Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 1.

There are no changes recommended for any of our Portfolios.

I covered a lot of ground for Premium Members in today’s Monthly Recap article, so I’ll keep this Weekly Brief, well, brief.

Earnings reporting season is in full swing—roughly half of the companies in the S&P 500 index have reported their first quarter results. So far, more than three out of four companies earned more than analysts expected—which, oddly enough, is what typically happens. Only among Wall Street analysts and professional baseball players is being successful 25% of the time considered doing a good job … but that’s a topic for another day.

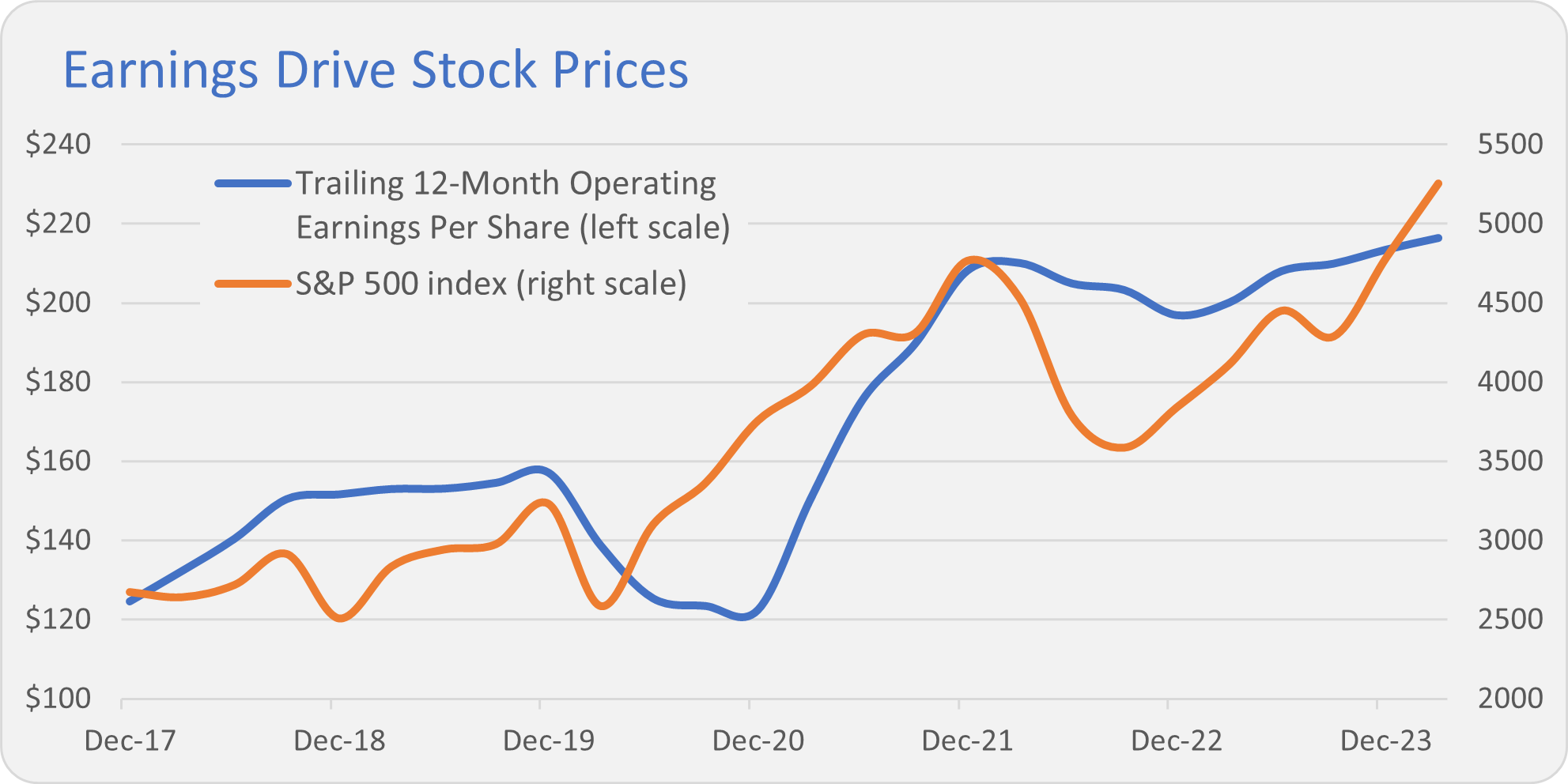

According to Lipper/Refinitiv, S&P 500 companies are on track to show earnings growth of 9% or so over the past 12 months. Earnings drive stock prices, and if earnings are rising, then so should stocks—all else being equal.

My mentor often said (and still does) that earnings and interest rates have the greatest influence over market returns over time. While earnings are growing, the interest rate story is a bit bearish.

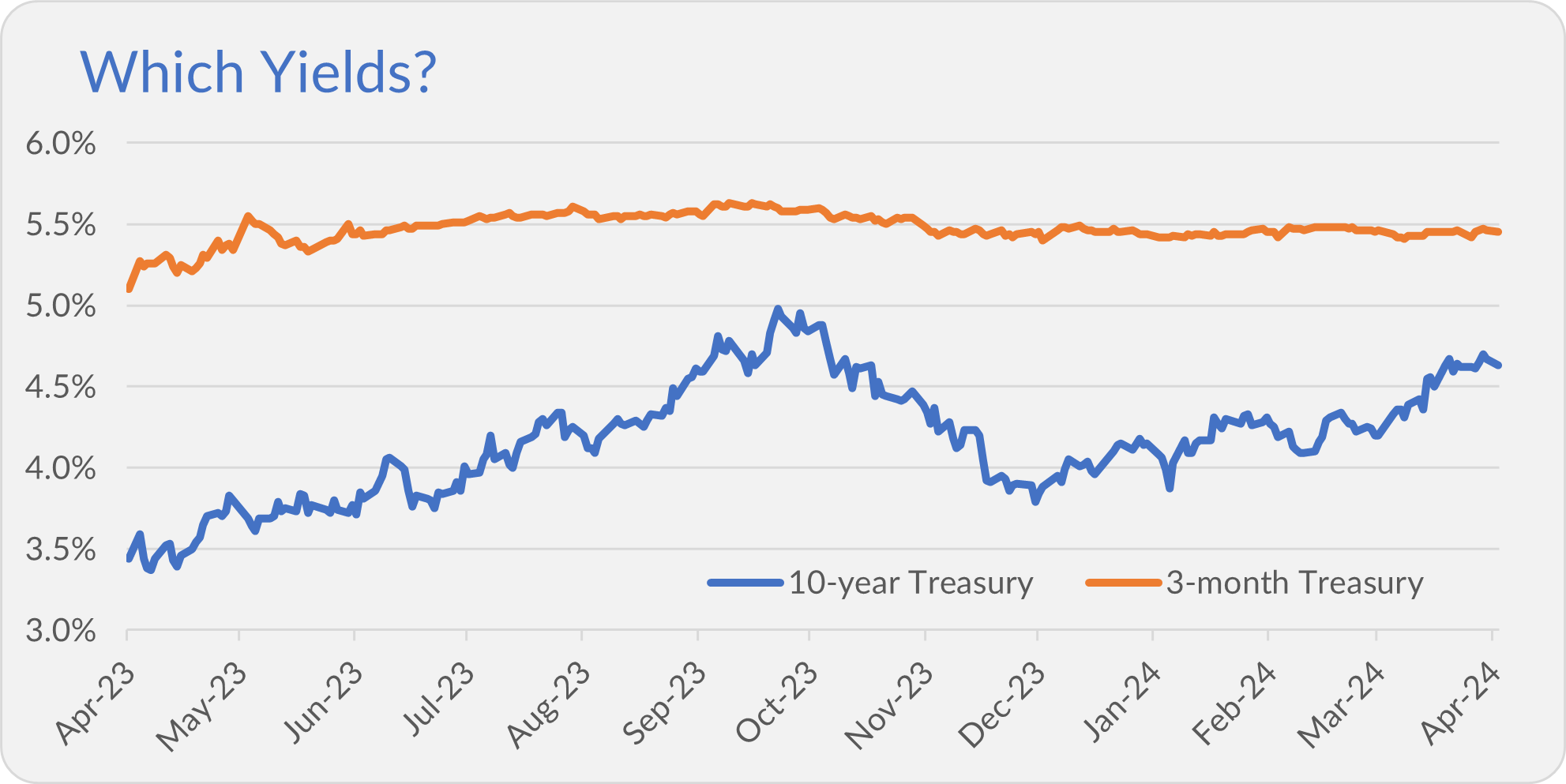

First, the yield on the 10-year Treasury has risen from 3.88% to 4.69% this year. Ordinarily, that’s not great for stocks. But, the 10-year Treasury has traded between roughly 4% and 5% for the past year or so. Said differently, the 10-year Treasury’s 4.69% yield is higher than it was at the start of 2024 but is not exceptionally high compared to where it has been over the past 12 months. So, maybe interest rates are currently a wash when it comes to stock valuations.

Also, despite what you’d think when listening to the media, there is more than one interest rate in the market.

If you look at, say, 3-month Treasury bills, their yields have been remarkably stable this year. And, with Federal Reserve policymakers on hold until further notice (which means until inflation falls), short-term interest rates should continue at this level.

I know that short-term interest rates of around 5% feel high compared to the prior 15 years (or so). They also provide more competition to stocks for investors' attention and dollars. But 5% interest rates haven’t stalled the economy nor caused a rush from stocks into bonds. And with companies continuing to expand their earnings, there’s no reason interest rates have to derail the bull market.

More Fees Ahead

Vanguard is meant to be the low-cost investment firm that looks out for the “little guy.” While Vanguard’s mutual funds and ETFs remain low-cost, Vanguard Brokerage Services is a different story as fees (particularly for smaller investors) keep cropping up.

I wrote about this last year—here and here. Today, Vanguard released an updated “commission & fee schedule” for Vanguard Brokerage Service (effective July 1, 2024), and fees are rising. I’ve attached the updated fee schedule below.

Two fees jump out as potentially impacting the largest number of investors:

First, buying and selling a Vanguard mutual fund (or ETF) over the phone used to cost nothing. Starting in July, however, it will cost $25 to trade a Vanguard fund over the phone unless you have over $1 million in qualifying assets (think Vanguard mutual funds and ETFs).

Second, Vanguard will start charging $100 to close or transfer an account—unless you have over $5 million in Vanguard funds.

Vanguard is changing fees on ADRs, MLPs and CDs and will start charging $250 to remove a restriction on a security in your account. See the fee schedule for more details if you think those fees will impact you.

Vanguard also introduced a new fee (which they call a “service”) related to class action settlements. Vanguard will start taking a cut (of 20%) if they “facilitate filing claims on behalf of clients in an attempt to recover class action settlement funds.” That’s a new one to me.

I suppose this is the “new” Vanguard. But, frankly, it feels like we are being nickeled and dimed.

The $25 fee to trade on the phone is particularly disappointing. I won’t be paying that fee because I trade online. Do you know who is going to pay that fee? A retiree who has been a lifelong Vanguard investor but isn’t confident or comfortable with the internet! Why is Vanguard imposing this toll on grandparents?

Our Portfolios

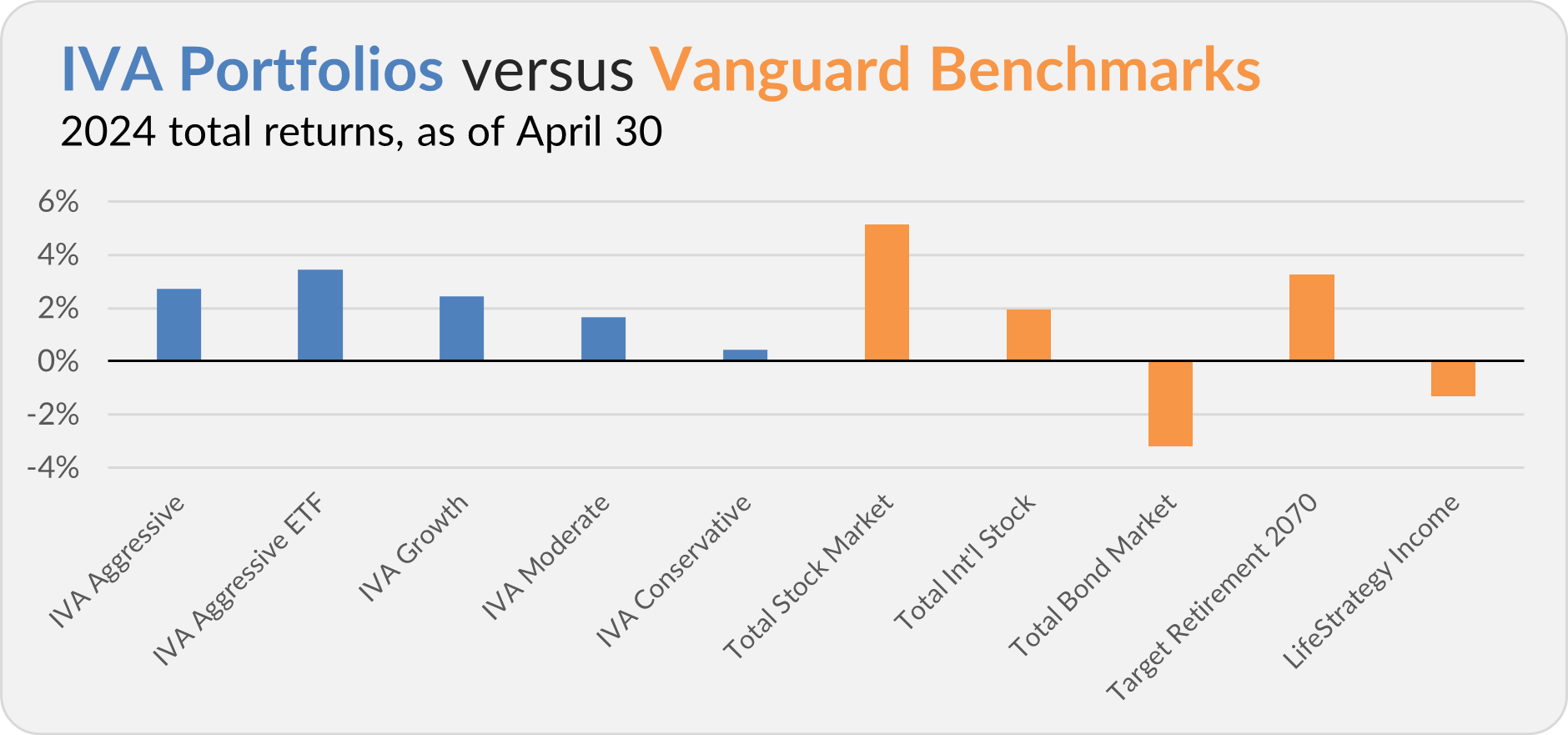

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.7%, the Aggressive ETF Portfolio is up 3.4%, the Growth Portfolio is up 2.4%, the Moderate Portfolio is up 1.7% and the Conservative Portfolio is up 0.4%.

This compares to a 5.1% gain for Total Stock Market Index (VTSAX), a 1.9% return for Total International Stock Index (VTIAX), and a 3.2% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.3%.

IVA Research

Yesterday, in Vanguard’s Exception to the Rule, I showed Premium Members how Vanguard’s index mutual funds are as tax-friendly as the firm’s exchange-traded funds (ETFs).

In today’s Monthly Recap article, I compared the current environment to the 1970s, provided an article round-up and dug into the performance of the IVA Portfolios.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.