Hello and welcome. This is Jeff DeMaso with the very first IVA Weekly Brief. Today is Wednesday, October 5th.

First of all, I want to thank each and every one of you for joining Dan and me on the next step in our decades-long attempt to cover all things Vanguard for the sole purpose of helping independent investors like you, and us, find great success with our money.

The Independent Vanguard Adviser is entirely of our own making, and we are very excited about the path ahead. The support we’ve received from you is humbling and encourages us to keep going.

This Weekly Brief is free to any and all investors, and you can expect to receive it on Wednesdays. If you are interested in more in-depth stories, Portfolios you can follow, fund ratings and more, we offer a Premium Membership with a free, 30-day trial. Whichever you choose, I’m thrilled you are here.

So, without further ado, let’s get started, or better yet, let’s keep going.

September was a no-good month for investors whether you owned bonds or stocks. The S&P 500 index posted its 3rd worst September in six-and-a-half decades. The bond market … well, bonds continue to take a beating–though there’s a silver lining there of finally earning a decent level of income.

By contrast, October got off to a cracking start with the S&P index gaining more than 2% on each of the two days. Today, as I write this stocks are trending the other way.

What this volatility tells me is that we are firmly in a bear market. During bear markets, stocks tend to move much more—both up and down—on any given day than in bull markets. In fact, the worst and best days in the stock market tend to happen during bear markets.

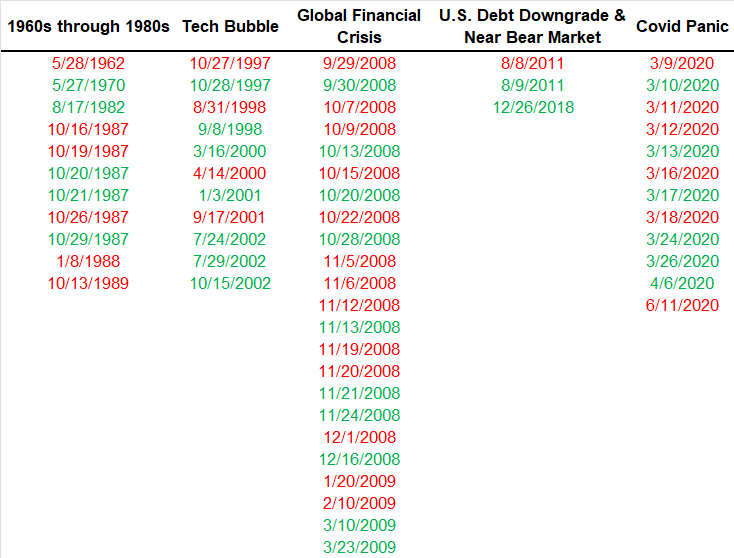

Check out this table that Dan put together showing the groupings of the best and worst days for stocks. The best days are in green and the worst days are in red. As you can see, most of the biggest moves happened during the bursting of the tech bubble (2002-2009), the Global Financial Crisis (2008-2009) and the COVID panic (March 2020). You also had a bunch of big days in October 1987 when traders were reeling from the biggest one day drop on record—October 19 (or Black Monday), when stocks fell 20% or so in a single day.

The 30 Best and Worst Days

There’s some logic to the best and worst days coming during bear markets: When stocks are down a lot, trader and investor emotions are on edge. When emotions are running high, the market is set up for big swings day-to-day.

For example, in one investor survey taken over each of the past two weeks, six out of 10 respondents were bearish on stocks. That’s an extreme reading that has only been hit a few times over the last three decades. Extreme bearishness, in my book, is bullish.

And look what happened. As October opened, 500 Index (VFIAX) gained 5.7% in two days.

Of course, that’s just two days and I’m certainly not ringing the “all clear” bell. Was Friday “the low” in this bear market? I kind of doubt it, but frankly that’s a guess. Nobody knows in real time when one bear market ends, and the next bull market begins. So, don’t play that guessing game.

Dan and I will have more on this topic in the coming weeks and months. For now, let’s get to our Portfolios.

In the old days, which I’ve taken to calling version 1.0, this is where I would quote the performance of our Model Portfolios.

As we transition to our new service, the Portfolios have been given a reboot. We changed the names to make things more intuitive (I hope) and introduced a more conservative option. If you were following one of our prior Model Portfolios, you shouldn’t have to make any changes today.

In terms of discussing performance, I’ll link up performance between our old Model Portfolios and their like-for-like new ones. Starting in the new year, I’ll just report on the new Portfolios. (The specific recommendations of our Portfolios are only available to Premium Members.)

With that said, our Portfolios are down this year, but are showing okay relative returns. Through Tuesday, the Aggressive Portfolio was down 19.2%, the Growth Index Portfolio had declined 20.8%, the Growth Portfolio was off 17.7%, and finally the Moderate Portfolio had declined 15.0%. This compares to a 20.4% drop for Total Stock Market Index (VTSAX), a 22.6% decline for Total International Stock Index (VTIAX), and a 13.7% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065 (VLXVX), is down 20.4% for the year and its most conservative, LifeStrategy Income (VASIX), is off 13.9% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 12.7%.

Until next week this is Jeff DeMaso wishing you a safe, sound and prosperous investment future. Thanks for being part of our journey.