Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 12th.

There are no changes recommended for any of our Portfolios.

Inflation and the Fed seem to be the only things that matter to traders these days, so all eyes will be on tomorrow’s update to the consumer price index. If you are inclined to “trade” around the inflation data, keep in mind that you have to get two things correct: Where inflation will clock in and traders’ reaction to the report. I’m not sure which task is harder.

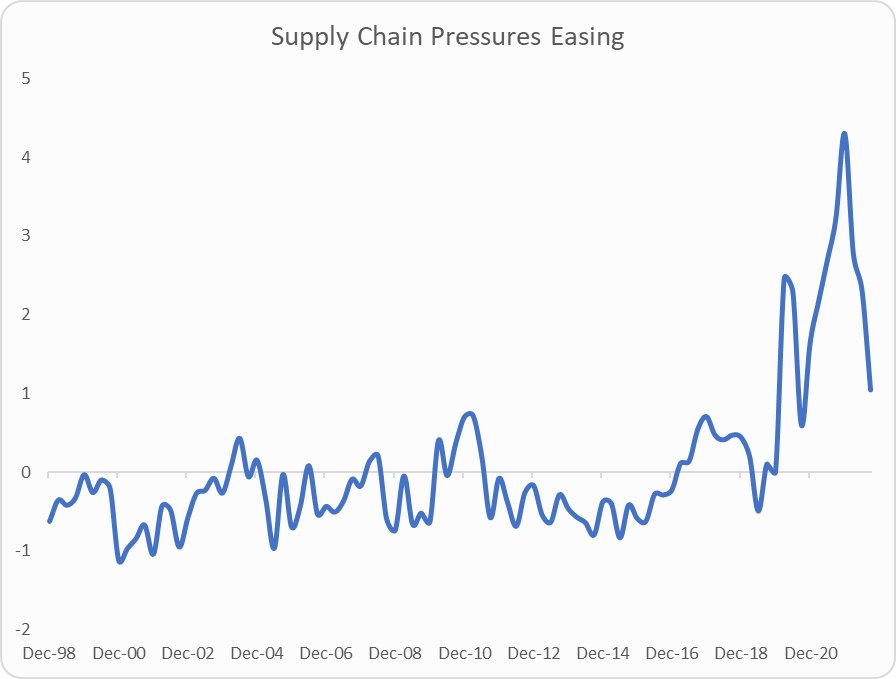

For what it’s worth, according to an index put together by the Federal Reserve Bank of New York, supply chain pressures are almost back to normal levels. My base case scenario for inflation is that it will trend lower over the next several months but will still be uncomfortably high.

Staying somewhat on the inflation topic, but pivoting slightly, several people shared with me a MarketWatch interview where hedge-fund manager Ray Dalio predicted “negative or poor real returns” over the next five years. Here are my thoughts:

First off, while the headline is negative and eye-catching, Dalio also made some positive comments. He sees opportunities in markets overseas—particularly in emerging Asia. Dalio also talked up innovation and “revolutionary changes” coming in artificial intelligence and health care. So, it wasn’t all doom and gloom.

Second, coming back to his market forecast—keep in mind that it is just that, a forecast. Dalio is certainly smarter and more experienced than I am, so he could be right. But it’s no guarantee. Also, Dalio is predicting “real returns.” That means he’s making an estimate on both the returns out of the market and inflation. To my eye, he seems more concerned about the inflation aspect of that forecast.

Third, if you are inclined to act on Dalio’s forecast, how would you change your portfolio? You could load up on emerging market stocks—but that’s probably outside of most investors comfort zone. I agree with Dalio about the bright future in health care and have a hefty allocation to the sector in my Portfolios, but how far do you want to lean in that direction?

Dalio also talks about “certain types of assets that diversify portfolios” ... without naming any specifically. If he’s talking about hedge funds, well, you and I certainly can’t get access to Dalio’s flagship funds. You could consider something like Alternative Strategies (VASFX), which I think of as Vanguard’s hedge fund, but it has lost money since its inception seven years ago. Is that really something you want to rely on? Commodity Strategies (VCMDX) might offer some diversification, but the asset class has a terrible long-term track record.

Also, keep in mind that if you are acting on Dalio’s prediction today, how will know if or when his view has changed? Point being, you probably shouldn’t overhaul your investment strategy based on one headline or interview.

And as I said, Dalio may be right or wrong—only time will tell. But with the S&P 500 index is 25% below its January 3rd high we are already in a bear market. Of course, stock prices could sink further from here, but purchases made during bear markets tend to work out over time. Remember, all bear markets end, and are followed by bull markets.

With that in mind, our Portfolios are showing losses for the year through Tuesday. The Aggressive Portfolio is down 23.3%, the Growth ETF Portfolio is off 25.1%, the Growth Portfolio has declined 21.3%, and finally the Moderate Portfolio down 18.0%. This compares to a 24.7% drop for Total Stock Market Index (VTSAX), a 27.1% decline for Total International Stock Index (VTIAX), and a 15.2% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065 (VLXVX), is down 24.5% for the year and its most conservative, LifeStrategy Income(VASIX), is off 16.9% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation(VPGDX) is down 15.6%.

Until next week this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.