Before I fully wrap up the year-end exercise of review and preview, several IVA readers have asked about Vanguard’s latest 2026 outlook—headlined “AI exuberance: Economic upside, stock market downside.”

Given that Vanguard is advising investors to flip the classic 60% stock / 40% bond portfolio on its head, the questions are understandable. If even Vanguard, a long-time torch-bearer for time in the market, is signaling that bonds now look more attractive than stocks, should investors be worried?

Vanguard’s forecast itself doesn’t worry me. As I said in my 2026 Outlook, an artificial intelligence boom dominates today’s market, but that hasn’t pushed me to the sidelines.

Let’s start at the beginning.

What Vanguard Is (and Isn’t) Forecasting

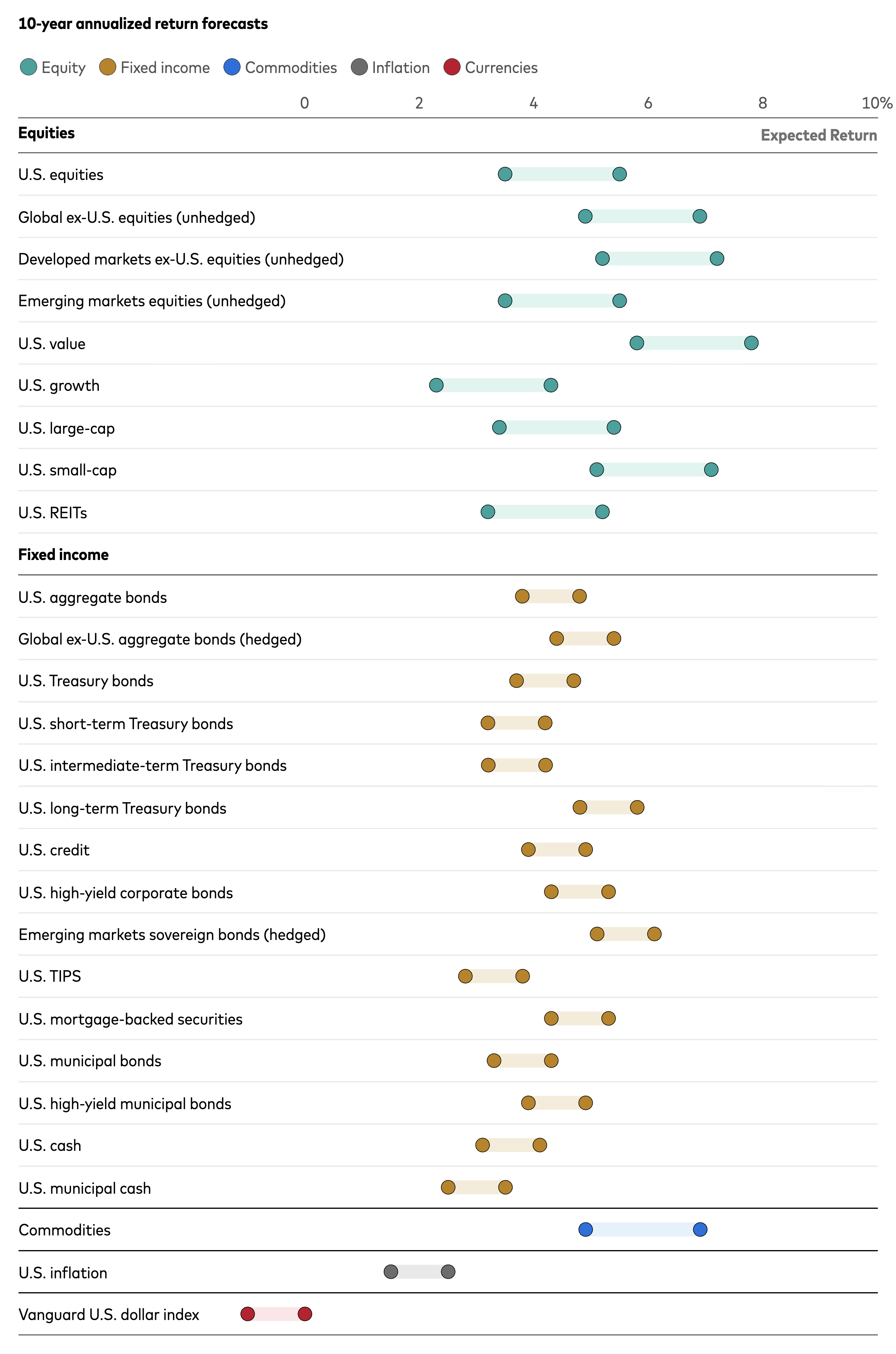

Vanguard is not in the habit of making one-year forecasts. Instead, it publishes 10-year predictions of expected returns for a host of asset classes based on its Vanguard Capital Markets Model—a computer program that simulates thousands of market scenarios based on market and economic data going back to 1960.

Below is a summary of its latest projections.

To put numbers to the chart, here’s the midpoint of Vanguard’s 10-year annualized return expectations for the major asset classes:

- U.S. Stocks: 4.5%

- Foreign stocks: 5.9%

- Real Estate: 4.2%

- U.S. Bonds: 4.3%

- Foreign Bonds: 4.9%

- Cash: 3.6%

In short, Vanguard expects foreign stocks to lead the pack, while bonds and real estate roughly match U.S. stock returns between now and 2035. Cash brings up the rear, but not by very much.

Yikes.

That’s a dour outlook—but it’s not a new one.