Vanguard’s boycott of cryptocurrency ETFs is officially over.

When iShares and Fidelity rolled out their Bitcoin ETFs in early 2024, Vanguard took a hard line, not just declining to launch its own, but banning all crypto products from its platform.

At the time, I thought Vanguard’s stance was unnecessarily heavy-handed. After all, you can buy gold ETFs on its platform. You can trade options. You can even trade on margin. But bitcoin ETFs? Off limits.

Well, Vanguard has come around to my way of thinking. You still shouldn’t expect a Vanguard-branded bitcoin ETF anytime soon, but you can now buy competitors’ crypto ETFs in your Vanguard brokerage account.

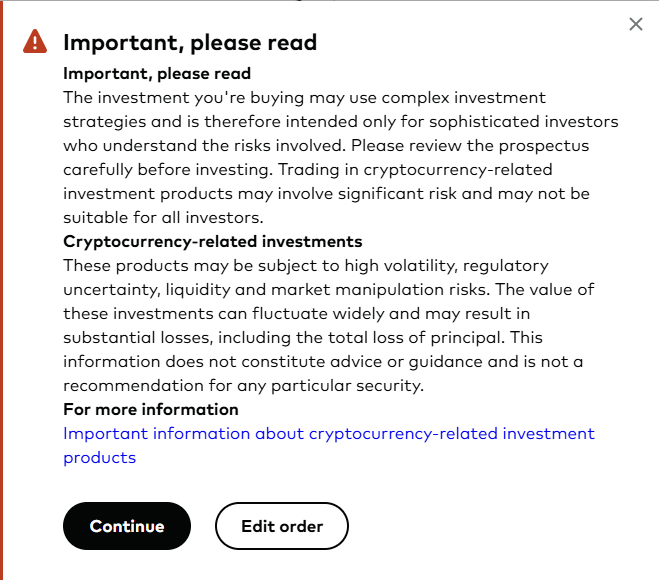

Granted, in the trade flow—before you submit your order—you have to acknowledge that what you are buying “may be subject to high volatility, regulatory uncertainty, liquidity and market manipulation risks” and “may result in substantial losses.”

Still, Vanguard reversing course is a win for access. The bigger question is: How much crypto do you actually need?