Hello, and welcome to the IVA Weekly Brief for Wednesday, December 3.

There are no changes recommended for any of our Portfolios.

Once again, the predictions of an imminent bubble burst—or full-blown market crash—proved wrong. Or perhaps just premature, depending on your level of cynicism.

Judging by the headlines (and a few notes in my inbox), you might’ve thought the stock market spent November in free fall. It didn’t.

Yes, on November 20, the S&P 500 briefly slipped into “pullback” territory, down 5.1% from its October 28 high. But after rising in six of the past seven trading days, the index now sits just 0.9% below that record. Hardly the stuff of panic.

Even the tech-heavy Nasdaq Composite never crossed into correction territory—a 10% decline. It’s now only 2.3% off its October 29 peak.

The point is not that markets can’t fall; it’s that they often don’t follow the dramatic narrative we’re tempted to construct around them. Pullbacks, corrections and bear markets are all part of the investing landscape. But timing each wiggle at the top and bottom? I haven’t met anyone who can reliably do that. Absent that superpower, the rational course is to build a diversified portfolio that can both weather dips and participate in rallies.

With that perspective in mind, let’s turn to Malvern. I have a full slate of Vanguard updates and reminders for you this week.

Total Bond, But Bolder

Salim Ramji wasn’t exaggerating when he, shortly after being hired from iShares to run the fund behemoth, said he intended to bulk up Vanguard’s bond ETF lineup. He has already rolled out 10 new fixed-income ETFs this year, and number 11 is about to sneak in under the wire.

On Tuesday, Vanguard filed the final paperwork with the SEC to launch Core-Plus Bond Index ETF (BNDP). To be clear, the ETF isn’t trading yet—there's usually a short lag between this filing and an ETF's official launch.

I’ll share a full Quick Take with Premium Members once the fund is up and running. For now, here are the essentials:

Think of Core-Plus Bond Index ETF as Total Bond Market ETF (BND) with a slight twist. The new ETF—run by Vanguard’s bond-index veteran, Joshua Barrickman—will charge just 0.05% and add a (roughly) 10% sleeve of high-yield bonds to the traditional core bond mix.

In other words, this is one-stop, broad bond exposure for index investors who want a bit more credit risk around the edges. It’s a sensible addition to Vanguard’s increasingly crowded fixed-income shelf, but let’s be honest: This isn’t a reinvention of the wheel. It’s Total Bond Market ETF with a little extra kick.

The “Plus” fund may drive a little faster and hit a few more bumps, but whichever car you choose—Total Bond Market ETF or the new Core-Plus version—you’re headed toward roughly the same destination.

Finally, I know Vanguard’s bond lineup is starting to feel a little crowded, with several funds sporting similar names but serving slightly different purposes. Here’s a quick rundown to help keep them straight:

Total Bond Market Index (VBTLX or BND):

The classic. A broad, low-cost index fund holding investment-grade U.S. bonds—Treasuries, mortgage-backed securities and corporate bonds. This is the baseline that most other Vanguard bond funds echo or try to improve upon.

Core Bond (VCORX, VCOBX or VCRB):

Vanguard’s actively managed version of Total Bond Market Index. Same general mandate, but managers have flexibility to make modest bets around sectors, maturities and credit quality.

Core-Plus Bond (VCPIX, VCPAX or VPLS):

This is Core Bond with the dial turned up a notch. In addition to the investment-grade bonds, managers can own a slice of junk bonds. It’s designed to take a bit more risk in pursuit of a bit more return.

Core-Plus Bond Index ETF (BNDP):

As I said, it’s Total Bond Market Index with about a 10% sleeve of high-yield bonds. If we’re being honest, “Total Bond Market Index Plus ETF” might have been the clearer label.

Note: Technically, Core Bond ETF (VCRB) and Core-Plus Bond ETF (VPLS) are separate legal entities from their mutual fund counterparts. I group them because Vanguard designs the mutual fund and ETF versions to deliver nearly identical exposures and performance—different wrappers, same experience.

Lifetime Income

Speaking of expanding the lineup, Vanguard is developing a new family of Target Retirement funds—the Target Retirement Lifetime Income Trusts.

Technically, these aren’t mutual funds but collective investment trusts (CITs). They’re designed for 401(k) plans, and the headline feature is that they’ll allow investors to purchase a built-in annuity inside their target-date fund.

Vanguard has posted a landing page with the basics, but here’s the plain-English version of how these Trusts will work:

- Pick your “vintage.” As with the traditional Target Retirement funds, choose the fund whose year aligns with when you expect to retire (or turn 65).

- Before the age of 55: The portfolio looks just like Vanguard’s standard Target Retirement funds—mixes of Total Stock Market, Total International Stock, Total Bond Market and Total International Bond index funds.

- At 55: A slice of the bond allocation begins shifting into the TIAA Secure Income Account—not a fund, but an insurance product offering guaranteed income.

- By 65: Roughly 25% of the portfolio will sit in the TIAA Secure Income Account.

- At 72: The glide path (the transition from stocks to bonds) finishes at 40% stocks, 35% bonds and 25% in the TIAA income product.

- In retirement: You may annuitize all or part of the assets in your fund by purchasing a fixed annuity (from TIAA) that starts paying income straightaway. But you’re not required to do so.

- If you don’t buy the annuity, you’ll remain invested in the Trust and have access to your money as if it were a standard target-date fund.

Vanguard isn’t the first to market—BlackRock, State Street and J.P. Morgan already offer versions of “target date + annuity” products. But it’s another sign that Salim Ramji’s Vanguard is willing to push into new areas.

The Target Retirement Lifetime Income Trusts aren’t expected until 2026. And, if I’m reading this correctly, they’ll only be available through 401(k) plans, at least initially—unlike today’s Target Retirement funds, which anyone can buy in an IRA.

In other words, we have time to learn more.

My early take? At the right price, annuities can be useful—they can provide an income floor that some retirees find reassuring. But many retirees already have an annuity of sorts: Social Security, which provides guaranteed, inflation-adjusted income. Plenty of investors don’t need (or want) more insurance on top of that.

Premium Members can read more about withdrawal strategies here, and I’ll revisit the lifetime-income topic in the new year.

Vanguard Needs a Warning Label

Capital gains distributions season is fast approaching.

Premium Members already have a full guide on what to expect and how to navigate this month’s capital gains payouts. But everyone—Premium or not—should keep two practical reminders in mind:

First, a fund’s net asset value (NAV) drops by the amount of its distribution. So, if your fund suddenly “falls” 5% or 10% in a single day, that’s almost certainly a distribution—not a market event. (And if it is a market event, you can be sure it’ll be leading all the evening news reports.)

Second, in a taxable account, you typically do not want to buy a fund right before it pays out a distribution. Doing so means you’ll get some of your investment back immediately … and owe taxes on it. (Premium Members already know which funds are on deck and the expected payout dates—here.)

All well and good, but this is where I’d like to see Vanguard step up.

Vanguard publishes capital gains estimates—but does the average investor know that? Do they know where to look? Probably not. Even if you think of digging into each fund’s “Distributions” section, you then need to be able to understand that realized gains are future payouts.

Vanguard doesn’t make this easy.

For example, PRIMECAP Core (VPCCX)—set to make one of the largest payouts of any fund this year (14%)—still has a banner atop its profile page celebrating February’s fee cut, with nothing warning investors about the coming distribution.

Meanwhile, MidCap Growth (VMGRX), which is set to hand shareholders an eye-popping 17% of assets, does have a notice—but it’s a soft one, saying only that the recent manager change “may result” in a distribution.

Given what Vanguard now knows about what is slated to occur in the next couple of weeks, they could update that banner with a plain-English message like: “If you own this fund on December 16, you should expect a capital gains distribution equal to roughly 17% of the value of your holdings.”

Easy enough, right?

But let’s be honest: Many investors don’t check a fund’s profile page before clicking “Buy.”

A Simple Fix That Prevents Tax Surprises

So, here’s a simple fix for the firm that says its number one priority is to serve its shareholders: Flag the upcoming distribution right in the trade window—where it can’t be missed.

If you attempt to buy a fund in a taxable account that’s set to make a distribution, Vanguard could display a pop-up telling you the expected payout and the record date. This safeguard would only need to be active for a few weeks—between the release of official estimates and the record date, typically mid-November through mid-December.

If getting all those details is too “tricky” for Vanguard—and it shouldn’t be—how about a more generic message reminding investors to check on distributions before clicking “Buy”? It could include a link to Vanguard’s latest estimates.

And no, I wouldn’t expect Vanguard to do this for non-Vanguard funds, where information isn’t standardized. But for its own funds? Absolutely.

Giving investors an unmistakable heads-up before they hit “Buy” would prevent a lot of avoidable, frustrating tax surprises—and it’s the kind of investor-first detail that Vanguard should be nailing.

Until then, keep an eye on those distribution calendars and tread carefully when trading in taxable accounts at this time of year.

Backtracking on Bitcoin

Speaking of warning labels … as I told Premium Members yesterday, Vanguard has officially cancelled its boycott of cryptocurrency ETFs.

To be clear: Vanguard isn’t launching a bitcoin ETF. But as of now, you can buy competitors’ crypto ETFs in your Vanguard brokerage account.

This isn’t a crypto newsletter, and I’m not a fan, so I’ll cut to the chase: You do not need bitcoin or any other cryptocurrency in your portfolio. Most of the crypto universe remains speculation bordering on nonsense. If you want to gamble, that’s your call, but go in with your eyes wide open.

Bitcoin may be the exception that gets all the headlines, but even its “digital gold” narrative is looking shaky this year—gold is up 60% while bitcoin is flat. Buzz aside, buying bitcoin is speculating, not investing.

And for anyone wondering whether a Vanguard-branded crypto ETF is coming next: I wouldn’t count on it. Vanguard’s doing just fine without a gold ETF. I suspect the firm will survive without a bitcoin ETF, too.

Don’t Forget Your RMDs Until It’s Too Late

As we head into the final month of the year, a quick reminder about required minimum distributions (RMDs). Every year, I hear tales of woe from subscribers who run into headaches over their RMDs. Sometimes it’s an honest mistake, and other times it’s Vanguard tripping over its own electronic systems.

This year, for example, several IVA readers have told me that changes to Vanguard’s qualified charitable distribution process (a way of directing your RMDs to philanthropic causes) have caused unexpected delays.

My advice: If you haven’t taken your RMD yet, don’t wait until the last minute. Give yourself some margin for error. If something goes sideways, you’ll want time to get it sorted out.

🎁 Give the Gift of The IVA

Help someone make the most of their Vanguard investments.

Our Portfolios

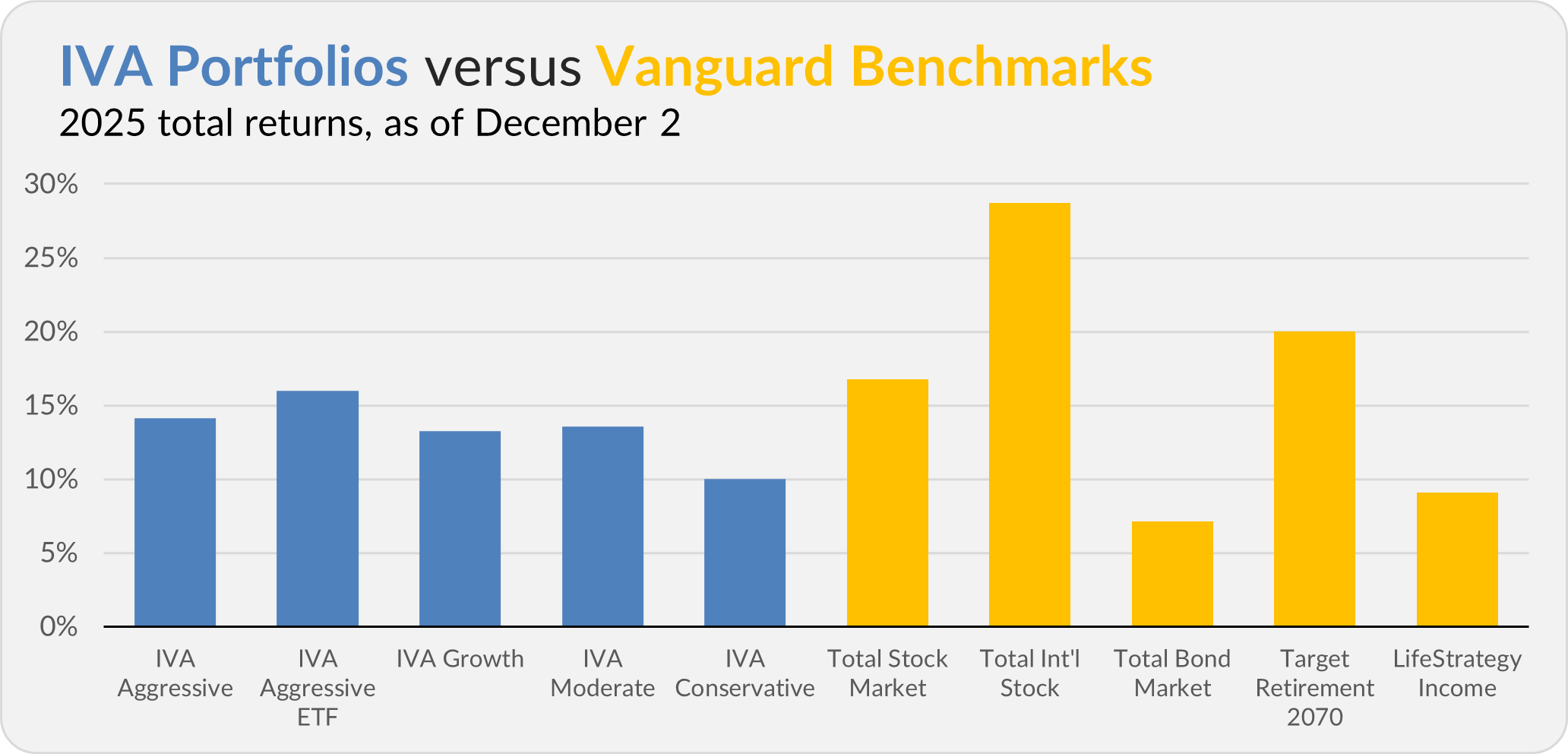

Our Portfolios are showing double-digit returns for the year through Tuesday. The Aggressive Portfolio is up 14.1%, the Aggressive ETF Portfolio is up 16.0%, the Growth Portfolio is up 13.3%, the Moderate Portfolio is up 13.6% and the Conservative Portfolio is up 10.0%.

This compares to a 16.7% gain for Total Stock Market Index (VTSAX), a 28.7% return for Total International Stock Index (VTIAX), and a 7.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 20.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.1%.

IVA Research

Yesterday, I shared a detailed comparison of Federal Money Market (VMFXX) and Cash Plus Account with Premium Members. My goal was to explain what exactly Cash Plus Account holders are getting in return for giving up 0.60% in yield.

I also shared a Quick Take on Vanguard’s decision to open its platform to bitcoin ETFs.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.