Executive Summary: Vanguard’s life-cycle funds offer low-cost simplicity, but one-size-fits-all investing has real limits. Relying on age alone to shape your portfolio is not a good way to plan your financial future. In this article, I break down how these funds work—and why a little customization can go a long way toward achieving better results.

Diversification is (finally) having its day.

For years, diversification felt like swimming with a 5-pound weight on each leg. 500 Index (VFIAX) kept racing ahead, and investors in Vanguard’s off-the-shelf, life-cycle funds—the Target Retirement and LifeStrategy funds—were left to wonder if a diversified strategy was simply broken.

This year, the narrative has flipped. So far (through June 6), Vanguard’s allocation funds—staples in many 401(k) plans—are up between 3.0% and 7.0%. Those aren’t eye-popping gains, but they are certainly outpacing 500 Index’s 2.6% gain.

What’s changed? Not the funds. They’re doing exactly what they were designed to do: Deliver low-cost, globally diversified investment exposure at varying risk levels.

The problem wasn’t the portfolios—it was the comparison.

Stacking a diversified, multi-asset fund up against an all-U.S.-stock index fund was always bound to mislead. It’s apples to oranges. 500 Index was a rocket ship, yes—but not a realistic benchmark for a portfolio with bonds and international stocks in the mix.

Still, I understand that escaping the gravitational pull of 500 Index is challenging. But 2025 is a timely reminder that diversification may be boring—and occasionally disappointing—but it’s not broken. It’s built for the long haul, not just the latest market rally.

Vanguard’s Target Retirement and LifeStrategy funds offer a lot to like: For the low cost of 0.08%–0.14% per year, you get a professionally managed, broadly diversified, transparent and simple portfolio. That’s a compelling package—and you could do a lot worse than investing here and never looking back.

But here’s the catch: In my view, choosing a portfolio based on a single variable—your age—doesn’t pass the test.

So, let’s take a closer look under the hood of these prebuilt portfolios. By the end, you’ll have the context and clarity you need to decide whether a one-size-fits-all fund really fits your needs and objectives.

Key Points:

- LifeStrategy funds have fixed allocations to stocks and bonds, while Target Retirement funds shift allocations over time.

- The funds are low-cost, diversified and straightforward.

- Buying a life-cycle fund based solely on your age could be a big mistake.

Life-Cycle 101

The basic premise (and promise) of a life-cycle fund is that with one purchase, an investor gets a broadly diversified portfolio that can be held forever—at least, the mutual fund companies offering these funds, and there are many besides Vanguard, hope you’ll own it forever.

One decision, and the investor is done for life. Can it get any easier?

Probably not. But it’s not as simple as the fund companies would have you believe.

By my count, Vanguard offers 16 different life-cycle mutual funds—twelve Target Retirement and four LifeStrategy funds—all of which are funds of funds, meaning their portfolios are built of other funds rather than individual stocks and bonds.

What separates the LifeStrategy and Target Retirement funds is how their portfolios adjust—or don’t—over time.

Staying the Static Course

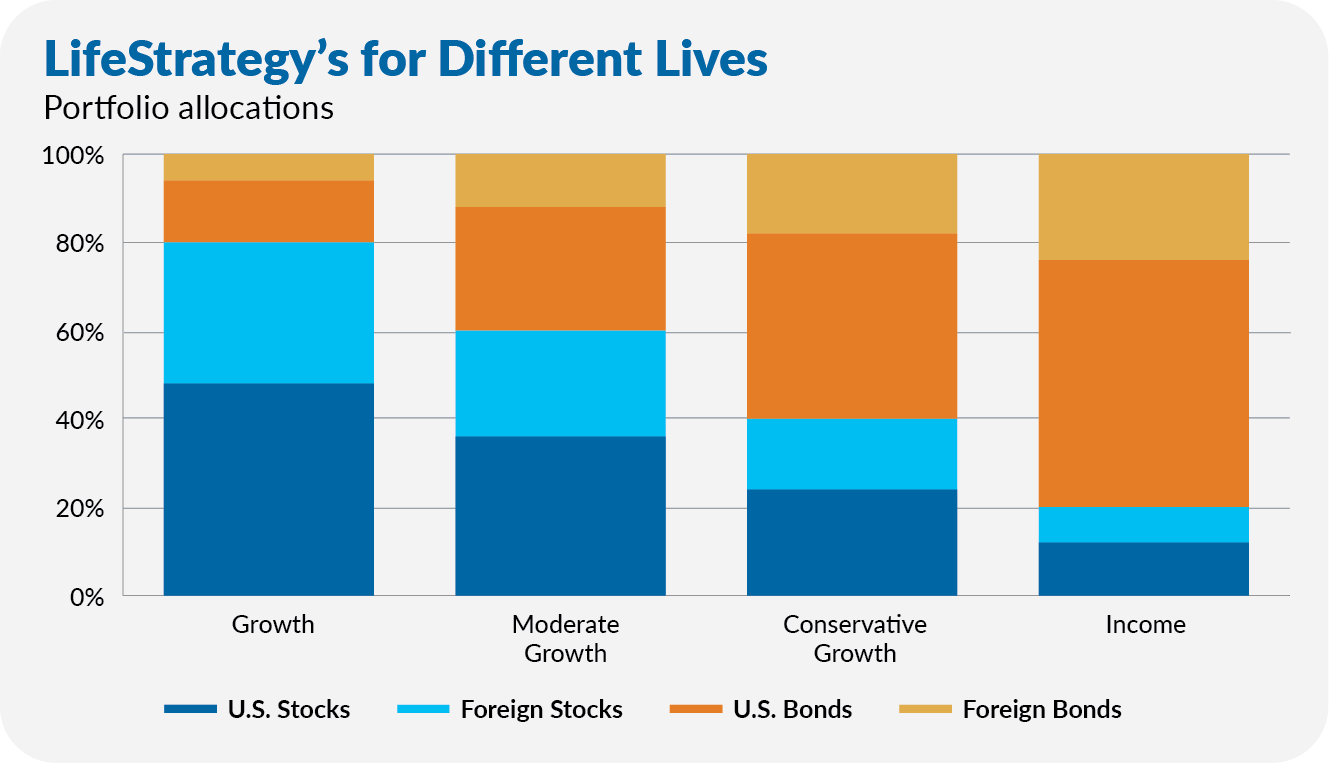

Start with the simpler of the two: The four LifeStrategy funds follow a static allocation. That means their mix of stocks, bonds and cash stays constant. If the fund’s mandate is 50% in stocks, 40% in bonds and 10% in cash, that’s exactly what it holds—day in, day out.

As investors add or withdraw money, Vanguard’s team rebalances to maintain those target weights. No glidepath (which I’ll talk about in a minute), no shifting allocations—just a steady, consistent allocation mix. (Though, as I’ll explain in a moment, Vanguard has changed these portfolios from time to time, so the definition of “static” is, well, loose.)

The chart below shows the static allocations of the four LifeStrategy funds.

You could say that many of Vanguard’s balanced funds, such as Balanced Index (VBIAX) or Target Retirement Income (VTINX), are also static allocators. I’ll take a broader look at Vanguard’s balanced lineup in a future Funds Focus article. (Vanguard also offers static allocation funds of funds in its 529 plans, but that’s a different discussion—one I last tackled here and here.)

A static allocation fund can be a good fit for investors who know exactly how much risk they’re willing to accept for the returns they’re aiming for. Once you pick your mix, that’s it—you’ll always know your exposure to stocks, bonds, and cash. That consistency can make it easier to stay the course, assuming you’ve set the proper course to begin with.

Time-Shifting Portfolios

Unlike the static LifeStrategy options, 11 of Vanguard’s 12 Target Retirement funds are what’s known as target maturity or target-date funds. (Target Retirement Income, as I noted above, is the exception.)

Target maturity funds are built for retirement savers of all ages. The concept, at its simplest, is that you invest in the fund closest to your expected retirement year. Then you sit back and let Vanguard do the work of slowly reducing stock exposure and increasing your investment in bonds and cash as you approach and enter retirement. It’s a hands-off approach to dialing down risk (and, of course, reducing potential returns) over time.

This gradual shift from stocks toward bonds and cash is what’s known as a glide path.

You can see Vanguard’s glide path in the chart below. (Note that while I list it as cash, technically Vanguard uses Short-Term Inflation-Protected Securities Index (VTAPX) in place of a money market fund.)

As the chart shows, the glide path ”lands” once an investor turns 75. At this point, the Target Retirement fund’s allocation has converged with that of Target Retirement Income—30% stocks, 53% bonds and 17% cash. Vanguard eventually merges the two funds, turning your target maturity fund into a static allocation fund.

As Vanguard merges one fund away, they launch the “next” fund in the series. Note: Not every fund company follows the same glide path. If your 401(k) offers target-date funds run by T. Rowe Price or Fidelity (two of the biggest target fund providers) or someone else, you should pop the hood on the portfolios to see just how much they are allocating to stocks versus bonds and cash.

Keep in mind: Target funds are designed to be held for life—while you’re working and then through retirement. This is why someone at 65 still has about half of their portfolio invested in stocks. That might feel aggressive to some near-retirees, but Vanguard assumes you’ll keep the fund for decades to come.

And that’s the rub. The fundamental flaw with target-date funds is that they treat every investor the same, as if age alone should determine your investment portfolio. More on that in a minute.

Retirement or Lifetime Income?

If you were looking for a single answer from Vanguard on how to generate income for life, well, sorry to disappoint you; there isn’t one.

Target Retirement Income (VTINX) and LifeStrategy Income (VASIX) both aim to deliver income for life (or at least the life of a retiree), but their allocations don’t line up. LifeStrategy Income puts 20% of a retiree’s assets in stocks, while Target Retirement Income allocates 30%. The target-date fund also includes Short-Term Inflation-Protected Securities Index; the other doesn’t, holding only bond funds instead.

Which is the better fund for income?