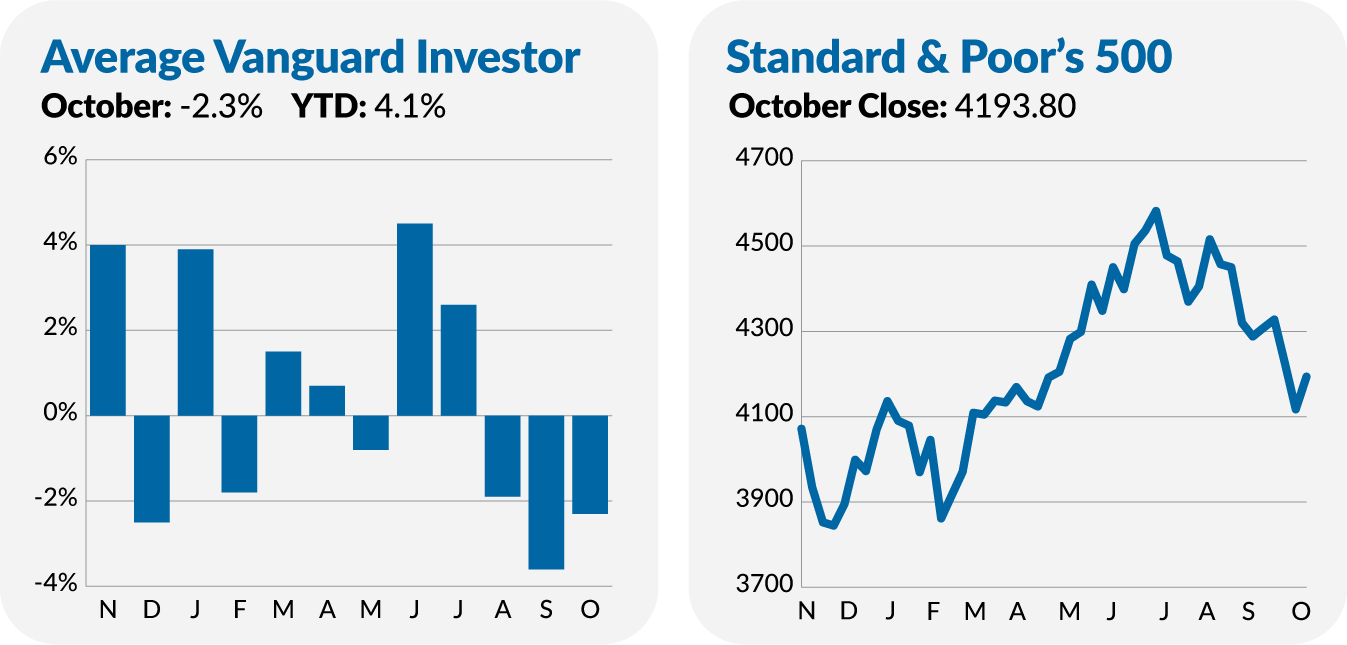

Stocks have declined for three straight months. It’s been nearly two years since the S&P 500 hit a record. If there was any question in your mind, the bear market that began in January 2022 is still not over. Though we’re in a bear market, U.S. stocks—particularly the biggest of the big—have been a haven this year. Let me explain.

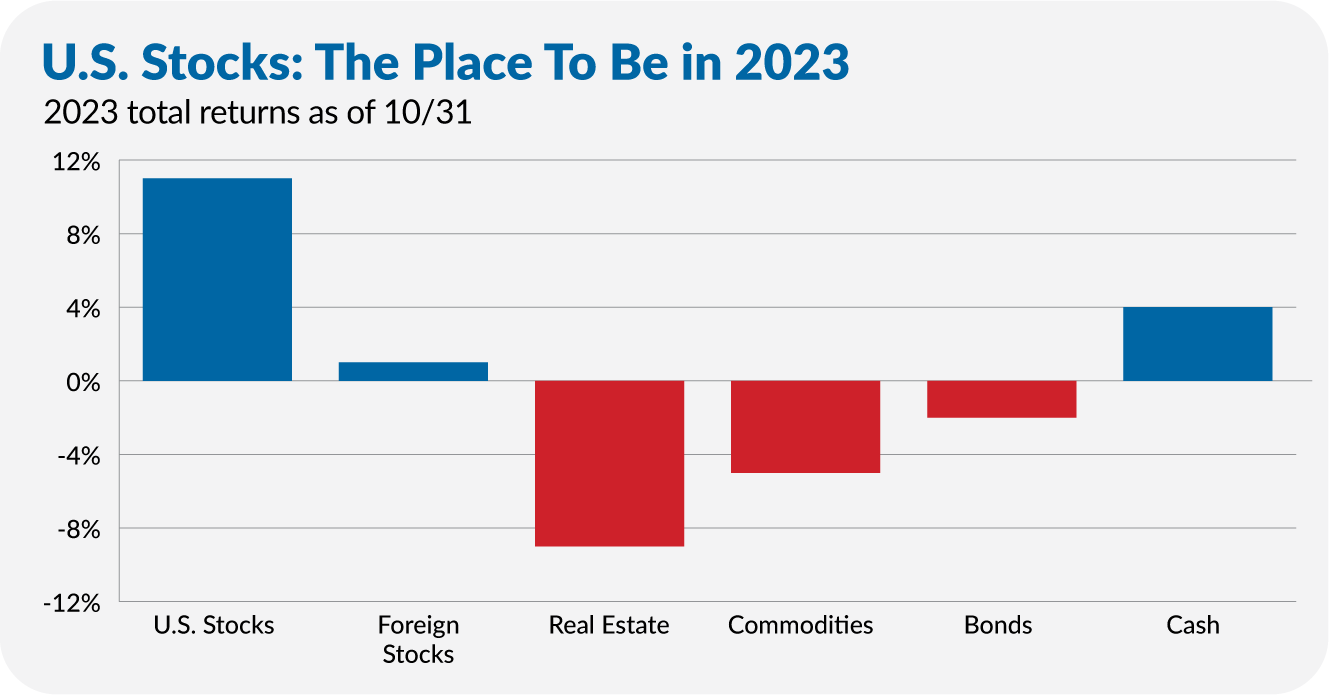

Vanguard’s flagship fund, 500 Index (VFIAX), is showing a decent but rather ordinary return of 10.7% this year. And yet, that’s head and shoulders above the other “major” asset classes that most investors focus on. Foreign stocks, bonds, real estate and commodities are all in the red in 2023. Only cash is providing any competition to U.S. stocks.

But pop the hood and you’ll see that even when it comes to U.S. stocks, the gains have been concentrated in a narrow part of the market—for lack of a better term, “big tech” has driven all the gains.

For example, MegaCap ETF (MGC) has gained 14.0% this year. But MidCap ETF (VO) is down 1.6% and SmallCap ETF (VB) has dropped 1.8%.