Executive Summary: Our Average Vanguard Investor Index (AVII) tracks how real investors with trillions of dollars invested at Vanguard are allocated and what they’re earning. It’s a valuable tool for setting expectations, measuring performance and keeping your portfolio grounded in reality, not headlines or hype.

Chances are, you think you're above average. Most of us do.

But what does “average” actually mean?

If you go by the headlines, you’d think the S&P 500 index is the benchmark to beat. However, the truth is that very few people invest solely in 500 Index (VFIAX) or own only stocks.

Back in 1997, my mentor Dan posed a better question:

Sure, you can measure your performance against the S&P 500. But that's just one, large-cap, U.S. stock index. It doesn't take into account the fact that many investors own portfolios that include small stocks, bonds, cash, and the like … So, what's a good yardstick for measuring your performance?

Dan set out to find that better yardstick—and created the Average Vanguard Investor Index, or AVII. When I relaunched this newsletter in October 2022, I carried the work forward.

Key Points

- Vanguard investors are more stock-heavy today than ever before.

- The average Vanguard investor has earned 7.6% annually since 1990.

- The IVA Portfolios have outperformed the average investor.

What Is the AVII?

The AVII is a meaningful benchmark for real-world investors. It captures the actual experience of (nearly) every dollar invested across all of Vanguard’s mutual funds and ETFs by individual investors. To zero in on “individual investors,” I count the more than $7 trillion held in Vanguard’s Investor, Admiral and ETF share classes as well as the Annuity portfolios (now owned by Transamerica).

Funds with more assets carry more weight in the index, as more investor dollars are riding on them. Smaller funds still matter, just less.

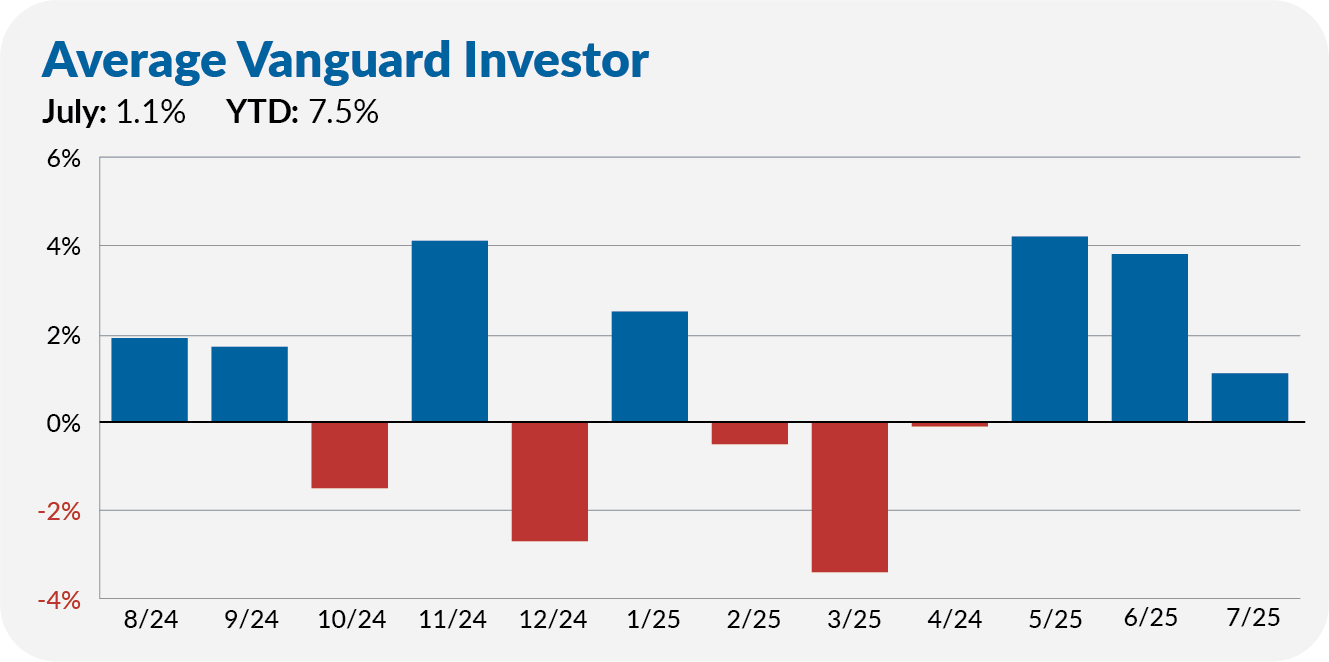

Each month, I publish the AVII in the Monthly Recap, providing a single number that shows how the average Vanguard investor performed during the month as well as for the year to date. A bar graph tracks monthly returns over the past 12 months for added context.

Recently, a few of you have asked about the AVII—not just what it is, but also how to use it.

The short story is that the AVII provides a useful lens for putting markets and headlines into perspective. If you really want to know how you stack up, don’t compare yourself to 500 Index or Total Stock Market Index (VTSAX). Compare yourself to your peers, or the Average Vanguard Investor.

Let’s take a closer look.

What Vanguard Investors Actually Own

Before diving into performance, let’s take a step back and examine how Vanguard investors really invest.

In other words: How much have Vanguard investors put into each fund? How much is in stock funds versus bond funds? What share is in balanced strategies or money market funds?