The first rule of compounding is to never interrupt it unnecessarily.

-Charlie Munger

I could’ve started this article with the Einstein quote about compound interest being the eighth wonder of the world—though there’s no evidence he actually said it. Pick your favorite quote … the point is that compounding is powerful. But as Charlie Munger (Warren Buffett’s business partner) alludes to, it takes time to for its true rewards to emerge.

This is one reason why successful long-term investing isn’t easy—you don’t really see the benefits of saving, investing and being disciplined until years have passed. But small differences early on can result in dramatically different destinations in the end.

Let me show you:

It’s December 1976, and four 25-year-old friends get together around the holidays, and the topic inevitably turns to saving and investing. Claire declares that she is going to invest $100 a month into the recently launched 500 Index (VFINX). Her friend Earl decides to do the same but is worried that he won’t be able to save once he starts to build a family. Nina likes the idea of saving, but isn’t sold on investing, so she commits to saving $100 a month, too, only she’ll sock it away in Prime Money Market (now Cash Reserves Federal Money Market, VMRXX). Larry says he can’t find a way to save right now but promises that when he does start saving, he’ll save twice as much to play catch-up.

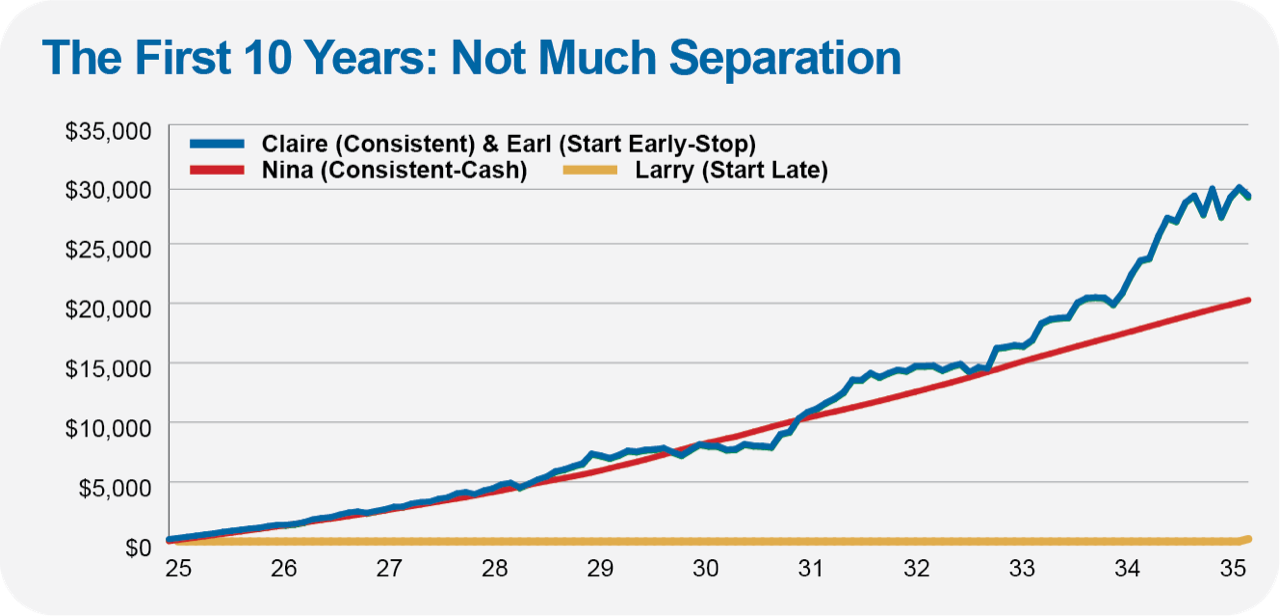

A decade later, the four friends, now age 35, get back together and check in on their progress. I’ve plotted their course so far in the first chart below.

Claire and Earl are in exactly the same spot with nearly $30,000 built up. Earl announces that, as he feared, he’s had to stop saving money each month, but at least he’ll be able to keep the money he has put away invested in 500 Index.

Nina, with just over $20,000, isn’t far behind her friends.

Larry, true to his word, has just started saving and is putting away $200 a month. Seeing the success of Claire and Earl, he invests his savings in 500 Index.

At this point it is hard to spot the true power of compounding. Yes, Claire and Earl have roughly 40% more money in their accounts than Nina does, but the dollar differential doesn’t seem all that far apart. That will change.

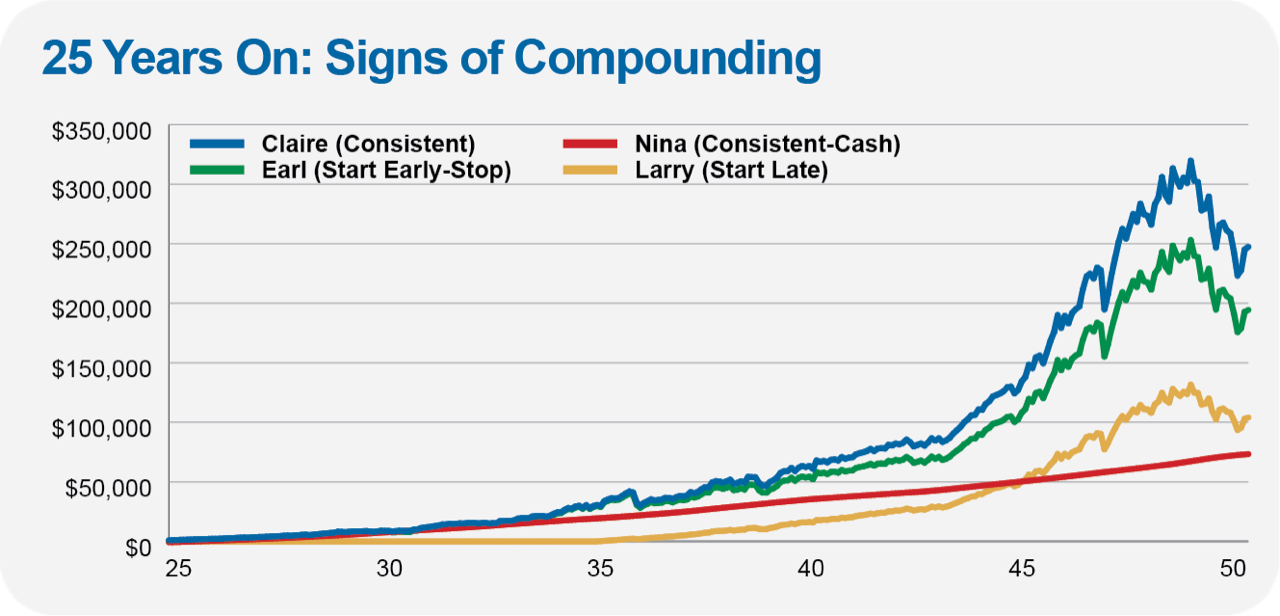

Fast-forward to 2001, and the friends all meet up to celebrate their 50th birthdays. It’s been 25 years since they started on this saving and investing road, and as you can see in the graph below, they are in distinctly different places, as compounding has begun to show its stuff.

Claire is at the front of the pack, with nearly a quarter of a million dollars. Earl isn’t far behind, despite no longer adding to his account. Larry is making progress and has caught up to Nina—though he is still well behind Claire and Earl.

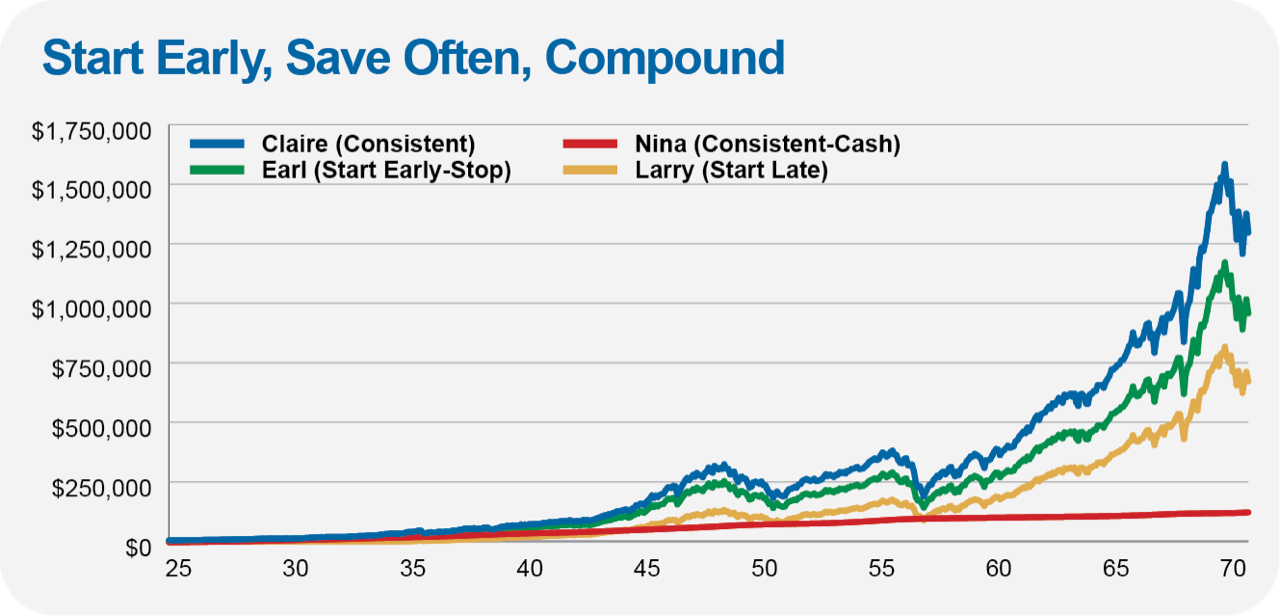

Finally, this past December, the four friends got together at age 71. Over the final 21 years, the power of compounding was on full display.

Nina and Claire, having been diligent savers month-in and month-out, each put $55,300 away over the past 46 years. But Nina has turned her $55,300 into $125,000, while Claire has nearly $1,300,000 set aside—10 times as much as Nina.

Earl, despite only saving $12,000 early on, has nearly a million in his account—almost $300,000 more than Larry, who started late but put away much more money.

Now, let me be clear. When it comes to Earl (who starts investing early but stops) and Larry (who got the late start), the past 46-year history for 500 Index is just one period—albeit a long one. I have run other simulations where Larry does indeed catch up to Earl either by saving at a higher rate or through a different pattern of returns.

Still, each of the four friends has a lesson to impart.

- Earl exemplifies the importance of starting early—even if you can’t save a lot, start when you can with what you can.

- From Larry, we can learn that it’s better to start saving and investing late than not at all.

- Nina demonstrates how we can’t just save our way to prosperity—it requires taking risks.

- Finally, Claire shows how combining an early start with consistent saving and compounding can lead to real wealth building.

I started with a quote, so I will end with one—this time from Morgan Housel:

Compounding only works if you can give an asset years and years to grow. It’s like planting oak trees: A year of growth will never show much progress, 10 years can make a meaningful difference, and 50 years can create something absolutely extraordinary.