Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 19.

There are no changes recommended for any of our Portfolios.

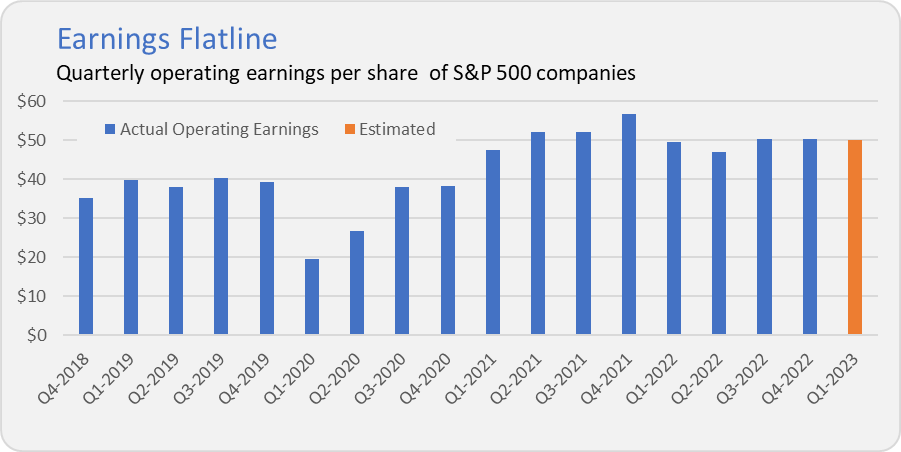

Earnings reporting season is underway, and according to Factset, 90% of S&P 500 companies are beating analyst expectations. Before you get too excited about that, only 6% of companies had reported results when that stat was compiled last Friday—we have a long way to go.

Since peaking in 2021, operating earnings have flatlined around $50 per share, according to S&P Global. Earnings drive stock prices over time, so I’ll be checking in as earnings season progresses. Stay tuned.

Get In Now

Inflation trending lower is generally a good thing—both for investors and consumers—unless we are talking about I-Bonds.

Premium members can find a primer on I-Bonds at the bottom of Trade-Offs in Action. The short story is that these are bonds backed by the full faith and credit of the U.S. government where the interest rate is adjusted twice a year (in November and May) based on inflation (measured by the Consumer Price Index).

With inflation on the decline, when the Treasury department resets the interest rates for I-Bonds in May, the input tied to inflation will drop from 6.5% to 3.8% or so. Note that a portion of an I-Bond’s interest rate is fixed for life. For bonds issued between November and April, that fixed rate is 0.4%—which brings the total interest rate available today to 6.9%.

We’ll have to wait and see what the Treasury uses for a fixed rate starting in May, but it seems likely the interest rate on I-Bonds is set to fall by around 2.5% in two weeks. So, if you are planning to buy I-Bonds this year, I recommend purchasing them before April 30. That way, you’ll earn 6.9% for six months before earning the lower 3.8% or so rate in the six months after that. If you wait until May 1, you’ll earn that 3.8% yield straight away.

The only reason to hold off would be if you expect the fixed portion will be set materially higher than 0.4%. But that seems unlikely to me.

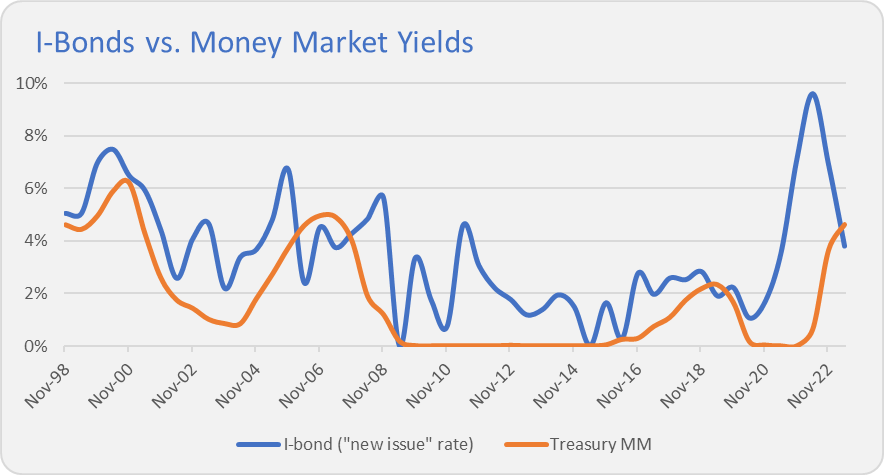

You may look at that 3.8% estimated yield and ask, with Treasury Money Market (VUSXX)—which is daily liquid and accessible without penalty—yielding 4.63%, well, why bother with I-Bonds?

Fair question. For some perspective, I’ve compared the yield of a “new issue” I-Bond with Treasury Money Market’s yield since I-Bonds were introduced back in 1998. Because that fixed portion of an I-Bond’s interest rate is set for life, buyers earn a different yield depending on which six-month window they made their purchase in. Early vintage I-Bonds sport fixed rates north of 3% … I think looking at the “new issue” I-Bonds makes for a more appropriate comparison.

You can see that most, but not all, of the time, I-Bonds paid a higher yield than the money market fund.

As I’ve said before, I’ve been transitioning part of my emergency fund over to I-Bonds. I made a purchase at the start of the year, so I’m locked in there. But even if I wasn’t, I wouldn’t be upending my plans to chase what could be a small and short-lived difference in yield.

Also, I’m happy to earn less income on this small part of my overall financial picture if it means better results (after adjusting for inflation) across my investment portfolio and an end to higher and higher prices at the grocery store.

Our Portfolios

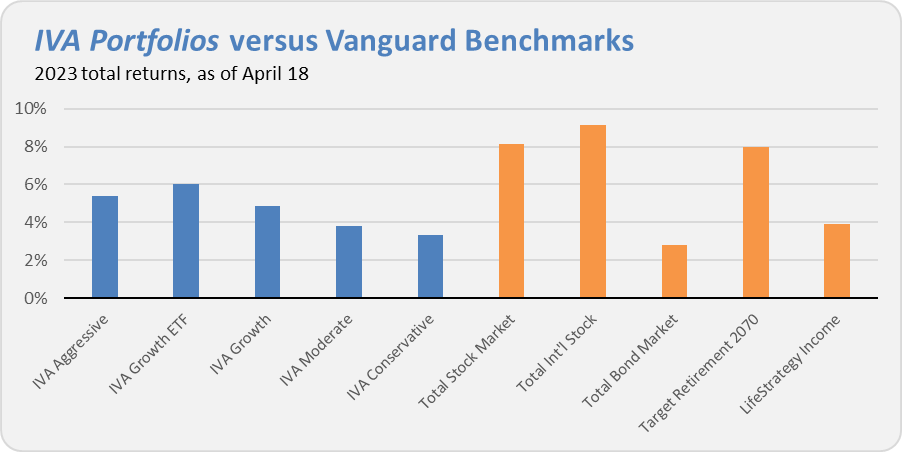

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.4%, the Growth ETF Portfolio has gained 6.0%, the Growth Portfolio is up 4.9%, the Moderate Portfolio has returned 3.8% and finally the Conservative Portfolio has returned 3.3%.

This compares to an 8.2% return for Total Stock Market Index (VTSAX), a 9.1% gain for Total International Stock Index (VTIAX), and a 2.8% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 8.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.9% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.