Keep More Money in Your Portfolio

In investing, you get what you don't pay for. Costs matter.

-Jack Bogle

If you are a Vanguard investor, then you are already picking up what Jack Bogle put down—the less you pay in fees, the more you keep in your portfolio.

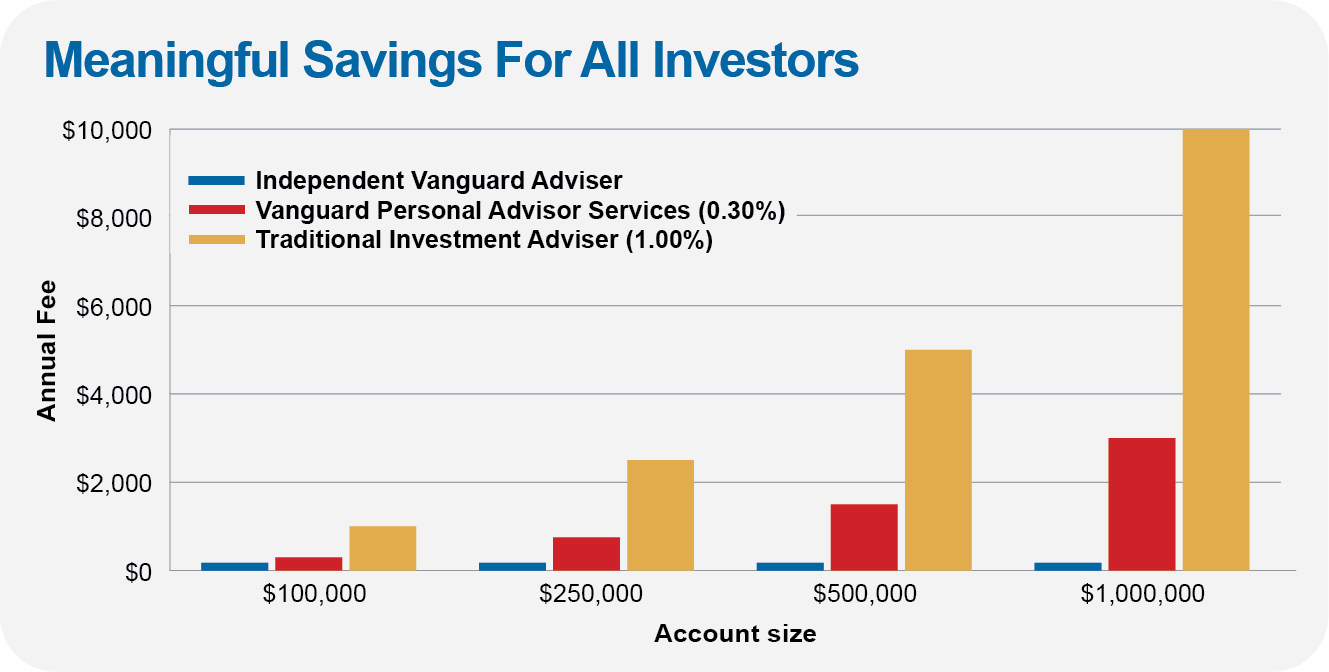

And while the fee war has largely played out among index funds and ETFs—heck, Fidelity offers no-fee index funds!—the shots have barely been fired among investment advisers. Traditional “human” advisers typically charge around 1% of your portfolio each year in fees. The more recent entrance to the advice battlefield—so-called robo-advisers—charge a good bit less. Vanguard’s Personal Advisor Services (PAS) charges 0.30%.

But what if there was an even better deal available?

At The Independent Vanguard Adviser, we provide institutional-quality investment portfolios and education … for just $175 per year—no matter how much money you have to invest.

If you’re investing even $100,000 with PAS, you’re still paying $300 per year—or nearly double the $175 annual fee to become a Premium Member of The Independent Vanguard Adviser. And, as your portfolio swells, the cost savings from utilizing The Independent Vanguard Adviser as a guide grows and grows.

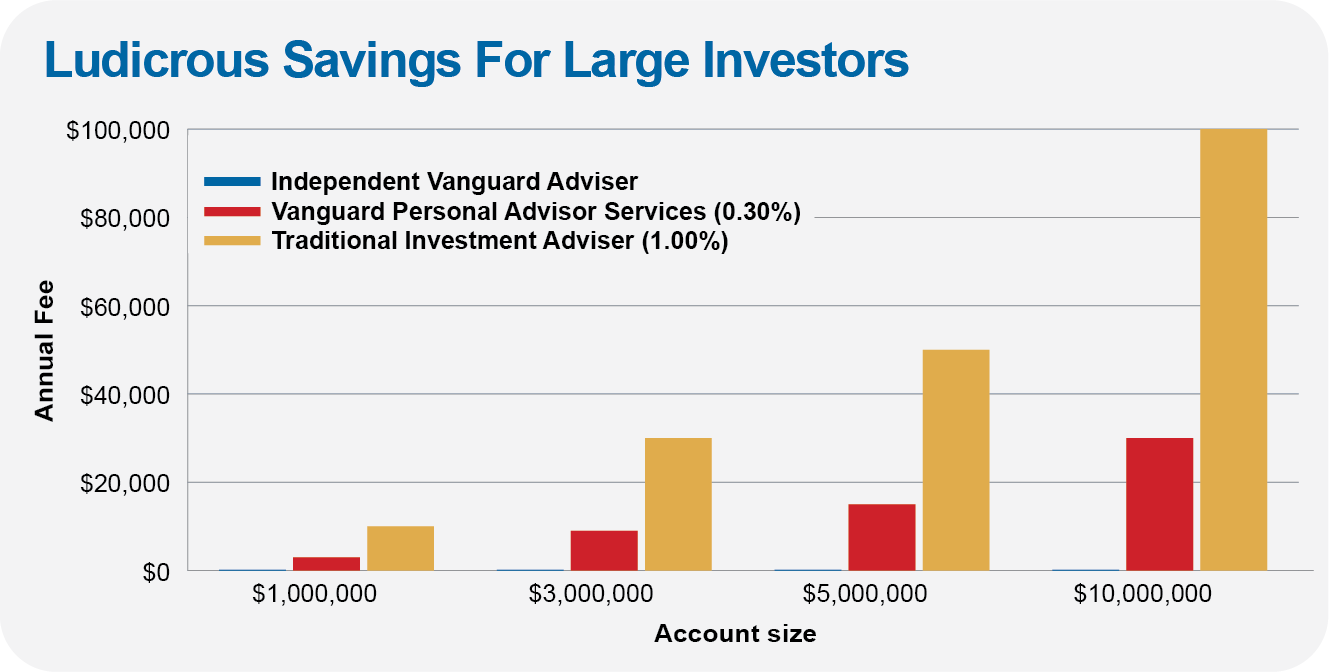

And the numbers just get silly if you are fortunate enough to have a multi-million-dollar portfolio. We’re talking savings of thousands and tens of thousands of dollars a year. That’s Bogle kind of money that you get to keep in your portfolio—compounding your wealth, not your adviser’s!

There are plenty of good reasons to partner with an advisor. As Warren Buffett said,

Price is what you pay, value is what you get.

And, frankly, a lot of investment newsletters aren’t worth the paper (or pixels) they are written on.

But by playing a different game and refusing to make false promises, we earned a reputation for providing real advice that real investors can rely on. Of the hundreds of financial newsletters that clog inboxes and mailboxes with pitches every year, few end up in the pages of The New York Times as a cost-effective solution for retirees. We did.

We’re operating under a new name—The Independent Vanguard Adviser—but continue to provide the same investment advice we’d want our family and friends to have, in a language they can understand … and at a price that even Jack Bogle would approve of!