You’ve heard plenty from me this week. Today, I shared my month-by-month review of 2025 (here) as well as a deeper dive into some of the details of last year’s markets (here). Earlier this week, my Weekly Brief (here) took the economy’s pulse using what I call the “Bessent Barometer.” And just three days ago, you received my 2026 Outlook, Investing Beyond the AI Hype.

So, I'll keep this short.

🚨Hot Hands update: If you follow my Hot Hands strategy, you can find the latest trade announcement here.

Last year was noisy—but for investors who stuck to their guns and stayed invested, it was also profitable.

Every single Vanguard fund finished 2025 in the black, and the average Vanguard investor earned a 15.5% return. No, that didn’t match 500 Index’s (VFIAX) 17.8% gain—but remember that the “average” investor owns bonds and cash as well as stocks. Still, for long-term savers, it was a meaningful step forward in building wealth and financial security.

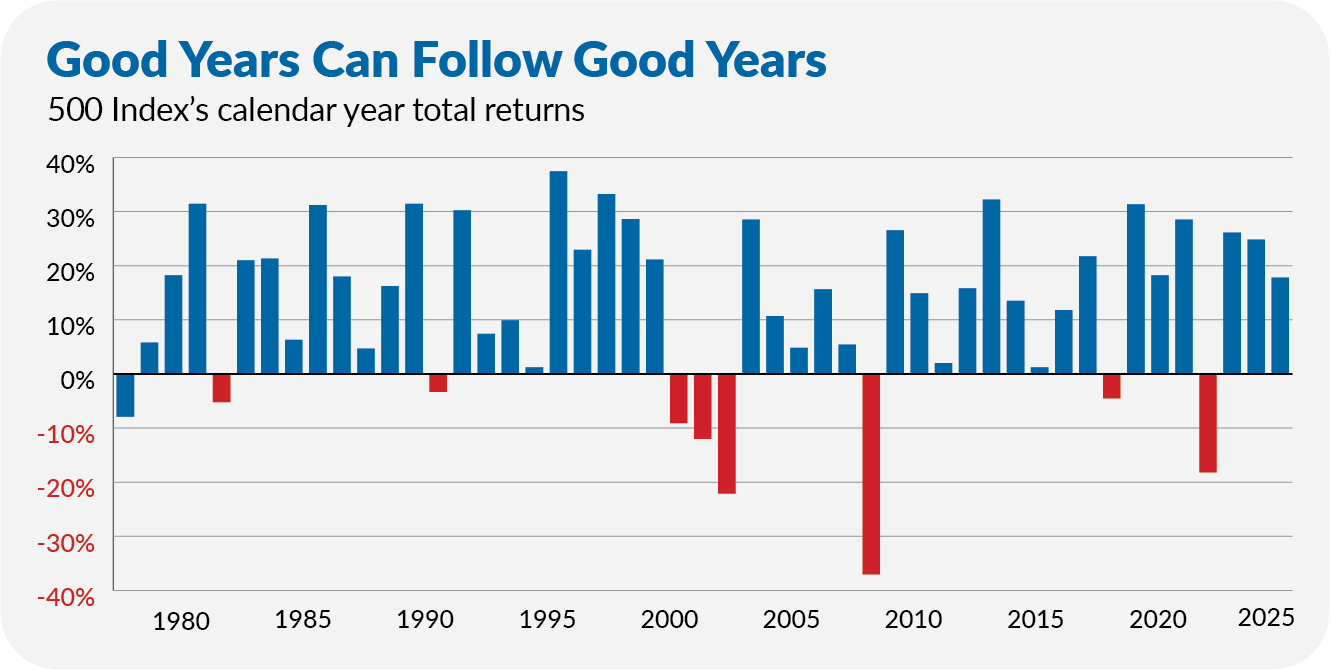

Speaking of 500 Index, the flagship index fund fell just short of notching a 20%+ return for the third consecutive year—something that’s happened only once before in its 49-year history. The only time? The tech bubble of the 1990s.

Back then, 500 Index gained 37% in 1995, 23% in 1996 and 33% in 1997. And while three great years might feel like a cue to sell, history tells a more complicated story. Investors who headed for the exit at the end of 1997 missed a 29% gain in 1998 and another 21% in 1999.

Of course, the cycle eventually turned. Those five years of 20%-plus returns were followed by three straight years of losses—the only time that has happened over the past five decades.

So, should we expect another year of 20%-plus returns in the U.S. stock market in 2026? No. But that doesn’t mean avoiding the markets altogether is the right response either.