfolio is off 19.7%, the Growth Portfolio is down 15.8% and finally the Moderate Portfolio has declined 13.3%. This compares to a 19.8% decline for Total Stock Market Index (VTSAX), a 20.9% drop for Total International Stock Index (VTIAX), and a 15.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065 (VLXVX), is down 19.5% for the year and its most conservative, LifeStrategy Income(VASIX), is off 15.9% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation(VPGDX) is down 11.3%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.