Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 18.

There are no changes recommended for any of our Portfolios.

Are big tech stocks the new flight-to-safety assets of choice? It sure looks that way right now.

The world is awash in conflict. While the war between Ukraine and Russia drags on, the conflict between Israel and Hamas intensifies. And the House of Representatives has been paralyzed—unable to consider legislation—for two weeks as Republicans search for a new speaker.

Understandably, investors and traders are on edge.

Usually, traders turn to Treasurys when they get spooked. But, so far in October (as of Tuesday night’s close), Extended Duration Treasury ETF (EDV), which is like holding Treasury bonds on steroids, has been Vanguard’s worst-performing fund with a decline of 5.0%. (If you exclude that niche ETF, Long-Term Treasury (VUSTX) is the worst performer with a 3.4% decline.)

The best-performing Vanguard fund in October is Communication Services ETF (VOX), with a 3.9% gain. Meta and Alphabet (more commonly known as Facebook and Google) are up around 7% this month and account for roughly 45% of Communication Services ETF’s portfolio.

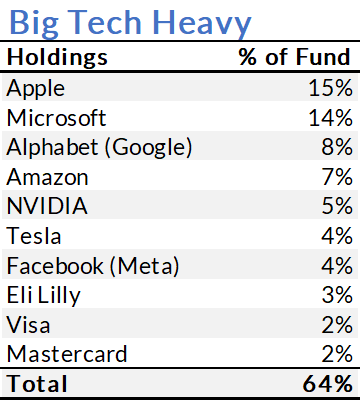

Right on the sector ETF’s heels is MegaCap Growth ETF (MGK), with a 3.4% gain this month. As you can see in the table below, big tech dominates this more diversified portfolio.

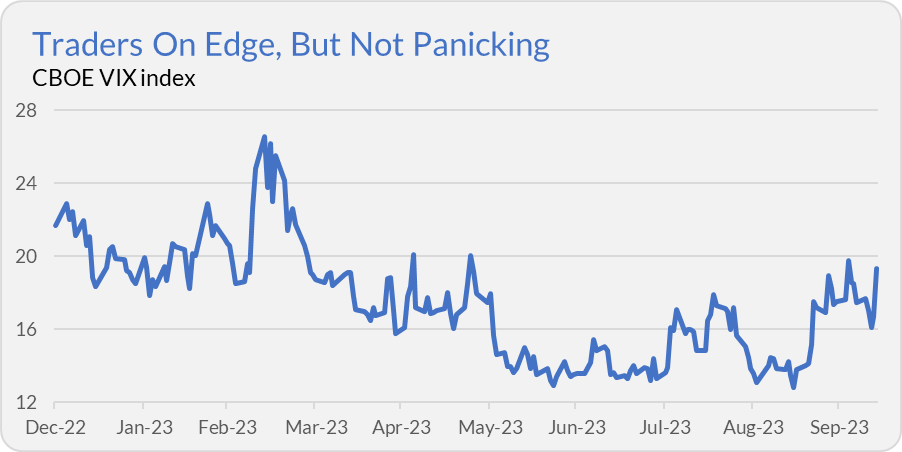

While traders are on edge, full-blown panic has not set in. For example, the VIX index (a measure of how volatile traders think stocks will be and commonly referred to as the “fear gauge”) has risen over the past month but is still below 20.

If fear takes hold, big tech stocks may or may not stay in favor. But, for now, the narrative seems to be that if you want to “stay in the game” but take some risk off the table, big tech is your answer.

Don’t Forget to Close the Door

One game that Vanguard has decided to quit playing is China.

Vanguard pushed to expand in China in the 2010s—opening offices and entering into a joint venture with Ant Group. The 2020s have seen Vanguard slowly head for the exit. Vanguard has canceled mandates with the Chinese government and closed offices in the past few years.

Earlier this year, Vanguard officials denied rumors that it was closing its Shanghai office and ending its joint venture with Ant Group. Well, there may have been some truth to those rumors, as Vanguard has sold its 49% stake in the joint venture back to Ant Group.

The Chinese market has attracted a lot of attention from U.S.-based asset management firms—given the size of the opportunity, that should come as no surprise. But while Vanguard is heading for the exit, competitors like Fidelity and BlackRock have been boosting their efforts to grow in China.

In The Value of Ownership? I discussed how Vanguard’s unique investor-owned structure may make expanding overseas challenging.

Our Portfolios

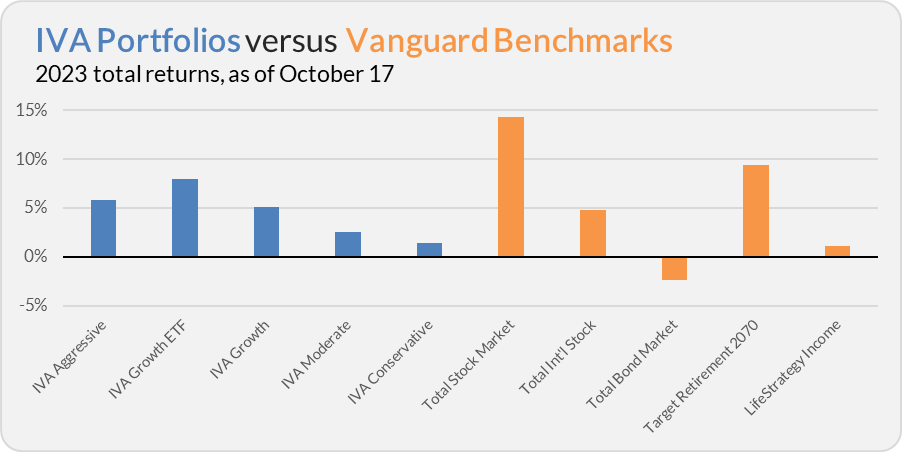

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.8%, the Aggressive ETF Portfolio is up 8.0%, the Growth Portfolio is up 5.1%, the Moderate Portfolio is up 2.6% and the Conservative Portfolio is up 1.4%.

This compares to a 14.4% gain for Total Stock Market Index (VTSAX), a 4.8% return for Total International Stock Index (VTIAX), and a 2.3% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.2%.

Speaking of the Portfolios, the original September 2023 report had a stale number for the total portfolio value of the Growth Portfolio. It showed $118,157 (the Portfolio’s value at the end of June) when it should have been $114,393. The website and PDF have been updated.

This error did not impact any of the performance returns or portfolio percentages. My apologies for any confusion. I have updated my process to help avoid this error in the future.

IVA Research

Yesterday, in Lunch Time in the Board Room, I shared my analysis of Vanguard’s directors and their investment alongside the shareholders they represent with Premium Members. I’ll complete that series with a look at the portfolio managers responsible for the day-to-day investment decisions in a few weeks.

Next week, I’ll provide Premium Members with an early look at year-end capital gain distributions.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.