Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 26th.

There are no changes recommended for any of our Portfolios.

On October 12, the S&P 500 index closed at 3577—which put the index 25.4% below its January 3rd high. Since then, the index is up around 8%. Was October 12 the low point for this bear market or is this rally just another “head fake”?

That may seem like the million-dollar question, but that’s only the case if we’re trying to trade the market. For longer-term investors, purchases made during bear markets tend to look pretty smart with time—even if they look silly in the short-term.

Speaking of million-dollar questions—or maybe I should say trillion-dollar questions—tomorrow we’ll get the first estimate of Q3 Gross Domestic Product (GDP). The economy, measured by GDP, shrank in the first and second quarters this year. Expectations are that the economy grew in the third quarter.

Even if GDP grew last quarter, I think there are more recession warning signs today than there were when GDP contracted in the first half of the year. Here are three potential recession warning signs on my radar today:

First, the yield curve has inverted. In English, short-term Treasurys are yielding more than long-term Treasurys. Notably, the 3-month Treasury is yielding more than the 10-year Treasury. It’s not by much and it’s only been for a day, but it is something I have my eye on. Keep in mind that an inverted yield curve has historically been an early warning sign of a recession.

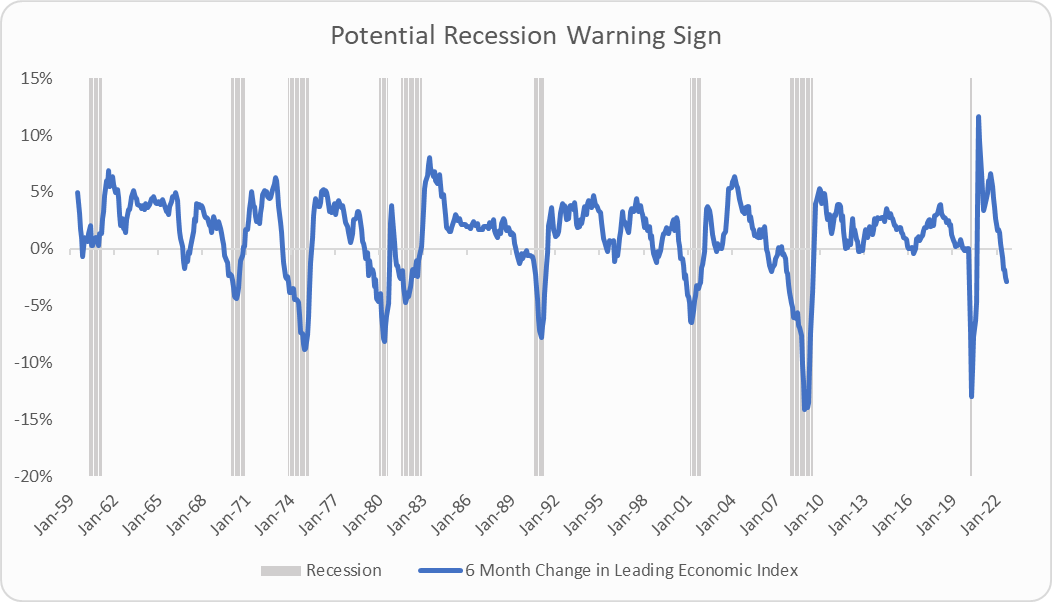

Second, the Conference Board’s Leading Economic Index, which is designed to combine several “forward looking” factors into one number, is also flashing yellow. Though it’s worth noting that there have been a few false signals in the past.

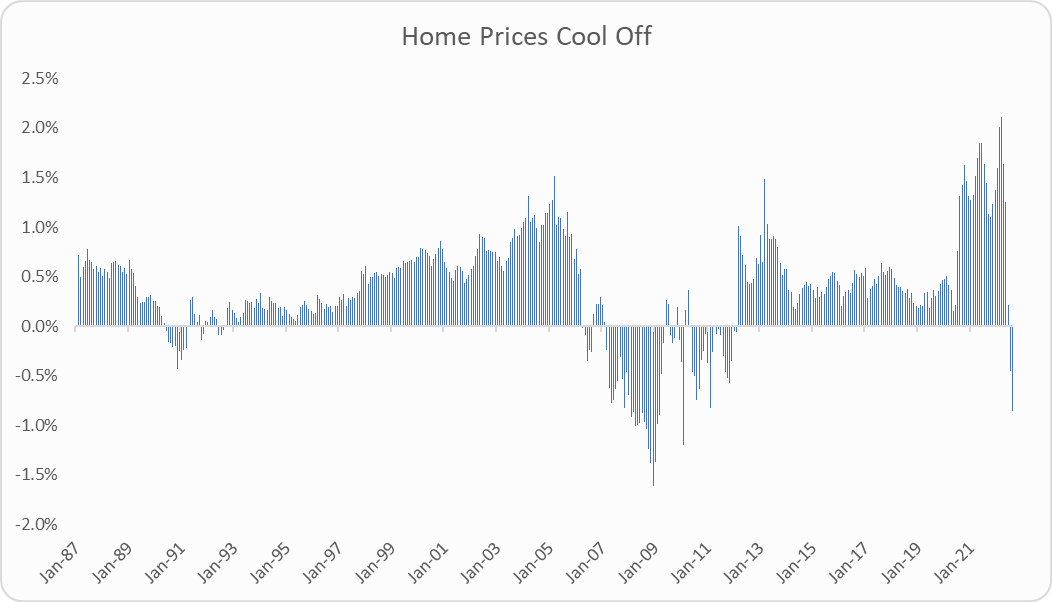

Third, the housing market is cooling off. According to Case-Shiller, home prices declined in July and August. That's the first time we've seen prices drop since the global financial crisis and its aftermath. It seems reasonable that home prices continued to fall in September, given that’s when mortgage rates really increased.

Everyone hears “falling home prices” and immediately thinks back to 2007 and 2008. So, let me be clear, I do not think housing is about crash or cause the financial system to lock up. After a torrid post-pandemic period, it was inevitable that the housing market was going to slow. A slowdown in housing has knock-on effects that point to slower economic growth ahead, but it doesn’t mean we are on the precipice of a collapse.

To that end, while I’m more concerned about a recession today than I was earlier in the year, that doesn’t translate into big—if any—portfolio changes. As I noted at the top, we are already in a bear market—and that statement applies to both stocks and bonds! The markets tend to act ahead of the economy, which means that not only do stocks typically fall before recessions arrive, they also often start rallying before recessions end. So, it's not enough to simply get the timing of a recession correct.

Plus, even with these warning signs flashing, that doesn’t guarantee we’ll find ourselves in a recession in the near term. Offsetting some of these recession concerns include a very low level of unemployment, healthy consumer balance sheets and growing company earnings.

The bottom line is that the macro picture is never clear and making big market timing trades has never been part of my game plan. So, I won’t start doing that now.

Our Portfolios are showing absolute losses but decent relative returns for the year through Tuesday. The Aggressive Portfolio is down 18.8%, the Growth ETF Portfolio is off 20.4%, the Growth Portfolio has declined 17.3% and finally the Moderate Portfolio is down 14.8%. This compares to a 19.2% drop for Total Stock Market Index (VTSAX), a 24.3% decline for Total International Stock Index (VTIAX), and a 16.0% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), is down 20.5% for the year and its most conservative, LifeStrategy Income (VASIX), is down 16.2% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 12.9%.

Until next week this is Jeff DeMaso wishing you a safe, sound and