What a difference three months make.

In April, traders were on edge. “Reciprocal tariffs” were on everyone’s mind, and the President’s musings about firing Federal Reserve Chief Jerome Powell didn’t help. The market responded accordingly—at its worst (on April 8) 500 Index (VFIAX) was within a hair’s breadth of a bear market, down 19% from its February peak.

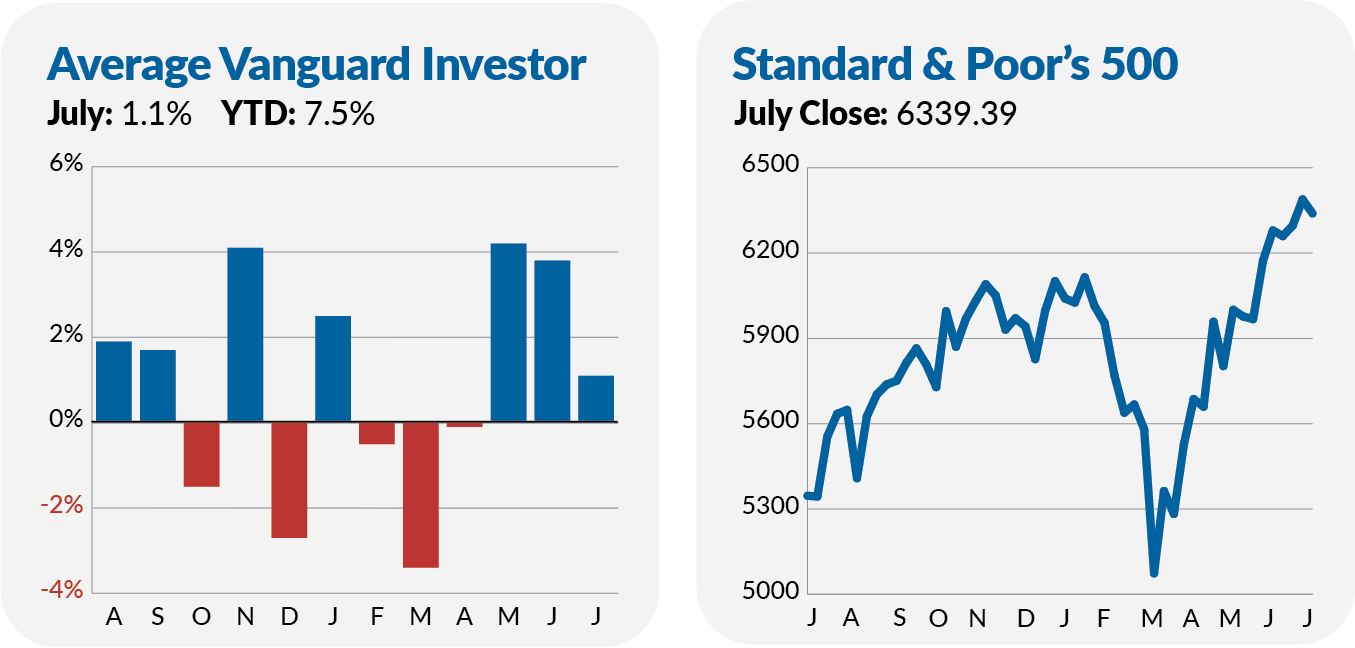

Fast forward to July: Tariff “deals” dominated the headlines, and those “reciprocal” duties are scheduled to take effect in seven days. Powell’s position was still in question. And yet … 500 Index hit record highs on 10 out of 22 trading days in July, returning 2.2% for the month.

Same headlines. Dramatically different results.

In the end, 500 Index was “the place” to be in July. Smaller U.S. stocks—measured by SmallCap Index (VSMAX)—gained ground but trailed the flagship index fund, returning 1.9%. Foreign markets lagged, with Total International Stock Index (VTIAX) dropping 0.9%.

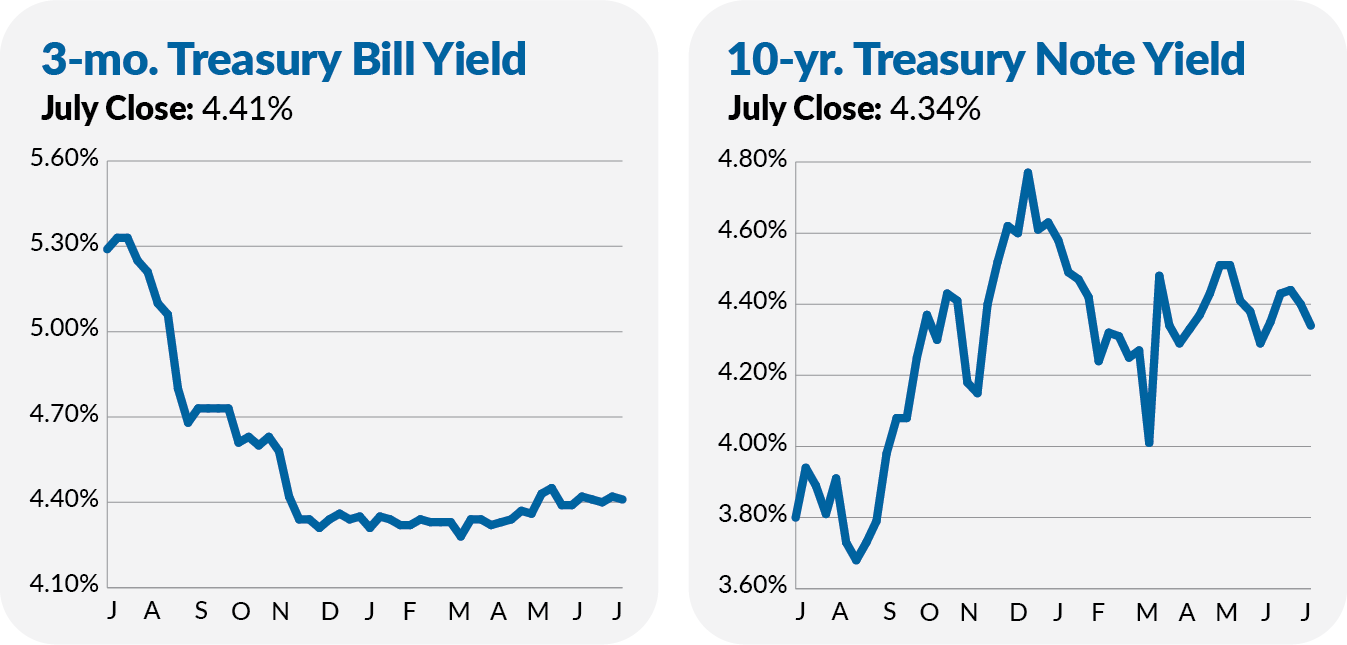

Emerging market bonds led the fixed income markets in July, with Emerging Markets Government Bond Index (VGAVX) gaining 1.1%. But cash wasn’t far behind, with Federal Money Market (VMFXX) returning 0.4%. High-quality bonds didn’t join the rally—Total Bond Market Index (VBTLX) slid 0.3%.

Looking beyond stocks and bonds, Real Estate Index (VGSLX) gained 0.1% in July, while Commodity Strategy (VCMDX) fell 0.5%. In short, alternative assets didn’t offer much diversification from mainstream stocks and bonds.

Put it all together, and the average Vanguard investor gained 1.1% in July and is up 7.5% on the year.

That was July in the markets through the lens of a Vanguard investor. Now, let’s talk about the broader backdrop—specifically, what the recent report on Gross Domestic Product (GDP) does and doesn’t tell us about the state of the economy.

A Word on GDP: Framing Matters

Let me offer two opposing takes on the U.S. economy as measured by inflation-adjusted GDP.