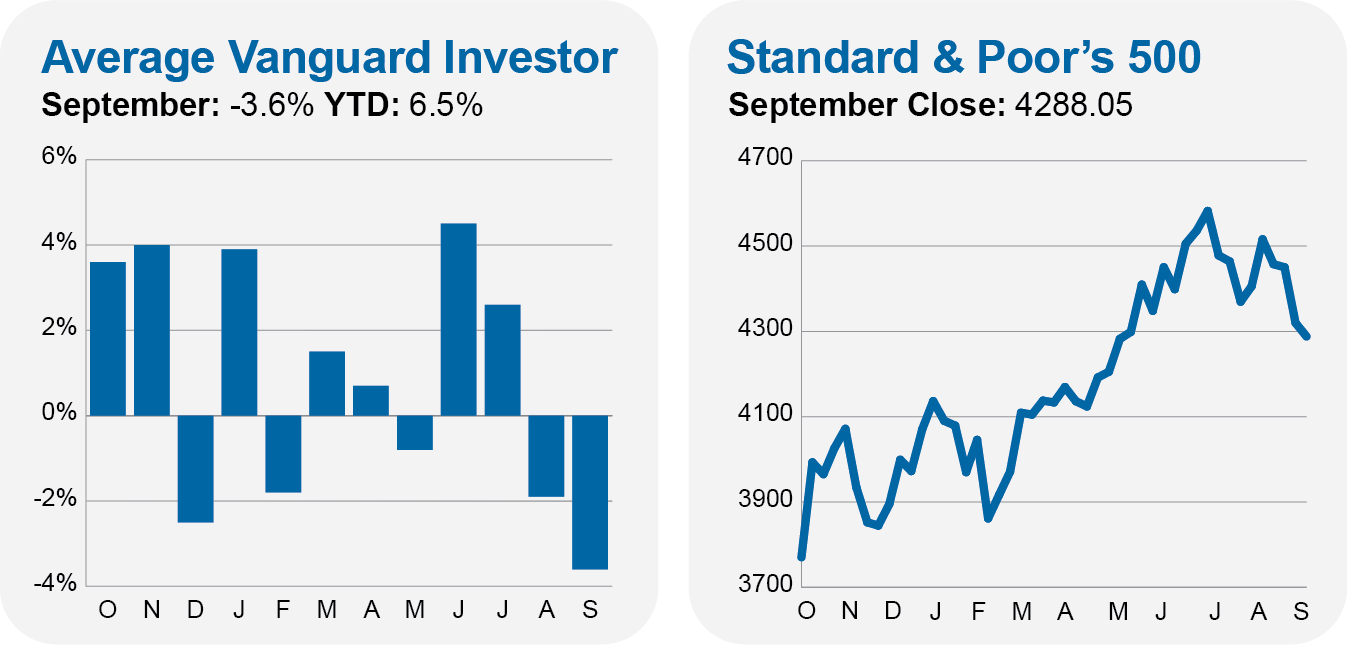

September lived up to its reputation as the worst month of the year for stocks. And bonds didn’t fare too well, either.

500 Index (VFIAX) fell 4.8%, and SmallCap Index (VSMAX) did even worse, declining 5.6%. Foreign stocks also fell, but not as much as U.S. stocks—Total International Stock Index (VTIAX) dropped 3.3%.

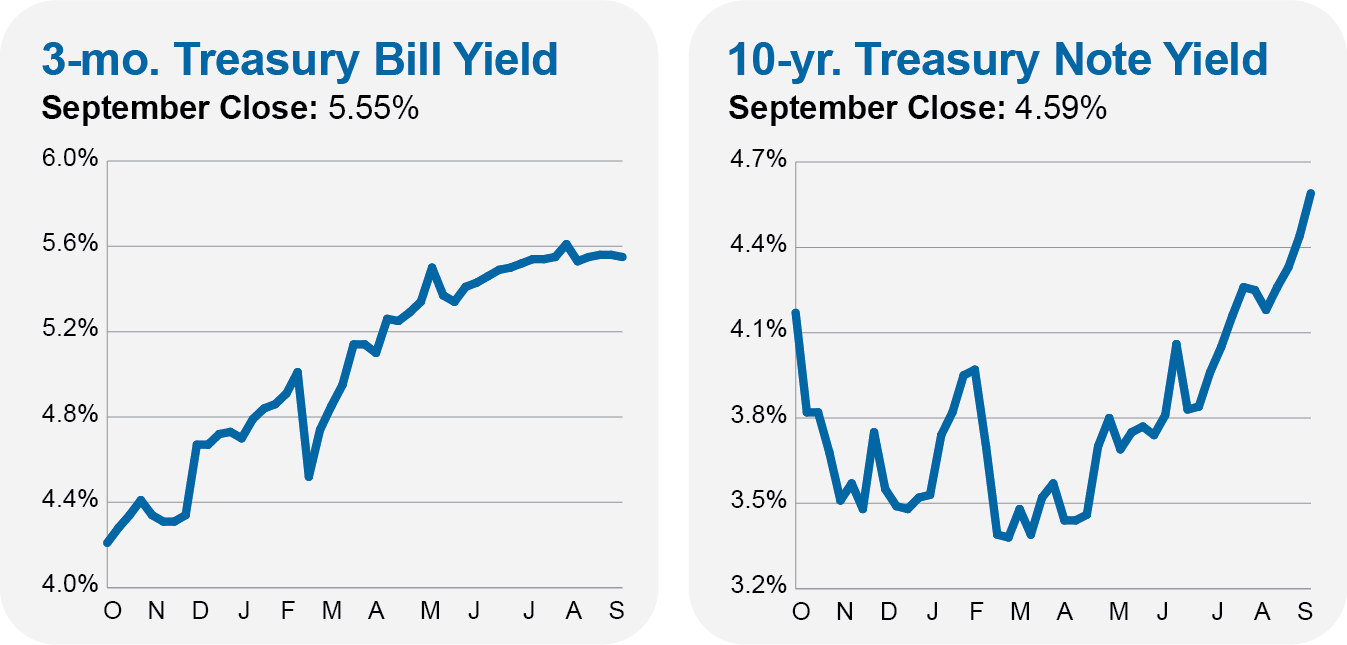

Fixed-income investors can’t seem to catch a break—though, higher yields will eventually redound to their benefit. Total Bond Market Index (VBTLX) fell 2.5% in September and is now down 0.9% on the year. It’s certainly possible the flagship bond index fund will notch its third consecutive negative calendar year—a record for the fund since its 1986 inception.

I’m sure you are tired of hearing me say it, but I’ll repeat myself anyway: you have to give bonds time to recover from the rough run over the past two years now. (Yes, I know—for some investors, that is a long time!) Remember that bonds were in an almost straight-up bull market for nearly four decades.

For most of that bull market, bond investors got to have their cake and eat it, too, as they earned a decent amount of income and saw their bonds rise in price more often than not. While the road directly behind us has been more challenging, that doesn’t mean bonds no longer have a place in a balanced portfolio.

Yes, with the benefit of hindsight, we know that the time to go to cash was two years ago, even if money markets were yielding just 0.01% in September 2021. But that’s in the past.

Our mission today is to ensure our portfolios are built for the road ahead. The hitch is that we don’t know precisely what the road ahead will bring—our windshield is covered in frost. My solution is to own a portfolio that can do reasonably well in multiple scenarios.

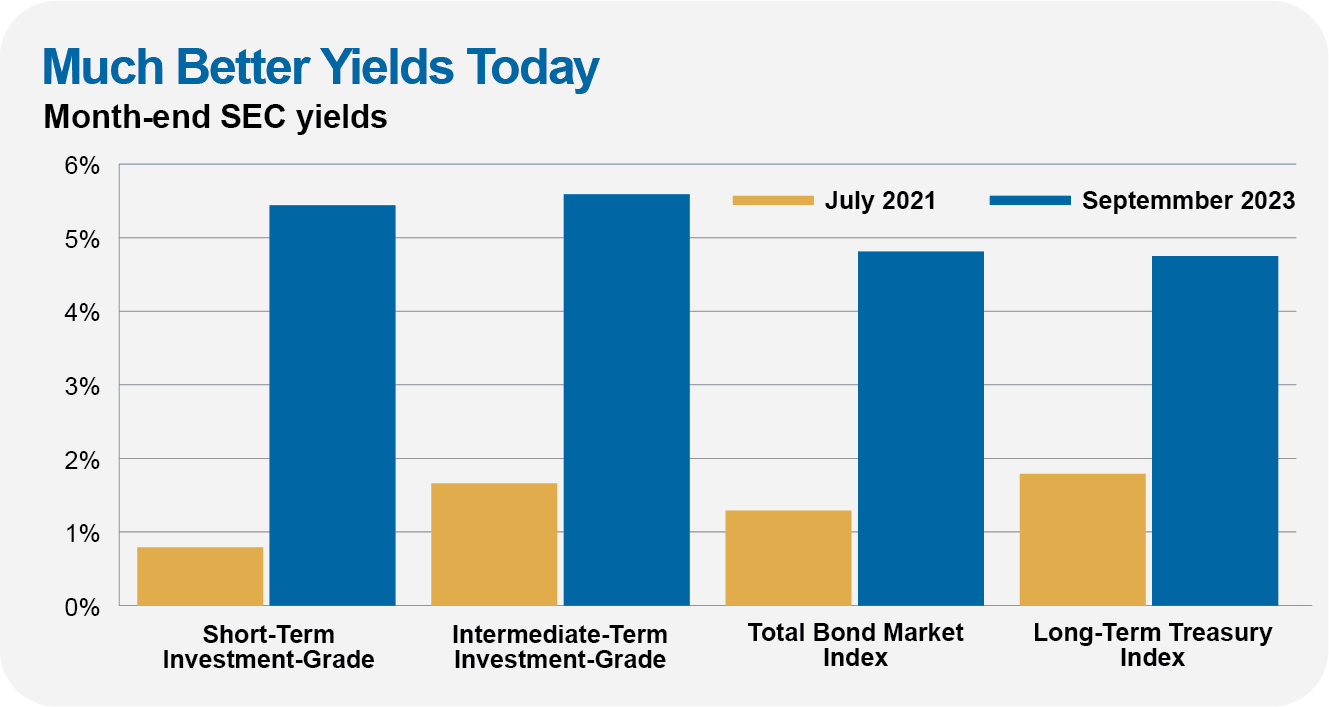

Remember, today’s bond fund yields strongly predict a fund’s return in the years ahead. As bond yields have risen (and prices have fallen) over the past 26 months, the outlook for the fixed-income markets has materially improved.