Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, February 7.

There are no changes recommended for any of our Portfolios.

“What the heck happened?”

I received that question from several subscribers this week. They had checked the markets and their accounts over the weekend and saw that the S&P 500 index was up on Friday (1.1%), but many of their funds were down. This pattern nearly repeated itself on Monday—while the S&P 500 index slid 0.3% on Monday, it held up better than other indexes and funds.

I try not to get caught up in the day-to-day moves of the market, but let’s take a look at what was going on.

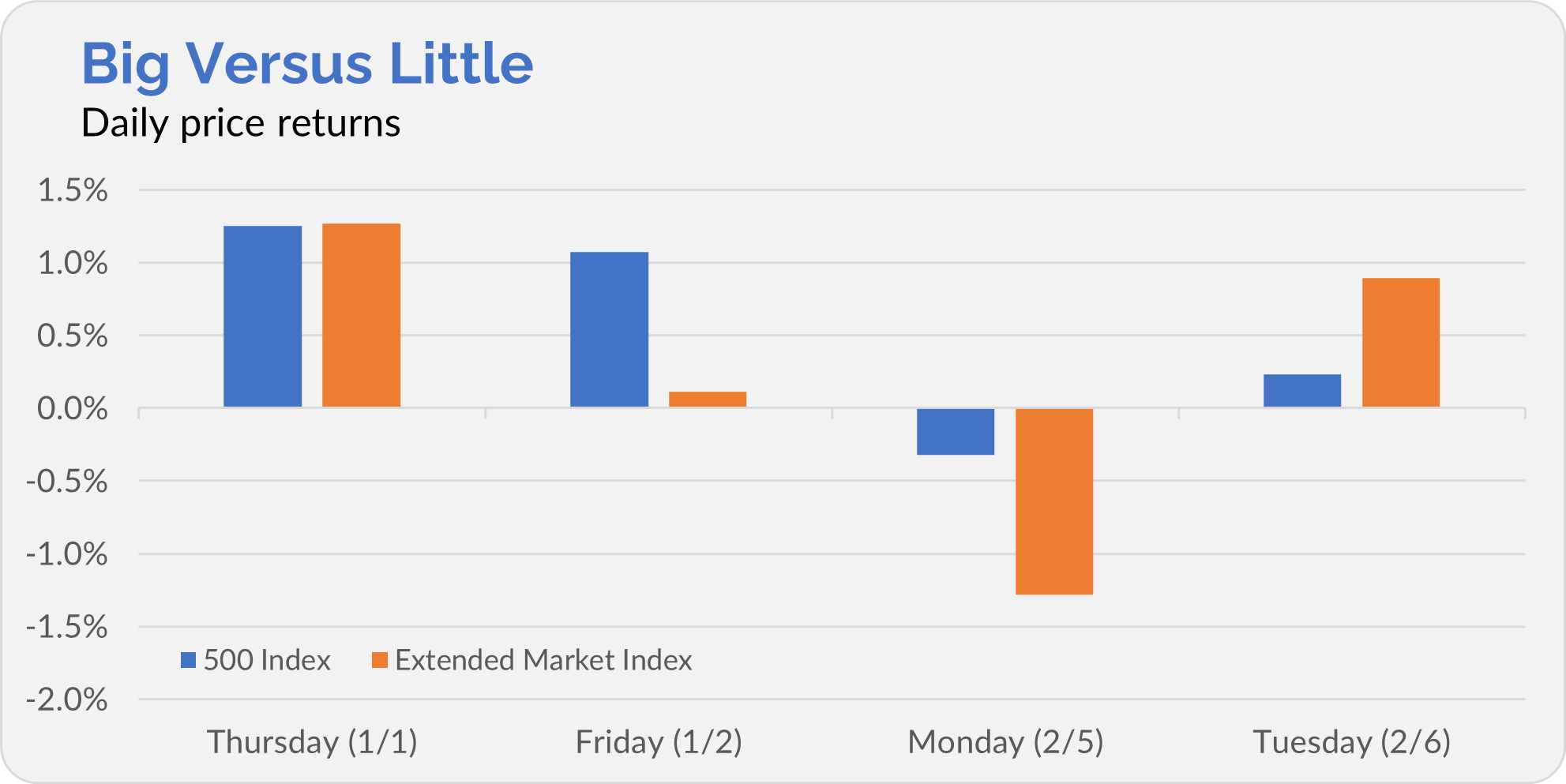

In the chart below, I’ve plotted the daily returns for 500 Index (VFIAX) and Extended Market Index (VEXAX, which is basically all of the U.S. stocks not included in 500 Index) since the start of February.

The chart shows that while large U.S. stocks gained ground on Friday, smaller stocks were flat on the day. Two stocks in particular drove 500 Index’s gains: Facebook (or Meta) was up 20%, and Amazon was up 8%. If you didn’t own those stocks (or you owned less of them compared to the index), then you fell behind.

On Monday, markets sold off following Fed Chair Powell’s 60 Minutes appearance—he said that policymakers were wary of cutting interest rates too soon. Note how large U.S. stocks held up better than smaller stocks.

That trend reversed on Tuesday as smaller stocks outpaced large stocks—chipmakers NVIDIA and AMD, along with Amazon and Facebook, weighed on 500 Index.

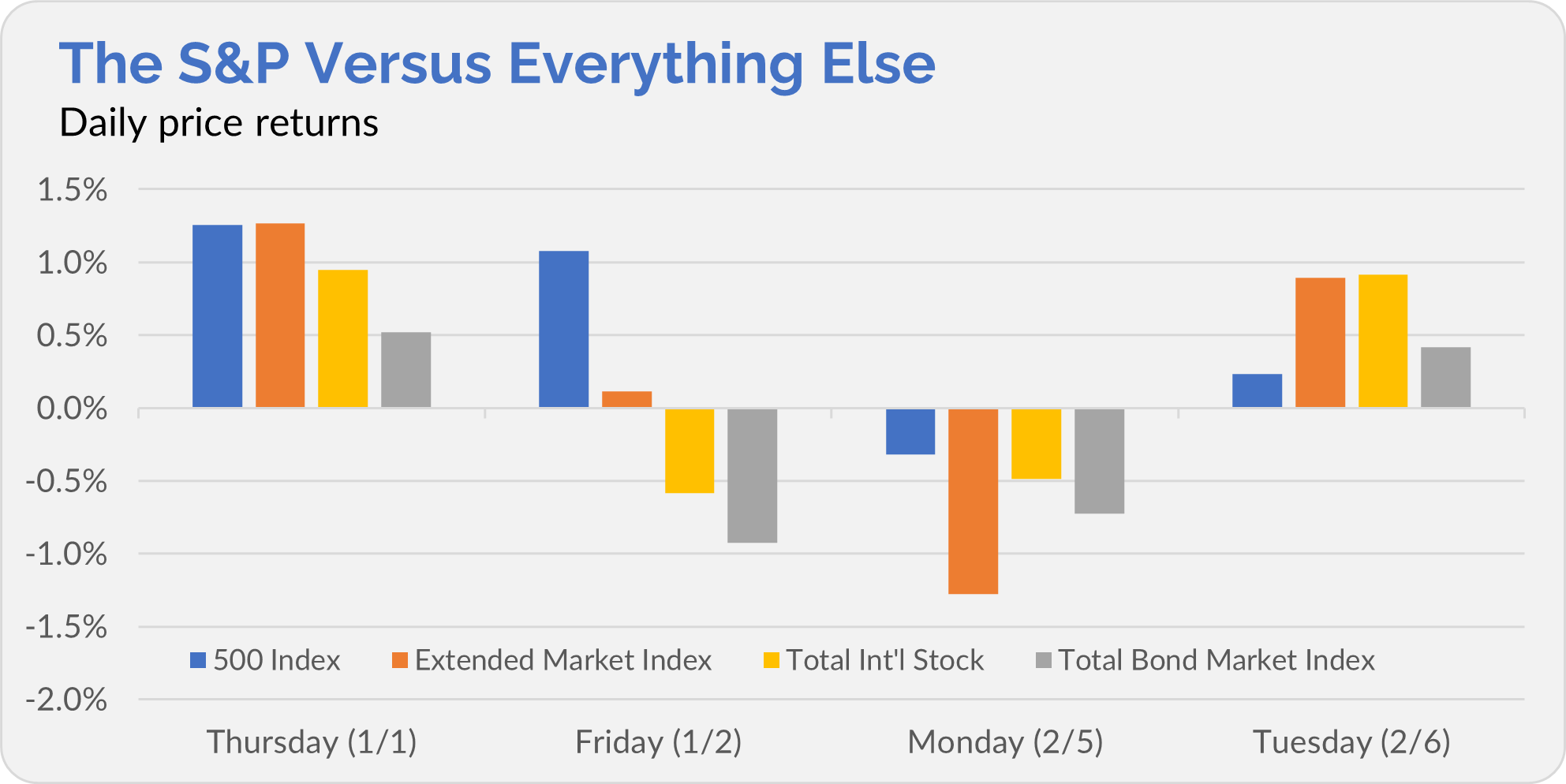

To add just a little more context, in the chart below, I’ve added Total International Stock Index (VTIAX) and Total Bond Market Index (VBTLX) to the mix. Most of us don’t own just large or small U.S. stocks, after all.

The same pattern occurs. On Friday and Monday, diversified investors felt silly, as seemingly everything trailed 500 Index. But diversification looked smarter on Tuesday.

It’s only three days in the market—that’s nothing in the context of an investment lifetime. I am confident that diversification will look smart over time. I invest accordingly.

Fund Ratings & Data

I’m always exploring ways to make The Independent Vanguard Adviser better and better.

To that end, last week, I made a small tweak to the website. In the navigation bar at the top of each page, I changed “Performance Review” to “Fund Ratings & Data.” As I said, it’s a small change.

But it achieves two objectives. First, while longtime subscribers may be familiar with the term “Performance Review,” it’s not necessarily intuitive for newer subscribers. Calling it “Fund Ratings & Data” is clearer. Second, I can now put the data I track on board and manager ownership at your fingertips.

If you hold your mouse on “Fund Ratings & Data” in the navigation bar (or if you tap it, if you’re on a mobile device), a dropdown menu will appear with three options:

- Performance Review

- Board Ownership

- Manager Ownership

Click on the link you're looking for.

I’ve got more projects in the works to improve The IVA. Stay tuned.

Our Portfolios

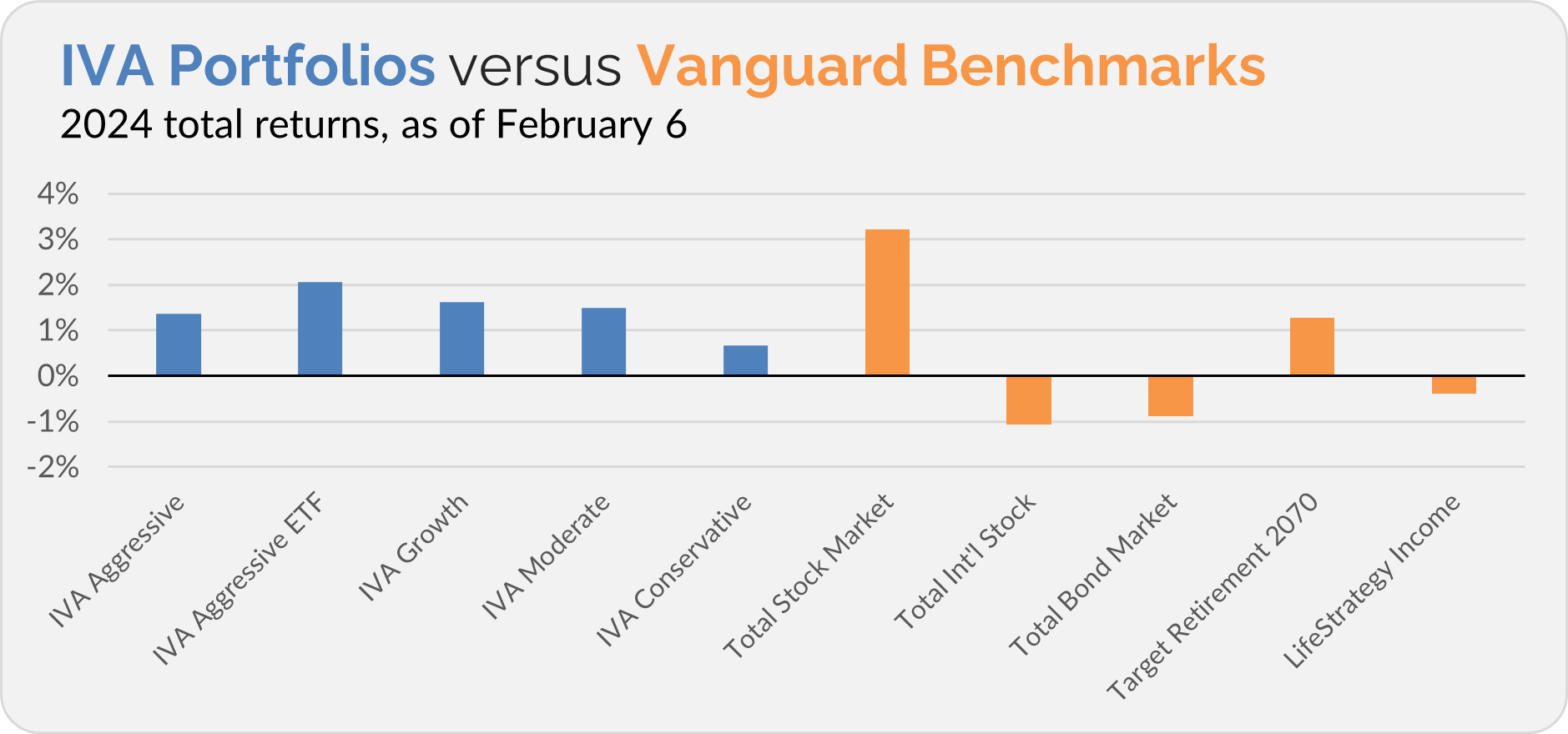

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 1.4%, the Aggressive ETF Portfolio is up 2.1%, the Growth Portfolio is up 1.6%, the Moderate Portfolio is up 1.5% and the Conservative Portfolio is up 0.7%.

This compares to a 3.2% return for Total Stock Market Index (VTSAX), a 1.1% decline for Total International Stock Index (VTIAX), and a 0.9% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 1.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 0.4%.

IVA Research

Yesterday, I shared my longest article yet with Premium Members. In Core Strength, I analyzed all of Vanguard’s growth and income funds. These funds own large, stable, name-brand companies that will compound earnings and your wealth over time. It’s where you should have the bulk of your dollars invested.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.