Executive Summary: AI is driving 2025’s stock market, but not all Vanguard funds participate equally. By examining holdings, sectors and correlations, I map where AI exposure actually exists.

Which Vanguard funds have the most exposure to artificial intelligence stocks?

This is a question I’ve been getting a lot lately as artificial intelligence (AI) has become the market narrative for 2025. Those asking seem focused, in equal measure, on the game-changing technology and the potential for a massive price bubble.

The trouble is that “AI stocks” aren’t neatly labeled, nor does Vanguard offer a dedicated AI fund against which you could measure your exposure.

So, where is artificial intelligence exposure found inside Vanguard’s lineup? And how much AI risk—or opportunity—do the IVA Portfolios carry?

To answer those questions, I’ve approached the question from three angles:

- Stock-level exposure: ownership of the Magnificent Seven—Microsoft, Apple, Amazon, NVIDIA, Alphabet (Google), Meta (Facebook) and Tesla

- Sector-level exposure: allocations to technology and communication services

- Theme-level exposure: how Vanguard funds behave relative to AI-dominated ETFs

Across all three lenses, one conclusion stands out:

AI exposure is widespread but not everywhere—and the IVA Portfolios carry materially less AI exposure than 500 Index.

If you're looking to tilt toward or away from AI, here's where that exposure truly lives.

What Counts as an AI Stock?

Before mapping Vanguard’s AI exposure, we need to define the universe. “AI stock” is not a formal category—so I use three practical proxies widely adopted by analysts and investors.

1) A Stock Proxy: The Magnificent Seven

The Magnificent Seven (Mag-7) term was coined in 2023 to cover seven giant companies driving the market’s gains—Microsoft, Apple, Amazon, NVIDIA, Alphabet (Google), Meta (Facebook) and Tesla.

Is it a perfect match for the AI story? No. Amazon, in particular, isn’t really an AI company—though the consumer giant is certainly trying hard to automate their warehouses. Apple also hasn’t delivered much on the AI front.

But the other five companies fall squarely in the AI bucket.

Microsoft—via its stake in OpenAI’s ChatGPT—is competing with Alphabet’s Gemini and Meta’s Llama in the generative AI or large language model (LLM) space.

NVIDIA is the mega-supplier of AI chips. Consider that when OpenAI introduced ChatGPT in late 2022, NVIDIA was worth about $350 billion. Today, its value is closer to $4.5 trillion. Without AI, there is no NVIDIA 12-bagger.

Even Tesla is an AI company—in my book. The company’s roughly $1.5 trillion market cap makes it worth as much as every other automaker … combined. That’s not because Tesla produces half of the world’s cars; it’s because the company promises to deliver self-driving cars and autonomous robots.

Whether or not each of the Mag-7 is an AI stock, there’s no denying that investors who simply bought the Roundhill Magnificent Seven ETF (MAGS), which owns just the 7 aforementioned stocks, have earned some gaudy returns.

The ETF launched in April 2023, only 5 months after ChatGPT. Since then, it has surged 159% (44% per year)—leaving the rest of the market in the dust: 500 Index (VFIAX) is up 70% (23% annually), and SmallCap Index (VSMAX) is up 43% (15% annually) over the same period.

The bottom line: The AI story is evolving beyond the giants, but for many investors, the Mag-7 has been a shortcut into the theme. It provides a good first look at a fund’s exposure to the theme.

2) A Sector Proxy: Technology + Communication Services

Most companies tied to the AI narrative sit in just two business sectors:

- Information Technology

- Communication Services

Yes, the Mag-7 features prominently in these two sectors. NVIDIA, Apple and Microsoft account for 44% of Information Technology ETF’s (VGT) portfolio, while Alphabet and Meta make up 46% of Communication Services ETF’s (VOX) assets.

But that still leaves another 430 or so companies across the two sectors that we didn’t account for in our first cut.

If we assume these sectors act as a rough “AI universe,” then analyzing sector weightings gives us a broader view into which Vanguard funds lean most heavily into the theme.

3) Thematic Proxies

As I said, Vanguard doesn’t have an “AI-themed” fund or ETF, but the market’s largest AI-specific option is Global X Artificial Intelligence & Technology ETF (AIQ). Its portfolio holds companies involved in computing, chips, cloud services and digital networks. While not perfect, it serves as a reasonable thematic benchmark.

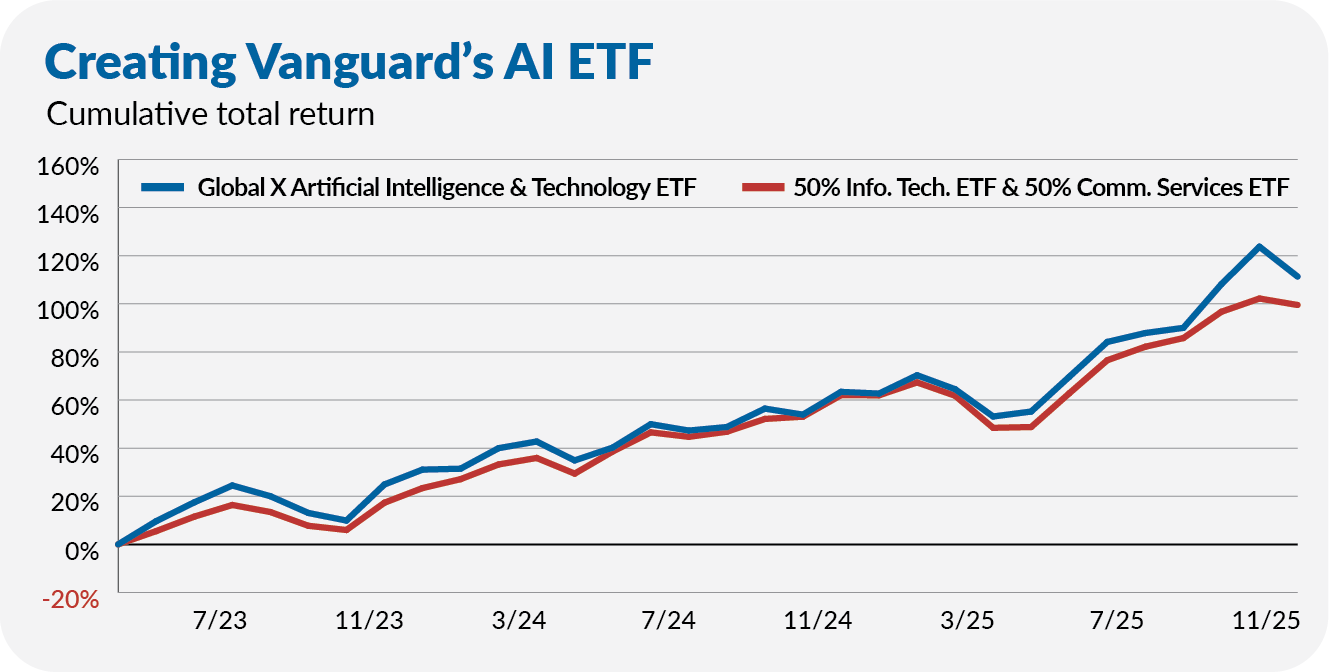

To create a “Vanguard equivalent,” we can combine Information Technology ETF (VGT) and Communication Services ETF (VOX) in equal weights. This 50/50 blend gives us a clean, Vanguard-flavored benchmark for AI exposure.

As you can see in the chart below, the Global X ETF and our Vanguard composite have plotted similar paths to essentially the same destination over the past two and a half years. Global X’s AI ETF is up 111% (34% annually), while the two-sector Vanguard mix is up 99% (33% annually). Close enough for our purposes.

With those three working definitions in place, let’s break down how AI exposure actually shows up within Vanguard’s lineup.