We enter the new year firmly in the grips of a bear market. I’m also officially on recession watch for 2023. And yet, I’m more optimistic about the prospects for stocks and bonds than I was 12 months ago. Yes, you read that correctly.

The short story behind my more optimistic outlook is that the conditions I was worried about a year ago have flipped 180-degrees.

As we entered 2022, inflation was rising, valuations were high, interest rates were super low (meaning bond prices were super high) and investor speculation was rampant (think, meme stocks and cryptocurrencies).

Today, inflation is falling, valuations are lower (though not low by any stretch), interest rates have more than doubled (meaning bonds look better) and investor sentiment is lousy. These are almost perfect conditions for a rebound.

OUTLOOK QUICK TAKE

- Stock market gains ground despite a recession in 2023

- Bonds find their footing after a difficult year

- Bold call: We look back at 2022 as the year foreign stocks started outperforming U.S. stocks

Read on to see how I square that outlook with recession concerns, but first, as I do every year, I want to use history to set a baseline for our expectations.

Gains Are the Default

Stocks have been the best means of growing your wealth over time—period. But, as we just experienced, stocks don’t “just go up.” In fact, history also tells us that the stock market falls apart roughly once a decade—most recently in 2000, 2008 and 2022 (the 2020 “mini bear” is an outlier). So, to earn those attractive stock market returns, you are virtually guaranteed you’ll have to endure some periods of pain.

To give a little more color (or numbers) to my broad stance on the stock market, I like looking at rolling returns—it gives me hundreds of data points to consider. That means evaluating returns from January through December periods as well as February through January and May through April, and so on.

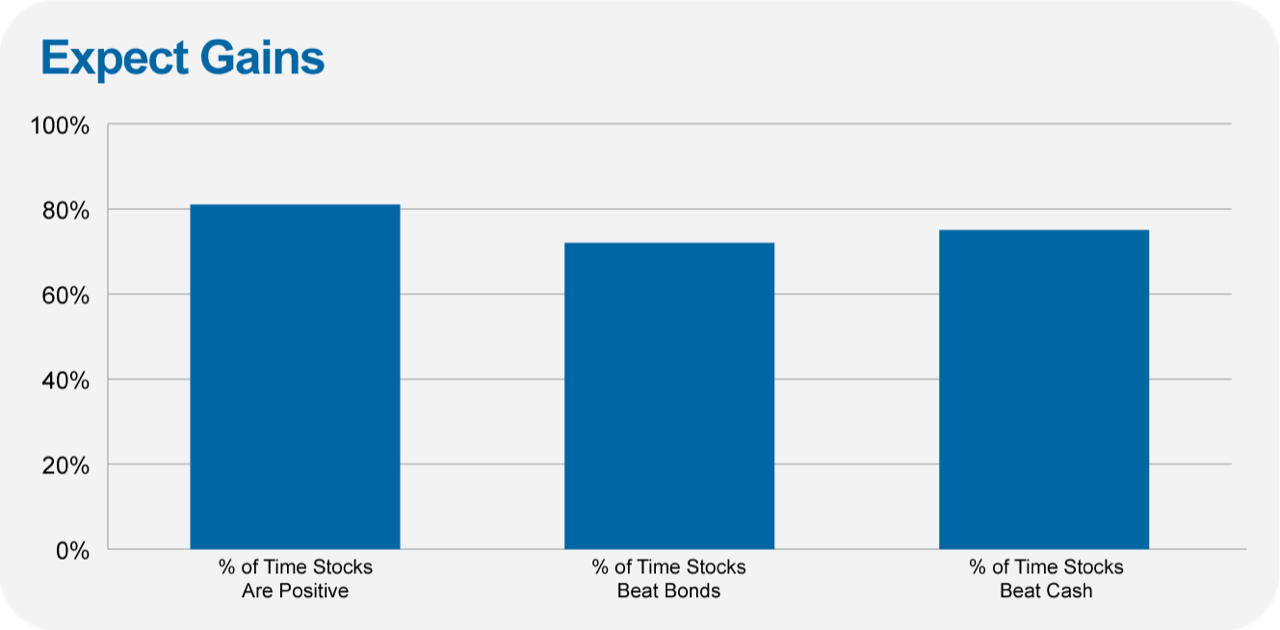

In the 46 years since its 1976 inception, 500 Index (VFIAX) has delivered positive returns in 81% of 544 rolling 12-month periods. The average 12-month return: 12.7%. Looking at the bond market, since its 1986 inception, Total Bond Market Index (VBTLX) has averaged a 5.6% return over rolling 12-month periods and was positive 87% of the time. Cash Reserves Federal Money Market (VMRXX) has averaged a 4.7% 12-month gain since its 1975 inception.

And let’s compare and contrast the performance for stocks and bonds over all of those rolling 12-month periods. 500 Index beat Total Bond Market Index (since the bond fund’s inception) 72% of the time by an average of 5.9%. Since its inception, an investment in 500 Index outperformed cash in 75% of rolling periods by an average of 8.0% per annum. Did I say stocks are the best way to grow wealth?

Cutting through all the numbers, your baseline expectations in any given year should be for gains; if I just say I expect the stock market to go up next year, I’ll be right about eight out of 10 times—which would be a better track record than most Wall Street forecasters can point to! Additionally, as I’ve shown, you should expect stocks to beat bonds, which in turn should outpace cash.

Of course, that also means you won’t avoid the bear markets. You’ll “miss” those two or three years each decade when stocks tumble and you’d have been better off hiding out in cash. It’d be great if we could anticipate those years, but I’ve yet to meet anyone that can repeatedly and reliably trade around bull and bear markets. That’s why Dan and I have a foundational belief in “time in the market, not market timing.”

The burden of proof should always be on the pessimists who call for bear markets and crashes. Yes, they’ll be right from time to time, but most of the time, and importantly over time, it is the optimists who will triumph.

Nobody Knows

There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.

― John Kenneth Galbraith

My inbox is already overflowing. Every investment firm that thinks it’s worth its salt publishes an economic and market outlook at this time of year. You can find predictions on everything from interest rates and inflation to economic growth and where the S&P 500 index will end the year. Those predictions often are carried out to two decimal places—implying a level of precision that is misleading. Even Vanguard is in the prediction business.