Executive Summary: PRIMECAP’s 2025 rebound underscores why disciplined, long-term investing still works. After years of lagging, the managers’ patience, fundamental research and independent thinking are paying off. The comeback doesn’t erase past challenges, but it reinforces the case for sticking with a proven team.

A year ago, I asked if PRIMECAP (VPMCX) at 40 had “lost its edge.” My answer was a simple “no”—I was holding the line and standing by the fund and its managers.

If 2025 is any indication, my conviction was well placed. PRIMECAP has rediscovered its edge, outpacing 500 Index (VFIAX) 23.6% to 17.5% through October. And it wasn’t a one-off: all five other PRIMECAP Management-run funds, both Vanguard’s and the private-labelled Odyssey funds, topped the index fund as well, with gains of 21.4% to 28.0%.

Not surprisingly, the “What’s wrong with PRIMECAP?” emails have dried up. Because many of you own at least one PRIMECAP-led fund—PRIMECAP Odyssey Aggressive Growth (POAGX) remains my largest holding—let’s take a closer look at what’s behind the rebound.

A Track Record Built Over 40 Years

I usually avoid leading my fund analysis with performance, but in this case, it’s necessary context. PRIMECAP Management has been one of the industry’s standout firms for four decades.

A few numbers make the case.

Since November 1984, PRIMECAP (VPMCX) has outperformed 500 Index (VFIAX) by nearly two percentage points annually—13.8% versus 11.9%. That may not sound like much, but let’s put it into action.

A $1,000 investment in PRIMECAP would have grown to $200,051 over the past four decades. That same $1,000 invested in 500 Index would be worth $99,790—roughly half as much.

As Vanguard founder Jack Bogle once wrote, “seemingly small differences in annual rates of return can result in enormous differences in total return over long periods of time … do not ignore the magic of compounding.”

Among the 127 diversified U.S. stock funds with performance records back to late 1984, PRIMECAP ranks fourth overall, trailing only Fidelity Growth Company, Fidelity Contrafund and Alger Spectra. That’s rarefied company.

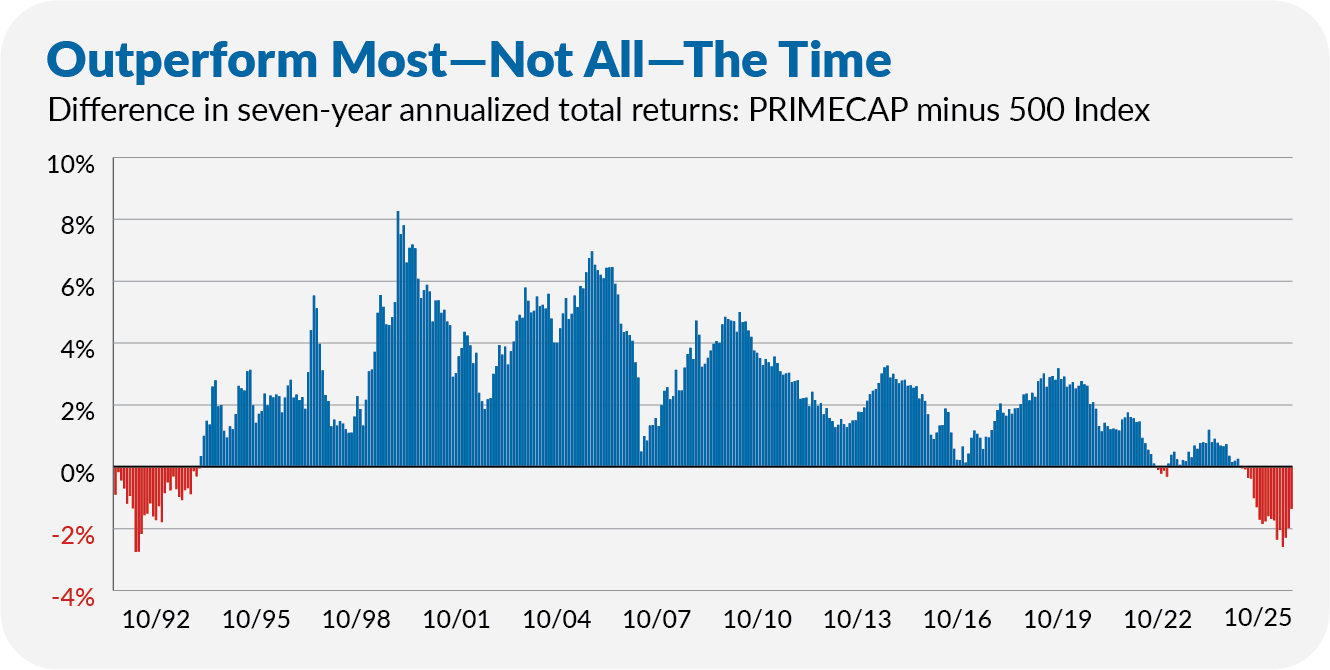

But none of this implies a smooth ride. Trailing the index is to be expected from time to time. In fact, PRIMECAP has only outperformed 500 Index 56% of the time—275 of 491 months since inception. That means you lag the index five months a year.

Investing, like football, is about gaining more yards than you lose. That brings you to the end zone every time.

Which brings me to the longer view. When I wrote my last deep dive, PRIMECAP was coming off one of its worst seven-year stretches—matched only by its early years.

Buying PRIMECAP in the early 1990s wasn’t obvious, but it proved exactly right for the next three decades. Sticking with the fund last year wasn’t obvious either, but it was the right call again.

It’s not just the track record itself that gave me the confidence to stick with the PRIMECAP-run funds. It came from an understanding of how these stock pickers built that track record in the first place.

The Philosophy Behind the Numbers

PRIMECAP Management was founded by three Capital Group (the firm behind the American funds) portfolio managers—Howard Schow, Mitch Milias and Theo Kolokotrones—in 1983. Initially, they managed money for a limited number of institutions, but a year later, at Jack Bogle’s behest, they started managing a new fund—PRIMECAP (VPCMX)—for Vanguard.

If I had to slap a label on their style, I’d call it growth-at-a-reasonable-price, or GARP. The PRIMECAP managers look for companies with the potential for strong earnings growth—but whose shares aren’t yet priced to reflect it.

That said, according to Morningstar, PRIMECAP is a large blend fund, which simply confirms that labels often obscure more than they reveal. What really matters is the philosophy and principles behind the buying and selling decisions.

PRIMECAP’s approach rests on three pillars:

- Fundamental research

- Independent thinking

- Investing for the long term

Talk to anyone at the firm, and those themes come up again and again. Let’s take them one by one.