Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, February 1st.

There are no changes recommended for any of our Portfolios.

Both stock and bond markets got off on the right foot this year. Total World Stock Index (VTWAX) gained a tidy 7.5% in January while Total Bond Market Index (VBTLX) returned 3.2%—the bond index fund’s sixth best month since its 1986 inception.

I’m on the record saying I expect positive returns from stocks and bonds this year, so I’ve got a nice head start. But it’s just one step in a long investment journey. And despite what some commentators would have you believe, how the market performs in January, tells us absolutely nothing about how the rest of the year will fare.

The Federal Reserve (Fed) met today and increased the federal funds rate by 0.25%. Their target range is now 4.50% to 4.75%. This time last year, the Fed’s target range was 0.00% to 0.25%, so, we’ve come a long way in less than 12 months. With inflation trending lower the past several months, it’s no surprise that the Fed is easing of the brake pedal.

An interest rate hike is a hike—and is designed to cool the economy—but directionally, the Fed isn’t pushing as hard to lower inflation as it was last year. Traders are taking that as good news.

We’re in the middle of earnings reporting season and so far, fewer companies than usual are beating Wall Street’s expectations. What’s notable though is that companies that “missed” estimates are not being punished. According to FactSet (via The Wall Street Journal), stocks of companies that fall short of expectations typically decline about 2% in price in the few days leading up to and after they announce earnings. Well, this quarter, those companies are seeing their stock prices rise 0.1% on average.

As I said last week, earnings aren’t easy to trade around.

A New Role

Yesterday, Vanguard announced that Sam Martinez had stepped away from his portfolio management duties at the firm. Martinez was a co-manager on a number of Vanguard funds: Ultra-Short-Term Bond (VUBFX), the Investment-Grade funds, Core Bond (VCOBX) and Global Credit Bond (VGCIX).

Martinez isn’t leaving Vanguard though; he’s moving over to lead the firm’s Fixed Income Index and ETF team within Vanguard’s Portfolio Review Department. Where does he fit in relation to Joshua Barrickman, the head of Fixed Income Indexing—Americas and the portfolio manager of most of Vanguard’s bond index funds including Total Bond Market Index? I’m not sure. Though it sounds like Martinez’s role is more “strategic” than about the day-to-day management of the funds.

When it comes to the funds Martinez is leaving, I’m not worried by his departure. Vanguard’s bond effort has always been more about the team than a “star manager.” Plus, Vanguard’s edge is driven by low costs and avoiding blow-ups—it’s not about making big interest rate or credit calls. Of course, who is running your fund is important, but there are some structural advantages at play here.

Out of the Oven

In other news out Malvern, after running Multi-Sector Income (VMSIX) behind lock-and-key for 15 months or so, Vanguard opened the new fund to all comers last week. I think this fund will serve shareholders well over time, but am not sure now is the time to pile in. Premium Members can read my Quick Take on the fund here and a deeper dive into the fund and its siblings Core Bond (VCORX) and Core-Plus Bond (VCPIX) here.

Proxy Test Flight

This morning Vanguard announced a pilot program testing out a system that gives mutual fund shareholders more control when it comes to voting the proxy statements from the companies that are held by their funds. Premium Members can read my Quick Take on the new program here.

Our Portfolios

Our Portfolios delivered solid absolute but lagging relative returns in January. Two of our better performing holdings last year, Dividend Growth (VDIGX) and Health Care ETF (VHT), haven’t kept pace with the market’s quick start to the year. Though, last year’s laggard, International Growth (VWIGX) is pulling its weight again—gaining 12.6% in January.

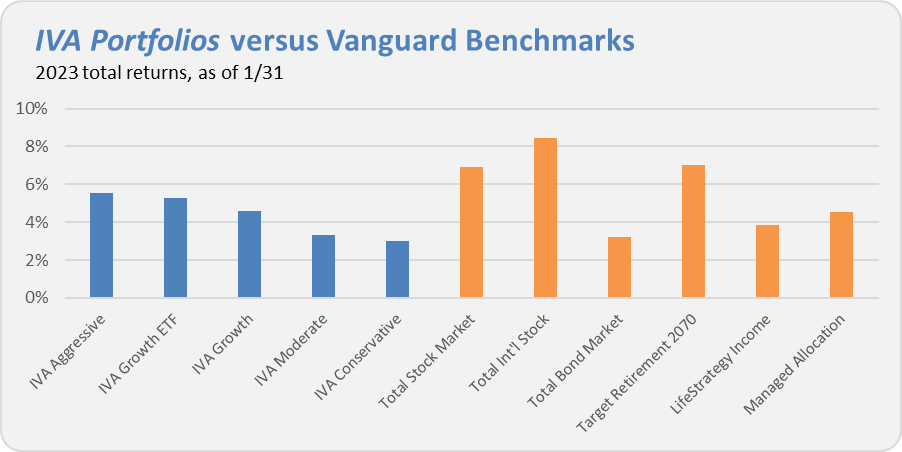

In the first month of the year, the Aggressive Portfolio gained 5.5%, the Growth ETF Portfolio returned 5.3%, the Growth Portfolio advanced 4.6%, the Moderate Portfolio returned 3.3% and finally the Conservative Portfolio gained 3.0%. This compares to a 6.9% return for Total Stock Market Index (VTSAX), an 8.4% gain for Total International Stock Index (VTIAX), and a 3.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), returned 7.0% in January and its most conservative, LifeStrategy Income (VASIX), gained 3.8%. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) gained 4.5% in January.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.