Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 19th.

There are no changes recommended for any of our Portfolios.

Last week I told you if you are inclined to trade around the inflation data, keep in mind that you have to get two things right: First, you need to have a good handle on where inflation will clock in. Then, you need to know how traders will react to the report.

As I said then, “I’m not sure which task is harder.”

I didn’t expect that warning to be quite so timely.

The September report found inflation coming in uncomfortably high: Headline CPI ticked lower from 8.3% to 8.2%, but core CPI (which strips out food and energy prices in an effort to give a better sense of inflation trends) ticked higher from 6.3% to 6.6%. Even if you predicted that core inflation was going to rise I'm not sure you would've expected the stock market reaction.

The S&P 500 opened down 2.4% initially. Okay, maybe that makes sense. But then stocks rallied 5.1% to close up 2.6% on the day. I'm doubt many people saw that coming. It was the S&P 500’s biggest intra-day swing since COVID.

The lesson, yet again, is that it is very hard to be a successful day trader, particularly when it comes to trading macro (or economic) data.

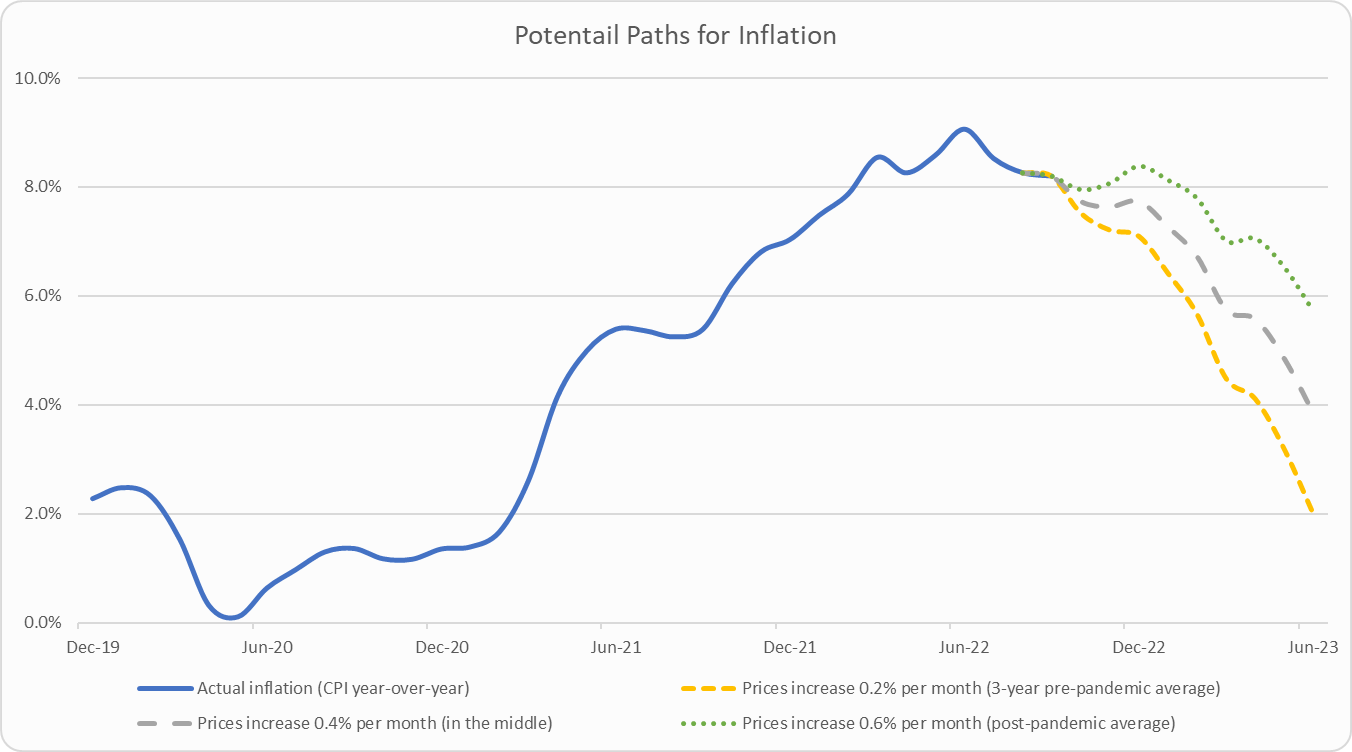

Staying on inflation for a moment, here’s an update on where inflation might be headed. If prices increase at the post-pandemic (June 2020 to June 2022) average pace—rising 0.6% per month—then we can expect inflation to clock in around 8.5% by the end of the year and fall to 6% in the middle of 2023. If prices rise at the pre-pandemic pace of 0.2% per month, then inflation will fall to 7% at year-end and drop to 2% next June.

My base case assumption is that inflation will land somewhere in between—I expect inflation to slow (it did in the third quarter) but it probably doesn’t go back to pre-pandemic levels. Prices rising in the 4% to 5% a year range seems like a reasonable expectation for the next several quarters.

I have no intention of attempting to trade off this inflation outlook. But I do find it helpful to set expectations for what we could see in the months ahead.

When it comes to news out of Malvern, I forgot to mention a manager change in last week’s Brief. On October 11, Vanguard fired sub-adviser TimesSquare Capital Management from International Explorer (VINEX). Premium members can read my full take on the change here, but the short story is that TimesSquare appeared to be the weak hand on the fund and Vanguard continues to search for the right sub-adviser mix at the small-cap focused International Explorer. There’s no need to rush into this fund.

After a rough September, stocks are having a much better October. 500 Index (VFIAX) is up 3.8% this month through Tuesday. SmallCap Index (VSMAX) is faring even better, up 5.5%. Even foreign stocks are having a good month as Total International Stock Index (VTIAX) has risen 2.3%.

While stocks are rebounding, bonds are continuing to sell off. Total Bond Market Index (VBTLX) is off another 1.2% in October and is now down 15.6% on the year. This is by far the worst year in the bond market in a generation.

If there’s a silver lining to this dismal bond market performance, it’s that the road ahead should be a lot more rewarding than the path just taken. Total Bond Market Index now sports an SEC yield of over 4%. This means that investors are finally earning a respectable level of income and can expect to earn around 4% per year from their bond funds over the next decade. I haven’t been able to say that in a very long time.

Finally, as has been the case for most of 2022, our Portfolios are showing poor absolute but decent relative returns for the year through Tuesday. The Aggressive Portfolio is down 20.7%, the Growth ETF Portfolio is off 22.6%, the Growth Portfolio has declined 19.0% and finally the Moderate Portfolio is down 16.2%. This compares to a 21.9% drop for Total Stock Market Index (VTSAX), a 25.1% decline for Total International Stock Index (VTIAX), and a 15.6% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), is down 22.3% for the year and its most conservative, LifeStrategy Income (VASIX), is off 16.5% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 14.1%.

Until next week this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.