Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, December 14th.

There are no changes recommended for any of our Portfolios.

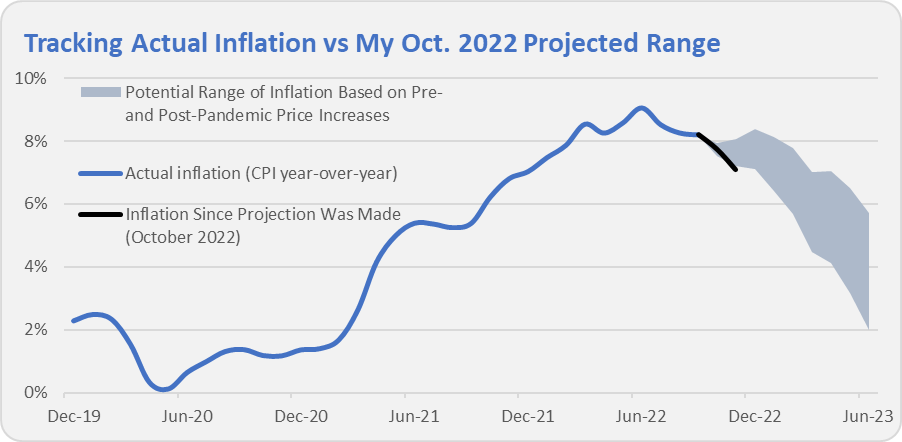

It’s looking more and more likely that inflation peaked over the summer. On Tuesday, the Bureau of Labor Statistics (BLS) reported that consumer prices rose just 0.1% in November. That puts the Consumer Price Index (CPI) up 7.1% over the last year. As you can see in the chart below, inflation is actually tracking slightly below the range I set out two months ago.

With inflation trending lower it’s no surprise that policymakers at the Federal Reserve (Fed) hiked the fed funds rates by 50 basis points (or 0.50%) today rather than continuing on the path of 0.75% rate hikes we’ve seen over each of their four prior meetings. The conclusion is that the Fed is still trying to tamp down inflation but are taking their feet off the brakes a bit.

Inflation is coming down and the Fed is nearing the end of the interest rate hiking cycle. Those have been two of investors’ key concerns throughout the past year—and may now be dissipating. Replacing those worries? Fear of a coming recession.

Signs are stacking up suggesting we are headed for a recession. That doesn’t guarantee we’ll have one—often the thing that everyone is worried about isn’t “the thing” that trips up the markets. Also, the last two recessions were doozies. When COVID struck we flipped a switch and millions of people lost their jobs literally overnight—that’s not normal. During the global financial crisis of 2007-2009 the “Great Recession,” as we now call it, saw the economy shrink by 4% and the unemployment rate roughly doubled from 4.5% to 10%. The next recession doesn’t have to be as bad as our recent experiences might suggest.

In fact, while stocks fell 37% during the Great Recession, on average stocks have fallen just 3% during the 10 recessions between 1957 and today. (Exclude that 37% drop and stocks were roughly flat during recessions.) With stocks down double-digits already, the coming recession, if it arrives, might not result in further market losses at all. We’ll just have to wait and see how it plays out. But big losses are not a given in today’s starting place.

From the macro to the micro let’s turn to Malvern, where capital gain distribution season kicked off on Tuesday. I’d suggest double checking Vanguard’s work through this busy season—whether it’s distributions or your RMD—as, unfortunately but no longer surprisingly, I’ve been hearing about a lot of Vanguard missteps from subscribers. And it doesn’t take a human to screw up your account—the computers are doing a fine job of that all by themselves.

One subscriber tells me that Vanguard suddenly stopped following instructions to send dividends to their settlement account and began reinvesting them instead. Another subscriber found discrepancies between their statements and their online balances.

Another subscriber shared a remarkable tale of Vanguard erroneously debiting his account (twice) and forcing a sale of shares in Dividend Growth (VDIGX) to cover the deficit. Even though Vanguard eventually made the shareholder whole, he is still on the hook for the taxes from the Dividend Growth sales. Oh, and he can’t buy back into the fund due to Vanguard’s frequent-trading prohibition even though he didn't place a trade.

Did Vanguard ever explain themselves? No. Did Vanguard even call him back, as promised, after he spent hours on the phone trying to rectify the situation? Again, no. And let’s be clear, this investor tells me that he’s a Flagship client. If it can happen to him … well, you get the point.

The common thread among all these stories is long wait times and a general lack of responsiveness from Vanguard. As I said, check Vanguard’s work during this busy season. And don’t want until the last minute to do your RMDs, make any charitable contributions or whatever year-end financial tasks remain on your to-do list.

Our Portfolios are still in the red for the year through Tuesday but are ahead of the broad market indexes. The Aggressive Portfolio is off 11.7%, the Growth ETF Portfolio is down 14.6%, the Growth Portfolio has declined 10.6% and finally the Moderate Portfolio is off 8.3%. This compares to a 15.8% decline for Total Stock Market Index (VTSAX), a 14.1% drop for Total International Stock Index (VTIAX), and an 11.3% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), is down 14.5% for the year and its most conservative, LifeStrategy Income (VASIX), is off 11.5% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 7.2%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.