Hello, and welcome to the IVA Weekly Brief for Wednesday, July 9.

There are no changes recommended for any of our Portfolios.

A quick note before I hit send: Vanguard officially launched its three newest bond ETFs today—Total Treasury ETF (VTG), Total Inflation-Protected Securities ETF (VTP) and Government Securities Active ETF (VGVT). I mentioned in last week’s Brief that these funds would be launching soon, and I’ll have more to say later. But for now, with plenty of similar options already available in Vanguard’s lineup, there’s no need to rush in.

On July 4, President Trump signed the One Big Beautiful Bill into law. Behind the branding and headlines, the sprawling piece of legislation includes a few helpful financial planning provisions, such as expanding 529 plan eligibility to cover trade schools and credential programs, and creating “Trump accounts” for newborns.

But the heart of the bill is budget policy. It cuts taxes, boosts spending in some areas (such as defense and immigration) and reins in others (notably Medicaid and other social programs). The result? A short-term economic bump that’s unlikely to “pay for itself.” In other words, the bill will add trillions to the deficit, according to estimates from non-partisan think tanks.

After the July 4 holiday, President Trump returned to the tariff table. The 90-day pause on the sweeping “reciprocal” tariff plan was extended—but only until August 1. More than a dozen countries, including South Korea and Japan, received notice that the U.S. plans to impose tariffs ranging from 25% to 40% starting next month. And that’s not the end of it—more tariff letters are expected.

At this point, it’s hard to find a fresh angle on tariffs. They’ve made trade more expensive, which likely means hotter inflation and cooler growth. The longer the uncertainty drags on—and the higher tariffs climb—the harder it gets for the economy to muddle through.

Strangely, you wouldn’t know any of this from watching the stock market. 500 Index (VFIAX) fell 0.9% over the last two trading days. That’s a loss, sure—but nothing like the index fund’s 10.5% two-day plunge we saw in response to President Trump’s Liberation Day announcement.

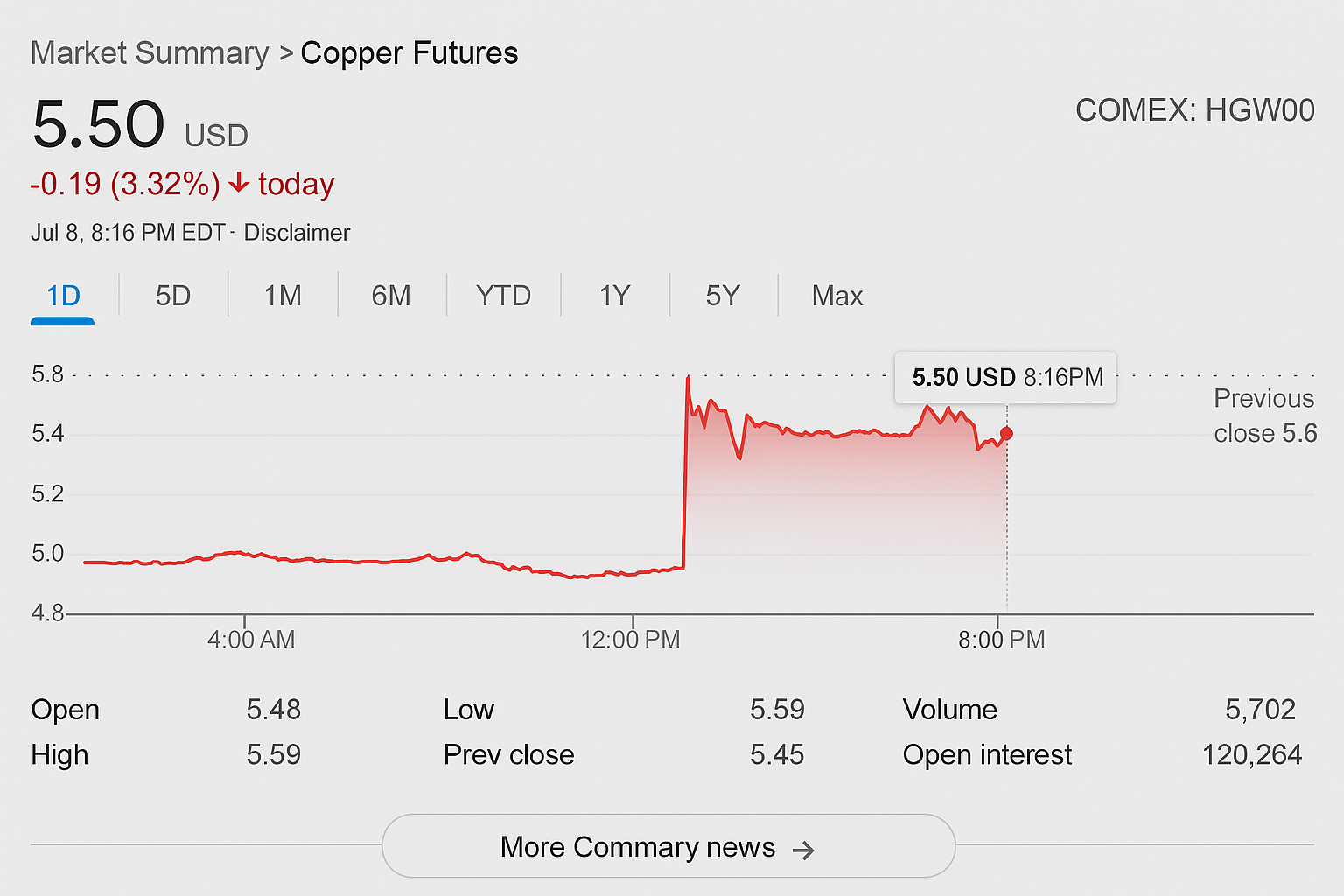

However, a decision to put 50% tariffs on copper imports sent the metal’s price soaring to a one-day record, up 13%. That’s what you’d expect, but here’s the kicker: As the chart below shows, copper’s price spiked the moment the news hit. Unless you had advance notice or the reflexes of a machine (and the infrastructure to match), there was no window to act.

This is exactly why I keep repeating: Trading on headlines is not an investment strategy (unless you have inside knowledge, which is, of course, illegal). Your best protection against whipsawed markets is diversification.

To that point, an IVA reader recently asked me:

Will AI [artificial intelligence] trading bots draw down returns for the rest of us?

It’s a smart question. And yes—someone will almost certainly figure out how to trade profitably with AI, if they haven’t already. But no, that doesn’t mean your returns are at risk.

Here’s how I think about it: There have always been smarter, faster and better-resourced traders—mutual fund and hedge fund managers, quant firms, high-frequency outfits. And yet, the “rest of us” have managed to compound wealth by spending time in the market, often at a pace better than that of the so-called experts.

Time in the markets has worked for decades—and I don’t see AI changing that anytime soon.

New Cost Basis Default

An IVA reader provided me with a helpful heads-up: Because he is a high-net-worth Flagship investor, his Vanguard representative called him to flag a change coming in August that could impact how taxes are calculated when selling shares in a taxable account.

The change? Vanguard is updating its cost-basis policy, specifically around the use of SpecID, or specific share identification. With SpecID, you tell Vanguard which “share lots” you’re selling, so that you can generate the lowest capital gains (or the highest if you’re trying to match losses elsewhere in your portfolio). SpecID is the method I use in my accounts because it gives me the most flexibility. Yes, it requires more manual effort, but I think it’s worth it.

Now, Vanguard isn’t eliminating SpecID—but they are making it harder to use by removing it as a default option for your accounts. In the future, you’ll only be able to use SpecID when placing market orders, and to do so, you’ll need to take an extra step or two when trading.

If you have SpecID as your default method, you’ll need to choose a new one or accept Vanguard’s choice of one of four different methods—average cost, first in–first out (FIFO), highest in–first out (HIFO) or MinTax. (You can read a quick description on each here.)

That could mean higher tax bills if you’re not paying attention. If SpecID matters to you (as it does to me), be sure to update your settings (when the time comes) and closely monitor each trade (as always).

Bottom line: No one loves cost basis housekeeping. But this is one of those small, behind-the-scenes changes that can have a real impact on your overall returns, especially come tax time.

Let’s hope the rollout goes smoothly. I’ll be watching for official word from Vanguard. If you hear anything from your rep, drop me a note.

Work in Progress

At Morningstar’s recent investor conference, Vanguard CEO Salim Ramji reportedly shared an optimistic message: Vanguard’s technology spending is paying off.

I’m not quite ready to join the celebration.

Ramji pointed to quicker updates to the “front-end experience” (the side of Vanguard’s site you and I use) as proof of progress. But two weeks after I first wrote about it, I still don’t have a “Compose” or “Send Message” button in my Message Center on vanguard.com. So, no, I wouldn’t say updates are coming quickly.

And that’s far from the only glitch readers are reporting.

Earlier this month, two IVA readers contacted me after their routine ACH transactions failed. One had an automatic monthly transfer that’s been humming along for more than a decade and suddenly stopped. The other had a trade reversed because Vanguard was unable to withdraw the money from their external savings account.

Then there’s the simple (yet fundamental) task of showing the correct fund holdings.

Take Total International Stock ETF (VXUS), which owns more than 8,500 stocks. On Vanguard’s Investor site, the holdings list shows… just three companies: SCB X PCL, Saregama India, and AEM Holdings. (If you haven’t heard of them, you’re not alone.)

Flip over to Vanguard’s Advisor site, and the correct holdings are all there.

As Ramji put it, improvements may not be “transparent.” But these errors are pretty apparent. A working Message Center, functional ACH transfers, and accurate fund pages aren’t big asks. And transparency around the issues Vanguard’s clients are facing would go a long way to building trust.

Until we see fewer glitches and more polish, I’d say Vanguard’s tech journey still has a few miles to go.

Our Portfolios

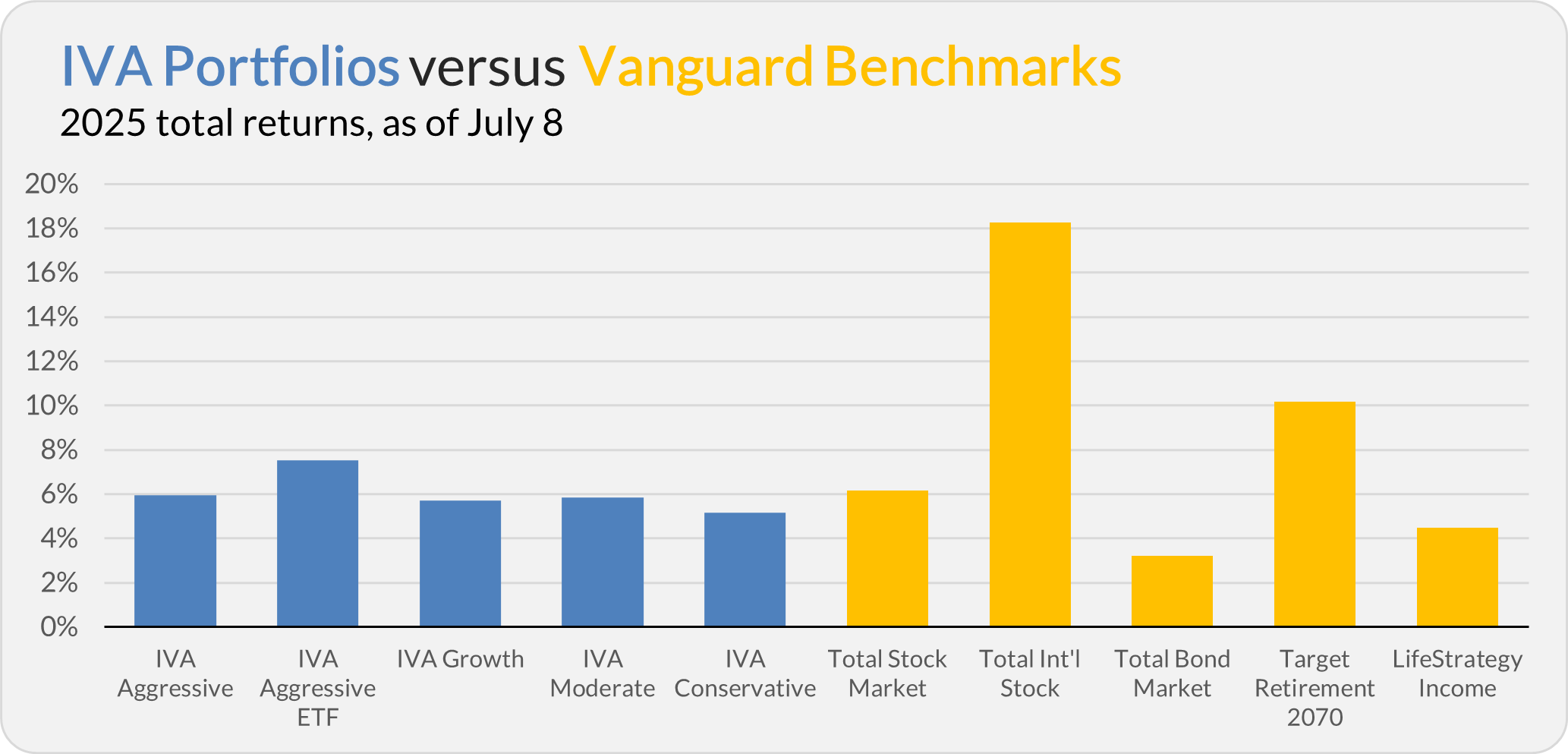

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 6.0%, the Aggressive ETF Portfolio is up 7.5%, the Growth Portfolio is up 5.7%, the Moderate Portfolio is up 5.8% and the Conservative Portfolio is up 5.2%.

This compares to a 6.2% gain for Total Stock Market Index (VTSAX), an 18.3% return for Total International Stock Index (VTIAX), and a 3.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 10.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.5%.

IVA Research

Yesterday, shed light on Vanguard’s profit-sharing plan—the Partnership Plan—and how much the firm’s executives likely earn in compensation.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.