Hello, and welcome to the IVA Weekly Brief for Wednesday, August 20.

There are no changes recommended for any of our Portfolios.

Is diversification making a comeback?

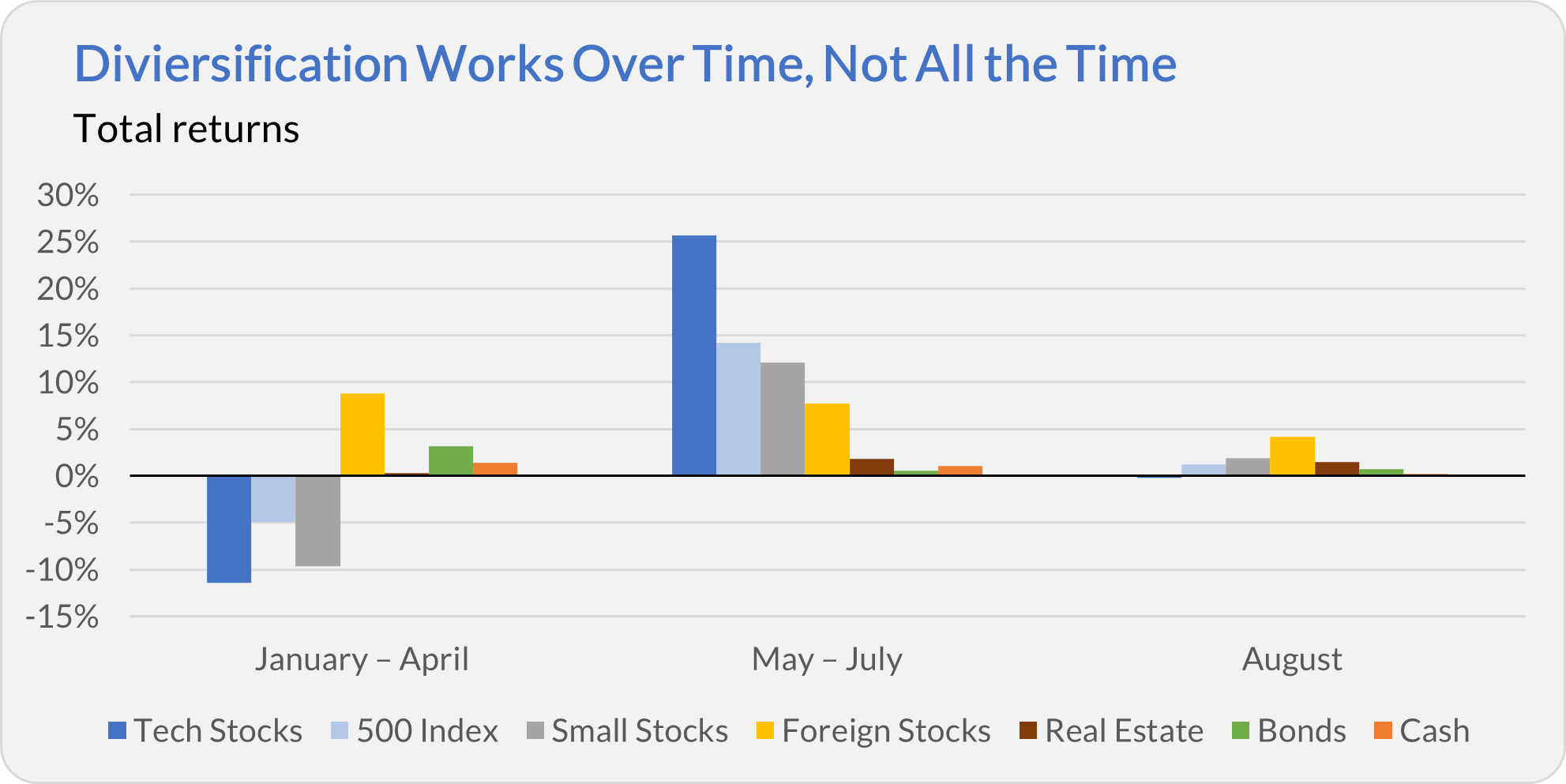

Through the first four months of the year, diversification looked like the right call. While 500 Index (VFIAX) fund fell 4.9% and Information Technology Index (VITAX) tumbled 11.4%, a broad mix of other investments posted gains. Foreign stocks, real estate, bonds and cash all delivered positive returns ranging from 0.3% and 8.8%.

Then, the market flipped. (Technically, it had started to flip in April, but let’s keep it simple with monthly data.) As the chart below illustrates, tech stocks staged a sharp rally, gaining over 25% between May and July. That resurgence catapulted 500 Index past those earlier winning diversifiers. Suddenly, broad diversification didn’t look so smart—one might even say it looked silly (to use a technical term).

But here we are in August, and diversification may be reclaiming some respect. Through Tuesday’s close, Information Technology Index is slightly negative on the month (off 0.2%) while the 500 Index has gained 1.2%. Meanwhile, small stocks, foreign stocks and real estate are all ahead of the flagship index fund.

The point isn’t to claim victory for diversification based on a few weeks of performance. It’s that market leadership shifts—often without warning. If you could pick tomorrow’s winner with certainty, you wouldn’t need to diversify. But since none of us has that superpower, diversification remains the best way (for us mere mortals) to spend time in the market.

Vanguard Gets Active

As I told Premium Members in Monday’s Quick Take, Vanguard is set to launch its first-ever actively managed ETFs with human stock pickers at the helm. Three new funds are scheduled to debut in November, each sub-advised by Wellington Management.

Let’s clear up one key point: While two of the ETFs share (nearly) identical names with existing mutual funds, these will be brand-new funds—separate legal entities, not just new share classes slapped on legacy funds.

A few things jump out to me as a longtime Vanguard observer:

- The funds include “Wellington” in the name—a real commitment from Vanguard.

- Vanguard isn’t waiting around for SEC approval to launch dual mutual fund–ETF share classes—a sign that the fund giant is moving faster under new(ish) CEO Salim Ramji than before.

Here’s what you—as an investor—need to know about each ETF:

Wellington Dividend Growth Active ETF (VDIG) is the clearest case of “same strategy, new wrapper.” Peter Fisher will run this ETF using the same playbook as he does at Dividend Growth (VDIGX) and Advice Select Dividend Growth (VADGX). That means investing in companies that not only pay dividends but have both the ability and willingness to grow those dividends over time.

If you already like Fisher’s approach, you’ll soon have a more tax-friendly version to consider.

David Palmer will be calling the shots at Wellington U.S. Value Active ETF (VUSV). Palmer manages 70% of Windsor’s (VWNDX) portfolio, so you can think of this new ETF as “Windsor Lite”—minus the 30% of the fund currently managed by deep-value shop Pzena.

Don’t let the name fool you. Wellington U.S. Growth Active ETF (VUSG) will not be a clone of the U.S. Growth (VUSGX) mutual fund. Instead of Drew Shilling and Clark Sheilds, Vanguard is asking Brian Barbetta and Michael Masdea—who run part of Global Equity (VHGEX)—to manage the ETF. So, this is not a tax-efficient twin of U.S. Growth.

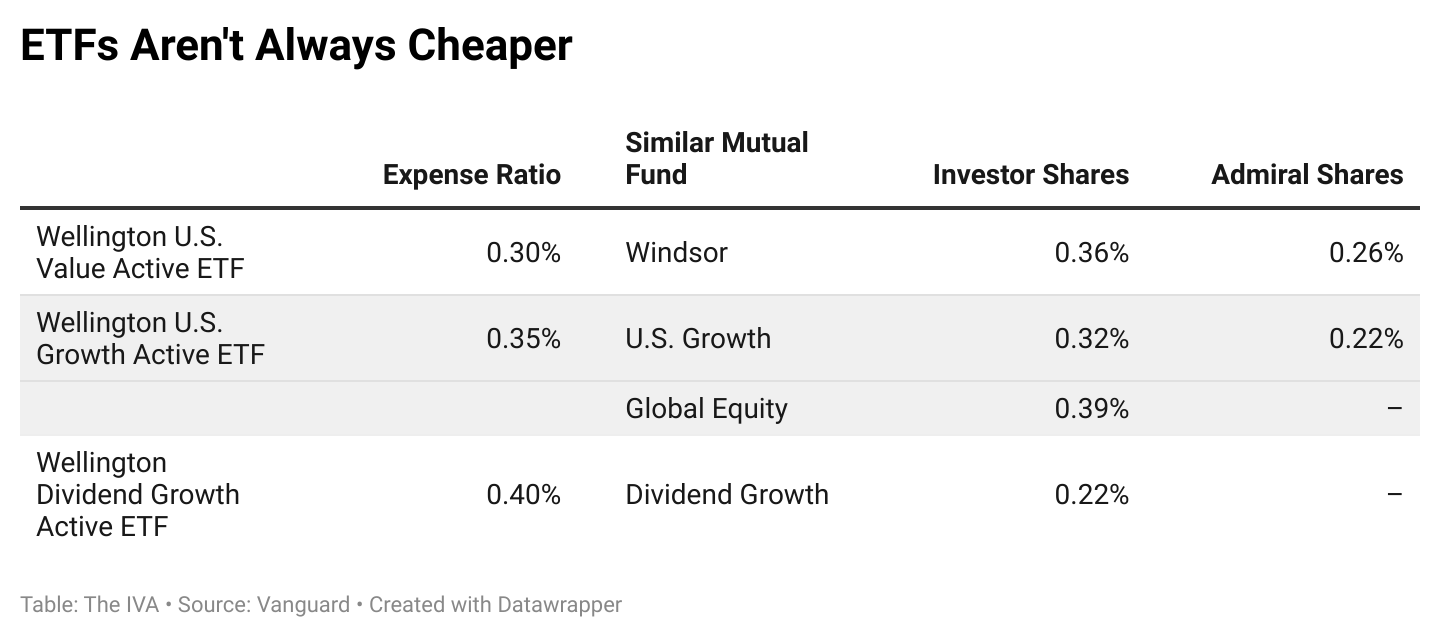

A word on expenses: While the initial filings I saw did not disclose expense ratios, Vanguard has since confirmed they’ll range between 0.30% and 0.40%. The table below compares the Active ETF expenses against their mutual fund analogs.

Despite common “knowledge,” the ETF structure does not automatically make for the cheapest option. For instance, the existing Dividend Growth mutual fund will cost about half as much as its ETF sibling.

Ok. That’s not quite everything you need to know. The obvious question I haven’t answered: Will these ETFs be worth investing in?

As someone who owns Dividend Growth (the mutual fund), I’ll likely recommend the ETF version—especially for taxable accounts.

But, to fully answer this question requires more than just a Weekly Brief. Fortunately, the funds aren’t due out for months, so we’ve got time for thoughtful analysis—not just reaction.

Premium Members can look forward to my complete analysis closer to the fund’s launch—stay tuned.

Our Portfolios

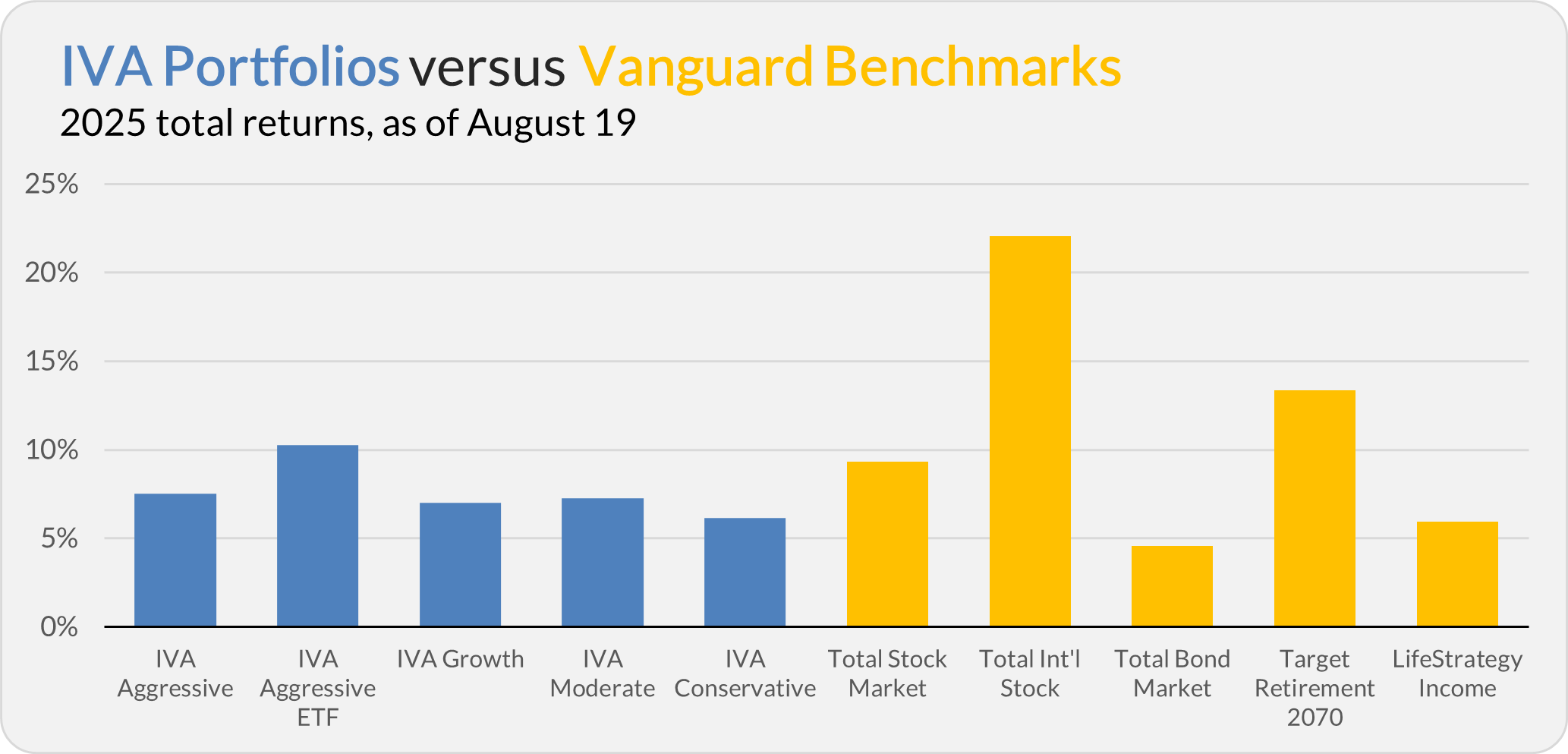

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 7.5%, the Aggressive ETF Portfolio is up 10.3%, the Growth Portfolio is up 7.0%, the Moderate Portfolio is up 7.2% and the Conservative Portfolio is up 6.2%.

This compares to a 9.3% gain for Total Stock Market Index (VTSAX), a 22.1% return for Total International Stock Index (VTIAX), and a 4.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.9%.

IVA Research

Yesterday, I wrapped up my two-part series on currency hedging. In the first piece, I made the case for why foreign bond funds should always hedge currency risk. In the second, I tackled foreign stock funds—where the decision is far less clear-cut.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.