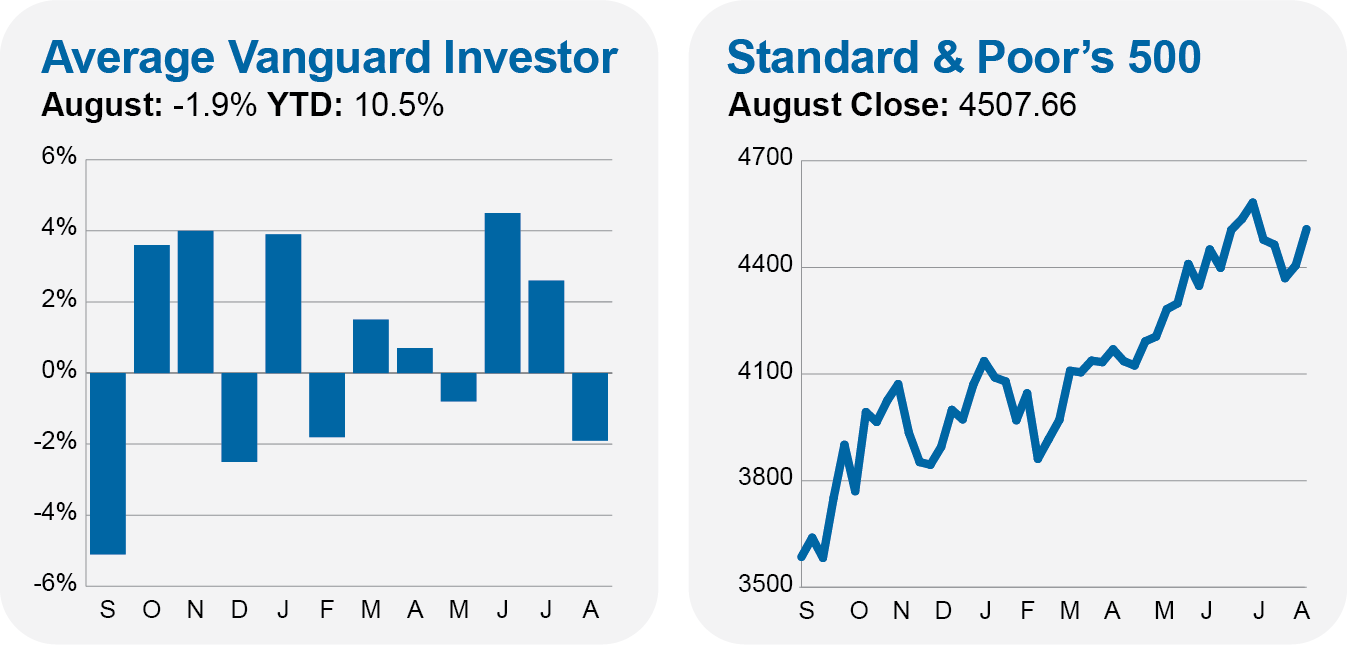

August had been shaping up to be a terrible month for investors. On August 17, Total Stock Market Index (VTSAX) was down 5.1% for the month, Total International Stock Index (VTIAX) was off 6.3% and Total Bond Market Index (VBTLX) had fallen 2.1%. Ouch.

But, like they say, it ain’t over 'til the fat lady sings. Stocks and bonds rebounded in the month’s second half. By the close of trading on August 31, U.S. stocks finished down 1.9% for the month, while foreign stocks slid 4.4% and bonds dropped 0.6%. Losses are still losses, but that’s not nearly as bad as it could’ve been.

And that’s just the month. For the year, stocks are delivering some compelling returns. Total Stock Market Index, for example, is up 18.0%. Of course, there is a pretty wide dispersion of returns between different sectors if you look under the hood of the “total” fund, but despite all the recession calls earlier this year, it has paid to spend time in the market rather than trying to “time” the market.

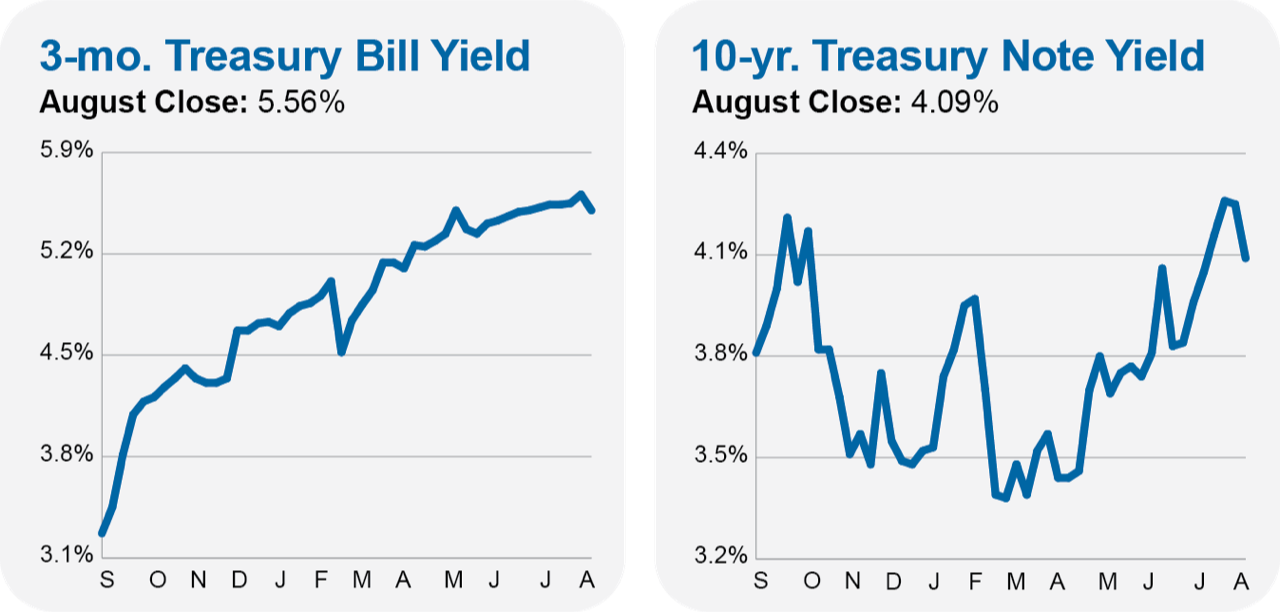

Spending time in the bond market hasn’t been as rewarding, however. Yes, bonds are holding up better than last year, but with Total Bond Market Index up just 1.6% when Cash Reserves Federal Money Market (VMRXX) is up 3.3%, many people still wonder if they should bother with bonds at all.

My answer is still a firm “Yes!” Bonds deserve a spot in a balanced portfolio, and today’s yields only make that advice more compelling. I wrote a lot about this earlier in the year—see here—but the short story is that earning more income will make up for today’s lower bond prices over time. As with stocks, it pays to be a bond investor, not a trader

I get it. I know that it hasn’t been fun getting to this point, but why abandon bonds now that they are finally paying a decent yield? Even after inflation, investors can earn a nice return from bonds.

Consider Inflation-Protected Securities (VIPSX).