🚨🚨 In October, I recommended trades in four of the five IVA Portfolios. You can review the trades and my reasoning behind them here.🚨🚨

What do you do if you're driving in a fog? You slow down.

—Federal Reserve Chair Jerome Powell, October 29, 2025 (here)

On Wednesday, Federal Reserve policymakers trimmed the benchmark fed funds rate by a quarter point (0.25%), lowering the target range to 3.75%–4.00%. In his post-meeting press conference, Chair Powell used the “driving in a fog” analogy to explain why policymakers might not lower rates further for a while.

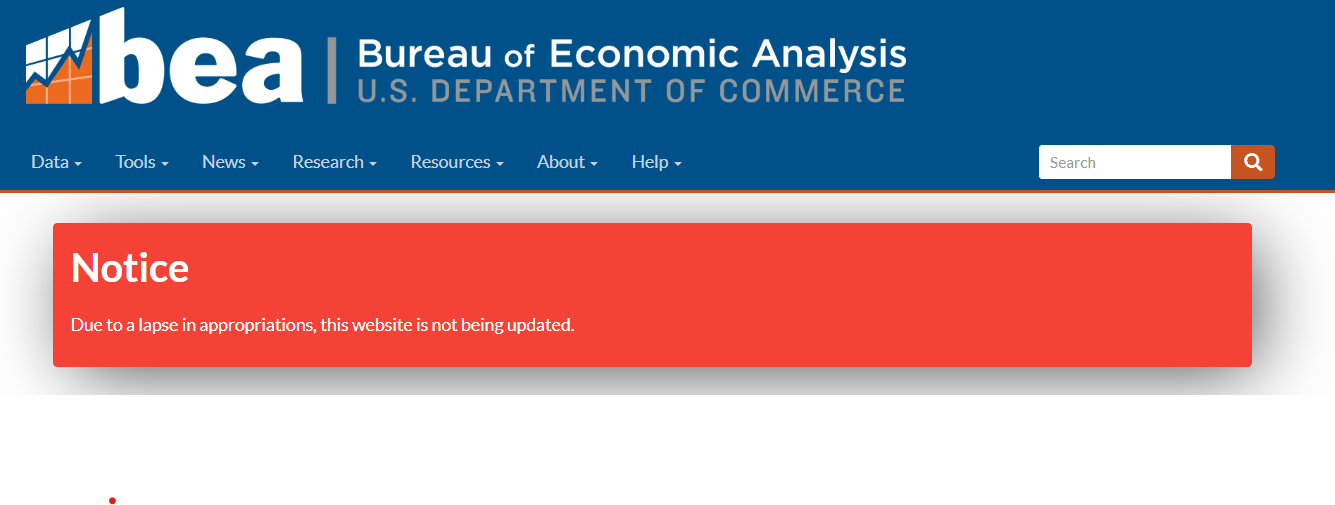

And make no mistake—policymakers are trying to drive the U.S. economy through a fog. With the government shutdown having now lasted through October, much of the economic dashboard has gone dark. The first estimate of third-quarter GDP, for instance, was scheduled to be released on October 30. Instead: Nothing.

I’ll circle back to the Fed and interest rates in a moment, but Powell’s analogy holds lessons for us as well.