Businesses may still be confused about the rules under which they are operating, but there was no confusion on Wall Street—or at least there didn’t seem to be—as 500 Index (VFIAX) gained 6.3% in May and Total International Stock Index (VTIAX) rose 4.7%.

U.S. stocks (measured by 500 Index) are now up 5.2% since April 1 (the day before President Trump’s Liberation Day “reciprocal” tariff announcement) and are just 3.4 % below their February 19 high.

That’s fairly remarkable given that it’s been two months and we still don’t know the answer to a simple question: What are the rules?

In May, the Administration caused traders its fair share of tariff whiplash. Tariff pressure eased as the U.S. announced a “trade deal” with the U.K. and agreed to a 90-day ceasefire in the trade war with China. However, President Trump then threatened the European Union with 50% tariffs in short order before reverting to the original timeline. He also stated tariffs on steel and aluminum imports would double to 50% starting on June 4.

However, it wasn’t just the Administration; the courts also got involved.

In the final few days of the month, a three-judge panel at the U.S. Court of International Trade ruled that the President could not impose sweeping tariffs under the International Emergency Economic Powers Act—throwing out the 10% global baseline tariff, all of those paused “reciprocal” tariffs and the 20% fentanyl-related duty on China, Mexico and Canada.

The U.S. Court of Appeals granted the Administration a stay on that ruling while it considered the matter. I wouldn’t be surprised if this ends up before the Supreme Court sooner or later.

So, where does this leave investors?

Well, as I’ve been saying all along, the tariff story is far from over.

The Administration is not likely to “give up” on tariffs. Even if their appeals are unsuccessful, I expect the President and his team to pursue alternative avenues. After all, some of the tariffs—such as those on autos, steel and aluminum—were imposed under a different authority and remain in effect.

The bottom line is that with tariffs constantly shifting—on and off, up and down—the rules remain unclear and uncertainty remains high.

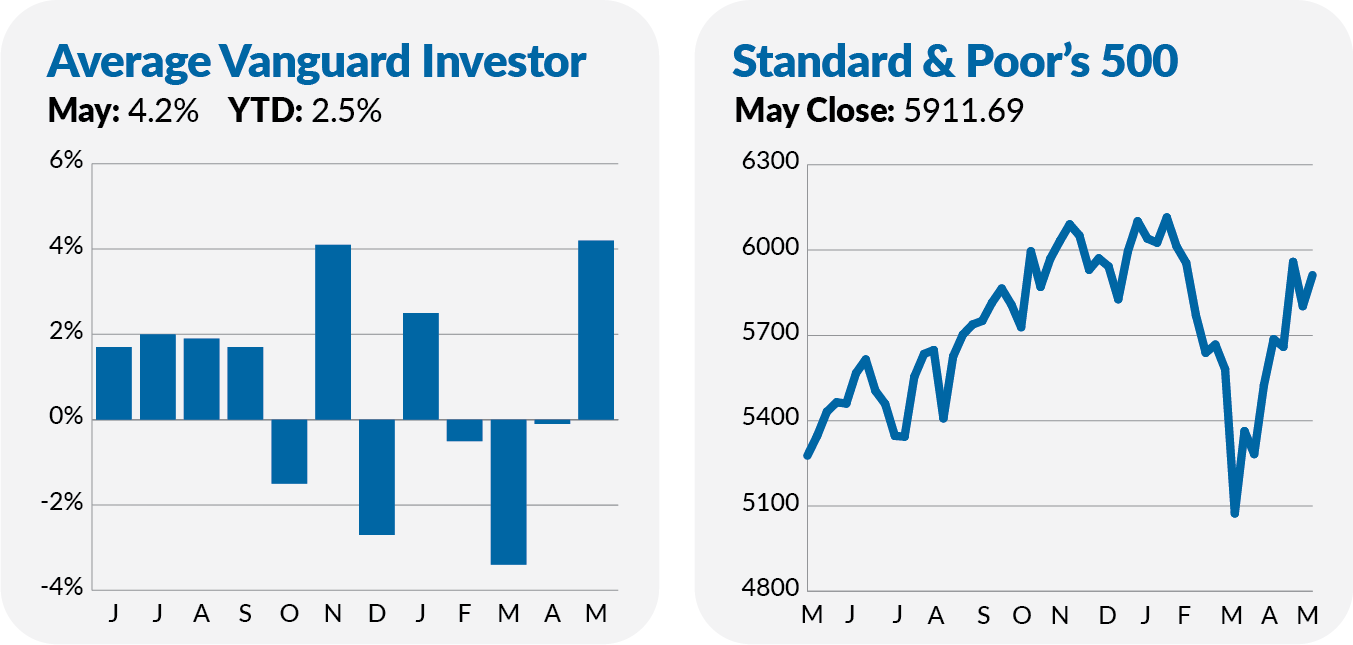

Despite the headline noise and manic Wall Street trading, investors are earning decent returns this year. While the average Vanguard investor is up 2.5% this year, what’s really caught my eye is the performance of Vanguard’s one-size-fits-all, off-the-shelf solutions—its Target Retirement and LifeStrategy funds.

Vanguard’s index-based allocation portfolios, which are popular in 401(k) plans, are up between 3.0% and 5.4% so far this year—meaning all of them are well ahead of 500 Index’s (VFIAX) 1.0% gain.

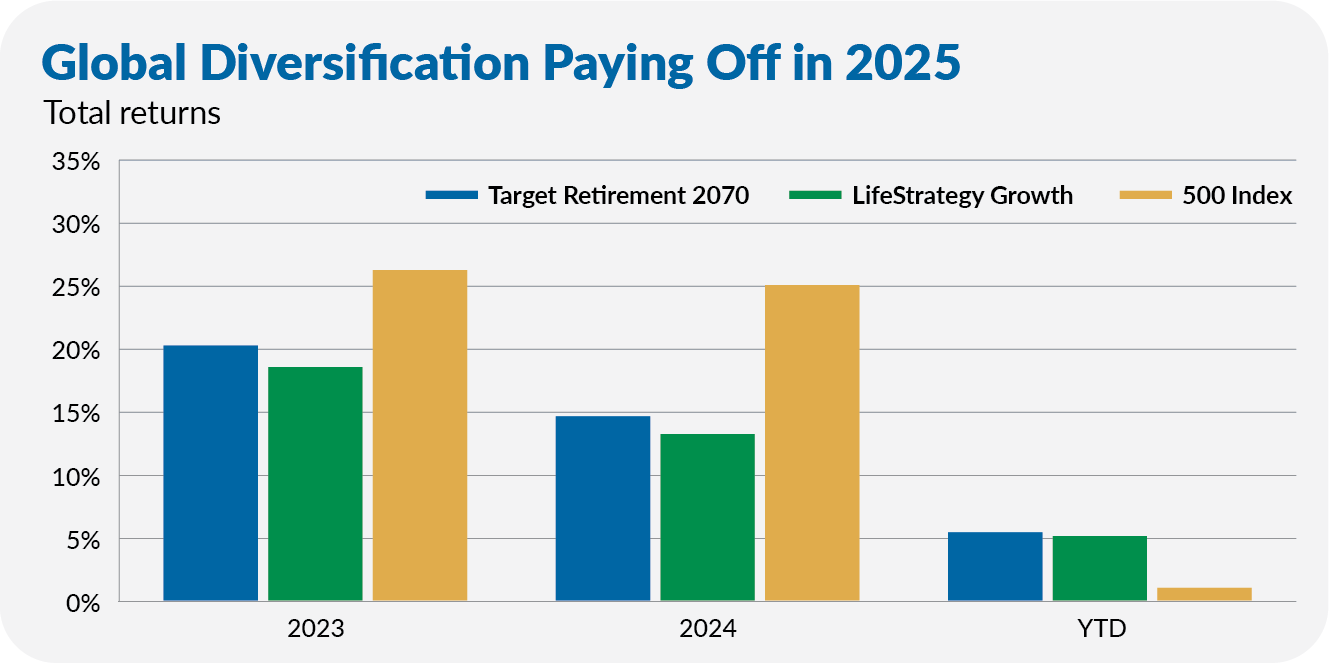

That’s welcome news to investors who watched these funds trail 500 Index by wide margins over the past two years. As the chart below shows, Target Retirement 2070 (VSVNX) returned 20.2% and 14.6% in 2023 and 2024, respectively, while LifeStrategy Growth (VASGX) gained 18.5% and 13.2% in the same periods. Solid enough absolute returns, but both funds trailed 500 Index’s 26.2% and 25.0% returns.

Granted, 500 Index isn’t an appropriate benchmark for these balanced funds. 500 Index is an all-stock portfolio, while even the “long duration” Target Retirement 2070 has 10% in bonds, and LifeStrategy Growth allocates 20% to bonds. Still, some investors look at these aggressive prebuilt portfolios and wonder if they should “just own the S&P.”

That’s the wrong question. What’s driving the Target Retirement and LifeStrategy funds’ 500 Index-beating results this year isn’t bonds, but a substantial allocation to foreign stocks. Remember, across all these funds, Vanguard allocates 40% of the stock “sleeve” to overseas investments.

Vanguard upped its standard foreign stock allocation from 30% to 40% in 2015. Until recently, that didn’t look so smart. From the end of 2015 through the end of 2024, Total International Stock Index (VTIAX) trailed 500 Index, 71% to 237%. However, with the foreign stock index fund up 13.8% this year compared to 500 Index’s 1.0% gain, well, Vanguard’s heavy investment in foreign stocks is (finally) paying off.

Like Vanguard, I advocate for owning a globally diversified portfolio. However, I haven’t been as rigid when constructing the IVA Portfolios. For most of the past decade, I have allocated approximately 15% of my stock portfolio to foreign stocks. I’ve moved aggressively (at least by IVA standards) to boost the foreign stock allocation closer to 35%—see here and here—as a new market cycle emerged.

I can’t tell you what the rules governing tariffs and trading will be next year, but I can say with confidence that the investment “rule” (really principle) of diversification remains as vital as ever.

Turning to Malvern, PA, Vanguard’s headquarters—between my last Weekly Brief and this monthly recap, Vanguard made two announcements. Here are my quick thoughts on those developments:

Quick Take: Proxy Program Expands

The fund giant added four funds to its Investor Choice proxy voting program. You can read about the program in-depth here, but here’s the short story: