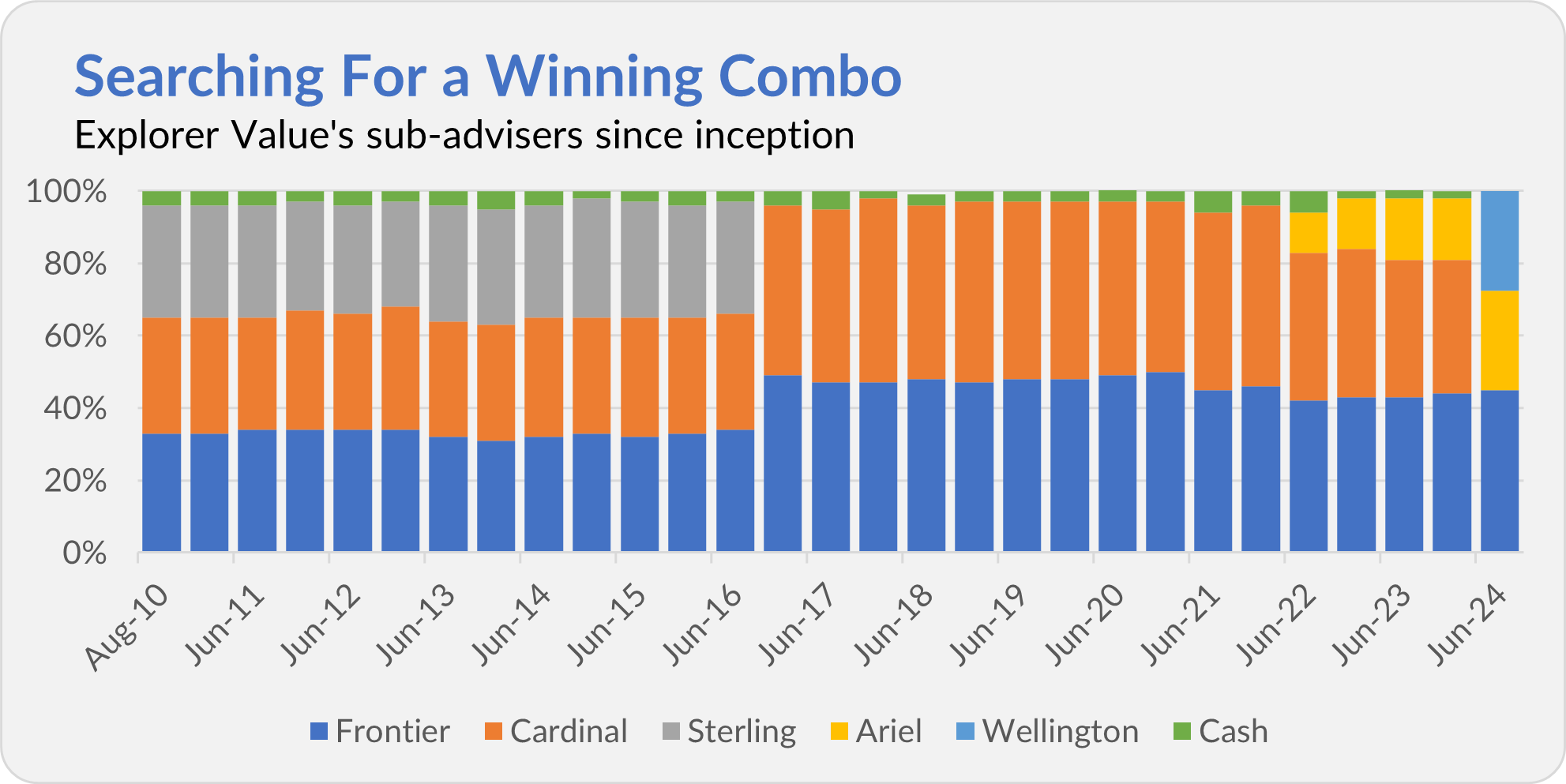

Vanguard’s search for a winning combination of active managers in the small-cap value arena continues.

Launched in 2010, Explorer Value (VEXFX) was meant to be an index-beating, actively managed small-cap value fund. Unlike some Vanguard funds, which begin life with only one manager or team and add managers as assets grow, Explorer Value was birthed with three teams sharing responsibility for finding value among smaller companies.

Today, Vanguard announced that it had fired Cardinal Capital Management from Explorer Value, leaving Frontier Capital as the last standing of the fund’s three original sub-advisers—Sterling Capital was fired in June 2016.

Vanguard has replaced Cardinal with Wellington Management and handed Ariel Investments (which joined the fund in 2022) a larger portion of the fund’s assets to invest.

Under the new management structure, Frontier will continue to invest 45% of Explorer Value’s assets. Ariel’s responsibilities are increasing from 17% to 27.5%. Wellington’s Sean Kammann will oversee the final 27.5% of the portfolio. The fund's expense ratio is expected to increase from 0.49% to 0.53%.

Why all the changes?