No “90 Deals”—But a Full Recovery

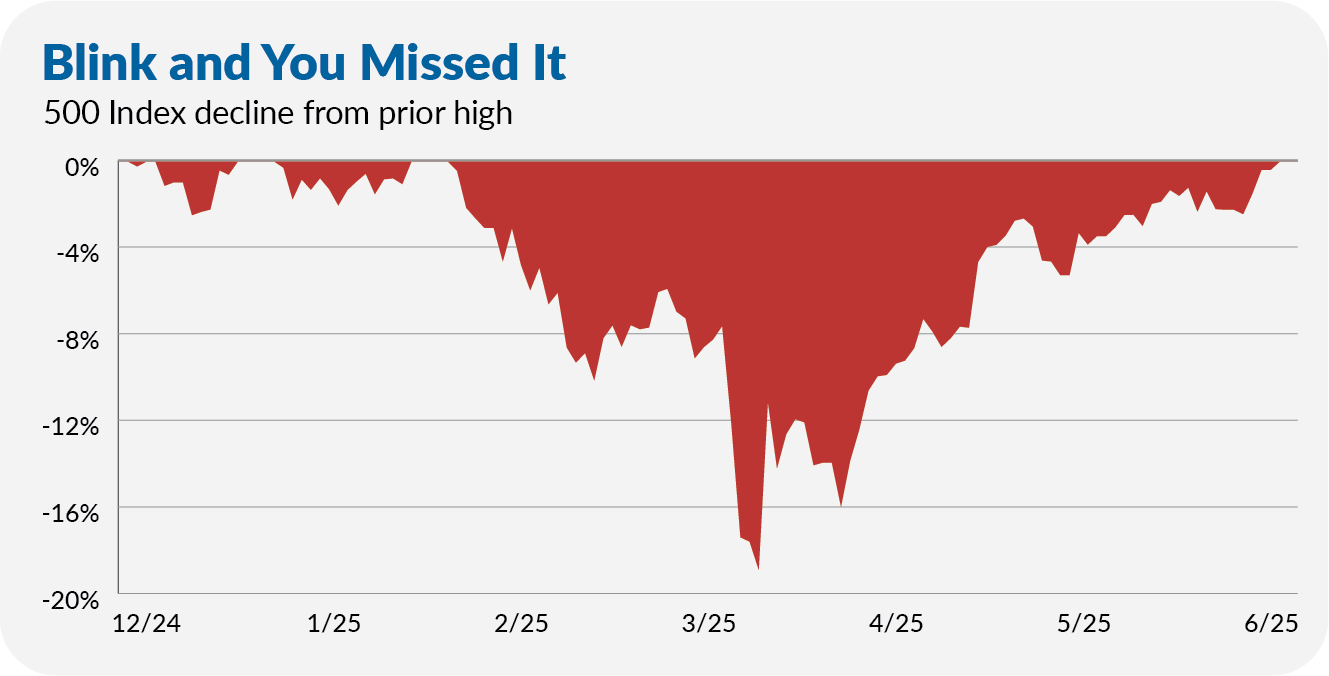

U.S. trade negotiators didn’t get “90 deals in 90 days.” But in the 82 days since President Trump paused the “reciprocal” Liberation Day tariffs, 500 Index (VFIAX) has gained 25%—enough to erase the 19% drop it suffered between its pre-tariff peak on February 19 and the April 8 low.

Back in March, while the market was selling off, I put the correction in perspective—here and here. At the time, I said:

The unanswerable question is whether the current correction is another (relatively) quick dip or if we are in the early stages of an extended bear market.

Well, we have an answer now: It was another quick dip. 500 Index fell 19% in two months and made it all back in three. That’s pretty typical for corrections, excluding the extremes of the tech bust (2000) or the global financial crisis (2008).

Still in the Tariff Woods

Look. We are not out of the tariff woods yet.