Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 24.

There are no changes recommended for any of our Portfolios.

Blink, and you missed it. But the S&P 500 index was in a “pullback” … for a day.

A pullback is typically defined as a 5% decline from a prior high. For the record, if the index falls 10%, we are in a “correction.” A 20% drop puts us in “bear market” territory. And a decline of 33% or more is a “crash.”

Well, on Friday, some AI-related high flyers lost altitude. In particular, NVIDIA dropped 10%, and Super Micro Computer fell 23%. As a result, the S&P 500 index closed at 4967.23 on Friday—5.5% below its March 28 high.

However, the pullback didn’t last long. Over the next two trading days (Monday and Tuesday), the index gained 2.1%, leaving it just 3.5% below its prior high.

Pullbacks happen, but you shouldn’t let them keep you from spending time in the market.

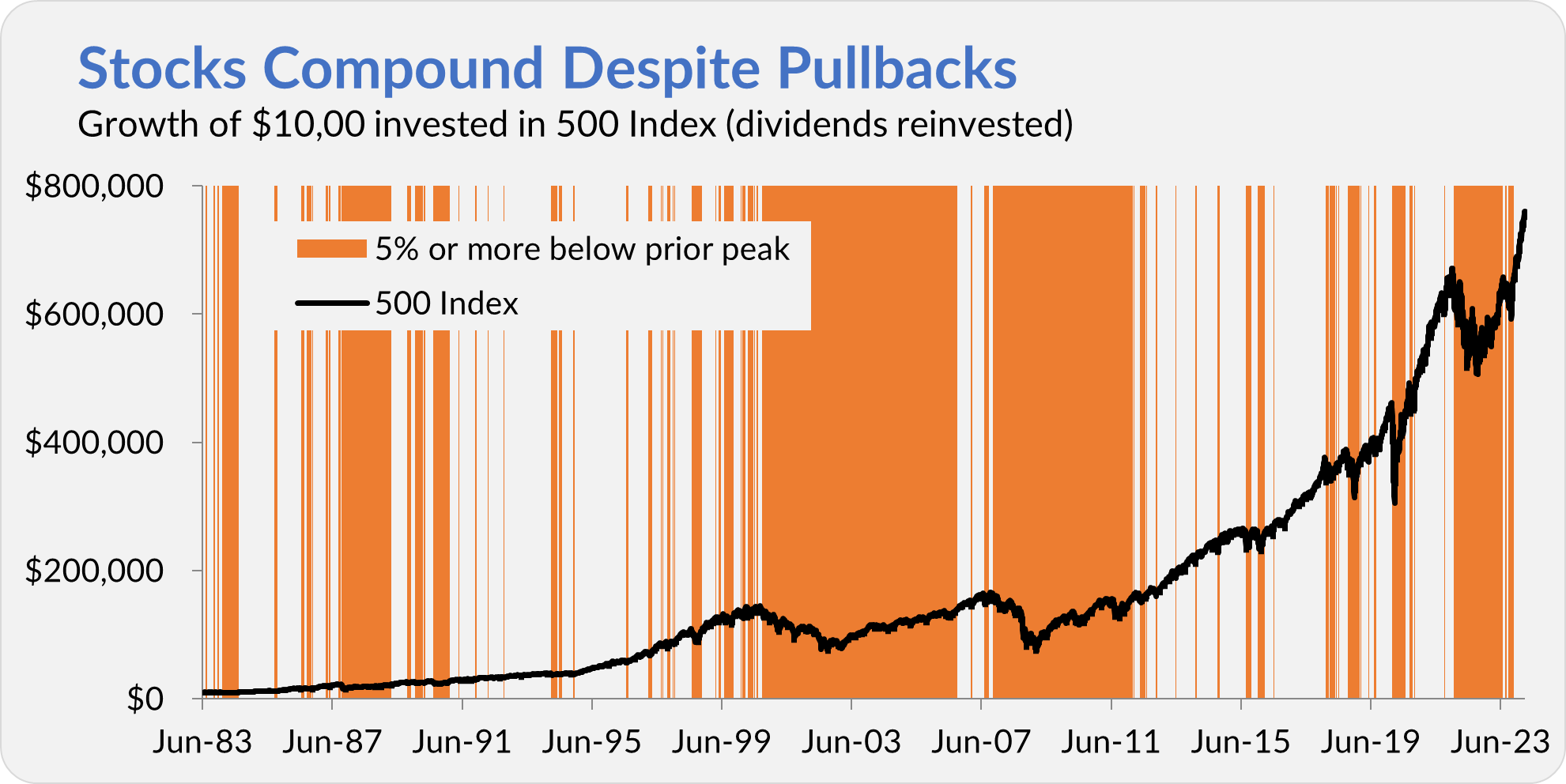

Over the past 40 years or so (between June 1983 and March 2024), 500 Index (VFINX) has compounded at an 11.2% annual rate (with dividends reinvested), turning $10,000 into $760,000. However, nearly half of the time (44%, to be specific), an investor’s position in the fund was 5% or more below its high-water mark.

The chart below shows the trajectory of an investment in 500 Index. The orange bars mark when the flagship fund was down at least 5% from a prior high. As you can see, sometimes those pullbacks were fleeting, and other times, the index fund was underwater for an extended period.

If you can compound your money in the stock market but end up questioning that decision about half the time, well, that’s why I often say that spending time in the market is simple but not easy!

Small-Biz Moving to Ascensus

As I reported last week, Vanguard has sold its small business retirement accounts—individual 401(k), SIMPLE IRA and multi-participant SEP-IRAs—to Ascensus.

It took several days, but I finally received a letter from Vanguard alerting me that my account (I have an individual 401(k)) is moving to Ascensus’s platform in July. I don't know why they couldn’t also share this information via email.

Before getting that letter, I called Vanguard’s small-business phone line in search of more information. The automated system directed me to this website, which contained the same information as the letter.

Here’s what you need to know.

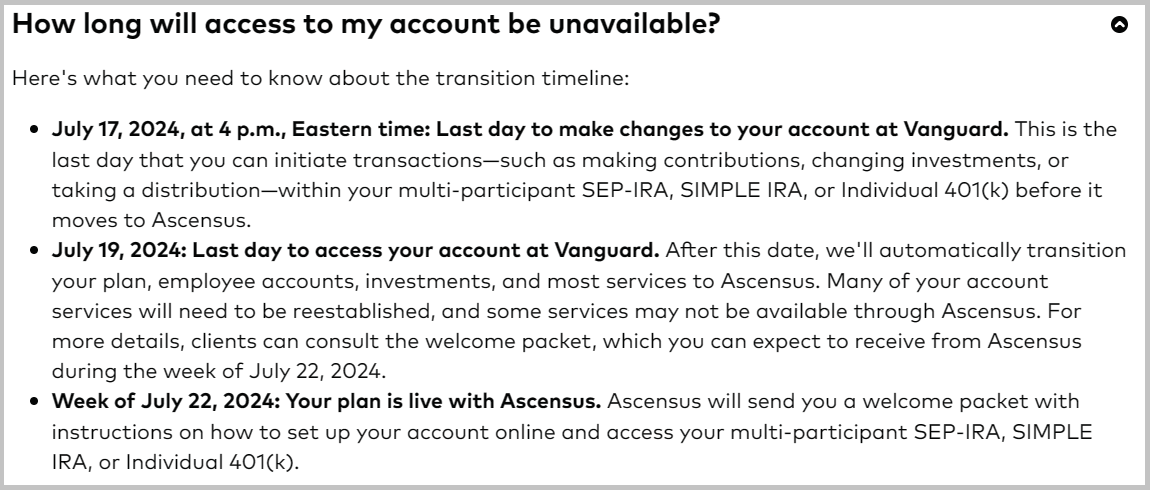

First, the transition from Vanguard’s platform to Ascensus will happen in July. Here are the dates you need to watch out for:

If you want to make any changes to your account before it moves, act before July 17. Vanguard and Ascensus are planning to move accounts over the following weekend, but they are giving themselves some wiggle room, saying that your plan will be live with Ascensus the “week of” July 22.

To be clear, this means that after July 19, you won’t be able to access your retirement account using your Vanguard login. You’ll have to log in at Ascensus.

One final date to keep in mind is January 1, 2025. If you want to close down your account, do it before the end of the year, or Ascensus will charge you $25.

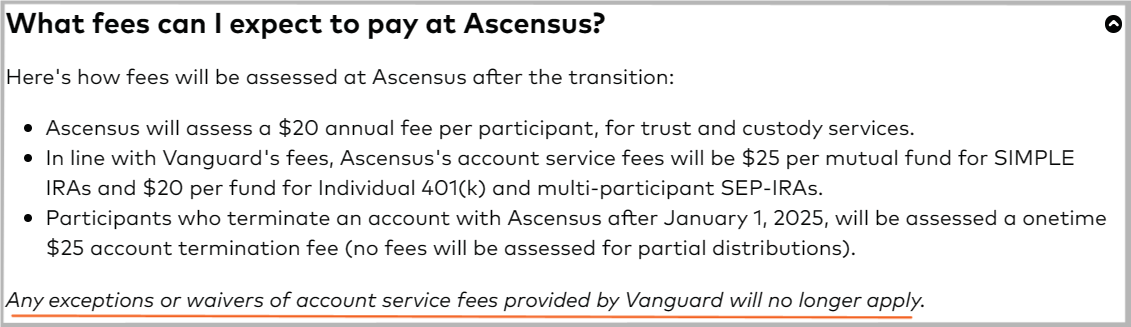

Speaking of fees—they are going up!

Ascensus will charge a $20 annual fee per participant for trust and custody services. Additionally, while the accounts were at Vanguard, those $25 or $20 fees for each fund were waived if you had at least $50,000 in qualifying Vanguard assets. Those waivers will no longer apply.

Third, this is ominous and lacking in detail … but many account services “will need to be reestablished” and others “may not be available” once the move is complete. Which services are those? I guess we’ll have to wait for that welcome packet in July to find out.

Finally, I couldn’t get a definitive answer on this, but this move will likely result in someone losing their status (think Flagship) with Vanguard.

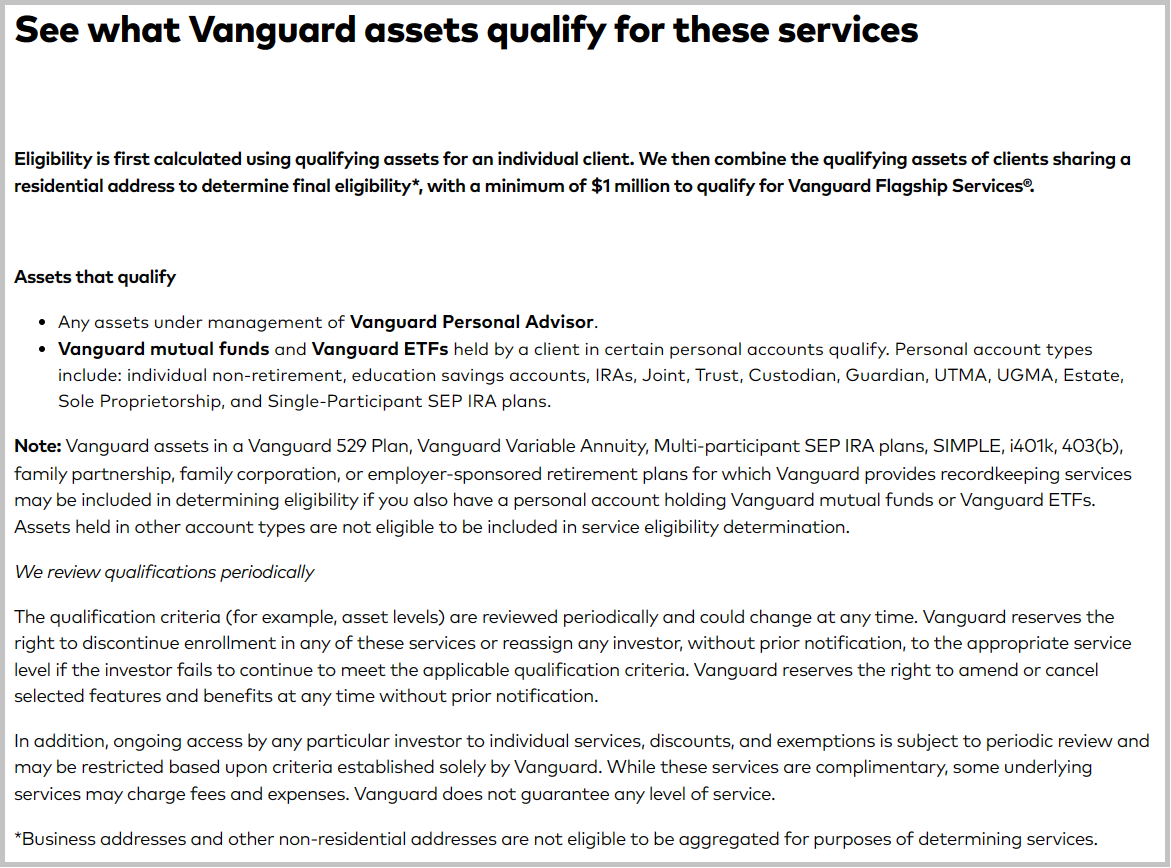

Flagship status is for Vanguard investors with $1 million to $5 million in “qualifying assets.” In English, you must own at least $1 million in Vanguard funds or ETFs in a Vanguard account to merit Flagship status. But you have to read the fine print.

Today, assets held in the accounts being transitioned to Ascensus (individual 401(k), multi-participant SEP IRAs and SIMPLE IRAs) “may be included” in determining eligibility. This means that it’s already unclear if the assets in these accounts count toward your status! (Thanks for the clarity on that, Vanguard.)

If you're wondering if you’ll be impacted, well, as I said, I don’t have a definitive answer. Vanguard’s PR department only advised that “any clients should reach out to Vanguard about their specific situation.” The Vanguard phone reps I spoke with didn’t know the answer either.

My guess is that once the assets move to Ascensus, they will no longer count toward your status. (The phone reps I spoke with thought that would be the case, too.) If that's the case, someone out there will lose their Flagship status in July through no “fault” of their own.

I hope I’m wrong, but it would be nice for Vanguard to provide clarity on this.

As I mentioned, I have an individual 401(k) at Vanguard. So, what am I doing?

The short answer is that I’m reconsidering my options.

When I set up my individual 401(k) last year, Vanguard was the easy decision. Vanguard’s solution wasn’t perfect, but it checked enough boxes that I didn’t shop around too much.

In particular, Vanguard’s solution allowed me to invest in Vanguard funds and make Roth contributions (as an "employee")—those aspects aren’t changing in the transition.

However, I also went with Vanguard because of the low costs, convenience, and, well, the fact that it was a Vanguard product. (Given that I write this newsletter, I feel it is important to experience as many Vanguard services as possible.) Now, my costs are going up, convenience is going down and it’s no longer a Vanguard product.

So, as I said, I’m reconsidering my options. I’ll let you know where I end up.

Our Portfolios

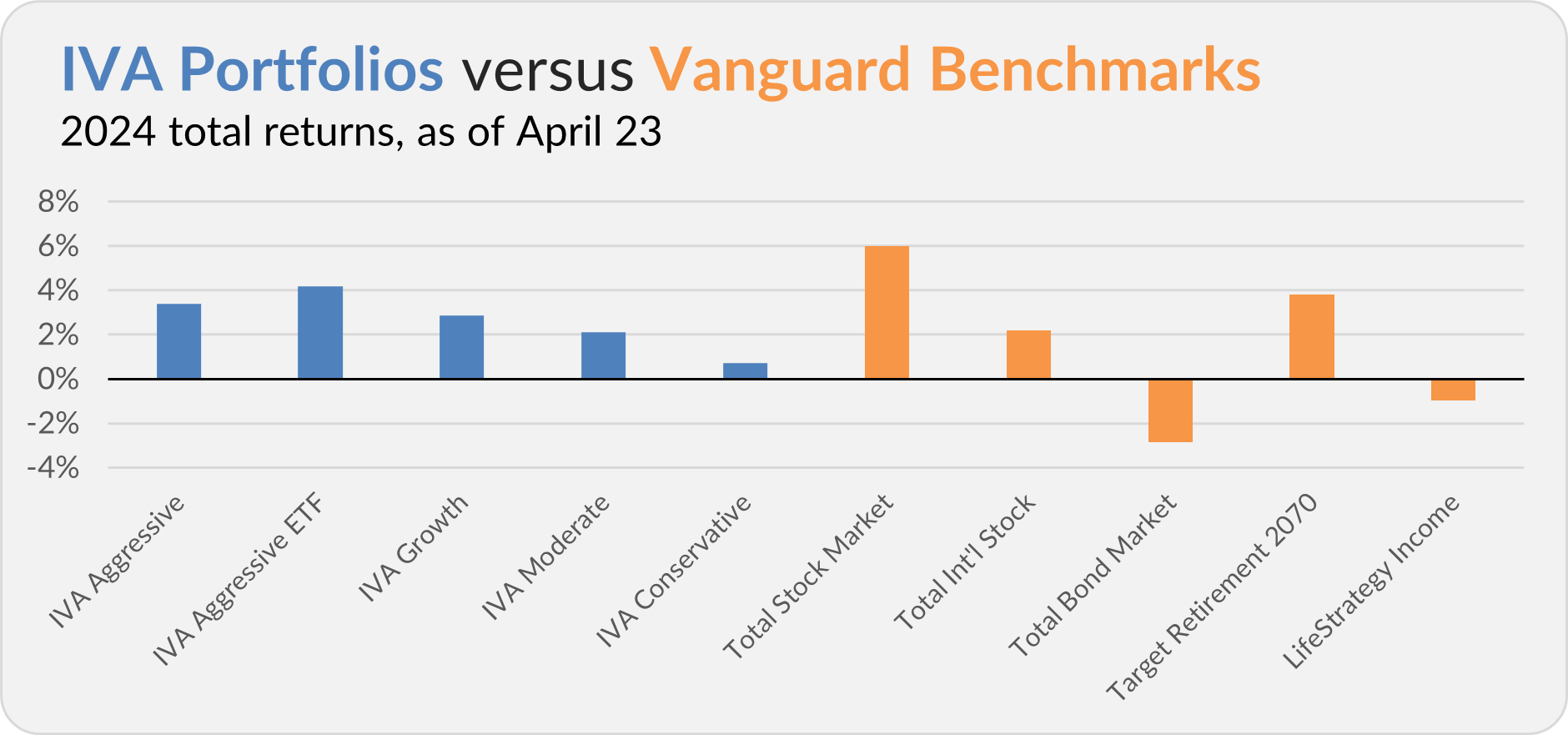

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.4%, the Aggressive ETF Portfolio is up 4.2%, the Growth Portfolio is up 2.9%, the Moderate Portfolio is up 2.1% and the Conservative Portfolio is up 0.7%.

This compares to a 6.0% gain for Total Stock Market Index (VTSAX), a 2.2% return for Total International Stock Index (VTIAX), and a 2.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.0%.

IVA on Air

If you missed it last week, I recently had the pleasure of participating in the Money Life with Chuck Jaffe podcast. You can listen to our 20-minute conversation below. Or you can find the full episode here.

IVA Research

Yesterday, I published two articles. I sent ETFs: Understanding the Basics to everyone (without a paywall) because every investor deserves to be informed and educated. The second article, ETFs: More Complicated Than Expected, went out only to Premium Members.

Next week, I’ll return to the topic of tax efficiency by comparing Vanguard’s ETFs and their index mutual fund siblings.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.