Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 29.

There are no changes recommended for any of our Portfolios.

You are going to hear a lot of chatter about the divergence between growth and value stocks in the media between now and the end of the year—heck, I’m sure I’ll talk about it again as well.

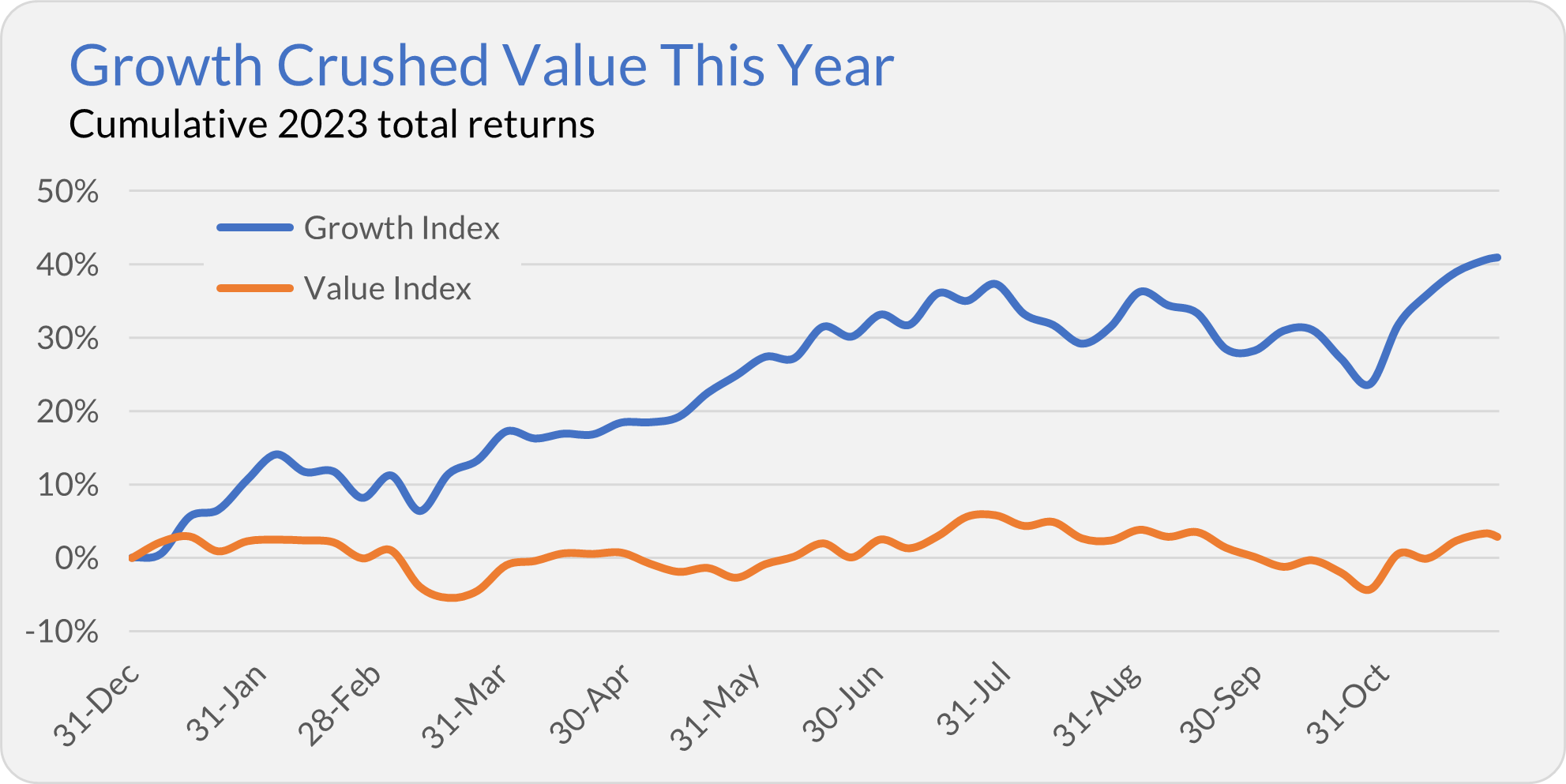

While I’m not a big fan of the labels, the bottom line is that your choice of acting like a growth investor versus a value investor has made all the difference in your returns this year. Growth Index’s (VIGAX) 41.0% return—nearly 40 percentage points ahead of Value Index’s (VVIAX) 2.9% gain—is a whopper.

If this holds through December, 2023 will clock in with the biggest difference in calendar year returns between the growth and value index funds since their inception 32 years ago.

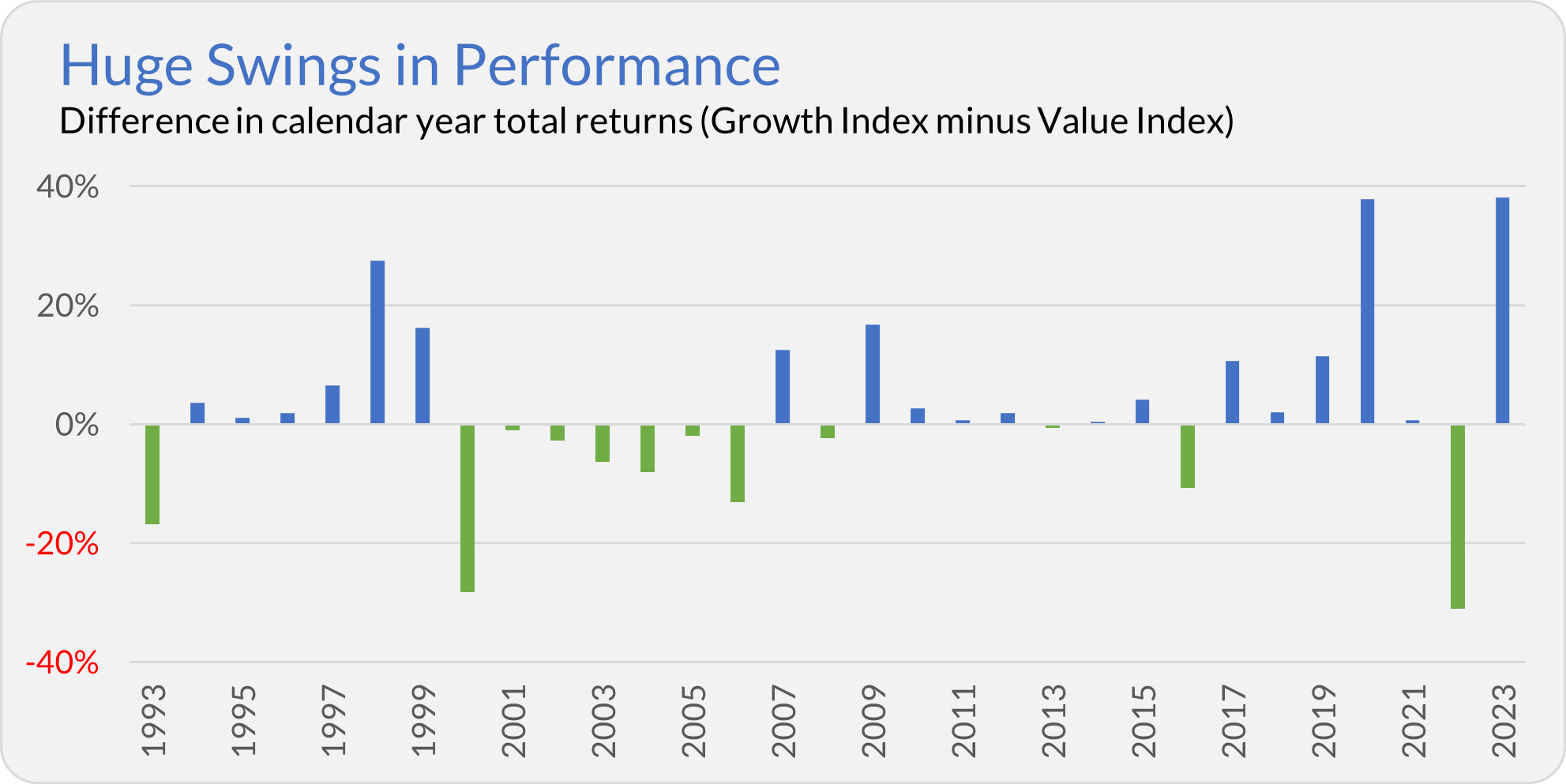

The chart below shows the difference in calendar year returns for the two index funds since their inception. The blue bars (above zero) show the level of Growth Index’s outperformance. The green bars (below zero) illustrate when value stocks led the way.

As you can see, the pendulum has been swinging from end to end for the past few years. The three years with the biggest difference in annual returns between growth and value stocks over the past three decades have been 2020, 2022 and (potentially) 2023. It’s enough to give even the most disciplined investor whiplash.

If you were on the right side of those swings, you made out like a bandit. If not, you’re probably ready to throw in the towel now. Though don’t be too hard on yourself, successfully timing the market is extremely difficult—if not impossible. Of the 720 timing strategies researchers at Dimensional back tested, only 30 “worked.” (And that number would shrink after including trading costs and taxes.) Before rushing to those successful timing strategies, note that the researchers were highly dubious of the merits of even the best-performing formula they found.

My advice is to avoid playing the guessing game at all. By holding a diversified portfolio, you’ll benefit whichever way the pendulum swings.

That’s why I recommend partnering with managers pursuing different strategies. The Baillie Gifford team running most of International Growth’s (VWIGX) portfolio are growth managers by any definition. A fund like U.S. Value Factor ETF (VFVA), which lands on the other side of the spectrum, can serve as a complement. Other managers, like the PRIMECAP team overseeing Capital Opportunity (VHCOX), don’t fall neatly into either category. Yes, they are growth managers, but they also are sensitive to the prices they are paying.

Motion Denied

Vanguard’s attempt to dismiss a class action lawsuit over the ridiculously large 2021 capital gains distributions paid out by its Target Retirement funds was denied.

You can read more about the lawsuit here, but the short story is that Vanguard botched its attempt to lower fees on its Target Retirement funds—unnecessarily handing investors large tax bills in the process. While the judge dismissed some of the plaintiffs’ arguments, the bottom line is that the trial will move forward.

I am not a legal scholar, but I suspect Vanguard will ultimately pay a price for how it handled the transition. In fact, Vanguard agreed separately to pay $6.25 million as part of a deal with Massachusetts’ regulators over the Target Retirement funds snafu.

Bad Timing?

The formula for a successful investment is simple: Buy low and sell high.

Unfortunately, that’s easier said than done—and many investors find themselves doing the opposite, buying what has done well (buying high), only to watch their investment move in the other direction (lower).

But it’s not just individual investors that succumb to this pattern. Large investment firms often launch new funds based on what has worked well recently, just in time for that strategy to fall out of favor.

Yes, even Vanguard has done this. One recent example would be Vanguard’s foray into private equity.

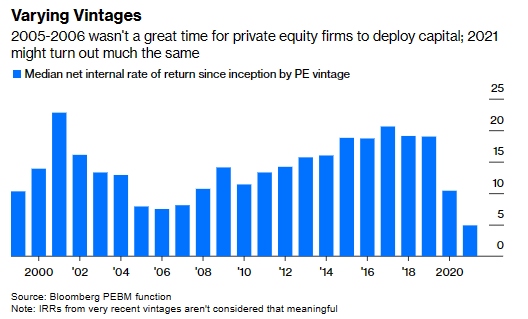

When it comes to private equity, when you invest can have as big an impact on your returns as what you invest in. This is why most people suggest building a private equity portfolio over several years by buying into multiple “vintages.”

It’s not dissimilar to dollar-cost averaging, except on a much larger scale, given the investment minimums most private equity funds, including Vanguard’s, require.

According to Bloomberg, private equity funds had a great run in the late-2010s; those vintages are reporting “internal rates of return” (or IRRs) between 15% and 20%. However, more recent vintages (2020 and 2021) are showing disappointing IRRs—in the 5% to 10% range.

Care to guess when Vanguard launched its first private equity fund in partnership with HarbourVest? In 2021, after the solid run for private equity.

I can (and maybe should) add a host of caveats to this data and commentary. One thing to remember is that IRRs are not the same as actual investor returns—you can’t compare these figures to the returns on, say, 500 Index (VFIAX).

Another important caveat: This is just aggregate data—we don’t know how Vanguard’s fund is fairing. And even if we did, it’s early days, making it too soon to judge investors’ success in Vanguard’s private equity offerings.

When Vanguard launched its private equity fund, I had hopes—though low expectations—that Vanguard would bring transparency to an opaque strategy. So far, Vanguard has not helped to shine a light on this (large) corner of the investment world.

Early adopters of Vanguard’s private equity funds (mostly institutions, though Vanguard has opened up newer vintages to individuals) may ultimately profit from their investments; time will tell. But early signs suggest that Vanguard’s timing wasn’t particularly good.

Our Portfolios

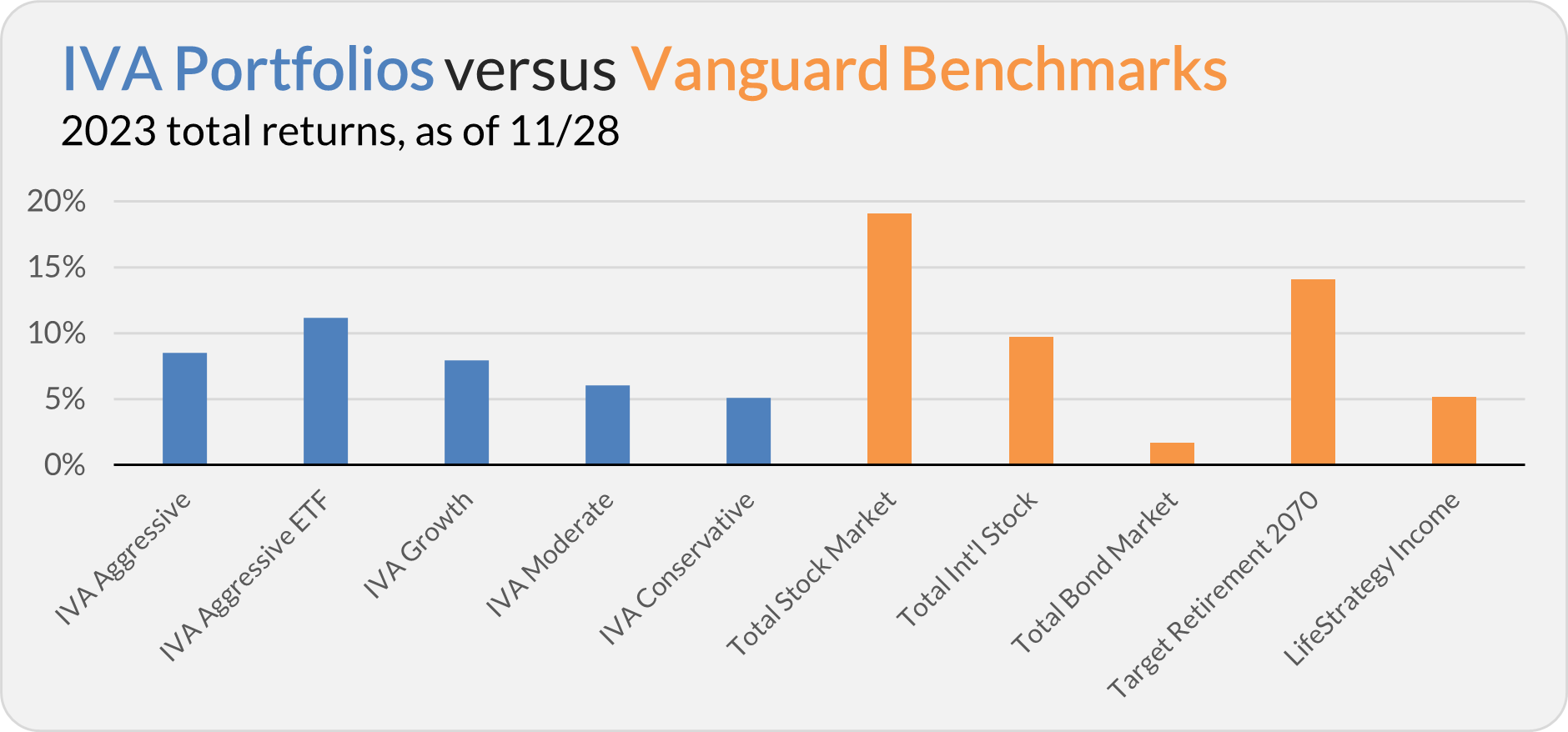

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 8.5%, the Aggressive ETF Portfolio is up 11.1%, the Growth Portfolio is up 7.9%, the Moderate Portfolio is up 6.0% and the Conservative Portfolio is 5.1%.

This compares to a 19.1% return for Total Stock Market Index (VTSAX), a 9.7% gain for Total International Stock Index (VTIAX), and a 1.7% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 14.1% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.2%.

IVA Research

Yesterday, in Restarting the Cycle, I shared my analysis of Global Capital Cycles (VGPMX) with Premium Members. Though Vanguard rebooted the fund five years ago, it’s still not a winner.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.