Welcome to part three of my cash management series. If you are just joining us or want to revisit one of the topics I’ve covered, here are the prior two installments:

- Van-guarding Your Cash: My take on Vanguard’s money market funds and new cash sweep programs.

- When Cash Isn’t Cash: My analysis of Vanguard’s cash options for annuity holders and 529 plan investors.

Today, I want to provide a framework for building your personal cash management program. The critical question is whether you feel you need every dollar to always be a dollar—or is some price volatility okay?

To be clear, I consider managing your cash to be different and distinct from managing a long-term investment portfolio. Speaking personally, cash management is the foundation of my financial life; it’s where money flows in and out of my accounts (for the most part). I’m not looking to grow my assets here—rather, my priorities are stability and simplicity.

I also don’t want to be constantly changing my cash management setup. I want to find something that works for me and allows me to be hands-off. I have better things to do than to worry about maximizing returns on every penny in my cash account.

It’s my investment portfolio where my philosophy of spending time in the market and working to compound my wealth comes into play. In fact, the next installment of this series will explore whether cash has a role to play in an investment portfolio, or not.

But that’s to come. Today, let’s talk about cash management by starting out with how, after years and years in this business, I’ve come to manage my own spending and short-term savings. I like to think that this is a good proxy for how most investors and savers should manage their cash and spending needs.

Three Needs

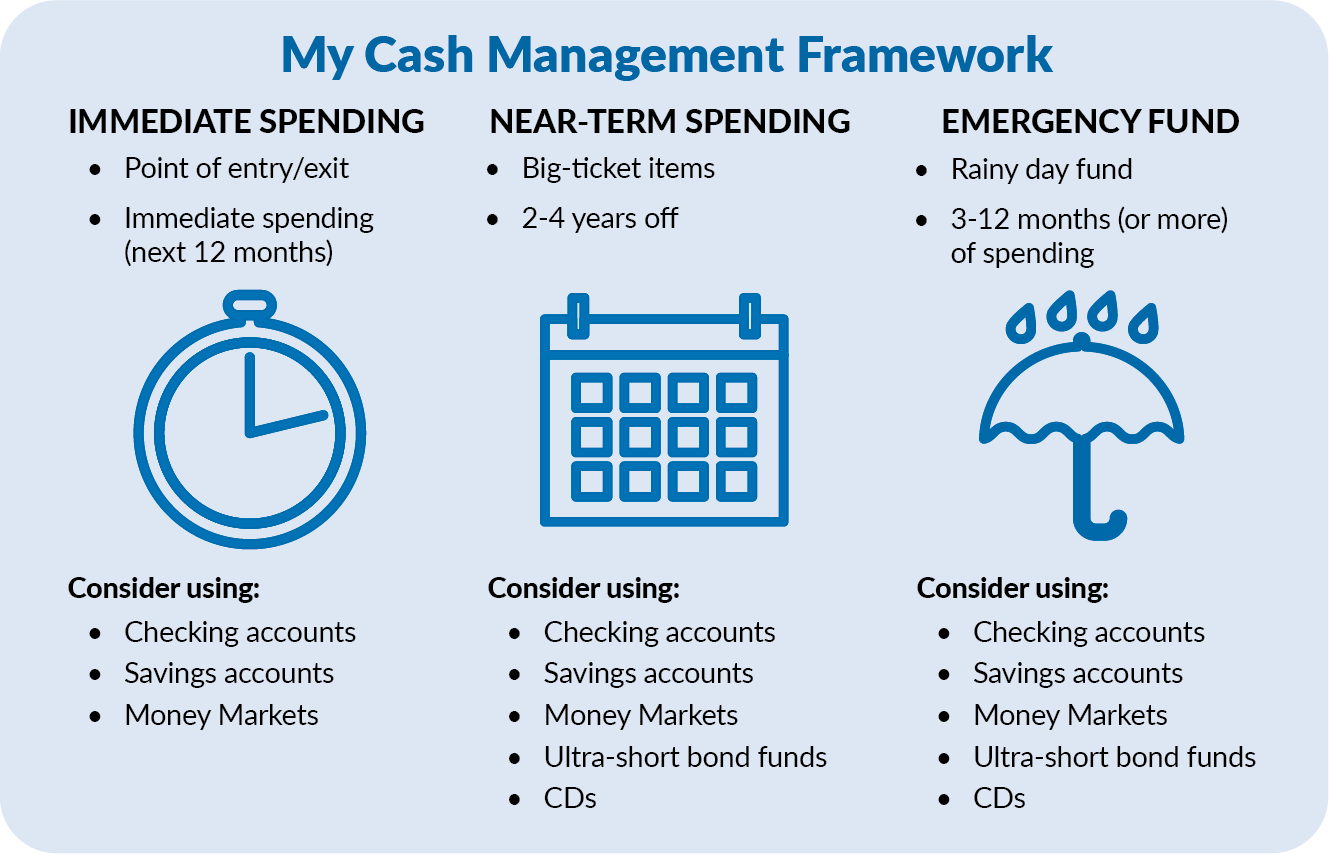

I think of cash management as accommodating three needs.

The first need is immediate spending—think groceries, transportation, medicine, rent, a trip to the zoo. This is the money I spend on a day-to-day basis, which I keep in my bank checking account. Okay. Technically, I put as many purchases on a credit card as possible, but when I pay those balances off in full each month, that money is drawn from my checking account.

The checking account also serves as the “pass-through” or the point of entry and exit where money flows into and out of “the bank of Jeff,” for the most part. (I qualified that statement because some cash bypasses my checking account and goes directly from my paycheck into a retirement account.)

The second cash need is for big-ticket items I can see coming down the road but are maybe two or three years off. Some examples would be a college tuition payment, a vacation, a new kitchen or even a down payment on a home.

The third cash bucket is what I need for my emergency fund because life happens—for example, a section of the cornice on my apartment building fell off during a recent storm. (No one was hurt.) It’s going to cost a pretty penny to fix it.

Having an emergency fund buffers my investment portfolio from all those speedbumps and falling cornices. I don’t plan to spend that money tomorrow, but it needs to be there when I need it.

The textbooks would tell you to have all three of these tiers “invested” in absolutely safe accounts where you put a dollar in and know that you can take a dollar out—think checking and savings accounts or money market funds.

I don’t think there’s anything horribly wrong with sticking your emergency cash in a savings account or money market fund. As I said, cash management isn’t about growing wealth. I like to say it’s more about a return of my capital than a return on my capital.

That said, I disagree with the textbooks on a couple of points!

Let me explain why. Then, I'll tell you how specifically I’m approaching cash management today.