Hello, and welcome to the IVA Weekly Brief for Wednesday, January 21.

There are no changes recommended for any of our Portfolios.

Traders were never going to shrug off the President’s actions forever.

President Maduro's ousting was dramatic, but Venezuela simply isn’t a major economic player. Markets took notice—then moved on.

The administration’s designs on Greenland—and its threat to impose tariffs on European countries unless they fall in line—proved to be a step too far for Wall Street; and rightly so.

Targeting Greenland risks driving a wedge between two major economic powers: the U.S. and Europe. Push that conflict far enough, and you’re no longer talking about diplomatic theatrics. You’re talking about the real possibility of a trade war with the European Union, a breakdown of NATO and a broader reordering of the global system that has governed trade, security and defense for decades.

I’ll leave it to the geopolitical pundits to handicap how that all plays out. What I can say is that what’s happening today introduces a new layer of uncertainty and disruption as businesses try to adapt to a shifting reality.

With stocks down 2.0% on Tuesday and bond prices also falling, traders signaled that a Greenland takeover and a trade war are no longer viewed as unthinkable tail risks. And the situation remains very, very fluid.

It’s just one day, but if you are worried about the rift between the U.S. and Europe, well, here’s what “worked” and what didn’t in yesterday’s markets.

Commodity Strategy (VCMDX) was Vanguard’s best-performing fund on Tuesday, up 1.8%. Market Neutral (VMNFX), Consumer Staples Index (VCSAX or VDC) and Global Capital Cycles (VGMPX) also gained ground, rising between 0.2% and 0.7%.

Vanguard’s short-term bond funds held steady, as did its money market funds—exactly as you’d expect.

Everything else in Vanguard’s stable was in the red.

Yesterday’s market action was reminiscent of last year’s reciprocal (Liberation Day) tariff sell-off. Both stocks and Treasurys declined: 500 Index (VFIAX) fell 2.0% and Total Treasury ETF (VTG) dropped 0.3%. Foreign stocks fared slightly better but still declined, with Total International Stock Index (VTIAX) down 1.2%.

The worst performers were U.S. growth stocks. Wellington U.S. Growth Active ETF (VUGS) fell 2.9%, Information Technology Index (VITAX or VGT) dropped 2.7% and Growth Index (VIGRX) slid 2.6%.

If you’re curious, the stock funds in the “flexible” IVA Portfolios fell between 1.2% and 1.8% yesterday—down, but better than 500 Index’s 2.0% drop. Two ETFs in the Aggressive ETF Portfolio—S&P 500 Growth ETF (VOOG) and MidCap Growth ETF (VOT)—fell a bit more, down 2.4% and 2.3%, respectively.

All-in-all, a decent showing from the Portfolios on a challenging day.

As I said, this is just one day in the market, which is never a reason to upend a portfolio. But days like this are informative, offering clues about how portfolios may hold up if tensions between the U.S. and Europe continue to escalate.

As I said last week—and many times before—when a U.S. administration plots a meaningfully different course, the range of possible outcomes widens. In that environment, diversification remains an investor’s best defense against uncertainty.

You won’t be 100% right—but you won’t be entirely wrong either.

Our Portfolios

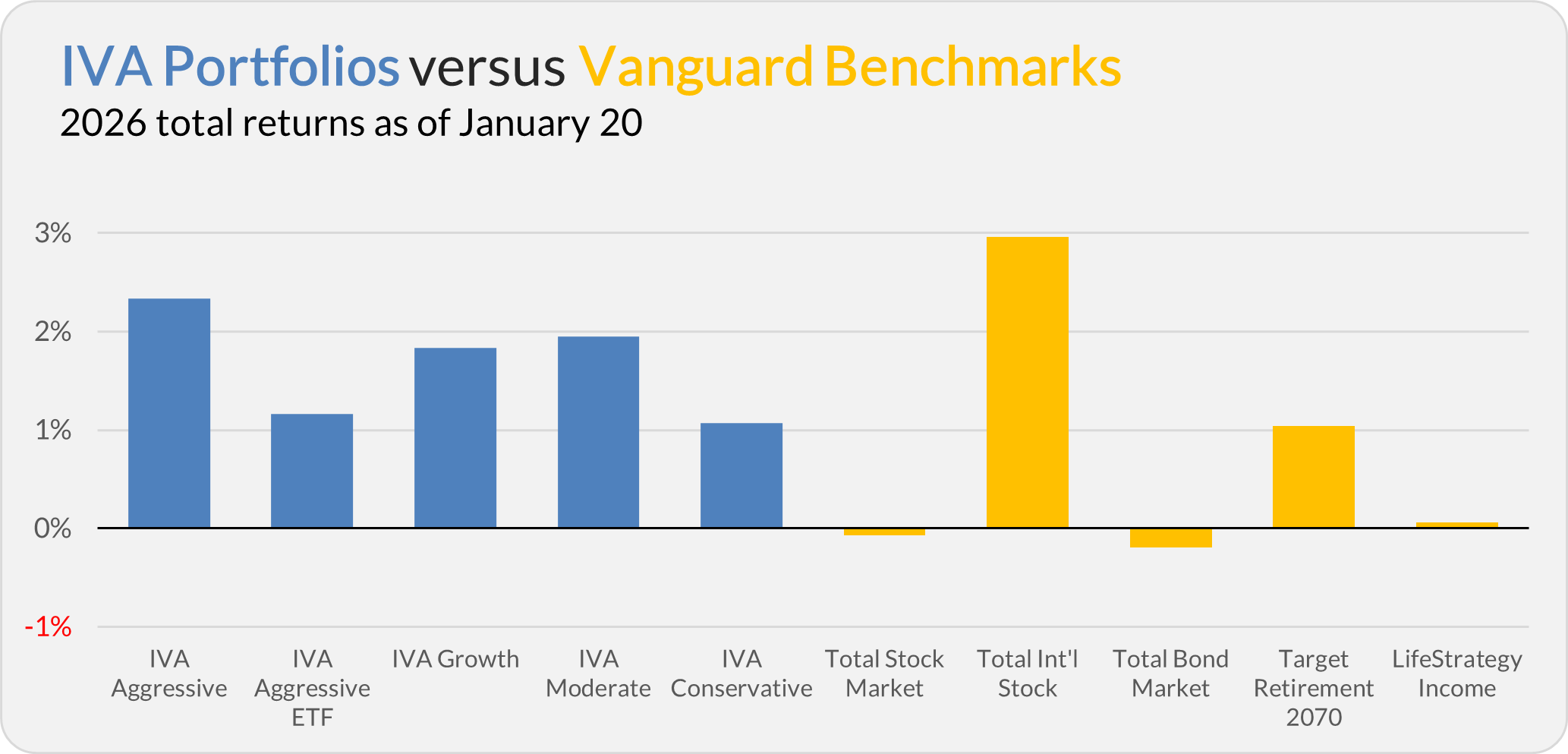

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.3%, the Aggressive ETF Portfolio is up 1.2%, the Growth Portfolio is up 1.8%, the Moderate Portfolio is up 1.9% and the Conservative Portfolio is up 1.1%

This compares to a 0.1% decline for Total Stock Market Index (VTSAX), a 3.0% gain for Total International Stock Index (VTIAX), and a 0.2% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 1.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.1%.

IVA Research

Yesterday, Premium Members received an my update on the 2026 retirement contribution limits.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.