🚨🚨In April, I recommended trades in all the IVA Portfolios. Premium Members can access a Trade Alert explaining the trades and my reasoning behind them. 🚨🚨

Are you interested in a Premium Membership? Start your free 30-day trial now.

April packed a year’s worth of market drama into just 21 trading days. So, let’s take a step back and consider where we stand.

Over the past month, the administration has tried to reshape the global trade order, unveiling sweeping “reciprocal” tariffs that target nearly all of America’s trading partners—effectively throwing a monkey wrench into the gears of the global economy.

As of today, the U.S. is levying 10% tariffs on most nations while negotiating dozens of bilateral trade deals before steeper duties are scheduled to kick in on July 8. Some carveouts have been granted, and certain sector-specific tariffs—like those on automobiles—have been relaxed.

It’s not just the duties that create challenges; it’s the start-stop-start nature of the tariff regime. Uncertainty is paralyzing. Business leaders can’t confidently invest when the rules of the game might change overnight. You can’t break ground on a new factory if tomorrow’s trade terms might erase the logic behind it. Better to wait it out—but that wait comes at a cost.

If that weren’t enough, the U.S. and China are locked in a trade war. Tariffs of over 100% were imposed effectively overnight, straining both economies. Chinese factories are slowing production as export orders dry up (here). The other side of that coin is that fewer ships—and fewer goods—are arriving at U.S. ports (here).

The U.S. economy has consistently shrugged off recession forecasts. But looking ahead, it’s hard to see how a downturn is avoided. And that’s not just because GDP contracted in the first quarter—that’s a backward-looking measure. The genuine concern is forward-looking: even if all tariffs were lifted tomorrow, the economy has already taken a body blow.

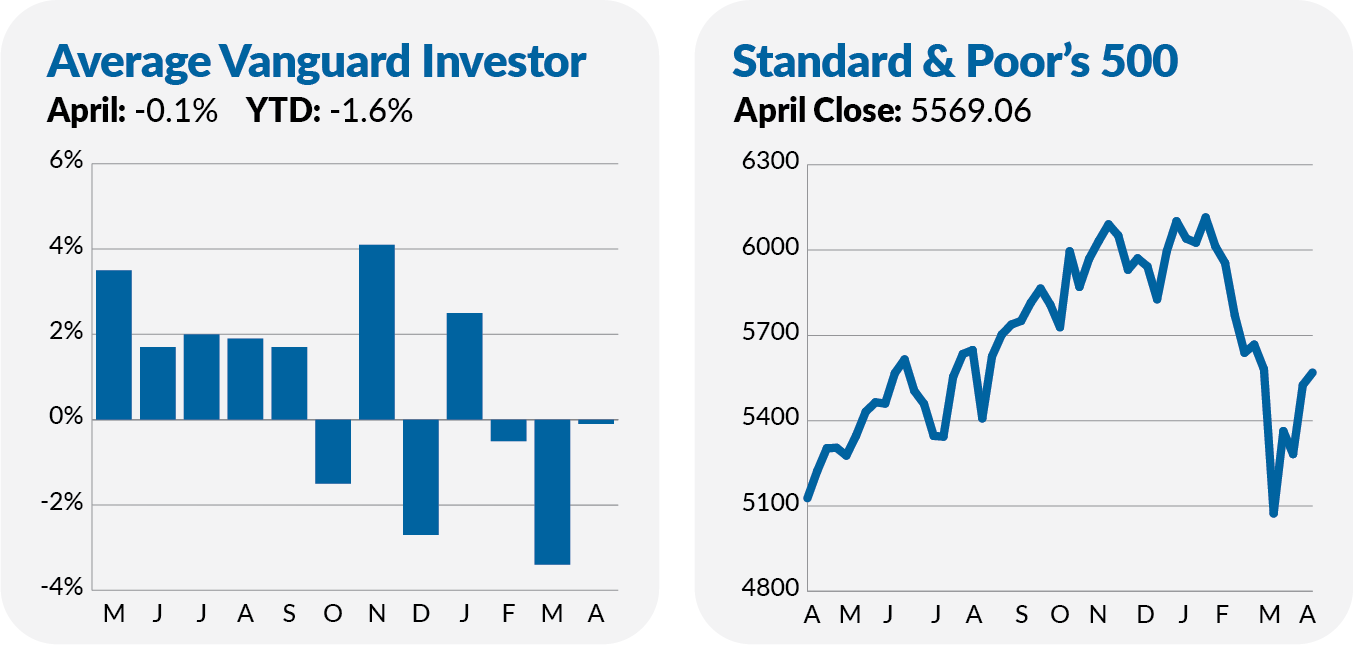

So, how have the markets responded to all this economic upheaval? Based on April’s returns alone, you’d hardly know anything was wrong.

U.S. stocks finished in the red, but I wouldn’t call it a bloodbath. 500 Index (VFIAX) dropped 0.7%, while SmallCap Index (VSMAX) fell 2.5%. Foreign stocks were positive in April, as Total International Stock Index (VTIAX) gained 3.1%.

Bonds also gained ground in April. Total International Bond Index (VTABX) led Vanguard’s pack with a 1.7% gain. But Total Bond Market Index (VBTLX) gained 0.4%. It wasn’t just high-quality bonds that did well; High-Yield Corporate (VWEHX) also delivered a positive 0.3% return in April.

Of course, as I noted yesterday, those monthly return figures mask a lot of intra-month volatility.

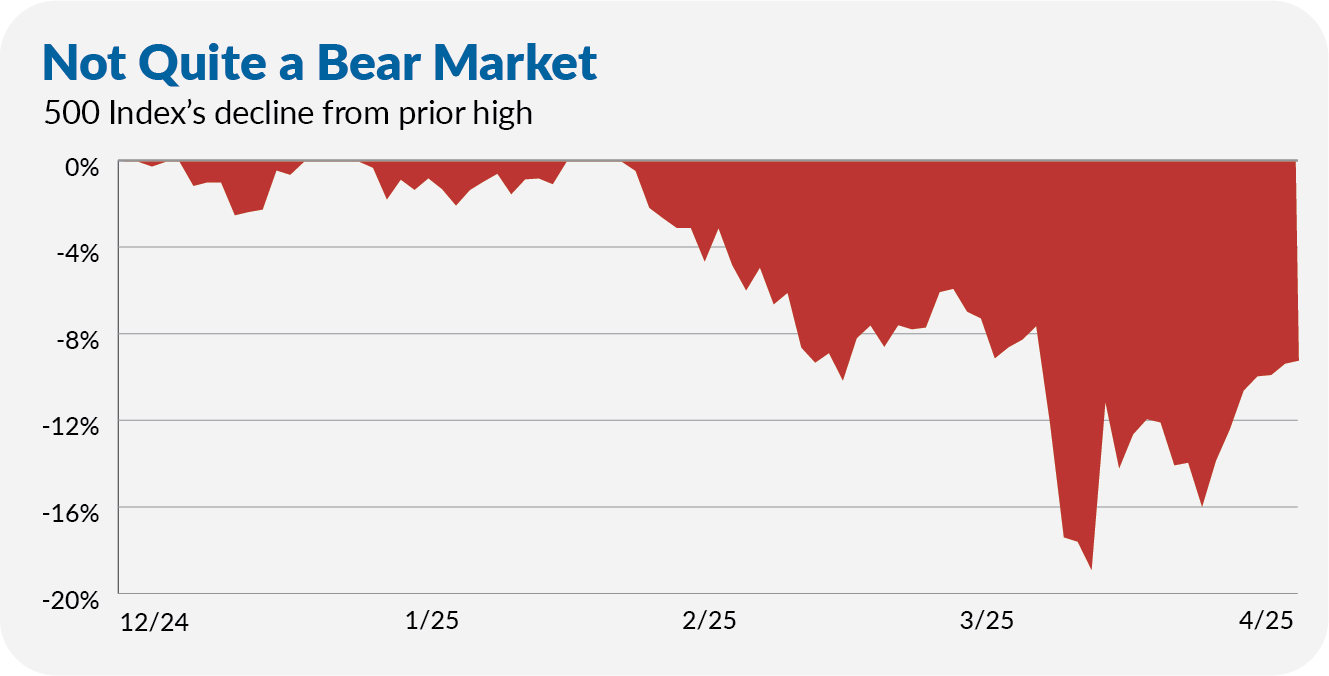

For example, 500 Index fell 12.1% in four trading days following the initial tariff announcement. The flagship index fund then notched its third-best day ever, jumping 9.5% on April 9 as so-called “reciprocal” tariffs were paused for 90 days. The index fund fell 5.4% over the following seven trading days before rallying 8.0% over the final seven trading days of April.

Despite April’s rollercoaster ride, the flagship index fund has avoided a bear market—a decline of 20% or more from a prior high. At its worst, 500 Index was 18.8% below its February 19 record high. Today it sits 9.1% below that high, and is down 4.9% in calendar year 2025.

What’s an investor to do?